European fintech companies secured only EUR 4.6 billion in funding in H1 2023, down by a staggering 70% from the EUR 15.8 billion raised during the same period last year, a new report by European growth investor Finch Capital shows. The massive drop was mainly driven by a decreased number of mega rounds, a retreat in activity from American investors, and a return to investment fundamentals, the firm says.

The 8th Annual State of European Fintech Report 2023, released on September 12, 2023, delves into fintech funding activity in the region during the first half of the year, highlighting shrinking deal count and funding volume, as well as a pullback from corporate investors as the macroeconomic environment remained uncertain.

According to the report, deal count in H1 2023 totaled a mere 463, representing a 48% drop. During the period, the top 20 funding rounds in Europe made up a larger share of total deal volume at 60%, against 50% in 2021 and 2022. This implies that investors put a greater focus on backing more established fintech companies with solid operations and strong growth prospects.

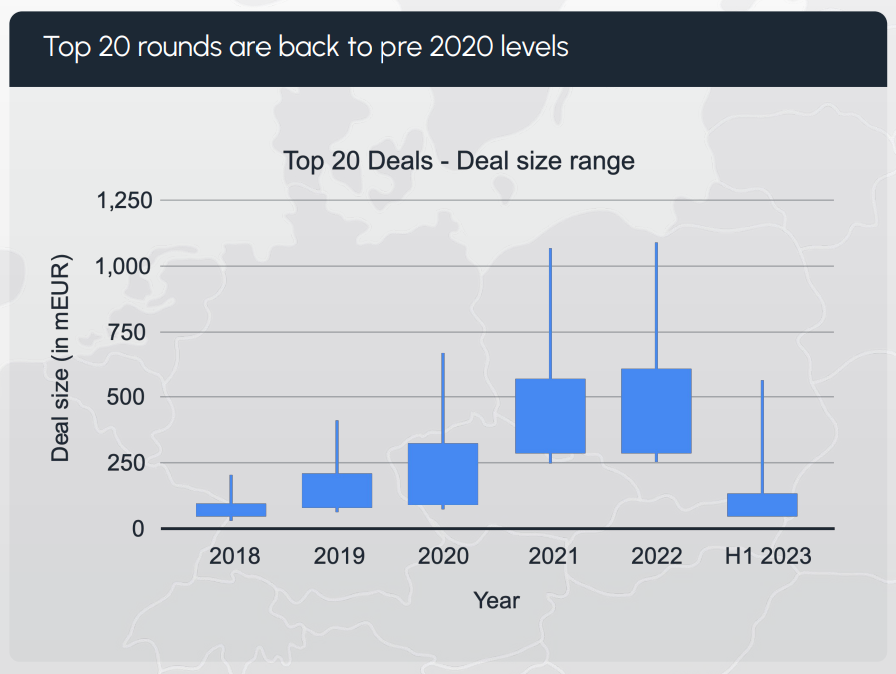

Top 20 fintech funding rounds in Europe, Source: 8th Annual State of European Fintech Report 2023, Finch Capital, Sep 2023

Deal size of the top 20 deals in H1 2023 also decreased substantially, falling below the EUR 130 million range and pulling back to pre-2020 levels. This compares starkly to average deal sizes observed in 2021 and 2022, which surpassed EUR 250 million.

Average deal sizes for the top 20 fintech funding rounds, Source: 8th Annual State of European Fintech Report 2023, Finch Capital, Sep 2023

A closer look at key European markets reveals that the UK market stood out from the crowd and showed more resilience than some others countries by accounting for over 50% of fintech funding in Europe. That’s a larger share than in H1 2022 during which the country made up 45% of fintech funding in the region.

