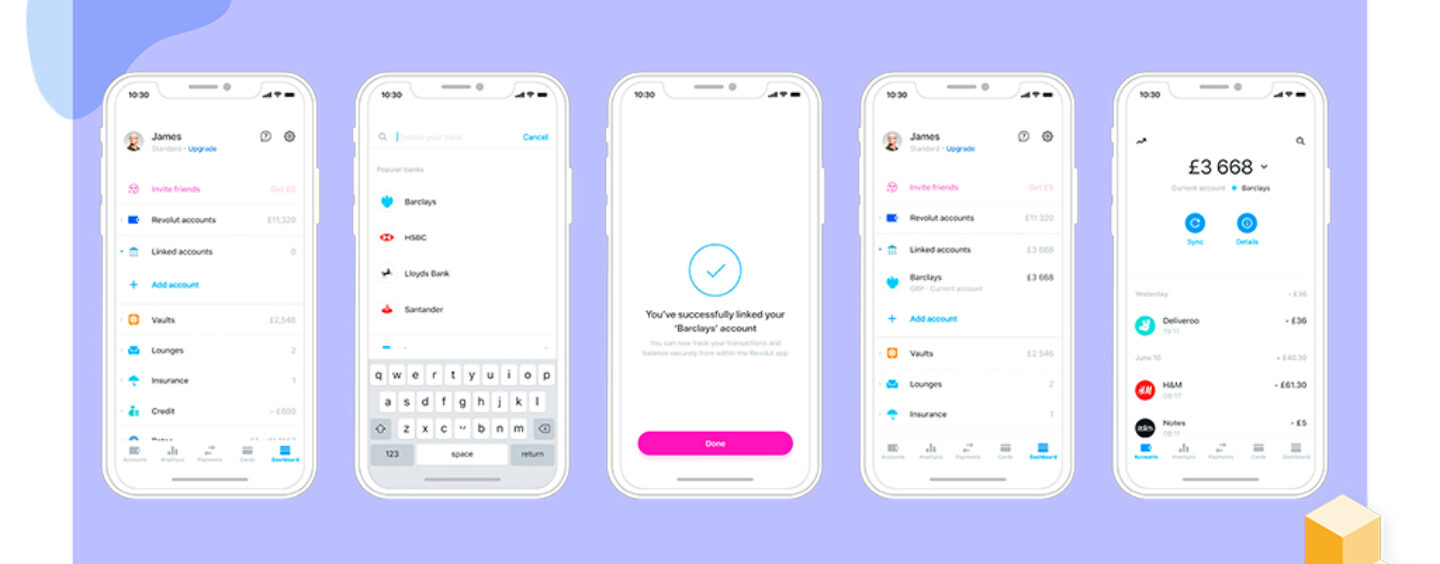

In pursuit of its goal to give people greater control over their financial lives, Revolut has launched Open Banking for all UK customers using TrueLayer

Revolut has chosen Truelayer as their Open Banking platform, giving them secure, reliable access to financial data in real-time. As a result, customers can now connect all of their external bank accounts to Revolut and manage everything from one place. This will provide greater visibility and control over spending and budgeting.

Putting customers in control of their data

Currently, bank account details like account information, balances, and transactions sit solely with a customer or business’ individual bank. Consequently, customers have reduced visibility into their financial health, as the only way to see the full picture is through accessing multiple bank websites and apps. This is a fragmented, broken process that leads to unfair fees, expensive overdrafts, and mismatched financial products.

From now, all UK Revolut customers will be able to see everything in one place, track spending, and set budgeting controls for their Revolut and external bank accounts.

A unified gateway to balances and transactions

When deciding which provider to work with on its Open Banking launch, Revolut chose to work with TrueLayer due to our scalability and superior developer experience.

Joshua Fernandes

“The entire process to get up and running and start experimenting with TrueLayer was quick and painless. We found their API was robust and developer-friendly, and we’re already realising the benefits.”

said Joshua Fernandes, Product Owner for Open Banking at Revolut.

“Delivering a seamless experience to our UK retail and business customers is hugely important for us to convert customers to Open Banking so they can begin to get instant value from the wide variety of new features we are building. Any initiative that enables more people and businesses to embrace Open Banking is good for everyone involved. When our customers say it’s easy to connect their external accounts using the TrueLayer integration, that’s a huge tick for us”.

By exposing Revolut’s 10 million customers to Open Banking, it is likely adoption for the technology will increase significantly in 2020. Recent research shows that Open Banking could realise as much as £18bn worth of value for people and small businesses in the UK over the course of a year.