German Fintech Sector Continued to Grow and Mature in 2022

by Fintechnews Switzerland March 27, 2023With nearly 1,000 fintech startups, among which 13 unicorns, a burgeoning startup ecosystem and a supportive regulatory and political landscape, Germany has become one of the world’s top fintech markets and the European Union (EU)’s fintech leader.

In 2022, the sector continued to grow and mature, on a back of solid funding activity, a dynamic merger and acquisition (M&A) landscape, and growing usage of digital financial services, including cashless payments and online brokerages, a new report says.

The study, produced by Fintech Consult, a fintech advisory company, and Contextual Solutions, a Berlin-based consultancy, coaching and publication agency specialized in fintech, legaltech and tech marketplaces, looks at the German fintech industry, providing an overview of the ecosystem and sharing key market trends.

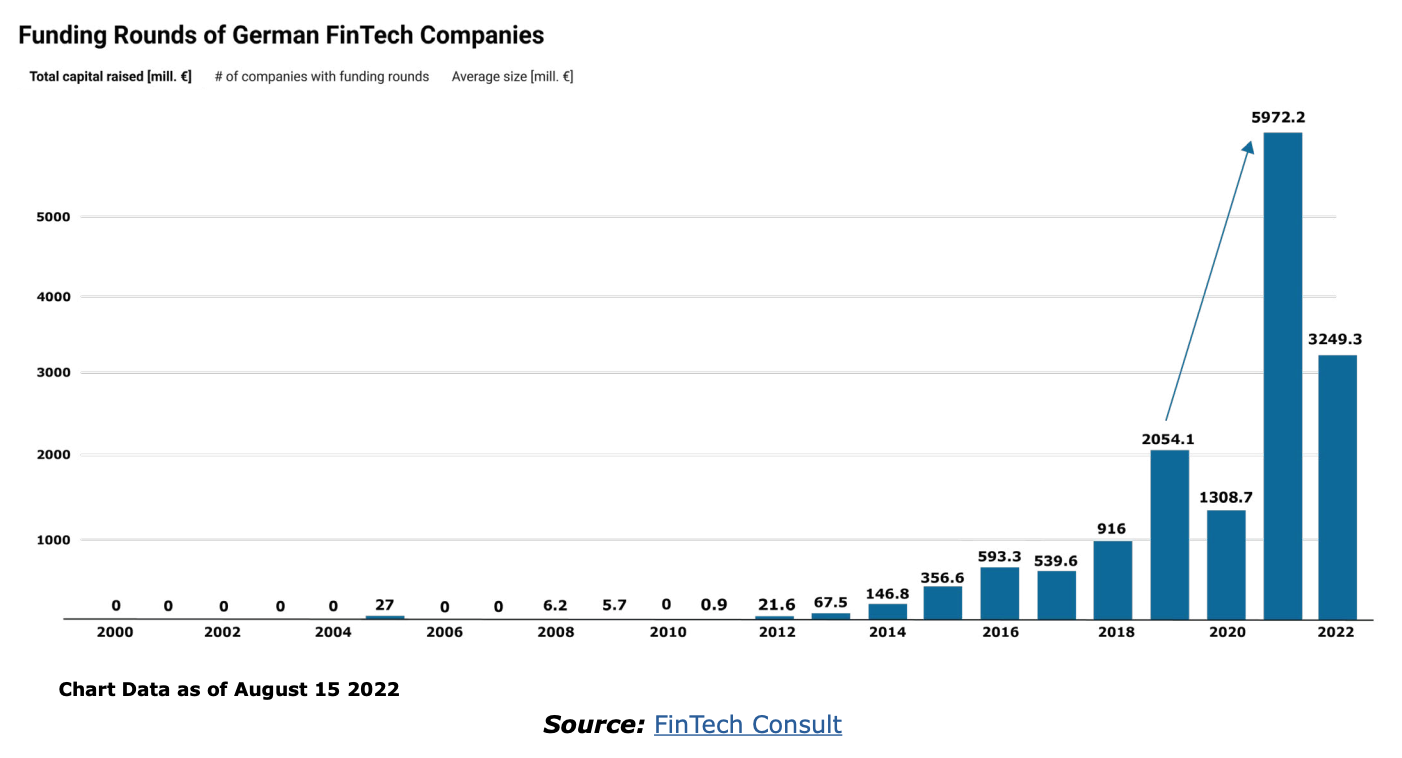

In the first eight months of 2022, German fintech companies secured a total of EUR 3.2 billion, already surpassing pre-COVID levels, the study found. The figure suggests that total fintech funding in Germany for 2022 will likely not reach 2021 levels (EUR 6 billion) but remained nevertheless strong despite the global downturn.

Funding rounds of German fintech companies per year, Source: German Fintech Report 2023, Contextual Solutions/Fintech Consult, 2023

A testament of the sector’s maturing is the rise of fintech deal sizes over the past couple of years, data from the report show. In 2022, the average fintech funding size reached a record of EUR 45.8 million, more than double the average deal size in 2019 (EUR 21.4 million).

Another evidence is the sustained M&A deal activity the sector witnessed in 2022 through deals like the acquisition of Simplesurance by Allianz X in September, the acquisition of Penta by French fintech rival Qonto in July, and the acquisition of Kontist by Ageras Group in July as well.

