IFZ Fintech Switzerland Study 2022 Summary: 9 Key Facts and Graphics

by Fintechnews Switzerland March 17, 2022In 2021, the number of active fintech companies in Switzerland declined for the first time since 2015, shrinking from 405 companies at the end of 2020 to 384 a year later. Despite a decrease of 21 companies, the Swiss fintech startups that remained grew their teams, raised larger rounds of funding, and expanded overseas, suggesting the further maturing of the fintech sector, according to the IFZ Fintech Study 2022.

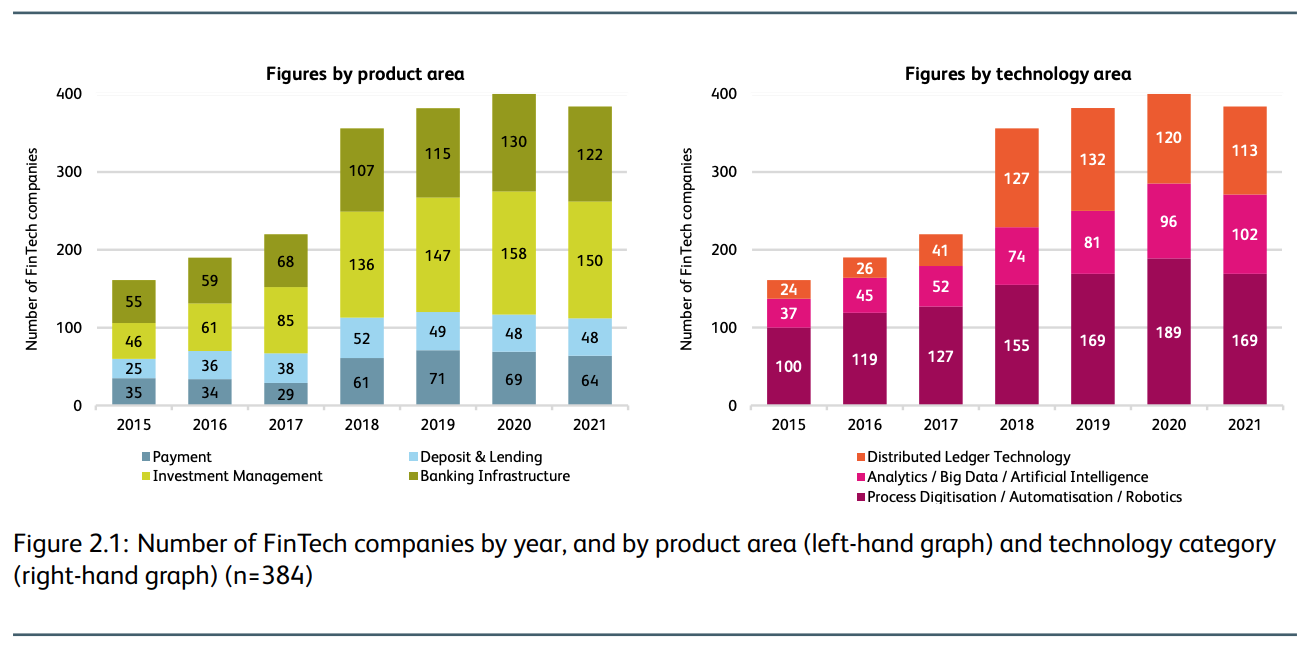

Number of fintech companies by year, and by product area (left-hand graph) and technology category (right-hand graph) (n=384), Source: IFZ Fintech Study 2022

Fintech funding reached a new all-time high last year with Swiss startups raising a total of US$3.1 billion in 2021. Much of that sum was raised by more mature, growth stage fintech companies through Series B rounds.

Venture capital invested in Swiss fintech companies, Source: IFZ Fintech Study 2022

An analysis of the total funding per company and the number of full-time equivalents employed revealed that the median values of both figures increased in 2021 after stagnating a year prior. In 2021, the median total funding amount rose to CHF 3 million from the previous CHF 1.5 million, while the median number of full-time employees grew to 20 from 12.

Median total funding (n2021=59) and number of employees (n2021=149) by year, Source: IFZ Fintech Study 2022

Looking at fintech exits in 2021, the report notes that although no initial public offering (IPO) took place in Switzerland last year, several buyouts were recorded. These include the acquisitions of Appway by FNZ, of Assentis Technologies by Smart Communications, of numas by Allocare, of Run My Accounts by Infoniqa, as well as the acquisition of majority stakes of Accounto by AXA and Crypto Finance by Deutsche Börse.

Fintech acquisitions have gained in relevance over the past year, totaling 906 deals in 2021, up from just 540 the year prior, data from CB Insights show. Top mergers and acquisitions (M&A) deals of 2021 are valued in the billions, and include the US$29 billion acquisition of buy now, pay later (BNPL) giant Afterpay, the US$4.7 billion acquisition of Indian online payment gateway BillDesk, and the US$2.5 billion acquisition accounting fintech Divvy.

Renewed interest in cryptocurrencies pushes token sales volume

Consistent with the renewed interest in the crypto assets sector observed over the past two years, token sales regained popularity in 2021 after two years of declining volumes. Last year, a total of 481 token sales took place around the world, raising a total of US$5.7 billion. This is a strong increase considering that 2020 only saw 91 token sales and a total of US$700 million raised.

