Beginning today, o2 Banking customers in Germany will gain access to WeltSparen’s wide range of savings and investment products directly through their mobile o2 Banking app.

In Germany’s ongoing low-interest environment, o2 Banking customers looking for new options to save or invest can enjoy significant benefits from Raisin’s higher interest rates and cost-effective, globally-diversified ETF portfolios.

Markus von Böhlen

“Particularly given this period of low interest rates, we are glad to be offering our customers attractive investment opportunities together with WeltSparen,”

said Markus von Böhlen, Director of Devices, Trading & Digital Life for Telefónica Deutschland and in charge of o2 Banking.

The WeltSparen products now available in the o2 Banking app include term deposits and overnight accounts from more than 60 partner banks across the EU, as well as transparent and cost-effective ETF portfolios in four asset classes, which are offered in cooperation with Vanguard and DAB BNP Paribas. All deposits invested through Raisin are protected by the respective national deposit guarantee schemes up to 100,000 EUR per bank per customer, as specified by EU guidelines.

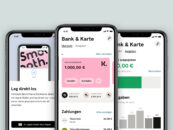

A simple and secure banking experience

The partnership with WeltSparen delivers the first external offers on the o2 Banking app and thereby represents a significant expansion into the area of open banking. Weltsparen (Raisin) offers a simple and secure online banking experience together with its deposit and investment products, making it an ideal partner for o2 Banking.

The mobile o2 Banking account is a full-featured checking account with a mobile-optimized user experience and has already received multiple awards. The bank account, including a debit Mastercard, is free of charge and available to all. It offers electronic transfers via mobile phone number along with comprehensive security features such as push notifications. o2 customers also receive an additional monthly high-speed data volume according to their use of o2 Banking. o2 Banking is implemented in cooperation with the Munich-based Fidor Bank AG.