Dutch payment news and intelligence the Paypers has released an updated version of its infographic of the global open banking ecosystem in 2021, mapping key solution providers and their core offerings and solutions.

The map categories open banking companies in eight segments depending on their offerings. Some companies such as Ndgit (Germany), Tide (UK) and Tink (Sweden) fall into multiple open banking categories because they offer several different solutions.

The first segment, open banking enablers, comprises companies either building PSD2 – the European Union (EU)’s revised Payment Services Directive – and open banking-enabled propositions, providing developers and payment services providers (PSPs) with access to bank data and payments, or assisting banks to publish the dedicated PSD2 compliance interfaces (APIs) via a set of consistent and cost-efficient products. Providers in this category include Flinks (Canada), Trilo (UK) and Yapily (UK).

The second category, API connectivity for payment initiation, comprises companies that are offering payment initiation APIs that allow third-parties to set up payments on behalf of customers and once authorized submit the payment for processing. Companies in this segment include Associated Foreign Exchange (USA), Modulr (UK) and Ppro (UK).

Excerpt for Open Banking Enablers and API Connectivity for Payment Initiative categories, Source: Global Mapping and Infographic of Key Players in the Open Banking Ecosystem, the Paypers, Mar 2021

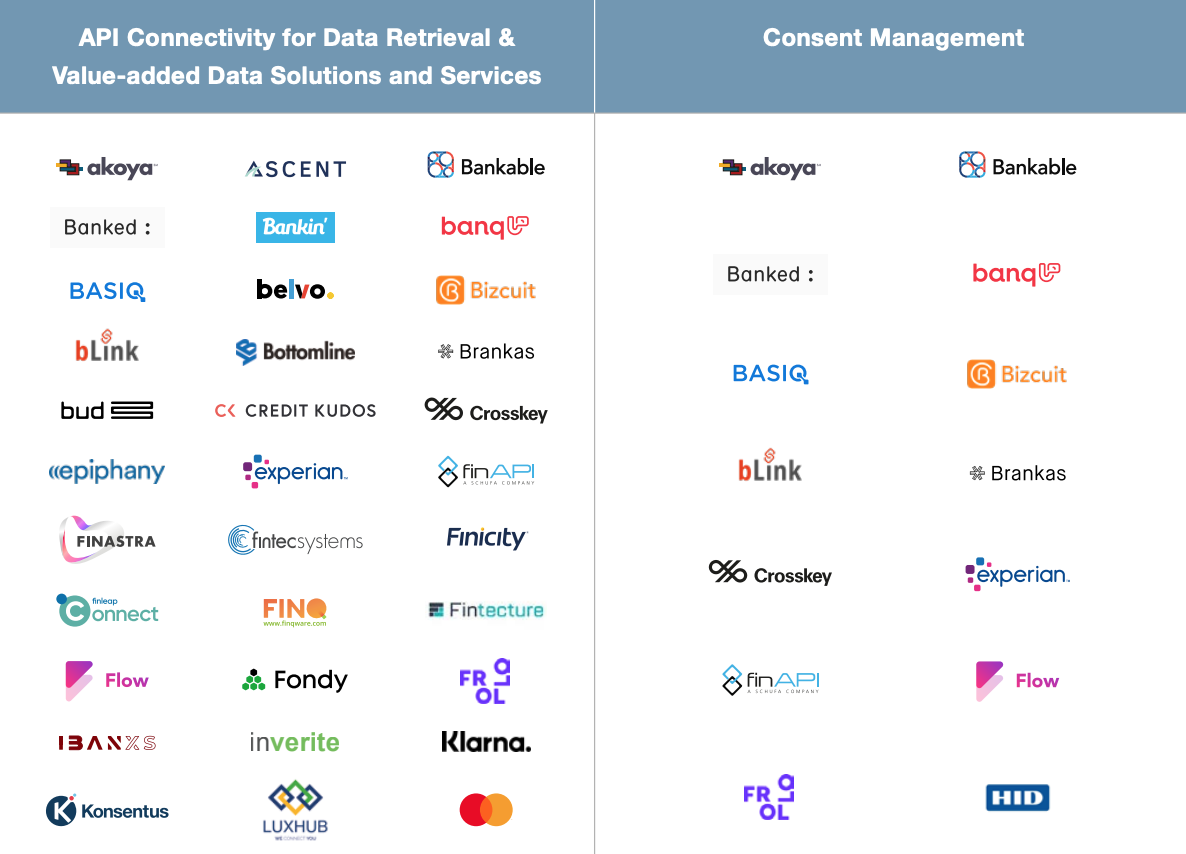

The third category, API connectivity for data retrieval and value-added data solutions and services, is made of companies that collect data from banks and provide insights and analytics on their customers’ transaction data. Services include raw data presentation, transaction categorization, credit scoring and white-label transaction monitoring. Providers in this category include Credit Kudos (UK), OpenWrks (UK) and Yolt Technology Services (Netherlands).

The next category comprises companies that offer consent platforms for financial institutions. These platforms allow them to ensure that access to bank account information and payments made on their customers’ behalf is fully compliant. Providers include CrossKey (Åland Islands), Pluggy (Brazil) and Ping Identity (USA).

