Generative AI Frenzy Pushes Nvidia Market Capitalization Past US$1T Mark

by Fintechnews Switzerland June 30, 2023Nvidia reached a market capitalization of more than US$1 trillion early this month, becoming the ninth company in history and the world’s first chipmaker to cross that threshold, according to Bloomberg and the Guardian. The company joined fellow tech companies and household names like Apple, Microsoft, Google parent Alphabet and Amazon in the US$1 trillion club.

Shares of the American chipmaker started soaring on May 24 after the company reported its first-quarter earnings for its fiscal 2024 with a stronger-than-expected forecast. Nvidia said it expects sales of about US$11 billion, plus or minus 2%, in the second-quarter, more than 50% higher than investors’ estimates of US$7.15 billion, CNBC reported in May 2023.

Nvidia’s share rose over 25%, and market value climbed to US$940 billion by the end of the following day. Shares price increased by another 4.2% on May 30, bringing the company’s total capitalization to over US$1 trillion.

Overall, Nvidia has risen by more than 160% over the past year, fueled by the artificial intelligence (AI) frenzy.

Founded in 1993 and headquartered in California, Nvidia is a software and fabless company which designs graphics processing units (GPUs), application programming interface (APIs) for data science and high-performance computing, as well as system on a chip units (SoCs) for the mobile computing and automotive market.

The company has led the revolution in computer graphics and videogame chips for about a quarter century, but its latest earnings shows momentum in its AI chips business as its technology is now at the center of the AI frenzy.

Nvidia’s data center group, which the company now calls “AI factories”, reported a record of US$4.28 billion in sales for the first quarter ended April 30, 2023, up 14% from a year ago and up 18% from the previous quarter.

The company said the increase was driven by demand for its GPU chips from cloud vendors and large Internet companies to train and deploy generative AI applications, a subfield of AI focused on developing algorithms and models that are capable of generating new text, images, or other media in response to prompts.

Nvidia’s chips provide the processing power needed to develop these new powerful AI applications. AI research laboratory and company OpenAI released ChatGPT in November 2022 with a brain composed of more than 20,000 Nvidia graphics processors, according to Bloomberg.

The company’s AI chips are also critical component of the cloud infrastructure that Alphabet, Amazon and Microsoft use. These services rent out their AI computing power to smaller companies and groups that cannot afford to build their own AI systems from scratch.

Last year, data-center operators collectively spending US$15 billion on bulk orders with Nvidia.

“You’re going to see tons and tons of ChatGPT-like things,” Huang said in an May 2023 interview. “This is basically a rebirth, a reinvention of computing as we know it.”

Huang had previously said that AI adoption was “at an inflection” with OpenAI’s ChatGPT “[capturing] interest worldwide.” He called the transformation an “iPhone moment” at a University of California, Berkeley, fireside chat on January 31, 2023.

Interest in AI has skyrocketed since the release of ChatGPT, an AI-powered chatbot that went viral for its ability to mimic human language and speaking styles, all the while providing coherent and topical information.

This has sparked a frenzy in the tech community and captured the attention of venture capital (VC) investors globally, ultimately benefiting Nvidia which produces 80% of the world’s GPUs, according to Reuters.

