Venture capital (VC) financing going into Swiss fintech startups pulled back significantly in H1 2023, plummeting by more than 45% year-on-year (YoY) as the global economic downturn continued to weigh on startup valuations and the VC funding landscape as a whole, new data released by online news portal Startupticker.ch and the investor association SECA, in cooperation with startup.ch, show.

The Swiss Venture Capital Report 2023 Update, published on July 13, 2023, shares key VC funding metrics for H1 2023, showcasing a grim fundraising landscape for Swiss startups during the first half of the year.

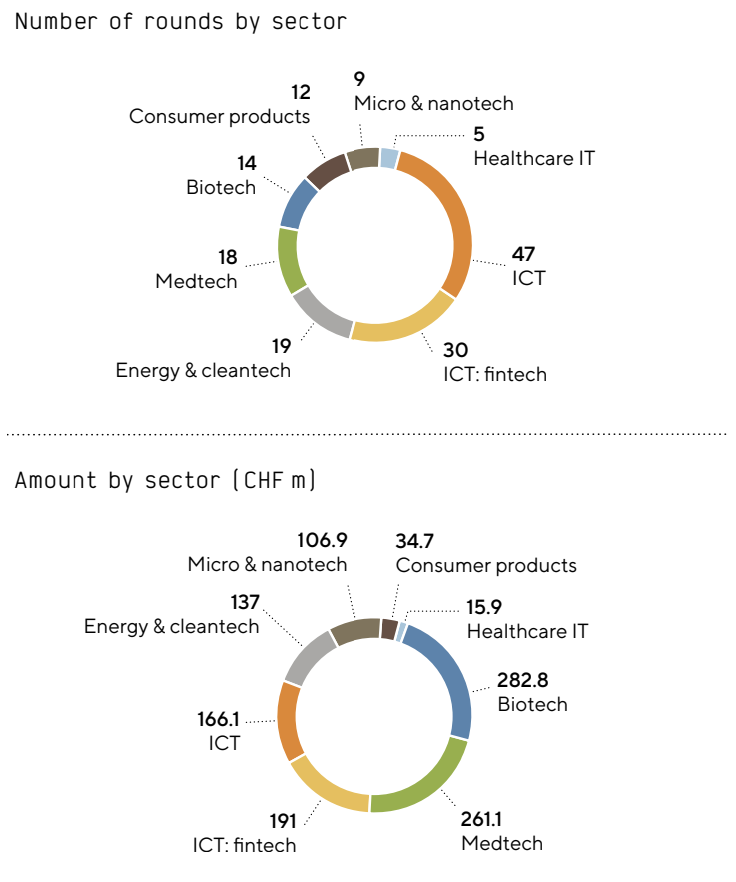

According to the report, Swiss fintech companies raised a mere CHF 191 million in H1 2023, nearly half of the sum secured in H1 2022 (CHF 349 million). Other startup categories also witnessed a significant drop in VC funding, with information and communications technology (ICT) and healthcare IT dropping by a staggering 80%+ YoY each.

Funding and round number by sector, Source: Swiss Venture Capital Report 2023 Update, Startupticker.ch, SECA and Startup.ch, July 2023

A survey of about 100 Swiss investors conducted by SECA as part of the report shows that the environment will likely remain challenging for Swiss startups for the rest of the year. A third of respondents said they will make fewer new investments in the next year, and instead focus more on follow-up financing.

When asked about the factors they now think are more important than 12 months ago, 70% of investors said they now pay more attention to valuation when making a new investment and 72% said they weigh capital efficiency more heavily today.

This suggests that startups wanting to receive investment now have to prove that they can efficiently achieve business milestones with the capital invested, and that they will likely have to accept compromises in their valuation.

Importance of investor factors, Source: Swiss Venture Capital Report 2023 Update, Startupticker.ch, SECA and Startup.ch, July 2023

Swiss investors expect valuations to continue to decline over the next 12 months. In the H1 2022 report, 44% of respondents said they expected valuations to decline over the following 12-month period, compared with 61% in this year’s questionnaire.

Respondents project the sharpest decline in financing volume and valuations in later stage and growth rounds, or Series B and later, but expect some improvement for seed investments.

When asked about the challenges in the year to come, Swiss investors highlighted two main points: realizing exits at attractive valuations and refinancing the startups that completed rounds with very high valuations in 2021 and 2022.

Despite the challenging environment, Swiss investors remain optimistic on the growth prospect of the ecosystem, with survey results revealing that Swiss VCs are still busy fundraising. About a fifth of all respondents – the same number as in 2022 – indicated being involved in fundraising, with those that are planning fundraising and those actively investing reaching 36% this year versus 39% in the previous year.

In H1 2023, Swiss VC financing totaled CHF 1.2 billion, representing a 54% decrease compared with the same period last year. The number of completed financing rounds also fell, reaching 154 in H1 2023 compared with 163 in H1 2022.

