New Report Sheds Light on Booming Challenger Bank Market

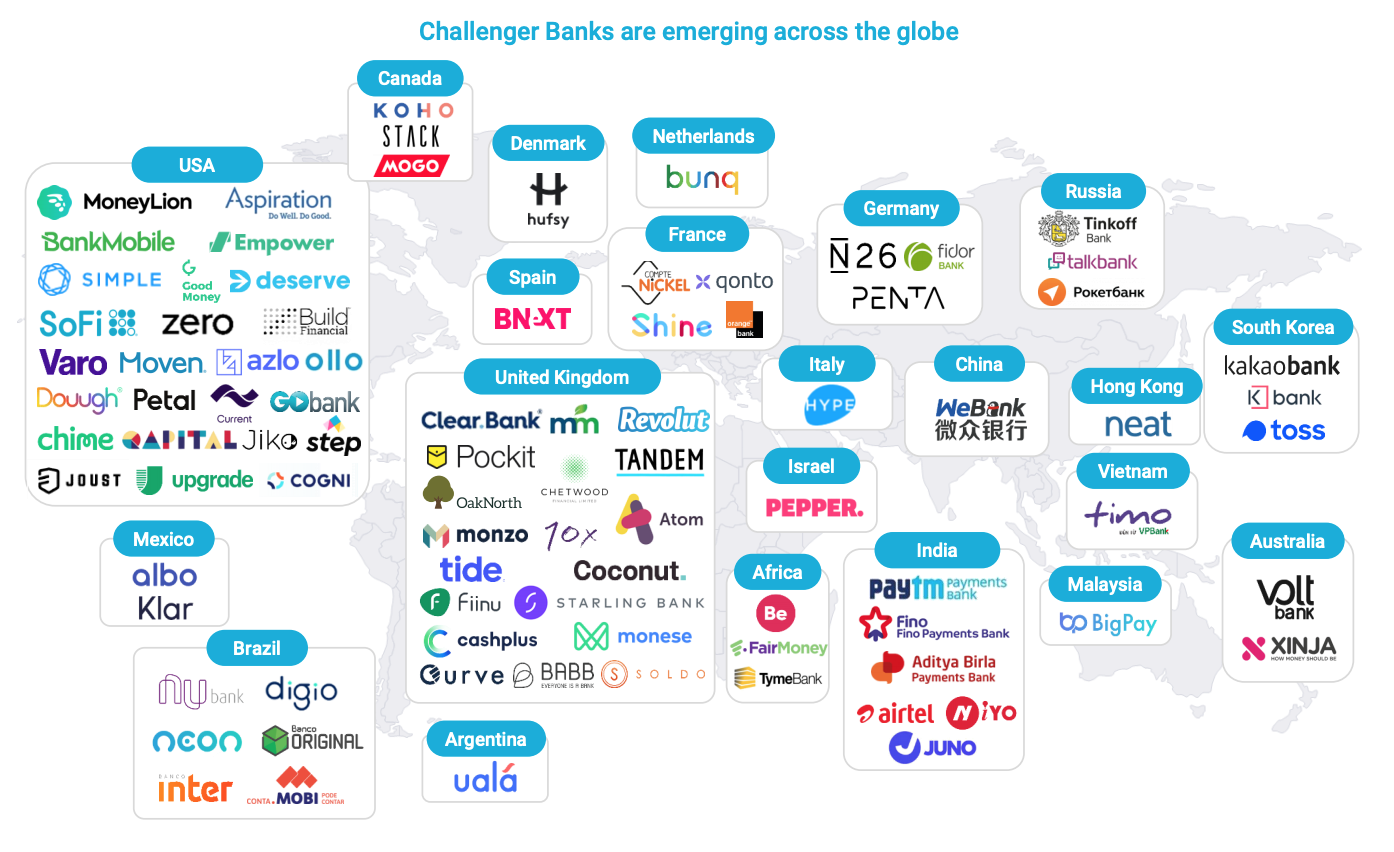

by Fintechnews Switzerland January 18, 2020The challenger bank trend first emerged in Europe and has progressively gained traction in all parts of the world. Today, challenger banks are growing significantly and attracting big money.