Excerpt for API Connectivity for Data Retrieval and Value-added Data Solutions and Services and Consent Management categories, Source: Global Mapping and Infographic of Key Players in the Open Banking Ecosystem, the Paypers, Mar 2021

The fifth category, third-party provider checking and repository, comprises companies that offer know-your-customer (KYC), identity verification, and anti-money laundering (AML) regulation compliance in the context of open banking/PSD2. Providers include Callsign (UK), LexisNexis (USA) and Salt Edge (Canada).

Bank in the box/banking-as-a-service/core banking infrastructure comprises firms offering white-label solutions spanning across multiple core banking modules, channels, and payment solutions to meet the operational needs of a bank. These players servie banks, fintechs, marketplaces and large corporates, and include Avaloq (Switzerland), Deposit Solutions (Germany), Finastra (UK), Meniga (Iceland) and Thought Machine (UK).

Excerpt for TPP Checking and Repository and Bank in the Box/Banking-as-a-Service/Core Banking Infrastructure categories, Source: Global Mapping and Infographic of Key Players in the Open Banking Ecosystem, the Paypers, Mar 2021

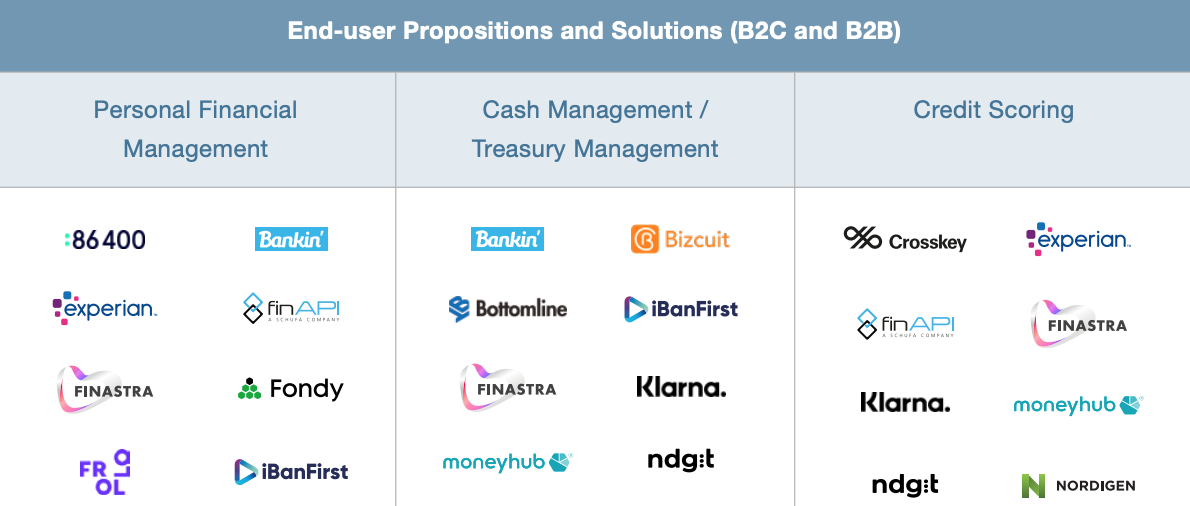

The end-user propositions and solutions category is made of companies providing both business-to-business (B2B) and business-to-consumer (B2C) solutions. These solutions can relate to personal finance management (e.g. 86400, Meniga), cash/treasury management (e.g. iBanFirst, Unnax), credit scoring (e.g. finAPI, Open Payments), savings and investment (e.g. Mode, Worldline), financial wellbeing and wealth management (e.g. Bizcuit, Frollo), lending (e.g. Klarna, Pelican), marketing/loyalty (e.g. Paylead, Nets), KYC based upon open banking (e.g. Know Your Customer, Pngme), and account aggregation (e.g. Bottomline, Finicity).

Excerpt for End-user Propositions and Solutions (B2C and B2B) category, Source: Global Mapping and Infographic of Key Players in the Open Banking Ecosystem, the Paypers, Mar 2021

