Fintech Funding in Europe Reaches Highest Quarterly High Since Q2’18

by Fintechnews Switzerland April 8, 2021In Q1’21, fintech funding in Europe reached its highest quarterly total since Q2’18, surpassing US$2.9 billion in just the first two months of the year, data from market intelligence startup CB Insights show.

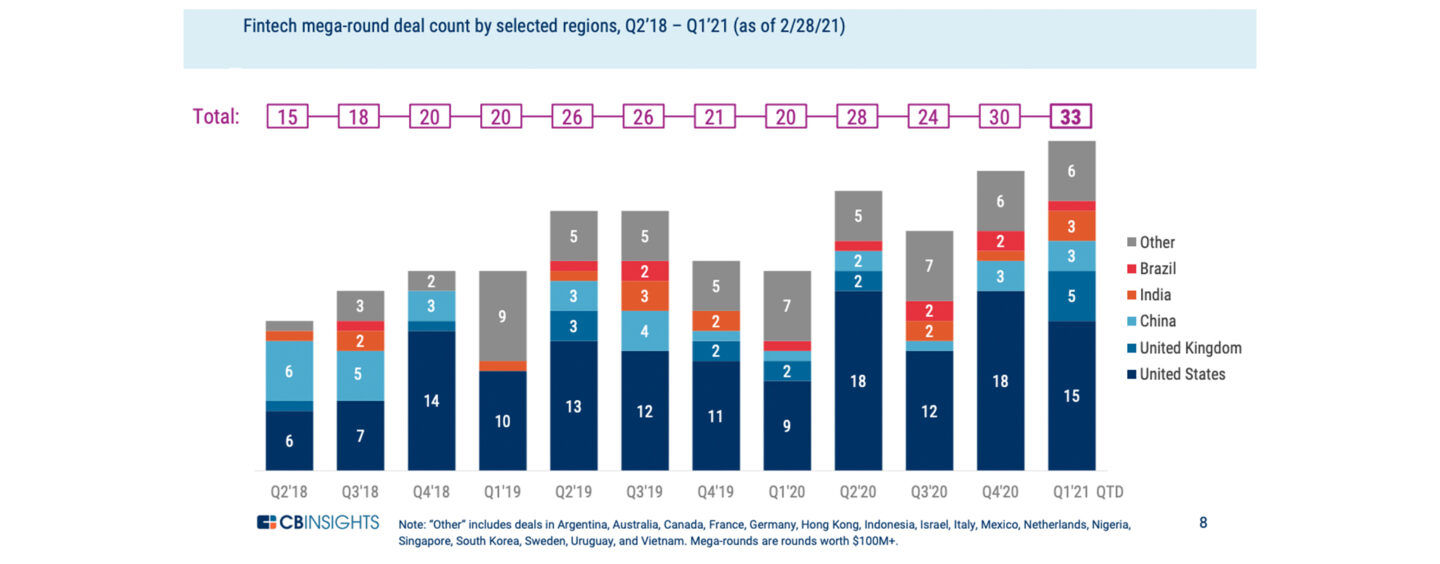

Global fintech funding ($M) by continent, Q2’18 – Q1’21 (as of 2/28/21), State of Fintech Q1’21 Preview, CB Insights