Challenger Banks are emerging across the globe, The Rise of Challenger Banks- Are the Apps Taking Over?, FT Partners, January 2020

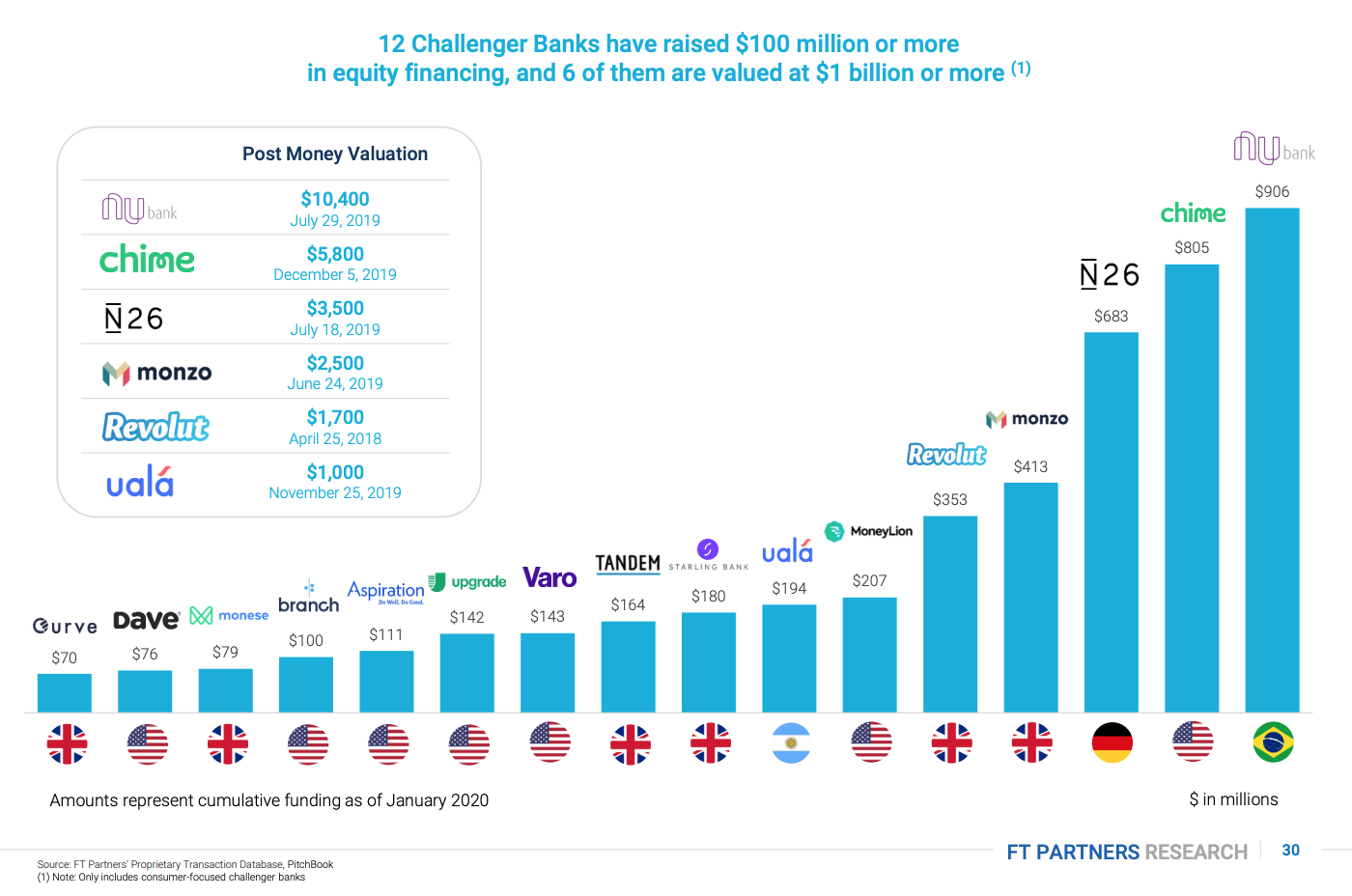

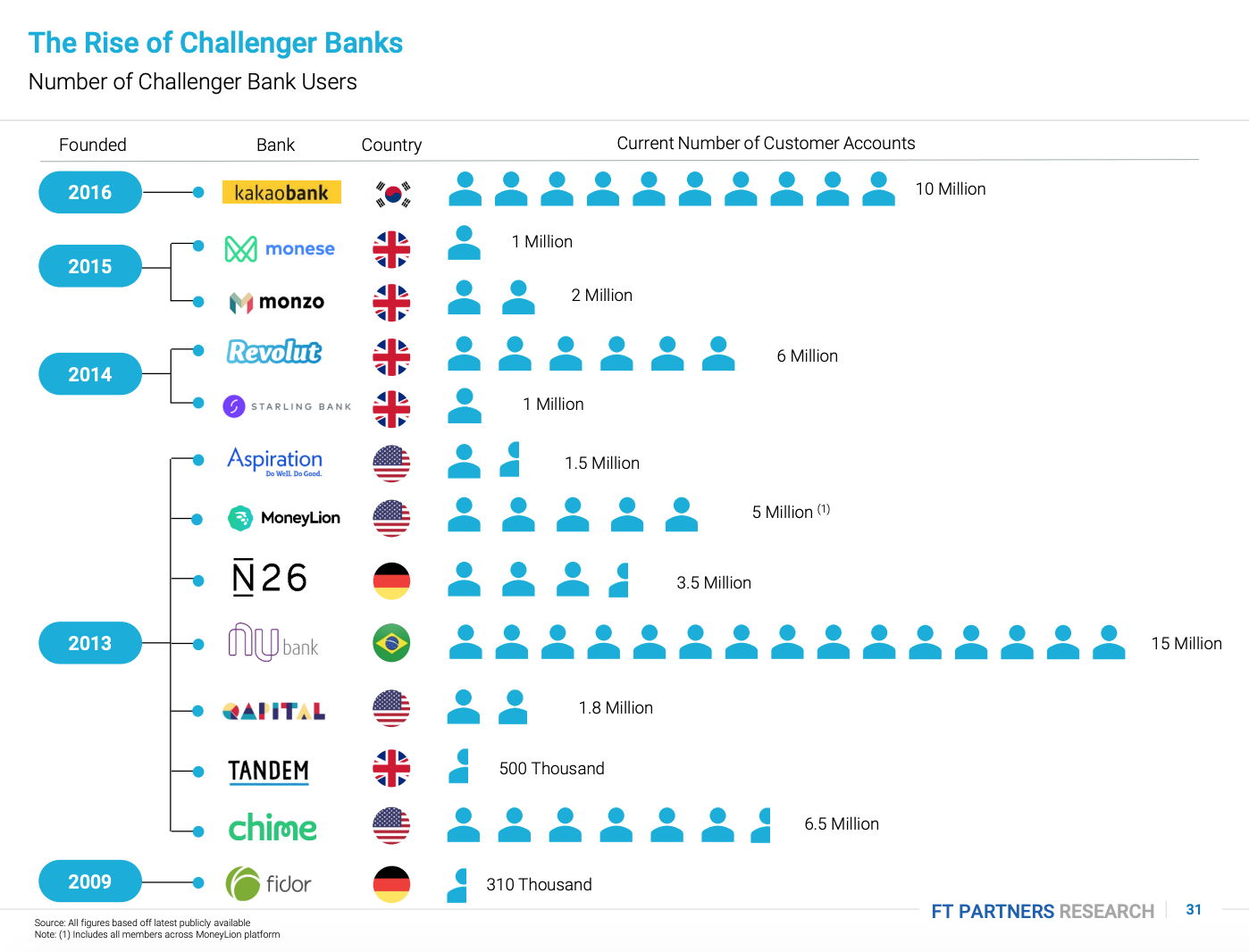

According to FT Partners’ newly released The Rise of Challenger Banks: Are the Apps Taking Over? research paper, Brazil’s Nubank is currently the world’s biggest challenger bank counting some 15 million users, and the world’s most well-funded challenger bank having raised US$906 million.