Financing rounds were smaller in size with the median sum falling from CHF 3 million in H1 2022 to CHF 2.48 million in H1 2023.

Investments in Swiss startups in H1 2023, Source: Swiss Venture Capital Report 2023 Update, Startupticker.ch, SECA and Startup.ch, July 2023

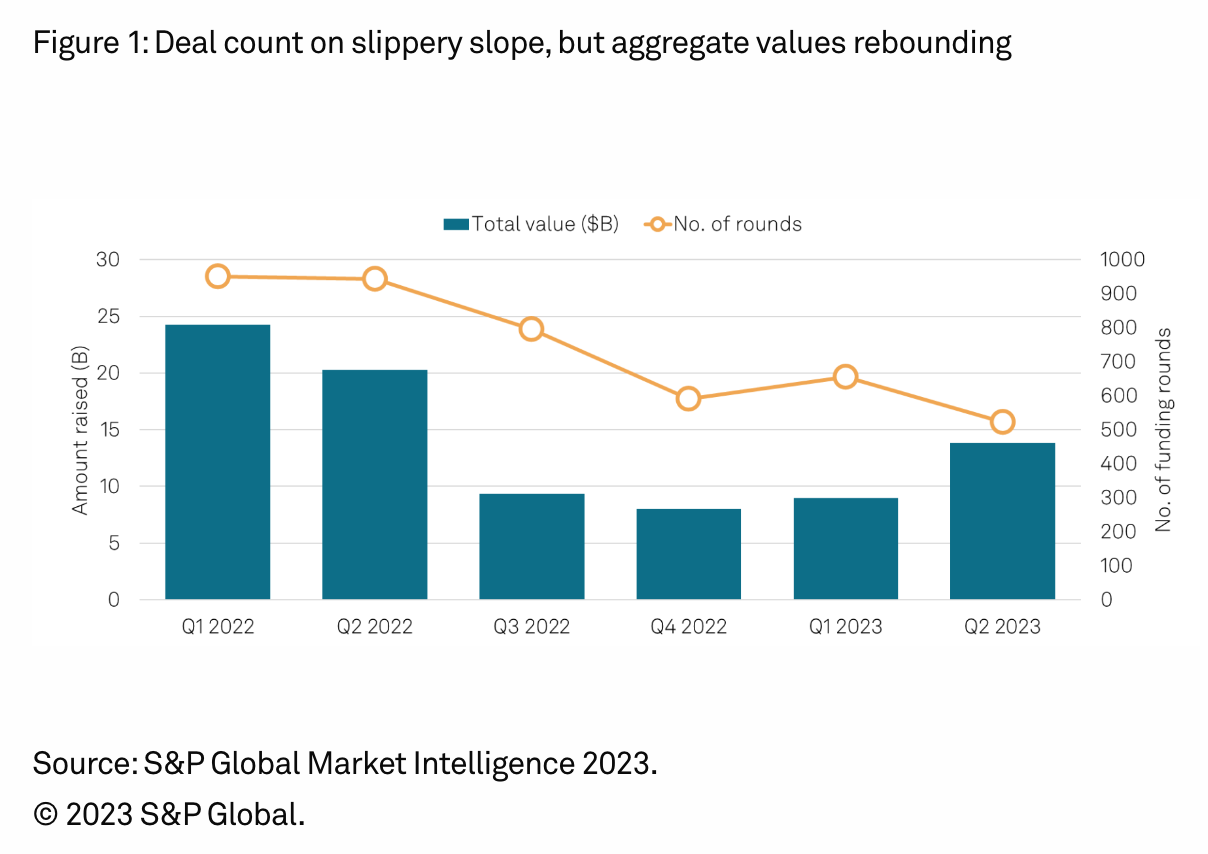

Plummeting fintech funding activity in Switzerland is consistent with what has been observed globally. According to an analysis by S&P Global Market Intelligence, VC funding of fintech startups globally plunged by 49% YoY in the first half of 2023, reaching US$23 billion. Deal count totaled 1,178, representing a 64% drop from H1 2022.

Global fintech funding by quarter, Source: S&P Global Market Intelligence 2023, July 2023

2022 and 2023 have been challenging years for startup fundraising. VC investors pumped the brakes on aggressive funding, spooked by an uncertain economic picture, plunging tech industry stock prices and growing recession fears. At the same time, a series of high-profile collapses shook the landscape, dampening investor risk appetite.

Silicon Valley Bank, once the most prominent bank for startups and VC firms, failed after a bank run in March 2023, marking the second-largest collapse of a financial institution in US history. The failure is said to have had some impact on startup funding by putting a momentary pause on large funding announcements, Crunchbase reported in the days that followed the event.

In late-2022, FTX, a cryptocurrency exchange once worth US$32 billion, filed for bankruptcy protection in the US. An investigation uncovered instances of commingling and misuse of customer deposits, with approximately US$8.7 billion being owed to its customers.

Featured image credit: edited from Freepik