Mexico

Mexican Fintech Clara Clinches Unicorn Status With US$70 Million Series B

Mexico City-based end-to-end corporate spend management solution Clara has secured US$70 million in a Series B equity financing round. The round was led by Coatue, and takes Clara’s valuation to US$1 billion. With the Series B, Clara has become the

Read MoreVisa Invests in LATAM Open Finance Platform Belvo’s US$43 Million Series A

Visa has invested in Mexico City-headquartered open finance API platform Belvo through its US$43 million Series A. The two companies have also signed a strategic partnership to jointly develop open finance solutions in Latin America, a statement from Belvo said.

Read MoreMexican Credit Card Issuer Stori Closes US$200 Million in Oversubscribed Series C

Mexican credit card issuer Stori announced that it has closed US$125 million during an over-subscribed Series C funding round co-led by global venture capital firm GGV Capital and growth-stage investor GIC. Other investors include General Catalyst, Goodwater Capital, and Mexico-based

Read MoreBrazil and Mexico Emerge as Top Fintech Countries in Latin America

Though the growth of fintech in Latin America (Latam) started later than in other region, it quickly picked up stream. Today, Latam is experiencing an explosion of fintech activity that’s being fueled by rising demand for online banking tools, encouraging

Read MoreMexican Fintech Credijusto Acquires Banco Finterra for Under US$50 Million

Credijusto, a Mexican lending platform for small businesses, announced the acquisition of a local bank Banco Finterra which specialises in financing solutions for small businesses and the agriculture sector. According to Reuters, Credijusto acquired the regulated bank in a deal

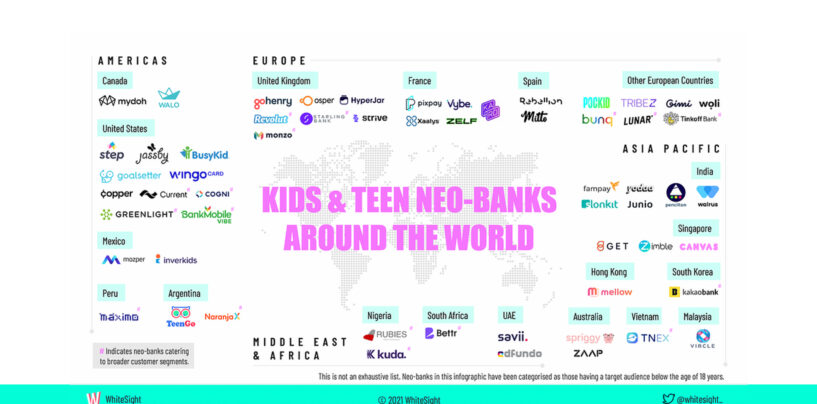

Read MoreNeobanks Come for Kids and Teens

Neobanks and digital banks have set new standards in customer experience and expectations, pushing incumbents to get out of their comfort zone and innovate. After accumulating an estimated 39 million users worldwide, neobanks are now coming after the next generation,

Read MoreAn Overview of South America’s Booming Neobanking Sector

South America has seen an exceptionally dynamic evolution of its neobanking landscape, with now more than 30 live neobanks and digital banks that serve over 50 million customers out of the region’s 430 million+ population (+11%), data from Dutch fintech

Read MoreWhat 2021 Holds for Fintechs and Challenger Banks in Mexico

In 2021 we will harvest the seeds of the accelerated adoption and development in technology that 2020 forced upon us. The fintech industry took a leap forward with the user base growing significantly. This will lead to more demands for

Read MoreRapyd Expands Card Acquiring Capabilities in Europe

Rapyd, a fintech-as-a-service company, announced a major expansion of its European platform, adding end-to-end card acquiring capabilities to its payments capabilities. Rapyd now offers a full stack payment acceptance capabilities in Europe including card acceptance through Mastercard and Visa, and

Read MoreNew Report Sheds Light on Booming Challenger Bank Market

The challenger bank trend first emerged in Europe and has progressively gained traction in all parts of the world. Today, challenger banks are growing significantly and attracting big money. According to FT Partners’ newly released The Rise of Challenger Banks:

Read More