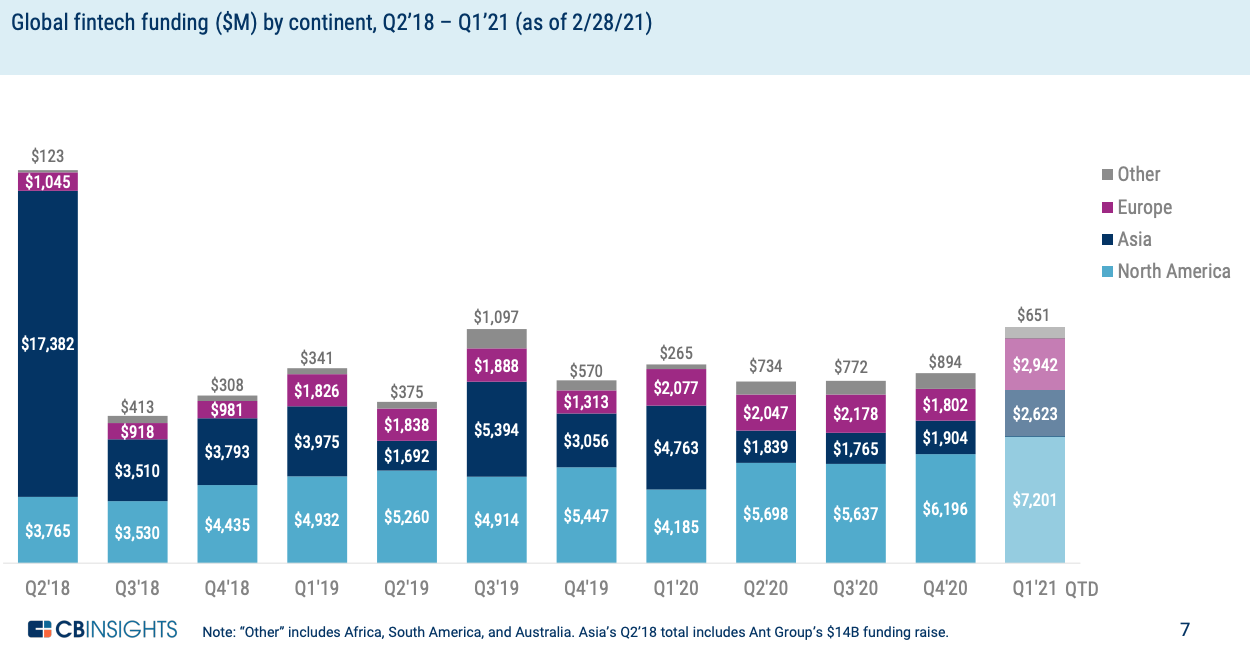

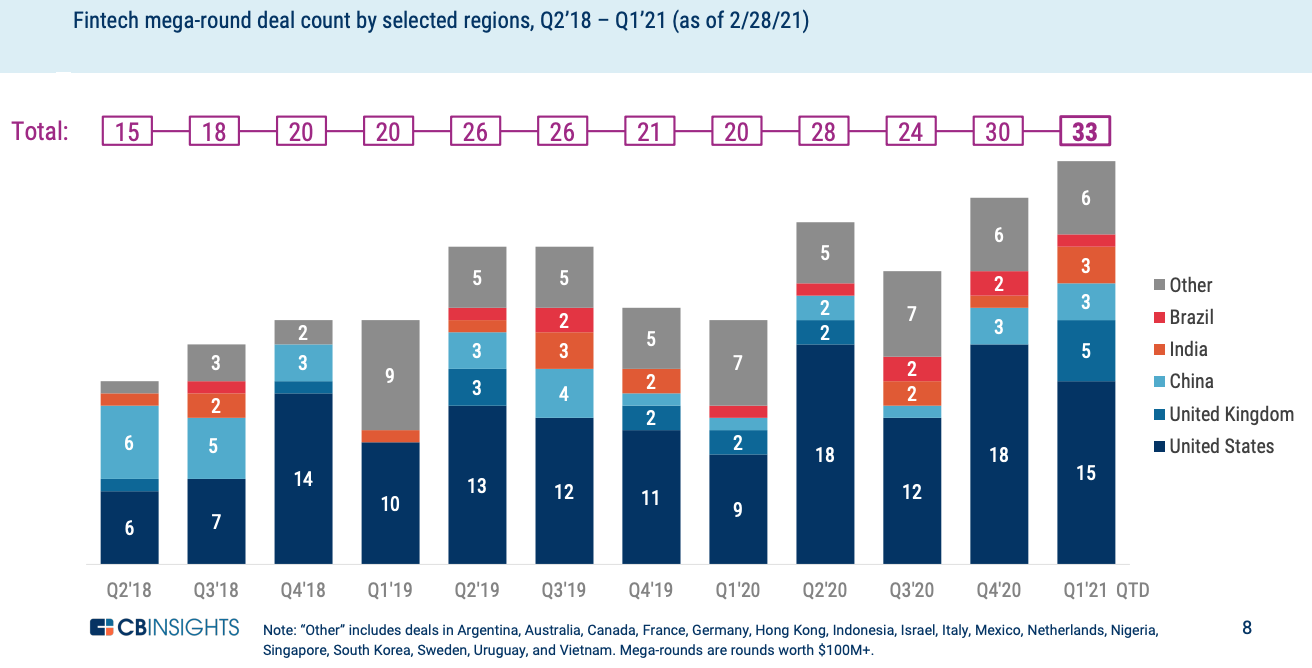

High fintech investment levels, not only in Europe, but also in Asia and North America, were fueled by a surge in mega-rounds, or investments of US$100 million or more.

As of February 28, 2021, the first quarter of the year already set a new record for both the number of mega-rounds and the volume of funds raised by mega-rounds. In January and February, mega-rounds’ share of global fintech funding amounted to 71%, and mega-round deals accounted for 8% of the total fintech deal count during these two months.

Fintech mega-round deal count by selected regions, Q2’18 – Q1’21 (as of 2/28/21), State of Fintech Q1’21 Preview, CB Insights

In Europe, such rounds included for example London-based online payments platform provider Checkout.com. The company, which processes transactions for companies like Grab, Klarna and Farfetch, nearly tripled its valuation to US$15 billion after it landed a US$450 million investment in January.

Germany banking software company Mambu closed a EUR 110 million mega-round in January, giving the startup a post-money valuation of EUR 1.7 billion. UK-based localized payment provider PPRO also hit a billion-dollar valuation that same month after closing a US$180 million funding round. The round was later extended by another US$90 million.

Blockchain.com, the Luxembourg-headquartered company behind a popular cryptocurrency wallet, an exchange, a block explorer and more, has raised a total of US$420 million in two funding rounds since the beginning of the year.

Just last month, challenger bank Starling Bank, insurtech startup Zego and crypto startup BitPanda, all raised mega-rounds and attained unicorn status, furthering the momentum. BitPanda is Austria’s first fintech unicorn.

Europe is home to 20 fintech unicorns, with the UK making up for more than half of the continent’s total number of fintech unicorns (13). The UK is followed by Germany with four fintech unicorns. Switzerland, the Netherlands, Sweden and Austria host one fintech unicorn each.