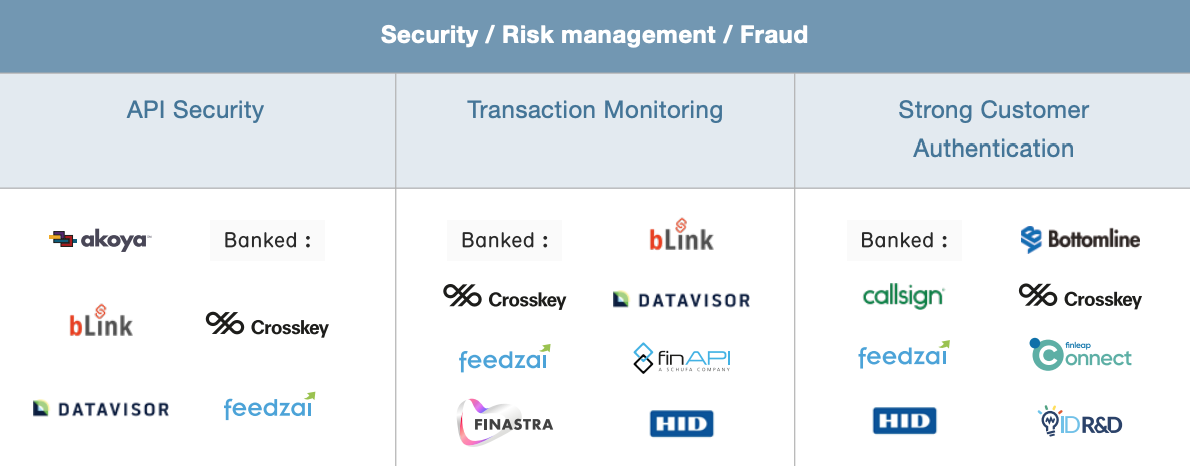

Finally, the last category, fraud/risk/security, features companies that include in their offering services aimed at transaction monitoring, API security, and strong customer authentication, such as Feedzai (USA), Truelayer (UK), and ThreatMark (UK).

Excerpt for Security/Risk management/Fraud category, Source: Global Mapping and Infographic of Key Players in the Open Banking Ecosystem, the Paypers, Mar 2021

Switzerland’s open financial ecosystem

Unlike jurisdictions such as the EU, the UK and Australia, Switzerland has taken a market-driven approach to open banking with no specific legal and regulatory requirements for banks and other market participants to follow. Instead the Swiss Bankers Association (SBA) published in 2020 a set of guidelines for the implementation of open banking,

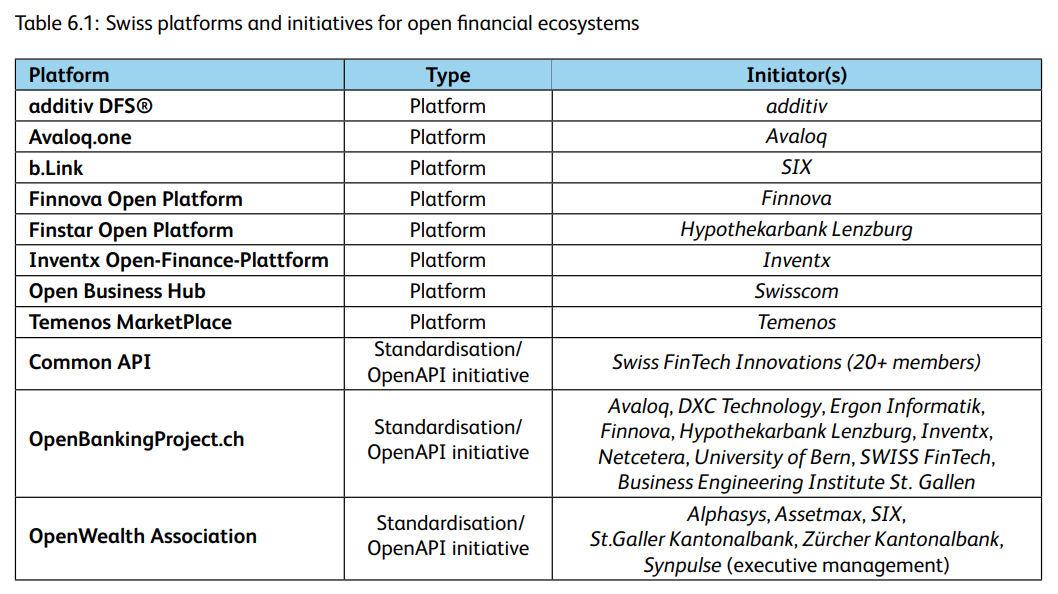

The lack of formal open banking rules has nevertheless not prevented an ecosystem to emerge. The 2021 IFZ Fintech Study, released earlier this month, gives an overview of the Swiss so-called “open financial ecosystem,” citing a number of providers and solutions along the value chain.

Klara, for example, is a API-based business software solution for small and medium-sized enterprises (SMEs). A solution provided by Axon Group, Klara was among the first solutions to join SIX’s open banking initiative, b.Link, a platform that simplifies the transmission of payment data and information.

Hypothekarbank Lenzburg is an example of a Swiss bank that provides banking-as-a-service solutions via APIs. Hypothekarbank Lenzburg’s Finstar open platform, which opened its doors to fintech companies in 2017, provides selected firms with partner interfaces to access data and services around accounts, securities accounts, and other banking processes of the bank. Swiss digital banking platform Neon provides independent products and services to end customers but execution and custody is handled by Hypothekarbank Lenzburg via Finstar.

Other Swiss platforms include Additiv DFS, Avaloq.one, Finnova Open Platform, Inventx Open-Finance-Plattform, Open Business Hub (Swisscom) and Temenos Marketplace. Meanwhile, numerous market initiatives focused on API standardization are currently being undertaken.

Swiss platforms and initiatives for open financial ecosystems, Source: IFZ Fintech Study 2021, Lucerne University of Applied Sciences and Arts, March 2021