In Switzerland, just one token sale was recorded for 2021: Concordium, the developer of a compliance-ready public blockchain infrastructure, which completed a US$36 million token sale in April.

Token sales globally across all sectors, Source: IFZ Fintech Study 2022

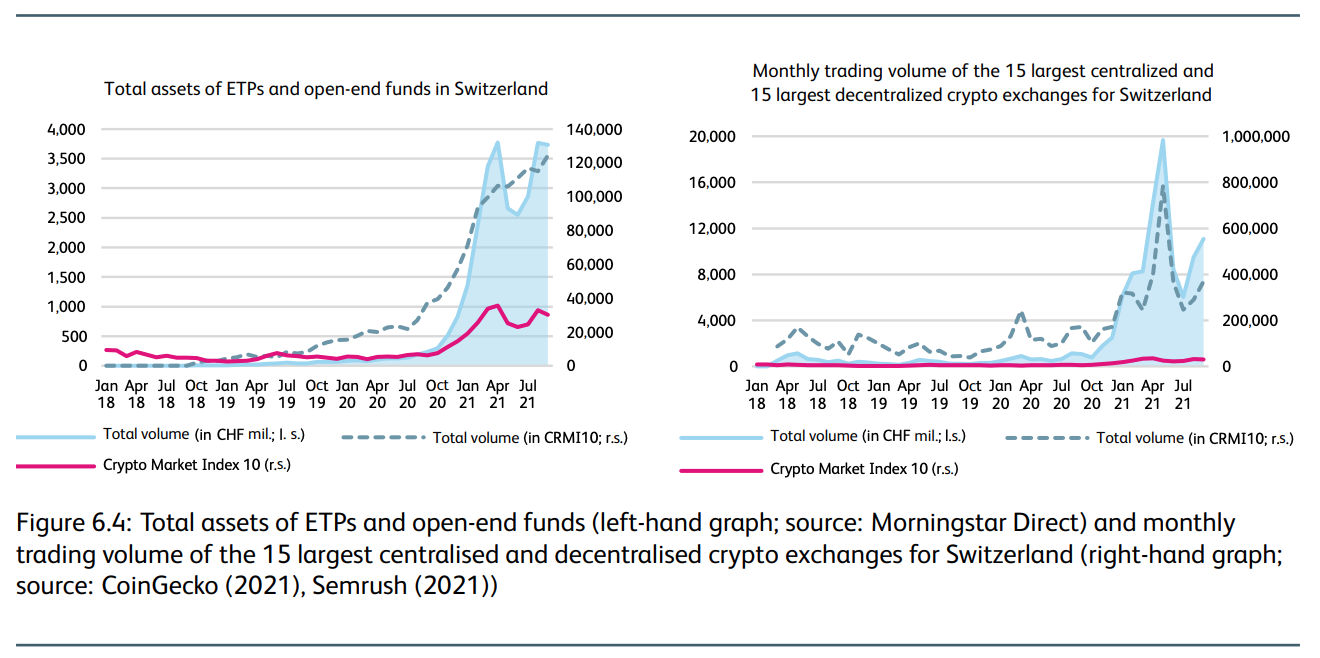

The revival of the cryptocurrency market was also seen in the surge in trading volumes for both direct investments in cryptocurrencies, i.e. the direct buying and holding of crypto assets, as well as and indirect investments, e.g. the buying of securities that track cryptocurrencies.

Indirect investments in cryptocurrencies through, for example, exchange-traded products (ETPs), more than tripled between late-2020 and September 2021, soaring from combined total assets of less than CHF 1 billion to roughly CHF 3.7 billion.

As for direct investments through exchange platforms, the IFZ Fintech Study 2022 estimates that trading volume in Switzerland ballooned to a total of CHF 96.6 billion between October 2020 to September 2021.

Total assets of ETPs and open-end funds and monthly trading volume of the 15 largest centralized and decentralized crypto exchanges for Switzerland, Source: IFZ Fintech Study 2022

The Swiss fintech sector in 2021

Like previous years, investment management and banking infrastructure were the two largest segments in the Swiss fintech sector in 2021, with 150 and 122 companies, respectively. They are followed by payments (64 companies) and deposit and lending (48).

From the technological perspective, Swiss fintech companies seem to be increasingly using technological concepts from the field of analytics/big data/artificial intelligence (AI). Adoption of these technologies is expected to increase further in the future as the financial industry continues to realize the untapped opportunity surrounding smart data, the report says.

This is in contrast to other technologies, including process digitalization/automation/robotics, and distributed ledger technology (DLT), which saw a decrease in the number of fintech companies using these technologies in 2021.

The report also outlines a growing tendency for Swiss fintech companies to focus on business-to-business (B2B) business models and to be predominantly internationally oriented considering the small domestic market.

By the end of 2021, B2B business models accounted for 58%, while B2C business models stood at 8%. One third of Swiss fintech companies pursued a hybrid strategy, targeting both business and private clients.

The majority of Swiss B2B (82%) and B2B and B2C (65%) fintech companies follow an international market strategy. Only pure B2C fintech companies tend to focus on their relatively small home market (62%).

Proportion of fintech companies by customer segments 2021 (n=154), Source: IFZ Fintech Study 2022