Average fintech funding size in Germany by year, Source: German Fintech Report 2023, Contextual Solutions/Fintech Consult, 2023

Rising usage of digital financial services

The growth of the German fintech sector comes on the back rising usage of digital financial services. Most notably, the report highlights the boom in online retail brokerage, where securities trading increased by a staggering 80% in 2020 over all German exchanges.

German exchange Tradegate reported that the number of trades on its platforms increased threefold between 2019 and 2020, soaring from just 18 million to 61.5 million. These figures imply an average annual growth rate of 86%.

Number of trades on the Tradegate exchange annually, Source: German Fintech Report 2023, Contextual Solutions/Fintech Consult, 2023

Digital payments are another fintech category that has witnessed steady growth over the past few years, especially since the COVID-19 pandemic. According to a survey conducted by the Deutsche Bundesbank, the German central bank, 43% of the consumers polled said they had changed their payment behavior in recent months.

Rising usage of digital payments comes at the detriment of cash. Since 2017, the share of cash payments measured by the number of transactions has declined by 16%, the Fintech Consult/ Contextual Solutions report notes. In contrast, the share of debit and credit card transactions grew by 4% and 5%, respectively.

Strategy consultancy payment experts expect the use of cash to continue to fall substantially in the years to come, a report by Germany Trade and Invest, the country’s economic development agency, claims. They project that the share of cash transactions will fall by 20 percentage points from 52% in 2017 to 32% by 2025.

Germany’s fintech journey

Germany is one of the largest and most vibrant startup ecosystems in the world, hosting more than 70,000 ventures and producing around 3,000 new startups each year, the Fintech Consult/ Contextual Solutions report says.

