Europe Leads in Climate Fintech Driven by Supportive Policies, Government Initiatives

by Fintechnews Switzerland August 4, 2022Europe is rising to leadership in the field of climate fintech, a position evidenced by the region’s large community of startups leveraging technology to address both sustainability and finance needs.

This rise has been driven by a supportive policy context and the multitude of initiatives introduced by governments across the continent to foster innovation in green finance, a new report by Swiss fintech and insurtech startup incubator and accelerator F10 says.

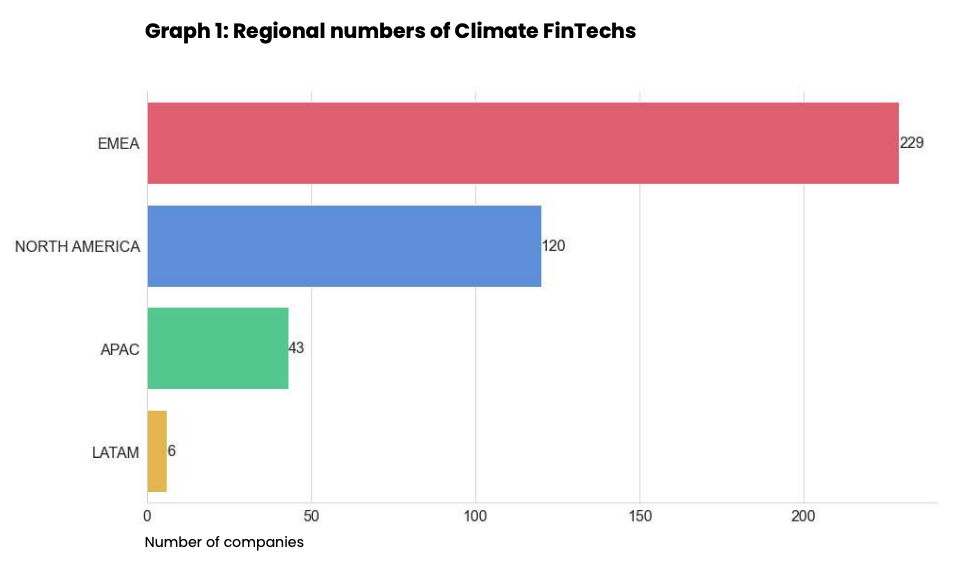

The Climate Fintech Report 2022, released in June, sheds some light on the global climate fintech industry, identifying over 400 climate fintech startups globally. Of these, 229 are based in Europe, the Middle East and Africa (EMEA), making the region the biggest climate fintech ecosystem in the world. EMEA leads North America, where 120 climate fintech companies are based, North America (120), Asia-Pacific (APAC) (43), and Latin America (six).