Fintech trends in Europe

This year, KPMG predicts that digital currencies and embedded finance will continue gaining traction.

Advanced in distributed ledger technology (DLT) and increased interest in both stablecoins and central bank digital currencies (CBDC) will further bring crypto-assets into the mainstream, the firm said in its latest fintech analysis paper released in February.

In 2020, central banks around the world ramped up their CBDC efforts with China beginning a real-world trial of its CBDC. In Europe, the European Central Bank is currently exploring the introduction of a digital euro within the next five years.

The Bank of International Settlements’ latest survey of central banks found that CBDC initiatives around the world are rapidly moving into more advanced stages of development. About 60% of central banks are currently conducting experiments or proofs-of-concepts (PoCs), while 14% are moving forward to development and pilot arrangements.

This trend will be coupled with the rise of institutional investors in the cryptocurrency space as the market continues its rally, which will subsequently push demand for operations-focused solutions, notably for compliance and investigative purposes. 2021 could also see the issuance of the first stablecoins by mainstream brands, KPMG predicts.

Embedded finance, a concept where non-financial companies integrate financial products into their service offerings, is another trend to watch for this year. In particular, embedded consumer lending such as buy now and pay later (BNPL) programs, and embedded payments, should witness increased interest and investments.

2021 will see further consolidation among Europe’s fintechs, which will ultimately bring together the strongest players, tech platform and customer experience technologies, KPMG said. Incumbents will continue to make investments in fintechs and forge partnerships to accelerate their digital transformation efforts.