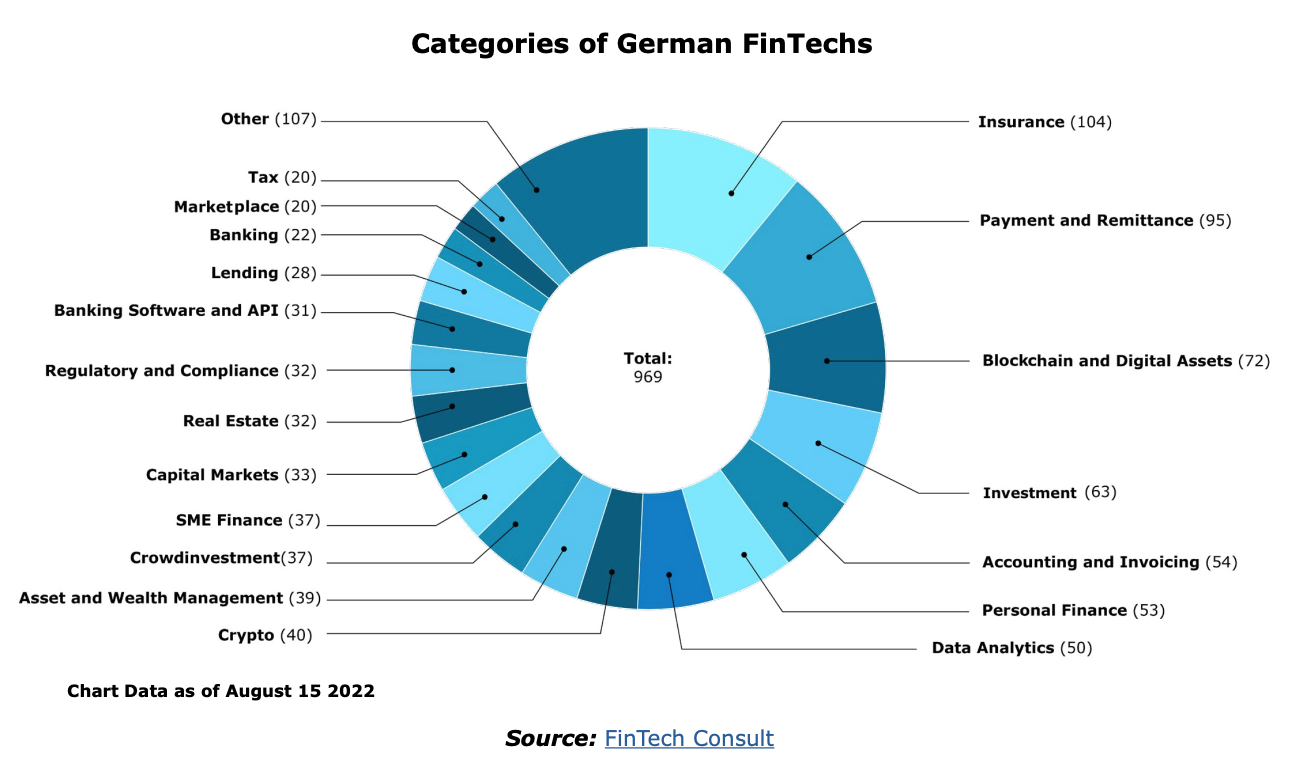

In this ecosystem, fintech has become one of the country’s most prominent startup segments, accounting for 3.1% of all of the country’s with nearly 1,000 companies in the space.

The German fintech industry is highly diversified, it notes, but insurance (104 companies), payments and remittances (95), and blockchain and digital assets (72) are the three largest fintech verticals.

Prominent names in these categories include Wefox, a digital insurer that’s at valued US$4.5 billion; Tradias, a division of securities specialist Bankhaus Scheich, which provides a decentralized finance (DeFi) service platform; and Fundament, a provider of asset tokenization services.

Fintech verticals in Germany and their respective number of startups, Source: German Fintech Report 2023, Contextual Solutions/Fintech Consult, 2023