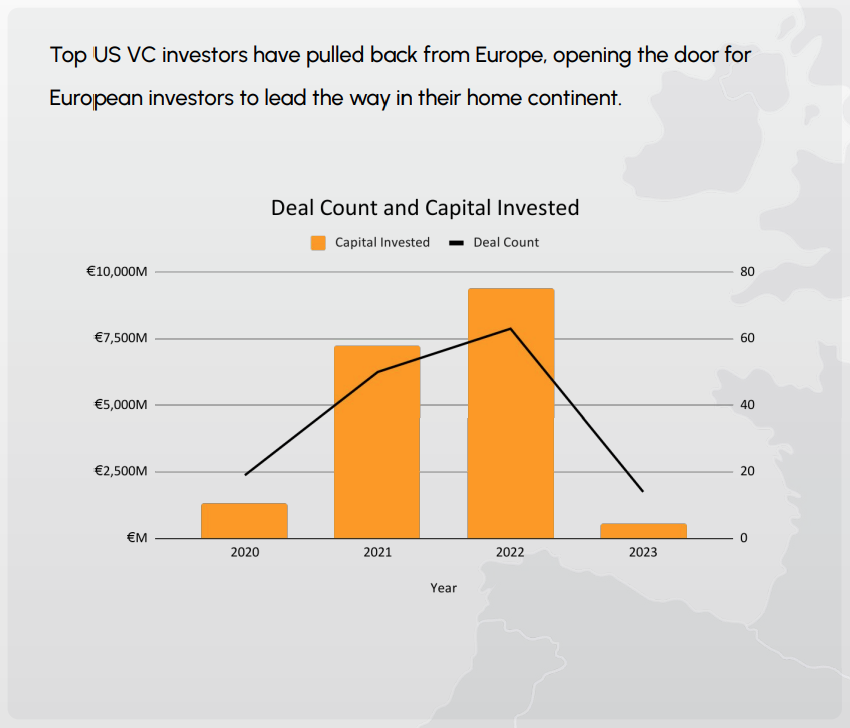

Another key finding of the Finch Capital analysis is the massive pullback from US-based investors in 2023. American investors have historically been rather active in the European fintech scene. In 2021, for example, three US-based firms were among the top five fintech investors in the UK. In H1 2023, however, no American firm made it into the list, the report notes.

Overall, the biggest and most active US investors in the European fintech industry committed far lesser capital to the region this year, investing less than a billion euros in the sector in H1 2023. In comparison, these venture capitalists (VCs), which include names such as Sequoia, Lightspeed, Coatue and Andreessen Horowitz, committed about EUR 9 billion in 2022 and a little less than EUR 7.5 billion in 2021.

Top US VC investors’ investments in European fintech companies, Source: 8th Annual State of European Fintech Report 2023, Finch Capital, Sep 2023

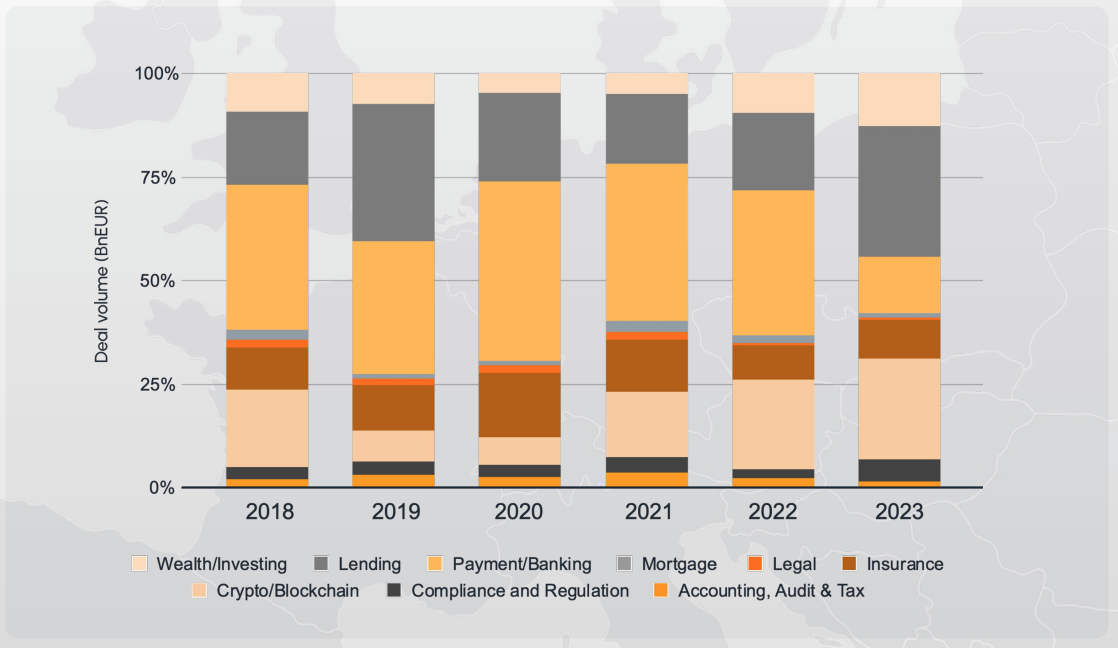

Sector wide, payments and neobanking took a big hit in the first half of the year and lost its position as the favored fintech segment.

While the sector has historically been a resilient category, registering record amounts of capital deployed in 2022, investments in the space pulled back significantly in H1 2023 as investors took caution to valuation inflation, the report notes.