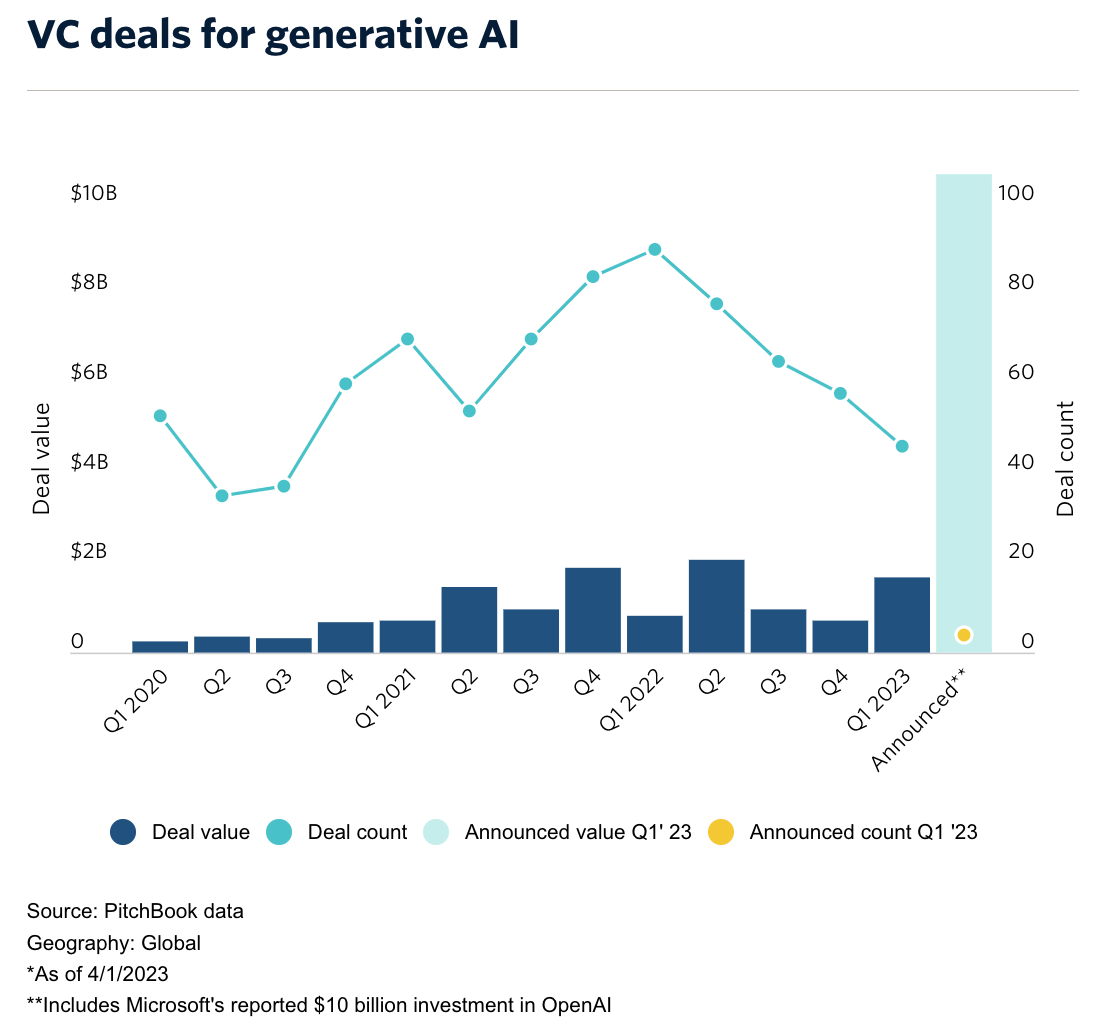

Although AI and ML funding declined last year, generative AI startup VC investment remained resilient in 2022, reaching a total of US$4.5 billion, according to Pitchbook data. This year, VCs increased their positions in the technology, with roughly US$1.7 billion being generated across 46 deals in Q1 2023 alone.

VC deals for generative AI, Source: Pitchbook, April 2023

Nvidia has pivoted to the AI market in the past few years after decades of leading the videogame chips market.

“We had the good wisdom to go put the whole company behind it,” Nvidia founder and CEO Jensen Huang told CNBC in an interview in February 2023.

“We saw early on, about a decade or so ago, that this way of doing software could change everything. And we changed the company from the bottom all the way to the top and sideways. Every chip that we made was focused on AI.”

Despite Nvidia’s lofty valuation, analysts believe the company’s AI chips business still has room for growth as generative AI technology remains at a nascent stage with wide adoption expected in the years to come.

McKinsey and Company estimates that adoption of generative AI could translate to the addition of up to US$4.4 trillion per year in value to the global economy. Generative AI also has the potential to substantially increase labor productivity across the economy, generating an estimate total economic benefit in labor productivity of up to US$7.9 trillion annually, the consultancy predicts.

This article first appeared on fintechnews.ch

Featured image credit: Edited from freepik