Europe might reasonably claim to be the cradle of open banking, with regulations such as PSD2 across the European Union (EU) as well as the UK’s Open Banking Standard certainly pioneering the concept.

“This article was written to be part of the Swiss Banking Open Banking Blogparade”

But unlike in the EU where members are obliged to implement PSD2, a directive intended to opening up payment transactions to non-banks and promote competition, Switzerland has no such regulation in place.

Though many could argue that the lack of guidelines and government push would slow down adoption, the Swiss Bankers Association actually believes that the market-led approach that Switzerland has adopted has so far been beneficial, the organization said in a report released this month.

For financial institutions and market players, the lack of stringent rules gives them the possibility to design themselves the conditions for open banking, experiment as they go, and collectively establish the foundations on which open banking will thrive and benefit the whole industry.

Swiss open banking initiatives

In Switzerland, several initiatives and market-driven partnerships are currently underway to set the foundations for open banking and achieve harmonized standards.

Many of these initiatives, including Inventx’s Open Finance Platform, ti&m’s Portal as a Service, and Aixigo’s Open API platform, revolve around enabling the development of these companies’ own respective ecosystem for collaboration.

Other firms have decided to join force with their peers to work towards uniform standards, a much talked about topic and a critical element in enabling the widespread adoption of open banking. Such consortia include for example the Swiss Fintech Innovations (SFTI) Common API, and the Open Banking Project, in which numerous banks and third-party providers alike have been working closely together to define uniform and open standards in areas such as payment services, lending and pensions, and promote their wider application.

But for Prof. Dr. Andreas Dietrich from the Lucerne University of Applied Sciences and Arts, five major Swiss open banking initiatives are worth keeping in mind: Avaloq.one, the Finnova Open Platform, the Lenzburg/Finstar Open Banking platform, the Swisscom Open Banking Hub, and b.Link by SIX.

State-controlled telco giant Swisscom was perhaps one of the pioneers in the Swiss market, launching in late-2017 its Open Banking Hub.

Avaloq, a leading provider of software for core banking serving more than 150 banking and wealth management players around the world, introduced its Avaloq.one open banking marketplace in April 2019. Since its launch, more than 100 fintechs have been onboarded to Avaloq.one.

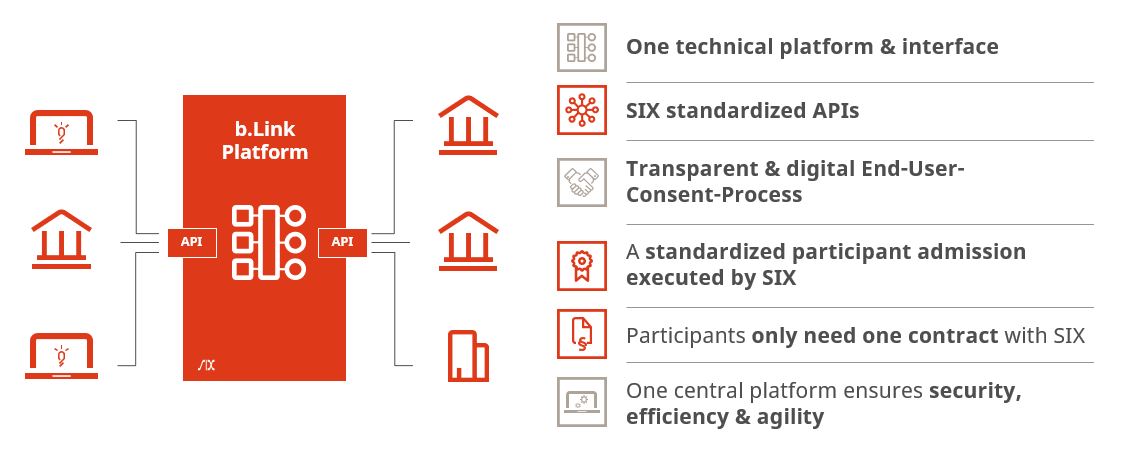

SIX is the latest large Swiss financial institution to join in, with the launch on May 19, of b.Link, a platform for the standardized sharing of data between financial institutions and third-party providers.

At launch, b.Link included two applications:

- The Account Information Service for Accounting Solutions and Financial Institutions, which allows third-party providers to obtain detailed account and transaction information from banks for their customers and use it, for example, for reconciliation with accounting; and

- The Payment Submission Service for Accounting Solutions and Financial Institutions, which allows third-party providers to automatically order their customers’ payments at their banks.

b.Link illustration, Source: SIX Group

b.Link is currently supported by Klara, Credit Suisse, Neue Aargauer Bank and UBS. Zürcher Kantonalbank plans to begin using b.Link as of September. SIX is now focused on bringing more banks and third-party providers in, and said it was in “intensive talks” with other banks to join the platform.

Despite the many recent developments, Prof. Dr. Dietrich believes that Switzerland is still “a few years behind” when it comes to open banking, especially when compared to the UK. One major limitation, he says, is that most current initiatives are focused on corporate customers, leaving private customers with a very limited product range to choose form. Additionally, the necessary standards and guidelines for operationalization are still missing, he notes.

In January 2018, a new ruling came into force in the UK, forcing the nine-biggest banks to allow licensed startups direct access to their data down to the level of transaction-account transactions, marking the debut of open banking. Since then, adoption has been rapid, with more than 240 regulated providers enrolled in open banking, as of May 2020.

Featured image credit: edited from www.slon.pics – www.freepik.com