Swiss Professionals Show Reticence to Share Data Despite Seeing Opportunities in Open Banking

by Fintechnews Switzerland October 5, 2022In Switzerland, the finance and banking industry believes open banking offers considerable opportunities across all major use cases. But despite the realization that the sector is moving towards greater openness and connectivity, there is a clear discrepancy regarding the practical implementation of open banking and resistance to share data with third parties.

These are some of the findings of a new survey conducted by the OpenBankingProject.ch, a cross-organizational network and industry trade group focusing on driving the development of open banking in Switzerland.

The study, which polled more than 170 respondents from various industries, found that around 60% of respondents are confident that open banking will become part of everyday processes, from consumption, health and mobility, to living and entertainments, in the next five to six years.

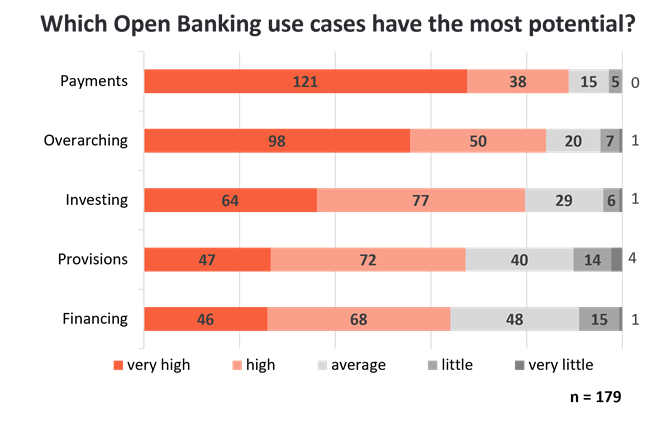

An overwhelming majority of respondents believe opportunities exist in all major use cases: 89% of respondents said data sharing will have a high or very high impact on payments, a figure that stands at 79% for investment, 66% for provisions, and 64% for financing. Overall, 83% said they believed open banking will bring opportunities across their entire business.

Which open banking use cases have the most potential? Source: Openbankingproject.ch, Sep 2022

All target groups showed a high to very high assessment of the potential of open banking, though board and management members of technology providers ranked the highest.

In the banking sector, survey participants said they expected open banking to expand their organization’s range of services and increase customer satisfaction.

Networking with other companies and the establishment of a clear open banking strategy were identified as prerequisites and success factors for the implementation of open banking. Respondents also said concrete use cases and experiments in the form of proofs of concept were needed to better understand the concept and implement it in a meaningful way.

Most companies indicated being ready to open up their data without major restrictions, striving to take on the roles of “early followers” and “first movers.” The banking sector, however, showed more cautiousness, with most indicating pursuing a strategy of selective and opportunities opening. In this industry, only 6% of respondents viewed their organization as “first movers” and most providers showed reluctance to pass on their customer data to third parties.

The need for a regulatory framework

When asked what they believed were the conditions for a successful implementation of open banking in Switzerland, respondents named API standardization as a critical success factor that would allow for efficient implementation, investment protection as well as ensuring the scalability of open banking use cases.

Against this backdrop, most survey participants indicated the need for regulation, believing that policymakers should analyze what other jurisdictions have done on the regulatory front and base their rules on the results observed in these markets. Survey participants also believe that industry participants should play an active role in designing the regulatory framework for open banking and be consulted.

Unlike jurisdictions like the European Union (EU) and the UK, Switzerland has approached open banking in an industry-driven manner, expecting that the market would eventually regulate itself through its competitive and collaborative forces.

The lack of regulatory mandates has ultimately made the standardization of processes and connectivity protocols more challenging, but has also encouraged Swiss market actors to join forces to develop industry standards.

Prominent standardization initiatives in Switzerland include Common API, a working group of Swiss Fintech Innovations that aims to provide API standards for use cases covering the banking and insurance industries; Swiss NextGen API, a set of APIs based on the EU’s PSD2 standards developed by OpenBankingProject.ch; and OpenWealth API, an initiative led by the OpenWealth Association focusing on wealth management-related services.

Findings from the OpenBankingProject.ch survey are consistent with results of other studies conducted on the subject. A 2021 study carried out by Mastercard showed that open banking can no longer be viewed as an “optional luxury that financial institutions can consider” but has instead become “an inevitability.”

The survey, which polled more than 1,000 Swiss consumers, found that although awareness of open banking was still low, consumers shared high interest in the concept. In fact, 49% of respondents said they were willingness to change their primary bank or add a new banking relationship to benefit from at least one open banking-enabled service.

Featured image credit: Edited from Unsplash