VC Fintech Switzerland

Swiss Fintech Funding Drops 38% in 2020

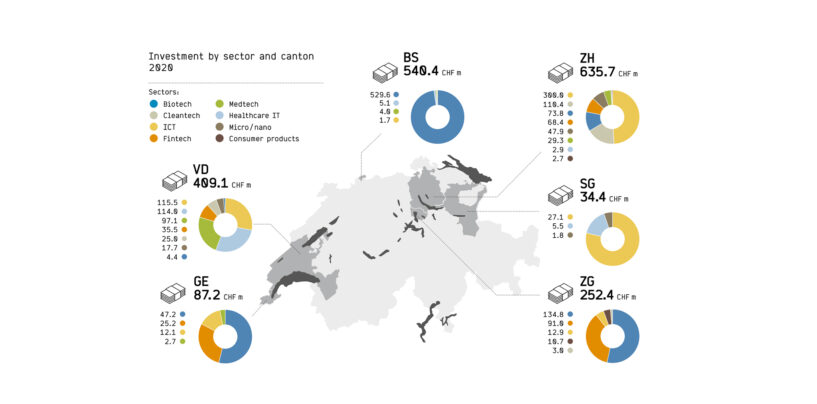

Swiss fintech companies raised a total of CHF 220.1 million in 2020, a 38% decrease compared the CHF 360.3 million raised in 2019, new data from local startup portal Startupticker.ch show. The decline in fintech fundraising, outlined in the newly

Read MoreSwiss Media Mammoth TX Group’s VC Arm Accelerates B2C Fintech Push

TX Group, Switzerland’s largest media group, has accelerated its push into consumer fintech this year, adding to its portfolio local startups Lend, a crowdlending platform, and Selma Finance, a regulated digital advisor. TX Group’s corporate venture capital (CVC) fund, has

Read MoreSwiss Insurance Group Helvetia Makes Fintech Moves

Swiss insurance group Helvetia is making fintech moves, partnering with fintech players and investing in fintech startups. This year, Helvetia has accelerated its push into fintech, teaming up with leading app-based Swiss banking solution neon to launch the first bancassurance

Read MoreSpicehaus Partners Fund: 50 Million CHF for Digital Transformation Startups

The Spicehaus Swiss Venture Fund was launched in 2019 with a target size of CHF 50 million investing in start-ups that drive digital transformation. The latest investments of the Spicehaus Swiss Venture Fund are in the areas of fintech, robotics,

Read MoreSIX VC Arm Looks for Switzerland’s Next Fintech Rockstars

SIX Fintech Ventures, the corporate venture capital arm of SIX Group, is seeking high-potential global fintech startups looking to become leaders in their fields and conquer the Swiss financial sector. The CHF 50 million investment arm, which currently counts six

Read MoreA Look at Postfinance’s Fintech Portfolio, Strategic Partnerships and Joint Ventures

In our new VC Fintech Switzerland series, Fintechnews.ch introduces different portfolios of investors and venture capitalists. If you are Fintech Venture capitalist and would like us to feature your Swiss fintech portfolio contact us: (editorial@fintechnews.ch). To start the series we

Read More