Founded in 2013, Nubank offers a no-fee MasterCard Platinum credit card that can be managed through a mobile app. Customers can open an account in less than three minutes. Nubank’s low-cost digital structure and advanced credit modeling and decisioning allows it to offer a lower interest rate than most current bank cards and pass cost savings onto consumers.

Nubank is followed by the US’s Chime (US), the world’s second most well-funded challenger bank (US$805 million), Germany’s N26 (US$683 million), and the UK’s Monzo (US$413 million).

12 Challenger Banks have raised US$100 million or more in equity financing, and 6 of them are valued at US$1 billion or more, The Rise of Challenger Banks: Are the Apps Taking Over?, FT Partners, January 2020

In terms of user count, South Korea’s KakaoBank ranks second with 10 million accounts, followed by Chime (6.5 million), and the UK’s Revolut (6 million).

Number of Challenger Bank Users, The Rise of Challenger Banks- Are the Apps Taking Over?, FT Partners, January 2020

The rise of challenger banks

Challenger banks began emerging in Europe as the regulatory landscape evolved to decrease the barriers to entry for new players. Regulatory changes including the UK’s open banking standards and the implementation of PSD2, the Second Payment Services Directive, have enabled new fintech companies, including challenger banks, to develop within the banking ecosystem.

Additionally, changing customer expectations and a shift towards digital have been driving the growth of the industry. The FT Partners report notes that in 2017, there was a shift in banking activity, with more than half of Europeans shifting to digital forms of banking. Europe’s leading economies including the UK, Germany and France spearheaded the change.