Regional numbers of climate fintechs, Source: Climate Fintech Report 2022, F10

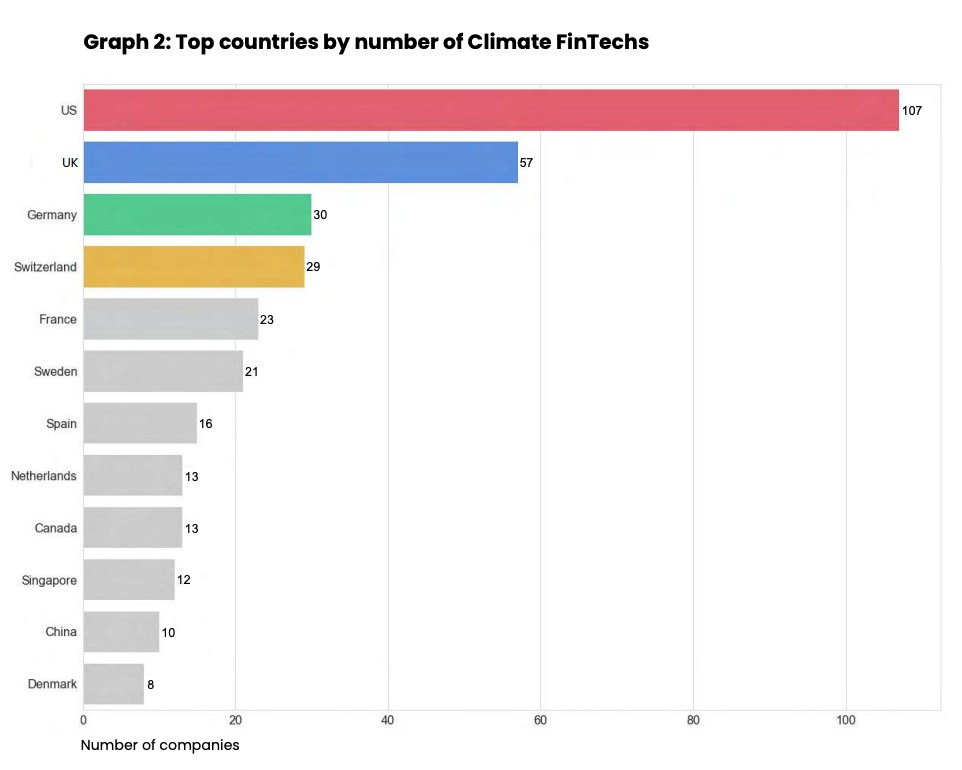

Delving deeper into the geographical distribution of climate fintech startups, the research found that, although the US hosts the most climate fintech companies than any single country (108), Europe takes the cake from a regional volume perspective with the UK (57), Germany (30), Switzerland (29), France (23), Sweden (21), Spain (16), the Netherlands (13) and Denmark (eight) ranked among the world’s top ten largest climate fintech hubs.

Top countries by number of climate fintechs, Source: Climate Fintech Report 2022, F10

Europe’s burgeoning climate fintech ecosystem can in part be explained by the region’s more progressive top-down climate finance policy-making, the report says, with initiatives such as the European Green Deal, a set of policy initiatives approved in 2020 with the overarching aim of making the European Union (EU) climate neutral in 2050, as well as the implementation of implementation of the Sustainable Finance Disclosures Regulation (SFDR), which mandate climate disclosures by companies.

