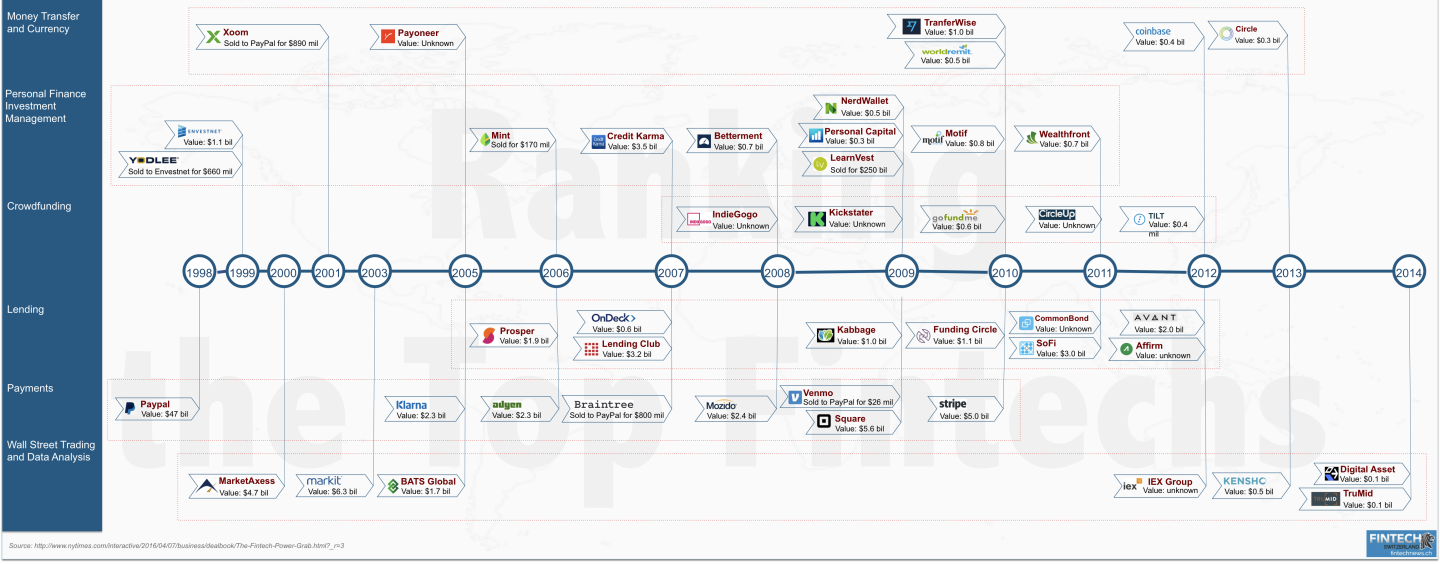

In the time of technology development and human creativity, more and more startups are established to tackle various problems in different industries. When it comes to Finance, technology and computers handles a bundle of automating and streamlining finance-classical processes as well as implementing calculations without human brain and emotion. There goes Fintech. This label is now heating Silicon Valley. Fintech is one of the fastest-growing sectors in the tech industry. In the early April, the New York Times offers a general report of Top Fintech Startups.

Money Transfer and Currency

TransferWise

Founded: 2011 – Head Quarters: London, UK – Valuation: $1.0 bil

Tapping into international money transfer, TransferWire promises to its customers about “sending money with the real exchange rate” by the peer-to-peer transfer system. In the interview on WSJ, Richard Branson reveals that TransferWise handles $750 mil across border every month. China and Mexico are the biggest markets. Within US, $2 bil was transferred on TransferWise last year.

WorldRemit

Founded: 2010 – Head Quarters: London, UK – Valuation: $0.5 bil

WorldRemit is an online money transfer service that provides international remittance services to expatriates and migrant workers. WorldRemit service is available to senders in 50 countries with more than 120 destinations across Europe, Asia, Africa, Australia and the Americas. In March 2014, WorldRemit had secured a Series A investment of $40m from Accel Partners. In February 2015 WorldRemit announced a $100m Series B funding round led by TCV.