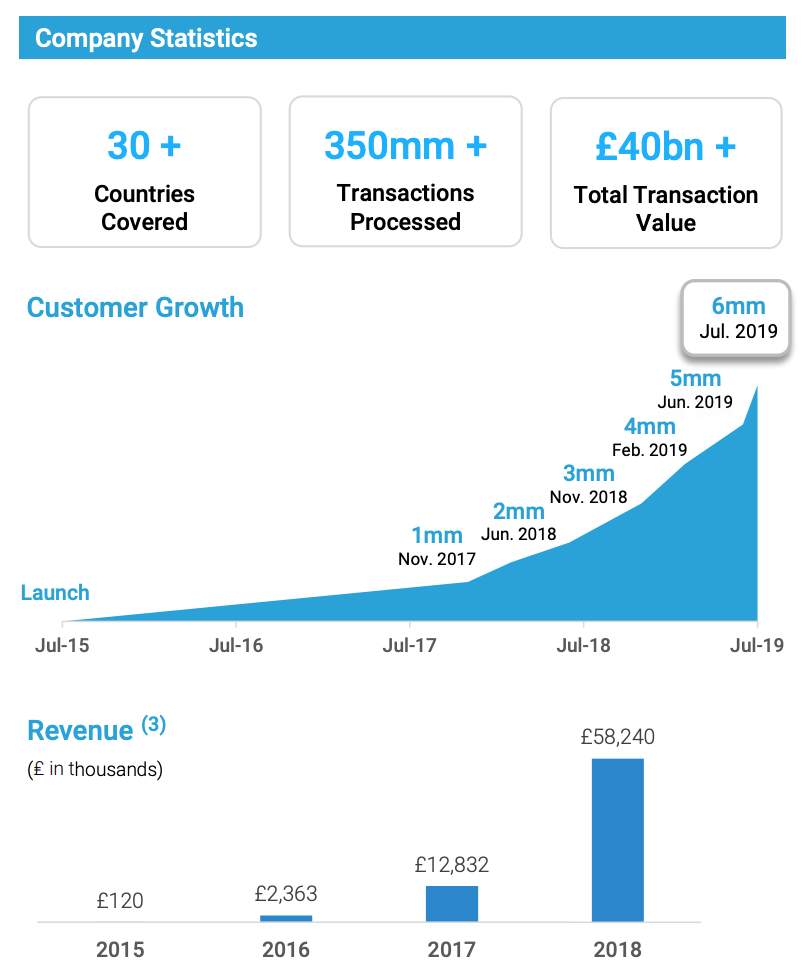

One of Europe’s biggest success stories is the UK’s Revolut, which now operates in over 30 European countries, Singapore and Australia, and plans to launch in the US, Japan and Canada soon.

Revolut statistics, The Rise of Challenger Banks- Are the Apps Taking Over?, FT Partners, January 2020

