Buy now pay later (BNPL) arrangements, which allow customers to buy items on credit and pay the money back over time, is witnessing record growth in Europe with demand from consumers rising and investor sentiment remaining overall optimistic, according to a new report by European startup news site Sifted.

Investment in European BNPL players grew 118% year-on-year in 2020 to EUR 1.1 billion, and 2021 started off with EUR 930 million raised in Q1 alone, suggesting another record-breaking year.

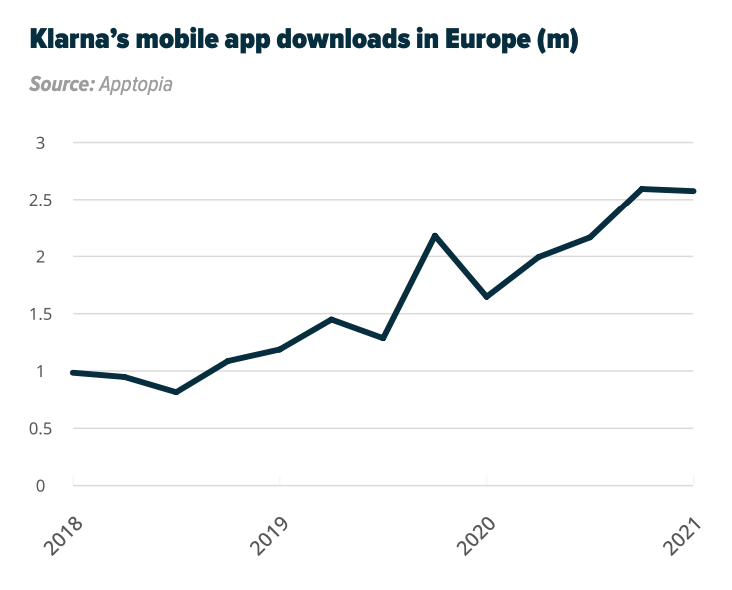

Meanwhile, demand from consumers is heating up. In Q4 2020, market leader Klarna saw over 4 million downloads in the US and over 2.5 million downloads in Europe, the report says, citing Apptopia data.

Across Europe, Klarna has consistently ranked the most downloaded app in the shopping category and has captured 10% of Northern Europe’s e-commerce market share, the report says.

Klarna’s mobile app downloads in Europe (m), Source: The payments revolution: fintech unwrapped 2.0, Sifted, 2021

As the space grows and matures, the rate of BNPL consolidation is also accelerating.

In mid-2020, Australian BNPL player Clearpay acquired Spanish rival Pagantis for EUR 50 million as part of its European expansion plan.

This year, Aussie BNPL fintech Zip announced a similar move, acquiring European BNPL provider Twisto as part of its European strategy. UK-based Twisto holds a European Payment Institution license, enabling the provision of payment services across all European Union (EU) member states.

Swedish Klarna, which has been on an acquisition spree, also brought Italian BNPL startup Moneymour last year.

The booming BNPL space has led many big-name companies to innovate on their offerings. PayPal and Amazon have all launched interest-free installment payment options. In the UK, Curve is also set to launch its own lending and loan offering called Curve Credit, which will allow customers to split eligible transactions into installments.

Emergence of installment credit cards

In the fast-evolving BNPL landscape, key emerging trends can be observed. In particular, the Sifted report notes the merging of BNPL and credit card models where players like UK-based Zilch are offering a card with a personalized credit line that’s then paid back in installments.

These credit cards are more convenient for consumers since users are no longer required to handle multiple BNPL providers with their own apps and platforms.

BNPL leaders including Klarna and Affirm are rapidly catching up with the trend, and have both launched card product. Similarly to Zilch, payments are made across the board and then split into installments.

Traditional credit card companies are also jumping onto the installment model. American Express, for example, has launched a hybrid model in the US called Pay It Plan It. The program allows customers to pay off small purchases on their American Express credit, or set up a payment plan for larger purchases.

Europe’s BNPL market

In Europe, Klarna is the undeniable BNPL leader. The Swedish firm is Europe’s most valued private company and the 4th biggest in the world with a valuation of US$45.6 billion, according to CB Insights data. Globally, Klarna counts over 90 million active users and processes 2 million transactions a day.

But Klarna’s stronghold on Europe’s BNPL market is coming under attack from a wave of new startups. In France, there is Alma, a startup that has raised EUR 62.5 million in funding. In Italy, there’s Scalapay, which claims to be the country’s biggest BNPL player. Scalapay is also available in France and Germany. In Denmark, there is ViaBill, which counts over 900 merchants and has expanded to Spain. And in the UK, there is Divido, which raised in June 2021 a US$30 million Series B funding round led by HSBC and ING.

Europe’s Buy Now Pay Later Market infographic, Source: The payments revolution: fintech unwrapped 2.0, Sifted, 2021

Fintech research specialist Kaleido Intelligence estimates that US$680 billion will be spent by global consumers using point-of-sale (POS) finance/BNPL over e-commerce channels in 2025. This will represent a 92% rise over the US$353 billion spent in 2019.

In Europe, e-commerce spend via BNPL is predicted to hit US$347 billion by 2025, accounting for 30% of all predicted e-commerce spend.