Platform-Based Banks More Profitable, Agile than Traditional Financial Institutions

by Fintechnews Switzerland August 13, 2020In the age of disruption and increased competition from tech players, the traditional banking model is rapidly becoming outdated. For banks and financial companies, platformification is emerging as the most fitting strategy to maximized results, enabling greater agility and personalization. According to the World Retail Banking Report 2020, platform-based banks can achieve twice as much operating profits, higher market value and more steady growth than traditional banks.

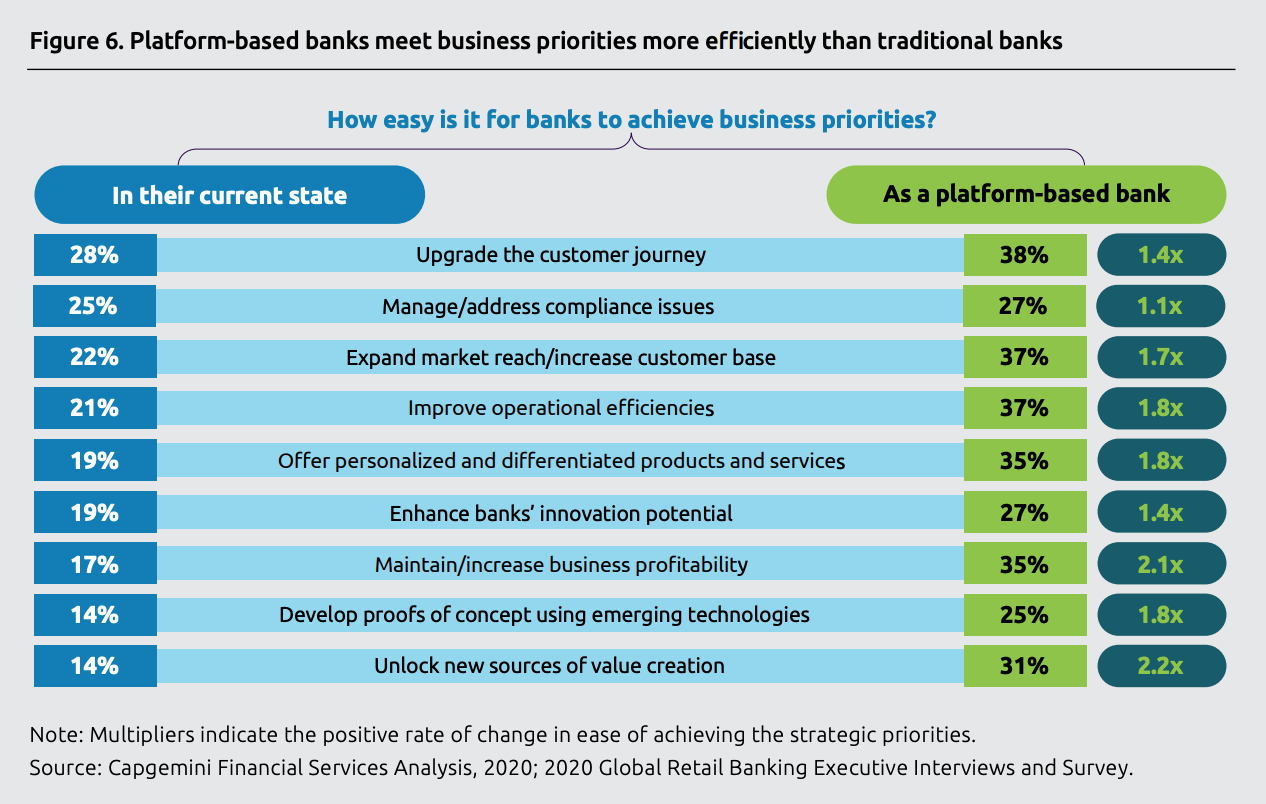

Capgemini, which conducted a survey of global retail banking executives as part of the research, found that platform-based banks are able to meet business priorities more efficiently than conventional banks.

According to the study, platform-based banks find it 2.2 times easier to unlock new sources of value creation, 2.1 times easier to maintain or increase business profitability, and 1.8 times easier to improve operational efficiencies.

It’s also much simpler for them to innovate and develop proofs-of-concept (POCs) (1.8x) and offer personalized, differentiated products and services (1.8x).

Platform-based banks meet business priorities more efficiently than traditional banks, Source: World Retail Banking Report 2020, Capgemini and Efma, June 2020

COVID-19 accelerates digital transformation

Advances in technology, as well as changing customer expectations, are forcing banks to evolve into platform-based models to remain competitive. But another key factor that has significantly accelerated customers’ shift to digital channels is COVID-19.

According to study, more than half (57%) of customers now prefer Internet banking, up from 49% pre-COVID-19. Customers are also favoring mobile banking apps in these times of social distancing, with the figure rising to 55%, compared with 47% previously.

The research also found that in these uncertain times, customers are more inclined to switch to bigtechs and fintechs, with 30% stating they would do so because of unsatisfactory experiences with their primary bank.

Navigating uncertain times: COVID-19 is driving customer behavior changes, Source: World Retail Banking Report 2020, Capgemini and Efma, June 2020

New entrants gaining ground

These findings show that incumbents must react quickly to this rapidly changing environment by embracing platform models and partnering with third-parties to complement product portfolios, enhance service delivery and boost revenue.

The research found that collaboration is a significant accelerant for banks’ digital success, with 58% of banking executives stating that it takes less than a year to launch a product in collaboration with fintechs/bigtech partners, compared to the usually one to two year timeline it would typically take when working alone.

With nearly 39 million users worldwide, challenger banks and neobanks are rapidly gaining ground, appealing to the general public thanks to their low-cost, hyper-personalized and customer-friendly offerings.

But though on paper it may seem that COVID-19 is providing these new entrants with an unprecedent opportunity to grow, the reality is more complex, especially for cash-strapped startups.

In Europe, popular London startup Monzo has been facing turbulences amid COVID-19. Following the shuttering of its Las Vegas-based customer support office and almost 300 staff being furloughed in the UK, Monzo announced internally in June that up to 120 UK staff would be made redundant. The startup also had to accept a 40% reduction in its previously GBP 2 billion valuation as part of its last funding round with a new valuation of GBP 1.24 billion.

Earlier this month, Finnish fintech Holvi, which offers banking services to sole traders and small businesses, announced that it was pulling out of the UK market, citing increased uncertainty due to the pandemic and Brexit.

The departure came after Germany’s N26 shut down its operations in the UK in February, also citing Brexit.

World Retail Banking Report 2020 infographic:

Infographic World Retail Banking Report 2020, Source: Capgemini, June 2020