LatinAmerica

Mastercard Study: Share of Financially Excluded Consumers in LatAm Cut in Half Since COVID-19

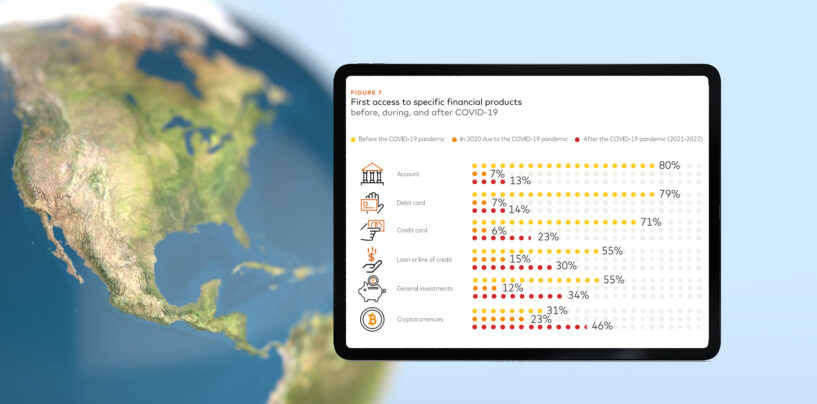

The number of cash-only consumers, or those without a financial account, has decreased substantially in Latin America (LatAm) over the past couple of years, plummeting from 45% in 2020 to only 21% in 2023, a new study by Mastercard and

Read MoreEuropean Merchants Tap Latin America E-Commerce Opportunity

Latin America (LatAm), one of the fastest-growing e-commerce markets globally, has become a preferred destination for European companies looking to expand globally, an appeal that’s owed to the region’s booming smartphone penetration, rapidly digitizing population and improving payment infrastructure, a

Read MoreIn Latin America, Fintech is Driving Banking Innovation and Improving Financial Inclusion

The rise of fintech in Latin America (LatAm) over the past decade has shaken up the region’s financial landscape, driving innovation in the banking sector, boosting competition and helping increase inclusion, a new paper by the International Monetary Fund (IMF)

Read MoreMastercard & Vesta Join Forces to Offer Enhanced Fraud Management Solutions

Mastercard and Vesta, an end-to-end fraud prevention platform for digital purchases, announced a new strategic partnership to provide a state-of-the-art fraud management platform for merchants across Latin America and the Caribbean. As the need and interest from consumers to shop

Read MorePayments Group PayU Finalises Acquisition of Colombia’s Ding to Expand to LATAM

Netherlands’ PayU has received the endorsement of Colombian regulatory authorities to acquire local electronic payment and deposit specialist Tecnipagos, better known as Ding. Based in Bogota, Ding allows merchants to make electronic deposits like they would with a savings account,

Read MoreDigital Banking and Insurtech Among Fastest-Growing Fintech Segments in Latin America

The fintech ecosystem in Latin America (LatAm) has risen quickly over the past couple of years with sustained growth observed in all segments and in the number of active fintech companies, a new report from the Inter-American Development Bank (IDB)

Read MoreForeign Fintech Companies Flock to Peru

Peru’s fintech industry is expected to get a boost this year, driven by favorable regulatory developments and rising demand for more accessible and inclusive financial services. Javier Salinas, director of Emprende UP, the center for entrepreneurship and innovation of the

Read MoreArgentina Paves the Way for Open Banking

In Argentina, the central bank is paving the way for open banking, introducing new regulation and initiatives to encourage digital payments and enable interoperability. New measures for regulating virtual wallets were adopted in May 2022 by the board of Banco

Read MoreHuobi Global Steps up Latin America Presence With Bitex Acquisition

Huobi Global announced the acquisition of Bitex, one of the first regional cryptocurrency exchanges in Latin America, as it moves to expand its footprint in the fast-growing region. The terms of the deal are confidential and were not disclosed. Founded

Read MoreColombian Proptech Habi Attains Unicorn Status With US$200 Million Series C

Habi, a Colombian data-driven residential real estate platform, announced that it has raised US$200 million in equity in its Series C funding round, The company said that it is the first proptech unicorn with a female founder and CEO in

Read More