Switzerland’s climate fintech ecosystem

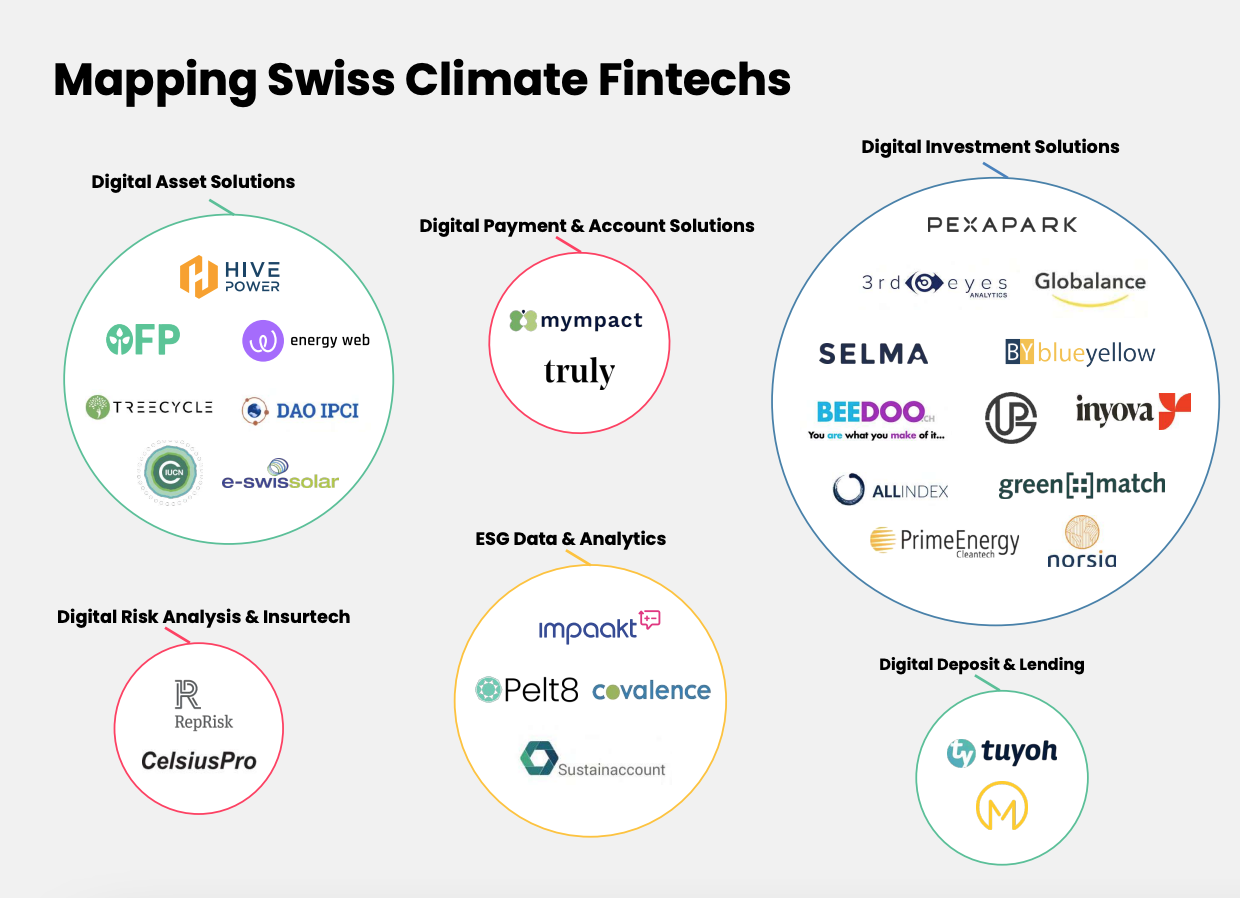

Ranked fourth globally in terms of total number of climate fintech companies, Switzerland is home to a thriving climate fintech space that’s been facilitated by supportive initiatives and promotion efforts by the government, the report says.

These initiatives include the establishment of the Green Fintech Network, set up in November 2020, and the subsequent release of the Green Fintech Action Plan in 2021. Most recently, the Federal Council launched a new system that measures the environmental impact of financial investments.

Currently, Switzerland’s climate fintech startup ecosystem comprises 29 companies, among which 12 that specialize in digital investment solutions. This makes digital investment solutions the most crowded segment in the Swiss climate fintech industry, followed by digital asset solutions (7), and environmental, social and corporate governance (ESG) data and analytics (4). Digital payments and account solutions, digital deposit and lending, and digital risk analysis and insurtech rank last with two startups each.

Switzerland’s climate fintech startups, Source: Climate Fintech Report 2022, F10

Two Swiss climate fintech startups are highlighted in the report: Mympact, an app that uses open banking to help people track their CO2-footprint across accounts, and motivate them to reduce their environmental impact with tips, challenges and more; and Inyova, a platform that allows customers to invest their savings in a way that’s consistent with their values and lifestyle, focusing on themes like renewable energy, electromobility, medical technology, gender equality, human rights and more.

Climate fintech startups and funding trends

Globally, climate fintech remains a rather nascent industry, the report says, a state that’s evidenced by the prominence of seed and Series A funding rounds.

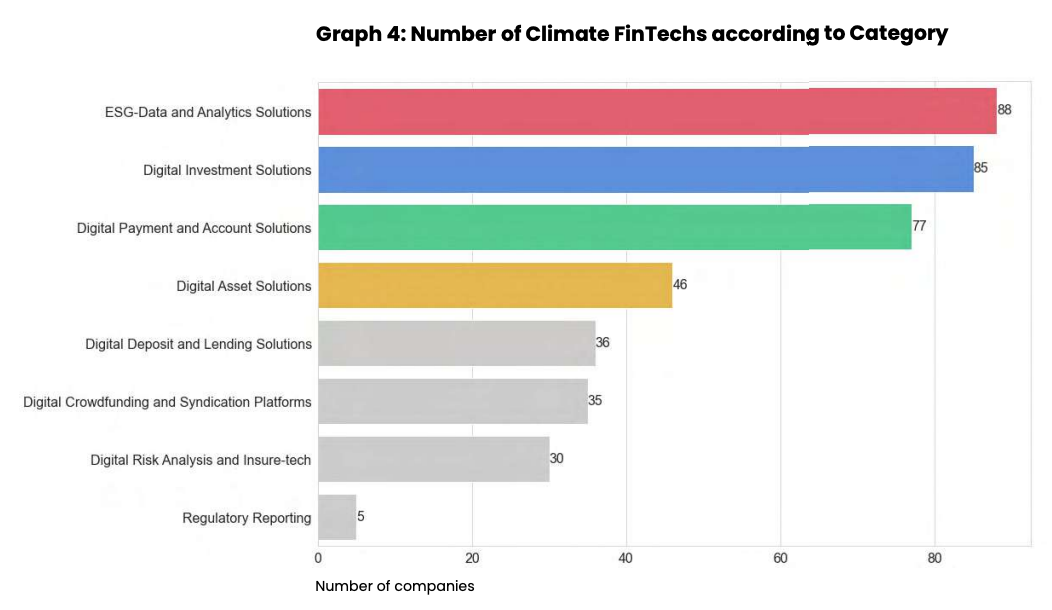

ESG data and analytics is the most advanced and represented segment, with 88 startups in the space out of the world’s 400+ climate fintech companies.

