Cloud and Digital Wallets to Drive Payments in Latin America, Despite Pandemic

by Fintechnews Switzerland January 26, 202164% of financial institutions in Latin America will be increasing investment in retail payments over the next two years, according to a survey conducted by OpenWay, a global vendor of digital payment software, and technology analyst house Omdia.

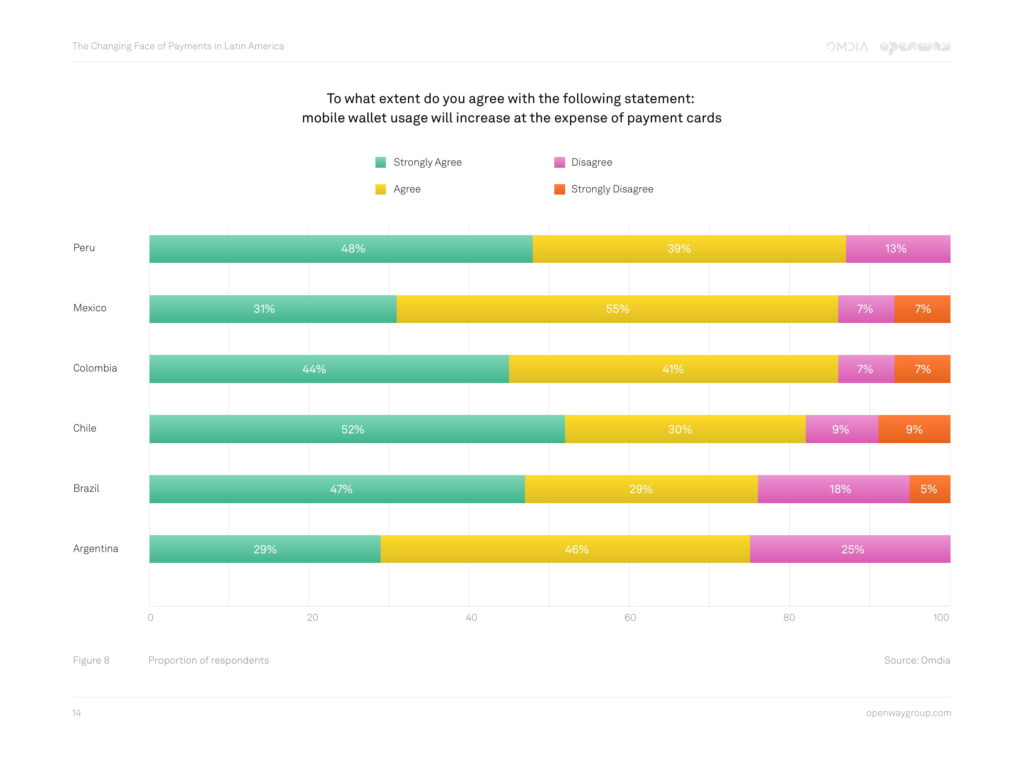

Banks and fintechs in the region are looking to improve their customer experience by focusing on mobile wallets, digitalization of back-office operations and use of cloud technologies.