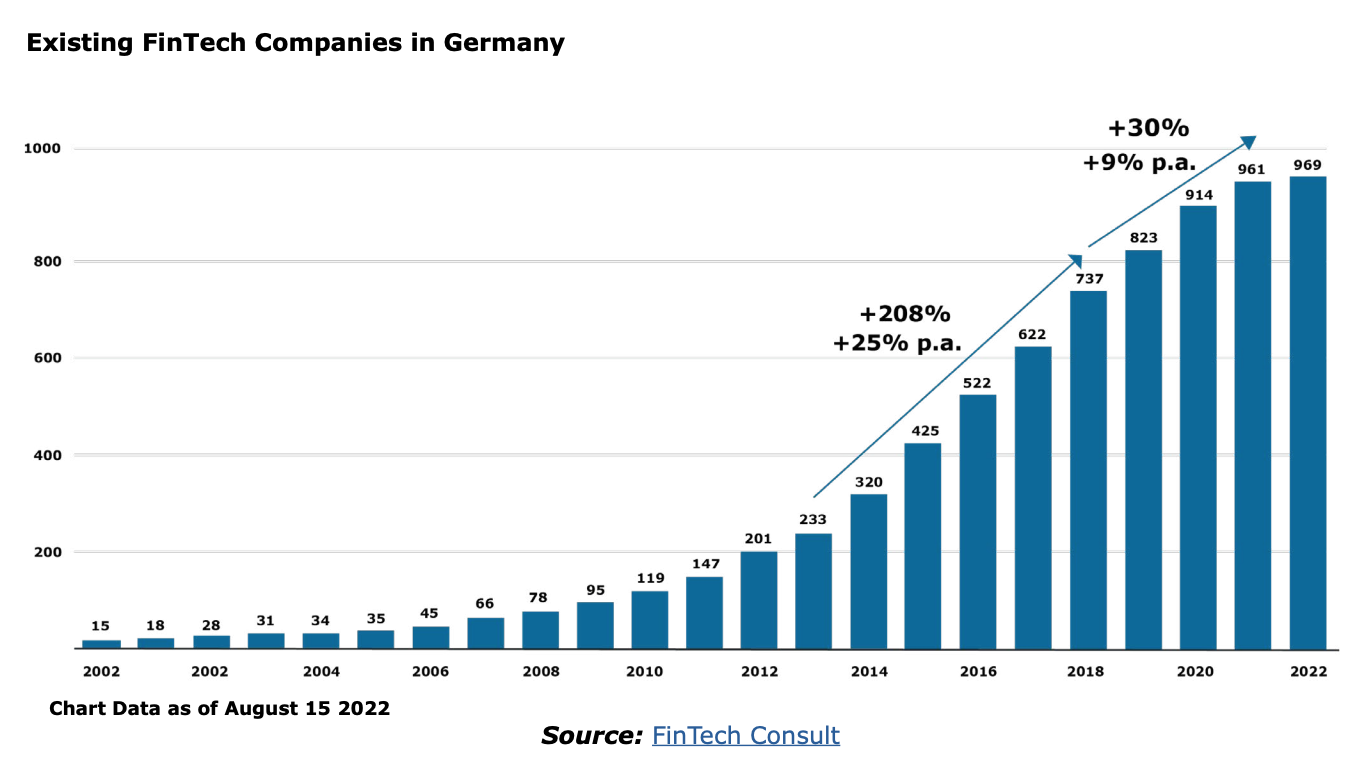

Germany’s fintech journey started back in early 2010s with neobanks, digital and peer-to-peer (P2P) lenders, digital wallets and payment solutions starting to emerge in the first wave. Many of these fintech companies are now in the scale-up phase and becoming profitable.

Between 2014 and 2017, the ecosystem focused mostly on establishing solid foundations for the growth of the fintech sector, prioritizing talent acquisition, accelerator and incubator programs, attracting investors as well as the regulatory landscape. The period also saw an acceleration of the growth of the local fintech startup scene, which recorded an average growth rate of 25% per year between 2013 and 2018 in terms of the number of fintech companies.

After this wave, in 2018, the focus started shifting towards new trends including artificial intelligence (AI), blockchain and green/sustainable fintech. The number of fintech companies joining the sector also started slowing down, witnessing an annual growth rate of 9% between 2018 and 2021. Additionally, more fintech companies have been closing their businesses since 2018, the report notes, further indicating a maturing ecosystem.

Existing fintech companies in Germany, Source: German Fintech Report 2023, Contextual Solutions/Fintech Consult, 2023

Featured image credit: Edited from freepik