ESG data and analytics is followed by digital investment solutions (85), digital payment and account solutions (77), digital asset solutions (46), digital deposit and lending solutions (36), digital crowdfunding and syndication platforms (35), digital risk analysis and insurtech (30) and regulatory reporting (5).

Number of climate fintechs according to category, Source: Climate Fintech Report 2022, F10

Looking at funding trends, the report notes that investment into climate fintech reached a new record in 2021, amassing a total of EUR 1.4 billion. The amount represents more than half of all investment ever raised by the industry (EUR 2.7 billion).

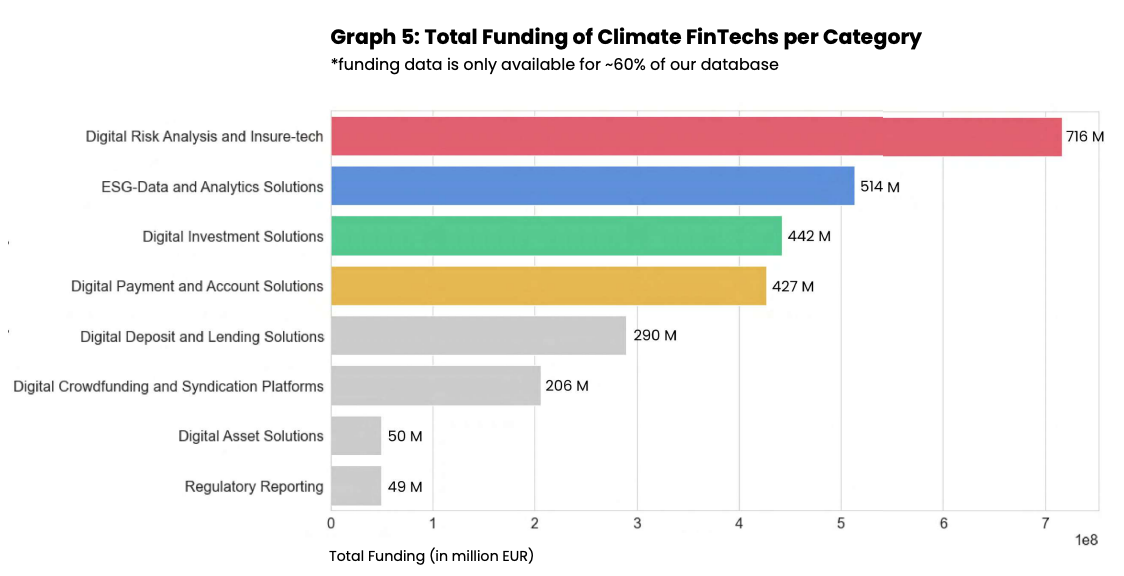

So far, much of climate fintech funding has focused on startups in digital risk analytics and insurtech, which have raised a total of EUR 716 million so far. The category is followed by ESG data and analytics solutions (EUR 514 million), digital investment solutions (EUR 442 million) and digital payment and account solutions (EUR 427 million).

Total funding of climate fintechs per category, Source: Climate Fintech Report 2022, F10

Funding activity in 2022 so far suggests that the momentum will likely continue this year. In February, San Francisco-based Watershed closed one of the largest funding rounds in the space, according to Crunchbase, raising a US$70 million Series B funding round. Watershed operates a platform that helps companies like Stripe, Spotify, Klarna, and Airbnb, measure, reduce, and report their carbon emissions with real-time, audit-grade emissions data.

Just last month, Xpansiv, a global carbon and environmental exchange commodities platform, raised US$400 million from Blackstone. Xpansiv connects buyers and sellers of environmental commodities and provides market data for voluntary carbon offsets, renewable energy credits, and low-carbon fuels.

Featured image credit: Edited from Unsplash