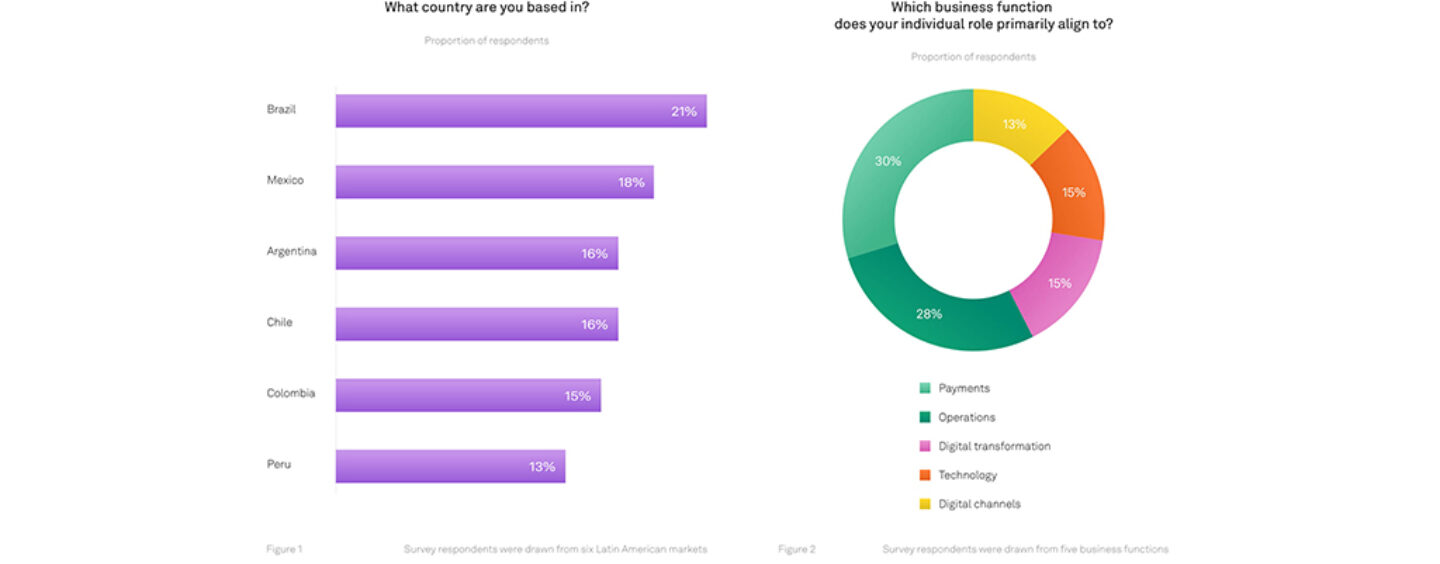

The economic landscape of Latin America has always been varied. But regardless of differences in financial inclusion, use of cash, and development of digital payment infrastructure, the pandemic has strongly affected financial institutions across the region. OpenWay and Omdia joined forces to explore how companies in Argentina, Brazil, Chile, Colombia, Mexico and Peru are responding to the challenges presented by COVID-19. In response to a comprehensive survey, key retail banks, processors, fintechs and neobanks revealed their product innovation and technology investment priorities in retail payments for the next 12-24 months.

Contrary to expectations, optimism marks the attitudes of the key players in the region’s retail payments market. The resulting report entitled The Changing Face of Payments in Latin America: Mapping the Digital Revolution shows that investments in Latin America are actually expected to grow. Some highlights of the findings:

Contrary to expectations, optimism marks the attitudes of the key players in the region’s retail payments market. The resulting report entitled The Changing Face of Payments in Latin America: Mapping the Digital Revolution shows that investments in Latin America are actually expected to grow. Some highlights of the findings:

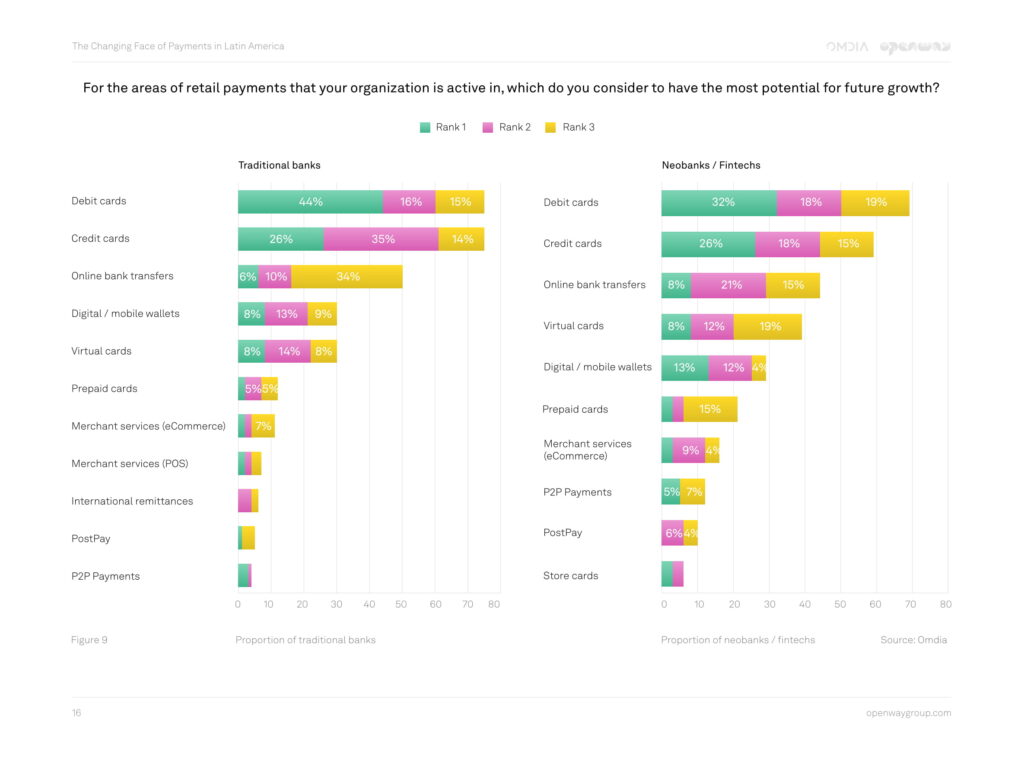

- Digital wallets and card propositions were most likely to drive investment from a product perspective. For those investing in cards, the focus is on digitalization, with 45% considering it top priority.

- Neobanks continue to include innovative products like eCommerce merchant services and digital prepaid cards in their offerings, but traditional banks are close behind with digital wallets and virtual cards gaining priority.

- 23% of banks and fintechs stated that regulation and compliance was the number one driver for increased spending, while 21% stated that it was security and fraud.

- Cloud consumption is the preferred consumption method for payment applications. Currently, 39% of applications are consumed through public and private cloud, with a preference for private cloud.

- The ability to add new services quickly is the leading requirement from companies when selecting new technology providers, followed by the ability to create unique services that are different from competitors.

The full version of the report is available for download here.

The full version of the report is available for download here.