IBM Studies: Banks, Financial Markets Institutions Ramp up Blockchain Development

by Fintechnews Switzerland October 7, 2016Blockchain solutions are rapidly being adopted by banks and financial markets institutions as they seek to anticipate disruption and stay ahead of fintech competition, according to IBM studies.

Released last week, the reports are based on two separate surveys. The first one, titled “Leading the Pack in Blockchain Banking: Trailblazers Set the Pace,” is based on a survey of 200 global banks. The other one, titled “Blockchain Rewires Financial Markets: Trailblazers Take the Lead,” is based on a survey of 200 global financial markets institutions.

They were conducted by the IBM Institute for Business Value with the support of the Economist Intelligence Unit and sought to explore the state of blockchain adoption in the financial markets and banking sectors.

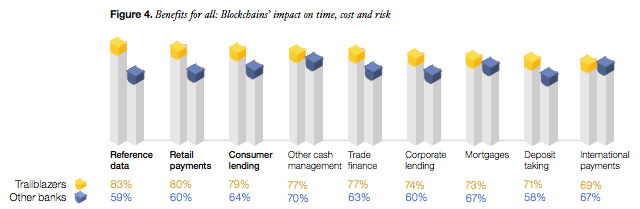

According to the reports, more than 70% of early-adopters in banking are prioritizing blockchain efforts to break down current barriers to creating new business models and reaching new markets. The main areas of focus are reference data, retail payments and consumer lending.

These banks perceive blockchain technology as an opportunity to better position themselves against competitors, notably fintechs. 15% of the banks in the study said that they are expecting to have blockchains in commercial production by 2017.

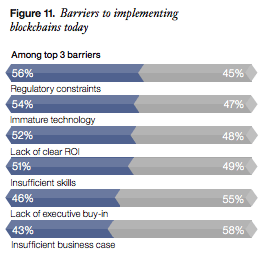

Banks identify the barriers to blockchain implementation as being regulatory constraints immature technology and the lack of clear return on investment (ROI).

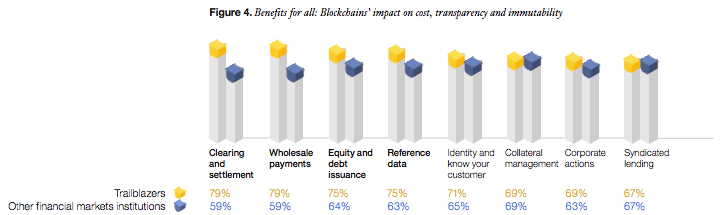

For financial markets institutions, 70% of early-adopters said that they are focusing their blockchain efforts in four specific areas: clearing and settlements, wholesale payments, equity and debt issuance and reference data.

14% of the financial markets institutions in the study expect to have blockchain solutions in commercial production and more critically at scale in 2017.

These institutions identify the key barriers to implementing blockchain technology as inefficient skills, lack of clear ROI and immature technology.

“There are many advantages to being an early adopter of blockchain technology,” said Likhit Wagle, global industry general manager at IBM Banking and Financial Markets.

“To start, first movers are setting business standards and creating new models that will be used by future adopters of blockchain technology. We’re also finding that these early adopters are better able to anticipate disruption, fighting off new competitors along the way.”

During SWIFT’s Sibos 2016 in Geneva in September, IBM’s CEO Ginni Rometty, emphasized the importance of blockchain technology in the digitalization of banking and financial services.

“I am not talking about bitcoin or a cybercurrency, but the underling technology that allows you to have trust and efficiency in the exchange of anything,” Rometty told the audience.

“This will have a profound change in how the world works. In supply chains, the improvement in efficiency could be worth $100 billion, and if you add trade finance, AML and tracking, the value gets into the hundreds of billions. The blockchain will do for transactions what the Internet did for information.”

IBM has been an active backer of the Linux Foundation’s Hyperledger Project, an open source collaborative effort aimed at advancing blockchain technology development.

“Consortia lay the groundwork for a better understanding of blockchains’ benefits, but many banks already recognize that more focused collaborations with a few key partners is also necessary to innovate business models,” the report says.

It concludes:

“New revenue models must anticipate the potential for disruption in areas core to business today and in the future. Whether defending each area or just a few, the surest offense is to focus early and fast on the opportunity to implement new revenue models.”

Featured image: Tomasz Bidermann / Shutterstock.com