Coinbase

Founded: 2012 – Head Quarters: US – Valuation: $0.4 bil

Coinbase is the world’s most popularly-used Bitcoin exchange and wallet platform. It also offers an API for developers and merchants to build applications and accept bitcoin payments. The company offers buy/sell trading functionality in 25 countries, while the wallet is available in 190 countries worldwide. Coinbase is about to launch a new application of more user-friendly interface.

Circle

Founded: 2013 – Head Quarters: US – Valuation: $0.3 bil

Supported by Barclays, Circle, starting as a social payment app of storing and transferring Bitcoin, becomes the first digital company in UK to be allowed to approach the bank’s infrastructure for its service of transferring Euro and sterling. Circle has received an e-money licence from the Financial Conduct Authority, which has granted about 80 such permissions. Launching the service, Circle is expanding itself into Europe step by step.

Xoom

Founded: 2001 – Head Quarters: San Francisco, US

Xoom is a digital money transfer or remittance provider that allows consumers to send money, pay bills and reload mobile phones from the United States to 41 countries, including China, India, Pakistan, Mexico and the Philippines. Xoom was bought with $890 mil by PayPal and becomes one of its PayPay service. PayPal CEO Dan Schulman said in a blog that his company planned to open up its money-transfer service, Xoom, to Cuba by year’s end.

Payoneer

Founded: 2005 – Head Quarters: New York, US

Payoneer helps businesses and B2B marketplaces move money across borders. It’s one of the biggest companies in this space; its customers include the likes of Amazon, Fiverr, Airbnb, Upwork and Taboola. As of 2015, Payoneer is available for more than 100 currencies in 200 countries. Recently, in the plan of market expansion into India, Payoneer has acquired an escrow-as-a-service platform Armor Payments last month.

Personal Finance and Investment Management

Credit Karma

Founded: 2007 – Head Quarters: US – Valuation: $3.5 bil

Credit Karma is recreating the financial industry around people. With over 40 million members, Credit Karma is on its way to becoming the place online where people in the U.S. manage their financial identities. It makes insight into $2.3 trillion of America’s household debt. This massive data enables Credit Karma to deliver top quality insights for everyone looking to improve their personal finances.

Envestnet

Founded: 1999 – Head Quarters: US – Valuation: $1.1 bil

Envestnet is a leading provider of integrated portfolio, practice management, and reporting solutions to financial advisors and institutions. As of March 2016, Envestnet supports over 47,000 advisors, and almost 3.5 million investor accounts and over $850 billion in total assets with almost $290 billion of fee‐generating assets under management (AUM) and assets under administration (AUA).

Motif

Founded: 2010 – Head Quarters: New York, US – Valuation: $0.8 bil

Motif Investing is a robo investing platform that allows investors to pick or create themed bundles of exchange traded funds. Motif, a four-year-old company, has 200,000 users and gets $126 million venture capital funding from venture capitalist and banks.

Betterment

Founded: 2008 – Head Quarters: New York, US – Valuation: $0.7 bil

Betterment, based in New York, had a $60 million investment round in February 2015, valuing it at $450 million. It has received $100 million from venture capital investors, pushing its valuation to $700 million, nearly double its value this time last year. Betterment says it will use the money to increase product development and expand its business. It is its largest investment round yet.

Wealthfront

Founded: 2008 – Head Quarters: US – Valuation: $0.7 bil

Wealthfront is another robo-advisor which has attracted investments from Greylock Partners and Marc Andreessen, the Netscape founder and Facebook board member, among others. Wealthfront and Betterment have both captured large portions of the online advisor market. Wealthfront has $2.8 billion in assets under management while Betterment has more than $3 billion.

NerdWallet

Founded: 2009 – Head Quarters: US – Valuation: $0.5 bil

NerdWallet is an American personal finance and information service, providing comparison tools to consumers for financial decisions. Founded in 2009, the company by 2016 had a valuation of $550 million and projected revenue of about $100 million.

Personal Capital

Founded: 2009 – Head Quarters: US – Valuation: $0.3 bil

Personal Capital is a next generation financial advisor. The company melds technology with professional advisors to help households manage their wealth. Personal Capital, formerly known as SafeCorp Financial Corp, was changed in 2010 and publicly launched on September 9, 2011. In both 2014 and 2015, Personal Capital was named to CNBC Disruptor 50 list.