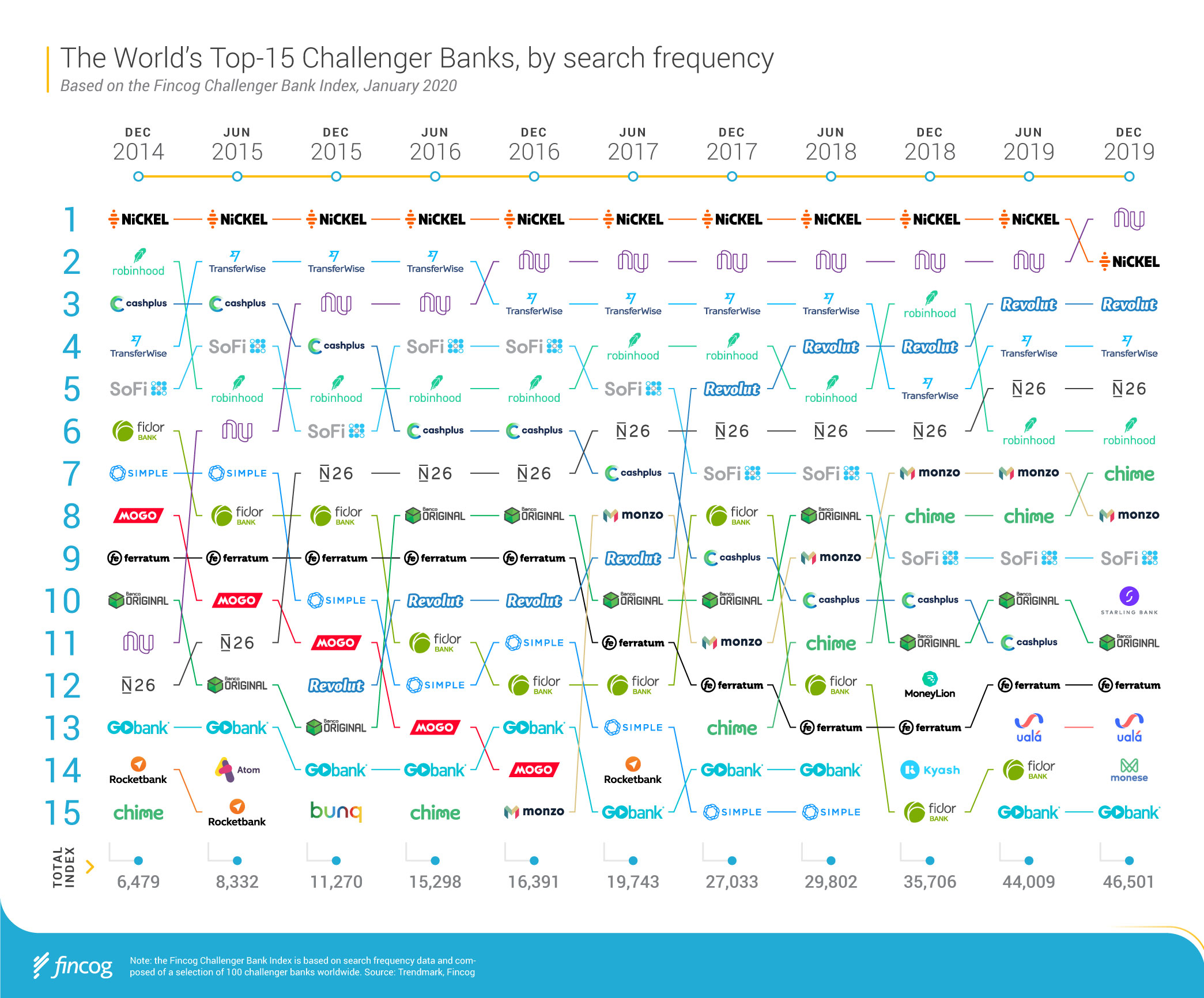

As of December 2020, Revolut was the world’s third top challenger bank by search frequency, according to a research by Amsterdam-based Fintech Consultancy Group (Fincog), after Nubank and France’s Nickel.

The World’s Top 15 Challenger Banks by search frequency, Fincog, January 2020

Opportunities in emerging markets

The FT Partners report notes the opportunity for challenger banks in emerging markets considering their large unbanked populations, high mobile penetration, and growing middle classes.

It cites the example of Malaysia’s BigPay, which was launched in 2018 to offer users in Southeast Asia an alternative to their traditional bank. In addition to basic banking services, BigPay also launched a remittance product and is developing a contextualized lending platform.

BigPay is the largest and fastest-growing pure play challenger bank in the region, the report says.

In Brazil, several challenger banks have emerged too. Besides Brazil’s top challenger bank Nubank, others exist including Banco Neon, a mobile-based bank that offers Visa debit cards and no monthly fees, as well as personal loans, investing options, and expense management tools, as well as Banco Original, formerly known as Banco JBS, which officially launched its digital retail bank platform in 2016.

Banks launch their own fintech brands

With challenger banks rapidly gaining ground, some traditional financial institutions have responded by creating their own fintech brands.

Amidst competition from the first online challenger banks, NetBank and Telebanc, ING launched its branchless ING Direct brand and Bank One launched WingSpan Bank in the late 1990s, early 2000s.

In 2009, GMAC transformed its banking subsidiary into the online-only Ally Bank, becoming one of the first of the new generation of challenger banks. Most recently, Goldman Sachs launched Marcus as a separate brand offering online loans and savings accounts, and in 2013, SunTrust began offering loans through its online consumer lending division, LightStream.

The World’s Top 15 Challenger Banks by search frequency, Fincog, January 2020

Other incumbents however have opted to collaborate with challenger banks. Toronto-based TD Bank has established relationships with Moven, an early player in the challenger banking space. Founded in 2010 by Brett King, Moven offers direct-to-consumer financial wellness mobile banking services, and launched in 2016 Moven Enterprise, which licenses its proprietary technology to banks.

Among the most prominent deployments and customers of Moven Enterprise are TD MySpend, an app that allows users to track their spending launched by TD Bank in 2016, and Yandex.Money, a Russian e-wallet provider with over 45 million users, which engaged Moven Enterprise to help it provide personalized and contextual advice to customers.

Potential future entrants

But competition in the challenger banking space is about to heat up as new and potential future entrants are set to enter the market, the report says.

These potential competitors include tech giants Amazon, Apple, Facebook and Google. Amazon already offers a number of financial products and has reportedly been in discussions with several banks including JP Morgan Chase about offering a checking account-type product.

Apple is active in the mobile payments and recently partnered with Goldman Sachs and MasterCard to offer the Apple Card, a digital and physical credit card.

Facebook operates the Facebook Pay payments platform and leads the Libra stablecoin project, and Google has been reportedly looking to offer personal checking accounts through Google Pay.

Other possible contenders, according to the report, include robo-advisor Betterment and stock investing platform Robinhood, which both recently launched their respective checking and savings accounts, as well as Uber, which announced last year the formation of a new division called Uber Money.