Payments and neobanking was overtaken by crypto/blockchain and lending, which were the top fintech subsectors in deal count and deal volume, respectively.

Share of deal volume of each fintech segment, Source: 8th Annual State of European Fintech Report 2023, Finch Capital, Sep 2023

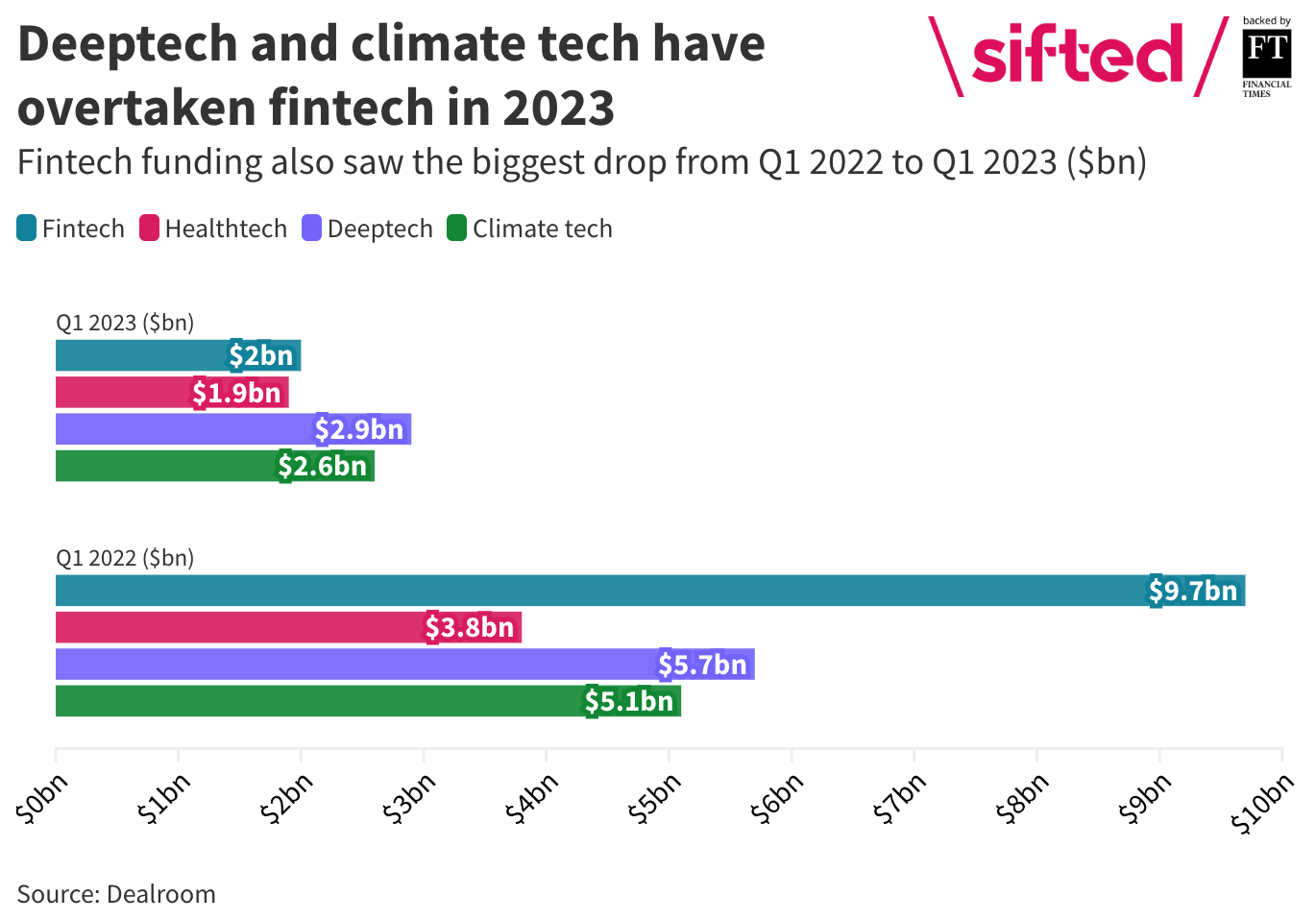

Funding across all tech sectors in Europe has declined over the past year, but fintech has by far been the hardest hit sector, data from Dealroom reveal.

In Q1 2023, fintech secured a mere US$2 billion (EUR 1.9 billion) in funding and lost its position as the most-funded tech sector in Europe. The sector was overtaken deeptech and climate tech, which secured US$2.9 billion (EUR 2.7 billion) and US$2.6 billion (EUR 2.4 billion), respectively, the data show.