LearnVest

Founded: 2009 – Head Quarters: New York, US

LearnVest is an American financial planning company founded by CEO Alexa Von Tobel. It sells personal finance software. LearnVest raised a $4.5 million Series A round, a $19 million Series B round, a $16.5 million Series C round, and a $28 million Series D round. LearnVest was acquired at $250 mil by Northwestern Mutual Life Insurance.

Yodlee

Founded: 1999 – Head Quarters: US

Yodlee is an American software company that develops an account aggregation service. As of 2013, Yodlee has over 45 million users, and over 150 financial institutions and portals (including 5 of the top 10 U.S. banks) offer services powered by Yodlee. On August 10, 2015 Yodlee sold itself to Envestnet for a reported $660 Million.

Mint

Founded: 2006 – Head Quarters: US

Mint.com is a free, web-based personal financial management service for Canada and the US, created by Aaron Patzer. On September 13, 2009, TechCrunch reported Intuit would acquire Mint for $170 million. An official announcement was made the following day. On November 2, 2009, Intuit announced their acquisition of Mint.com was complete.

Crowdfunding

Indiegogo

Founded: 2008 – Head Quarters: US

Indiegogo is an international crowdfunding website founded in 2008 by Danae Ringelmann, Slava Rubin, and Eric Schell. The site is one of the first sites to offer crowd funding. In January 2014, a Series B round of funding added $40 million to bring the total venture capital raised to $56.5 million.

Kickstarter

Founded: 2009 – Head Quarters: US

Another crowdfunding platform Kickstarter, launched in 2009, focuses on creative projects. Since their launch on April 28, 2009, 11 million people have backed a project, $2.3 Billion has been pledged, and 36 percent of the campaigns conducted actually get funded.

GoFundMe – Valuation: $0.6 bil

Founded: 2010 – Head Quarters: San Diego, US – Valuation: $0.6 bil

GoFundMe is a crowdfunding platform that allows individuals and personal to raise money for nonprofit events. GoFundMe operates in 160+ countries. In June 2015, it was announced that Damphousse and Ballester had agreed to sell a majority stake in GoFundMe to Accel Partners and to step down from the day-to-day oversight of the company. The deal valued GoFundMe at around $600 million.

CircleUp

Founded: 2011 – Head Quarters: San Francisco, US

Unlike traditional crowdfunding sites such as Kickstarter, CircleUp allows investors to receive equity in return for their investment. On the site, investors are able to find investment opportunities as well as diligence materials such as investor presentations, financials, product details, industry information and third-party data. On November 11, 2015, the company announced its Series C funding round of $30 million backed by Collaborative Fund.

Tilt

Founded: 2012 – Head Quarters: US – Valuation: $0.4 bil

With the vision of answering to the question “What will crowdfunding look like in a mobile world?”, Tilt has become a social crowdfunding app used by groups to raise funds for anything from events to social causes since its 2012 launch. Tilt receives $37m from the likes of a16z, SV Angel, Sean Parker and Naval Ravikant and what investors really want when investing in Silicon Valley startups.

Lending

Lending Club

Founded: 2006 – Head Quarters: US – Valuation: $3.2 bil

Lending Club is the first peer-to-peer lending company to register its offerings as securities with the Securities and Exchange Commission (SEC), and to offer loan trading on a secondary market. Lending Club is the world’s largest peer-to-peer lending platform. The company claims that $15.98 billion in loans had been originated through its platform up to 31 December 2015.

SoFi

Founded: 2011 – Head Quarters: US – Valuation: $3.0 bil

SoFi is a marketplace lender focusing on students. SoFi last year drew a $1 billion investment led by Japanese giant SoftBank Group Corp. that valued the startup at nearly $4 billion, making it one of the most valuable U.S. online lenders. In January 2016, SoFi surpassed $7 billion in outstanding loan volume. SoFi in recent weeks opened a credit fund that will buy its loans and some from its competitors.

Avant

Founded: 2012 – Head Quarters: US – Valuation: $2.0 bil

The online lending startup Avant issues more than $3 billion in loan originations since it launched. This week Avant announced that it is working with Birmingham, Alabama-based Regions Bank ($RF), a regional bank in the Southeastern US with $126 billion in assets, to issue loans for Regions Bank customers.

Prosper

Founded: 2005 – Head Quarters: US – Valuation: $1.9 bil

Prosper is a website where individuals can either invest in personal loans or request to borrow money. Citigroup stops securitizing Prosper by no longer buying Prosper’s debts to package it into bond. Goldman Sachs Group Inc. potentially takes this position. Together with LendingClub and Funding Circle, Prosper established an industry trade group, the Marketplace Lending Association, to respond to regulatory scrutiny and establish certain industry operating standards.

Funding Circle

Founded: 2010 – Head Quarters: London, UK – Valuation: $1.1 bil

Funding Circle was the first site to use the process of peer-to-peer lending for business funding in the UK, and now operates in both the UK and US markets. As of January 2016, Funding Circle has facilitated over £1 billion in loans to small and medium sized firms. Today, Funding Circle is one of the Top online lending platforms.

Kabbage

Founded: 2009 – Head Quarters: US – Valuation: $1.0 bil

Kabbage is an automated lending platform, funding directly to small businesses and consumers. In October 2015, Kabbage completed a Series E funding round of $135 million led by Reverence Capital Partners. Holland’s ING, Spain’s Santander and Canada’s Scotiabank. This latest funding values the company at over $1 billion. Kabbage also announced a strategic partnership with ING to deliver instant capital to small businesses throughout Spain.

OnDeck

Founded: 2007 – Head Quarters: New York, US – Valuation: $0.6 bil

The UK’s Innovate Finance and US marketplace lender OnDeck is an online platform for small business lending. $4+ Billion is delivered and more than 700 industries are served over the OnDeck platform. OnDeck have launched a Transatlantic Policy Working Group (TPWG) to share and exchange information on regulatory and policy issues impinging on the emerging fintech scene.

CommonBond

Founded: 2011 – Head Quarters: New York, US

CommonBond is one of the Top online marketplace lenders targeting on students. The company refinances graduate and undergraduate student loans for graduates of over 2,000 universities, saving the average borrower over $14,000 over the life of the loan. CommonBond also provides in-school loans to current MBA students at 20 programs in the United States. The company is on track to fund or refinance more than $500 million in student loans by the end of 2015.

Affirm

Founded: 2012 – Head Quarters: San Francisco, US

Affirm is one of the most ambitious new lenders, in terms of relying purely on algorithms and automation to make its lending decisions. This alternative lending site Affirm, started by PayPal co-founder Max Levchin, has raised a $100M Series D led by fellow PayPal co-founder Peter Thiel’s Founders Fund. To date, the company has raised $420M in a combination of debt and equity funding, according to CrunchBase.

Payments

PayPal

Founded: 1998 – Head Quarters: US – Valuation: $47 bil

PayPal is one of the world’s largest Internet payment system. In 2014, PayPal moved $228 billion in 26 currencies across more than 190 nations, generating a total revenue of $7.9 billion (44% of eBay’s total profits). The same year, eBay announced plans to spin-off PayPal into an independent company by mid-2015 and was completed on July 18, 2015. PayPal Credit comes to the UK with interest-free plans in this early year.

Square

Founded: 2009 – Head Quarters: US – Valuation: $5.6 bil

Mobile Point-Of-Sale startup Square have pioneered a whole new payments niche – accepting payments via tablets and smartphones. This is the payments tech, which Goldman has made investments into, including in its latest $150M round at a $6B valuation. Square launched its reader in Australia and opened a Melbourne office to cover its predominantly small-business market, which heats the Australia Fintech industry.

Stripe

Founded: 2011 – Head Quarters: US – Valuation: $5.0 bil

Stripe is another Top online payment processor. Square today launched the Build with Square program, a series of tools which offers independent businesses to join Square’s payment platform. At the core of Build with Square are new APIs that make it possible to bring e-commerce to websites quickly and cheaply.

Mozido

Founded: 2008 – Head Quarters: US – Valuation: $2.4 bil

Mozido is a mobile payments platform which unlocks financial freedom for roughly 2 billion people around the globe who carry mobile phones but no bank accounts. Last year, Mozido penetrated into Russia and China markets by the acquisition of PayEase. This year, in the partnership with Saavn, India’s leading music streaming service, Mozido enters into India, one of the world’s largest markets.