Healthtech, meanwhile, which has been among the lesser well-funded tech sectors in Europe, was almost on a part with fintech, raising a total of US$1.9 billion (EUR 1.8 billion) in Q1 2023.

Top tech sectors in Europe by deal volume, Source: Sifted and Dealroom, Apr 2023

What lies ahead

Finch Capital warns that the European fintech market is now entering a period of contraction and that a laser focus will continue to be put on building profitable businesses at sustainable valuations.

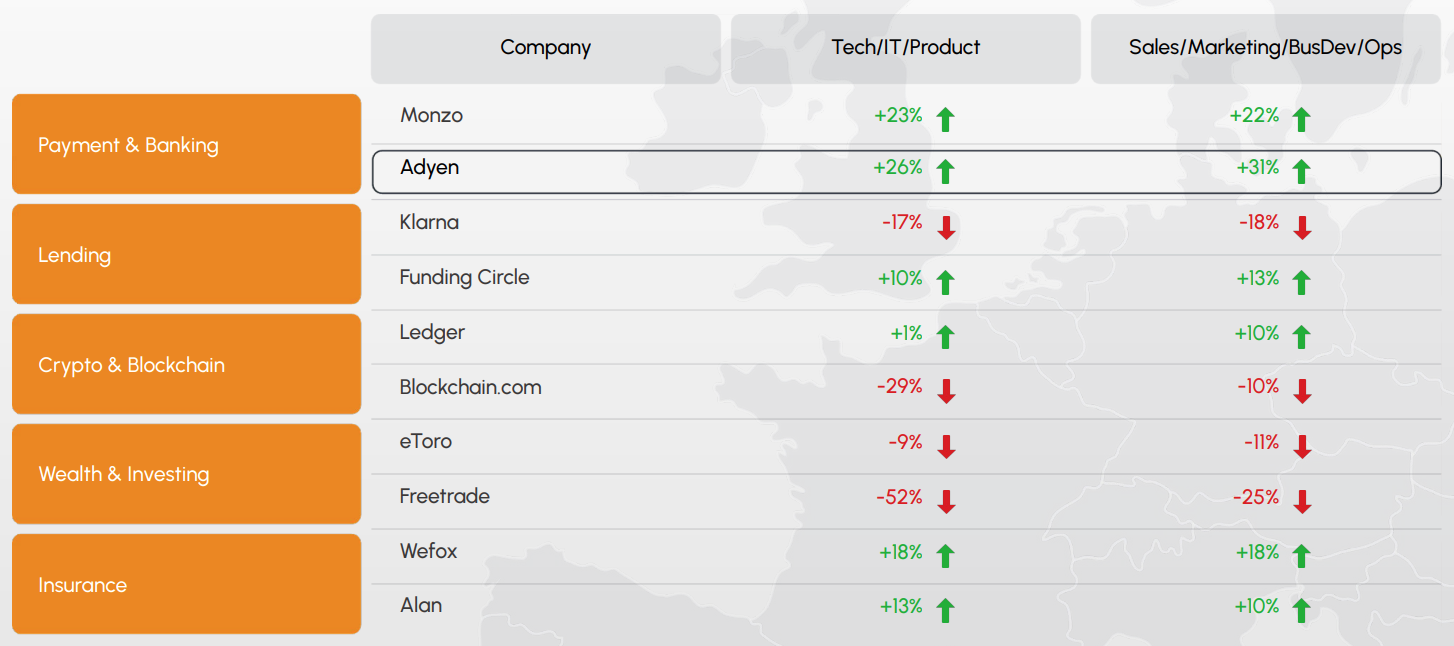

This fight for profitability emerged in the past year as the industry suffered from 3,100 announced layoffs, the report notes. While fast-growing players, including Monzo, Adyen and Funding Circle, continued to hire new employees over the past year, bringing in more than 1,050 new staff, Finch Capital expects these firms to start laying off in the second half of 2023.

Employee growth at the top ten fastest-growing fintech companies in Europe, Source: 8th Annual State of European Fintech Report 2023, Finch Capital, Sep 2023

The firm also predicts that the shift from consumer fintech to business-to-business (B2B) fintech, which started in the last couple of years, will carry on in 2023 and onwards, with segments such as regtech and artificial intelligence (AI) projected to pick up steam.

Interest in regtech will increase as governments continue to launch new initiatives and as changes in legal frameworks complexify compliance for fintech companies, it says.

Generative AI, a subfield of AI focused on developing algorithms and models that are capable of generating new text, images, or other media in response to prompts, will continue to gain traction and witness increased adoption as fintech segments including retail banking and insurance embrace the technology, the firm says.

Featured image credit: Edited from freepik