Klarna

Founded: 2005 – Head Quarters: Sweden – Valuation: $2.3 bil

In 2015, Klarna, a Swedish e-commerce payment solution for online storefronts. had more than 45M users and some 65,000 online merchants have so far hired it to run their checkouts. Klarna launched in the United States in September 2015, and the US has become its principal focus for future growth. As of 2016 Klarna is valued at over €2 billion.

Adyen

Founded: 2006 – Head Quarters: Netherlands – Valuation: $2.3 bil

Adyen is a global multichannel payment company offering businesses an outsourced payment solution. Adyen serves over 3,500 customers globally. The service is used by international and multinationals companies including, Uber, Facebook, Evernote, Spotify, Airbnb, Mango, Vodafone,Booking.com, KLM, Greenpeace, Soundcloud, Superdry and Groupon. In 2015, Adyen achieved a valuation of $2.3 billion, making it the 6th largest European unicorn.

Braintree

Founded: 2007 – Head Quarters: US

Braintree provides payment processing options for many devices. Braintree’s global payment platform processes more than $10 billion annually (with more than $2 billion on mobile) for thousands of online and mobile companies including Airbnb, Uber, Fab and LivingSocial. Braintree is in 46 markets across North America, Europe, Asia and Australia. Braintree has experienced more than a fourfold increase in a span of two years. From $12 billion in annual volume when Braintree first joined with PayPal, the company is now operating at north of $50 billion.

Venmo

Founded: 2009 – Head Quarters: US

Venmo is a mobile payment service that lets users transfer money to each other. In 2012, Braintree acquired Venmo for $26.2 million. In 2013, PayPal acquired Braintree for $800 million. PayPal announced in October 2015 that it plans to let merchants accept payments through Venmo. According to PayPal CEO Dan Schulman, Venmo itself had approximately $1 billion transferred on its interface in January 2016 alone.

Wall Street Trading and Data Analysis

Markit

Founded: 2003 – Head Quarters: London, UK – Valuation: $6.3 bil

Markit was founded in 2001 as the first independent source of credit derivative pricing. Today, their data, valuations and trade processing services are regarded as a market standard in the global financial markets. Markit have announced that Markit’s FX pricing distribution hub service added the Moscow Exchange to its network of trading venues, providing FX market participants trading access to the Russian exchange.

MarketAxess

Founded: 2000 – Head Quarters: New York, US – Valuation: $4.7 bil

MarketAxess was born to response to investors’ need for a single trading platform with easy access to multi-dealer competitive pricing in a wide range of credit products. MarketAxess has expanded and deepened its trading network with North America’s premier institutional investors, which include investment advisers, mutual funds, insurance companies, public and private pension funds, bank portfolios and hedge funds, and leading broker-dealers, both primary dealers and regional firms.

BATS Global

Founded: 2005 – Head Quarters: US – Valuation: $1.7 bil

BATS was founded in June 2005 in a time when market innovation and technology leadership were at risk due to over consolidation in the ECN and Exchange industry. Independent market centers were being bought up, and the number of credible places to trade were rapidly decreasing. As of February 2016, it operates four U.S. stock exchanges, two U.S. equity options exchanges, the pan-European stock market and a global market for the trading of foreign exchange products.

Kensho

Founded: 2013 – Head Quarters: US – Valuation: $0.5 bil

Kensho, a quantitative analytics tool, combines natural language search queries, graphical user interfaces, and secure cloud computing to create a new class of analytics tools for investment professionals. Addressing the three biggest challenges surrounding investment analysis on Wall Street today – speed, scale, and automation – Kensho’s intelligent computer systems are capable of answering complex financial questions posed in plain English.

Digital Asset

Founded: 2014 – Head Quarters: US – Valuation: $0.1 bil

Digital Asset is a blockchain technology company that provides settlement and ledger services for financial assets. The Australia Stock Exchange invested AUD $14.9 million for a 5% equity stake in New York-based blockchain startup Digital Asset Holdings. In February 2016, Digital Asset Holdings announced that Goldman Sachs and IBM have joined its recent funding round, pushing the total amount raised above $60m.

TruMid Financial

Founded: 2014 – Head Quarters: New York, US – Valuation: $0.1 bil

TruMid is a FINRA-approved broker dealer and SEC registered ATS operator of an electronic trading platform for round lots of corporate bonds and CDS.Venture capitalist Peter Thiel and billionaire George Soros are leading a $25 million investment in electronic bond-trading startup TruMid Financial LLC. Daily order volume currently totals about $750 million across both investment-grade and junk-rated bonds, the company said, and the average trade size is $2.5 million.

IEX Group

Founded: 2012 – Head Quarters: New York, US

IEX is the first equity trading venue seeded by a consortium of buy-side investors, including mutual funds, hedge funds, and family offices. Last month, Wall Street revealed that it put its own spin on the “speed bump,” a response-time delay first innovated by IEX Group.

Sources: Crunchbase; Bloomberg; Forbes; The Wall Street Journal; CB Insights; The NewYork Times; Wiki; and official website of mentioned Fintechs.

28 Comments so far

Jump into a conversationThis is an article that helps some individual regarding how they can send and receive payment. In addition, aside from what’s written above, I can save on transfers as well.

I was highly benefited by “Coinbase” from a long time. Because it offers an API for developers and merchants to build applications and accept bitcoin payments which very few other FinTech startups might do.

Some people may find the information in this page useful in understanding how to send and receive money. In addition to the aforementioned benefits, I can also spend less on transfers.

The information on this page might be helpful to some persons in learning how to send and receive money. I can save money on transfers in addition to the aforementioned advantages.

Well Said & Great Appreciation!

Thank you for sharing valuable information

thanks for sharing a great article

As we reflect on the top fintech startups over the last decades, let’s not forget the transformative power of innovation, much like the magic dust in Manok Na Pula Hack. It’s about pushing boundaries and revolutionizing the industry for a brighter future.

How to Convert image to a4 – Free & online with DocFly. Simply upload your file & let our PDF to Word converter do its magic.

Over the past decades, the fintech landscape has witnessed a remarkable evolution, with innovative startups reshaping the financial industry. Through the lens of PicsArt, we capture the dynamic rise of pioneering fintech companies, revolutionizing banking, payments, and investing, and paving the way for a digital financial future.

Over the past decades, the fintech landscape has witnessed a remarkable evolution, with innovative startups reshaping the financial industry. Through the lens of Inshot Pro APK, we capture the dynamic rise of pioneering fintech companies, revolutionizing banking, payments, and investing, and paving the way for a digital financial future.

Thank you for sharing premium info for free.

Are you deeply interested in sharing and downloading photos and videos on social media? Here, we present personally using the app that solves all your problems. The app’s name is Insta Pro APK. For Android Devices, Insta Mod is Developed by SamMods. Instagram Pro Provides Features Like Media, Status Privacy, and Story Downloading. Hurry up! Just install this application and enjoy it.

Various virus and malware detection engines have confirmed that Insta Pro Apk is safe. Also, you may use these platforms to scan through every update and enjoy Instagram Pro security.

This information is really amazing, and these startups are really good.

Thanks sharing this really important and valuable information with us about start ups.

Thanks for sharing this free premium information with us.

Amazing post and thanks for giving us this amazing information.

FIFA Mobile Mod APK

Thank you for all this information, loved to read about these fintech startups.

In recent years, the fintech sector has undergone a notable transformation, driven by the emergence of groundbreaking startups that are redefining traditional financial services. With PicsArt as our tool, we delve into the dynamic ascent of these trailblazing fintech enterprises, as they redefine banking, payments, and investment realms, setting the stage for a digitalized financial er

Thank you for sharing such valuable information. Also, Remini is a powerful photo editor that can convert old images into new images with high quality.

Resizing an image to fit perfectly on A4 paper for printing is a straightforward process, thanks to modern technology and user-friendly tools https://resizepng.com/resize-image-to-a4-size

Thanks For Share This Blog !!

Free Download picsart pro apk

Thanks for providing you such a valuable information for us.

Amazing data provided

Images can be resized to 20KB using various compression

techniques and software tools specifically designed for image optimization.

These tools reduce unnecessary data within the image file while preserving visual

quality to achieve the desired file size, try it resize image to 20kb