Prominent VC Firm Andreessen Horowitz Warns of Long-Term Costs Implications of Cloud

by Fintechnews Switzerland June 17, 2021In a lengthy analysis, Silicon Valley venture capital (VC) firm Andreessen Horowitz (a16z) argues that software companies could save billions by “repatriating” workloads from the cloud and running IT infrastructure themselves, shattering the common belief that the cloud is the most cost-efficient model for all companies in the space.

The new analysis, authored by a16z partner Sarah Wang and general partner Martin Casado, estimates that across 50 of the top public software companies currently utilizing cloud infrastructure, US$100 billion of market value is being lost among them due to cloud impact on margins.

Extending the analysis to the broader universe of scale public companies, the VC firm estimates that the total impact is potentially greater than US$500 billion.

“As the cloud matures … it’s becoming evident that while cloud clearly delivers on its promise early on in a company’s journey … [with] an incredibly powerful value proposition … driving efficiencies both in operations and economics … the pressure it puts on margins can start to outweigh the benefits as a company scales and growth slows,” the report says. “As growth (often) slows with scale, near term efficiency becomes an increasingly key determinant of value in public markets. The excess cost of cloud weighs heavily on market cap by driving lower profit margins.”

Drawing from conversations with experts, the VC firm estimates that cloud repatriation drives a 50% reduction in cloud spend, resulting in total savings of US$4 billion in recovered profit.

While the numbers differ from one company to another, experts interviewed by a16z converged on the “formula” that repatriation results in one-third to one-half of the cost of running equivalent workloads in the cloud.

“Across all our conversations with diverse practitioners, the pattern has been remarkably consistent: if you’re operating at scale, the cost of cloud can at least double your infrastructure bill,” the authors warn.

Growing awareness from software companies

Wang and Casado stress the need for cloud optimization, whether through system design and implementation, re-architecture, third-party cloud efficiency solution, or moving workloads to special purpose hardware.

The authors note that several companies have started to understand the true, long-term cost implications of the cloud, and embarked on infrastructure optimization initiatives.

Dropbox, for example, launched an infrastructure optimization initiative in 2016. By shifting the majority of its workloads from public cloud to “lower cost, custom-built infrastructure in co-location facilities” it directly leased and operated, Dropbox was able to save nearly US$75 million over two years.

In October 2019, customer data platform company Segment revealed that between July and January 2018, it managed to reduce infrastructure costs by 30% through incremental optimization of their infrastructure decisions.

Meanwhile, companies including CrowdStrike and Zscaler have decided to repatriate some of their workloads and adopt a hybrid approach, the authors note.

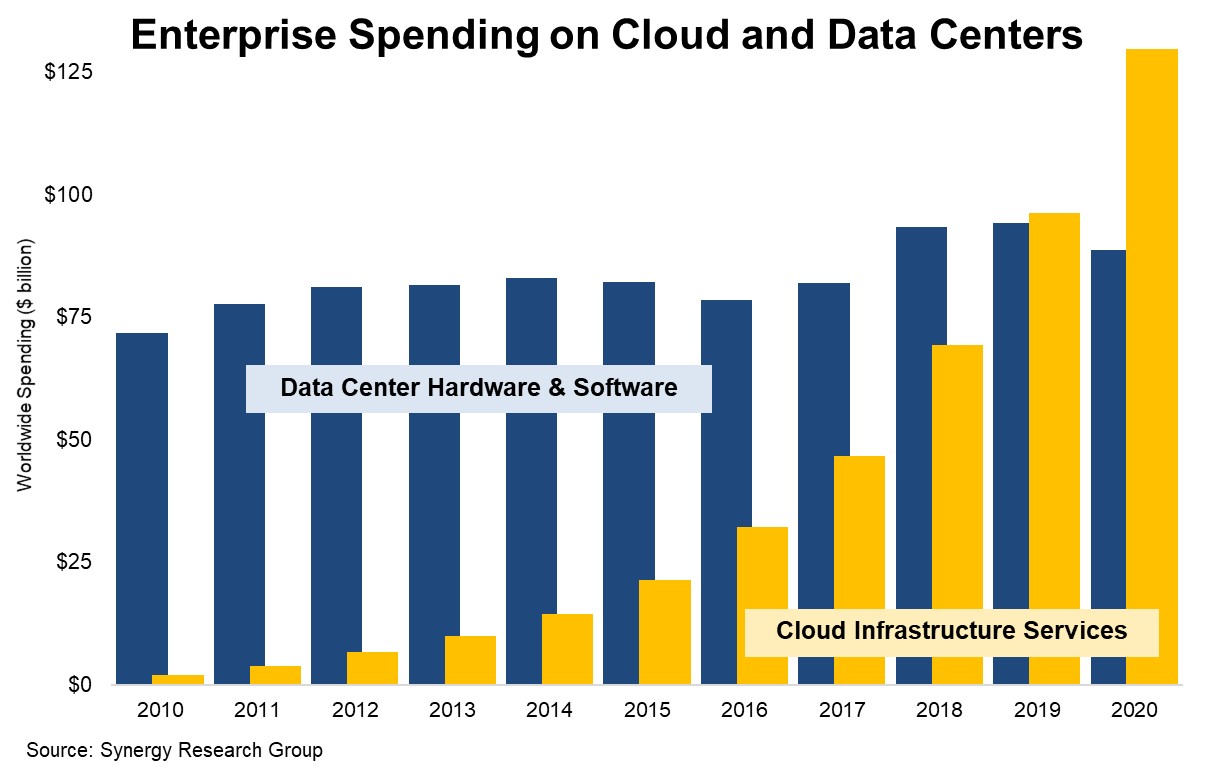

The report comes at a time of rapid adoption of cloud services across all sectors. In 2020, enterprise spending on cloud infrastructure services continued to ramp up aggressively, rising 35% to reach almost US$130 billion, data from Synergy Research Group show.

Meanwhile, enterprise spending on data center hardware and software dropped by 6% to under US$90 billion, continuing a decade-long trend of explosive growth in cloud and virtual stagnation in the market for enterprise-owned data center equipment.

Enterprise spending on cloud and data centers, Synergy Research Group, March 2021

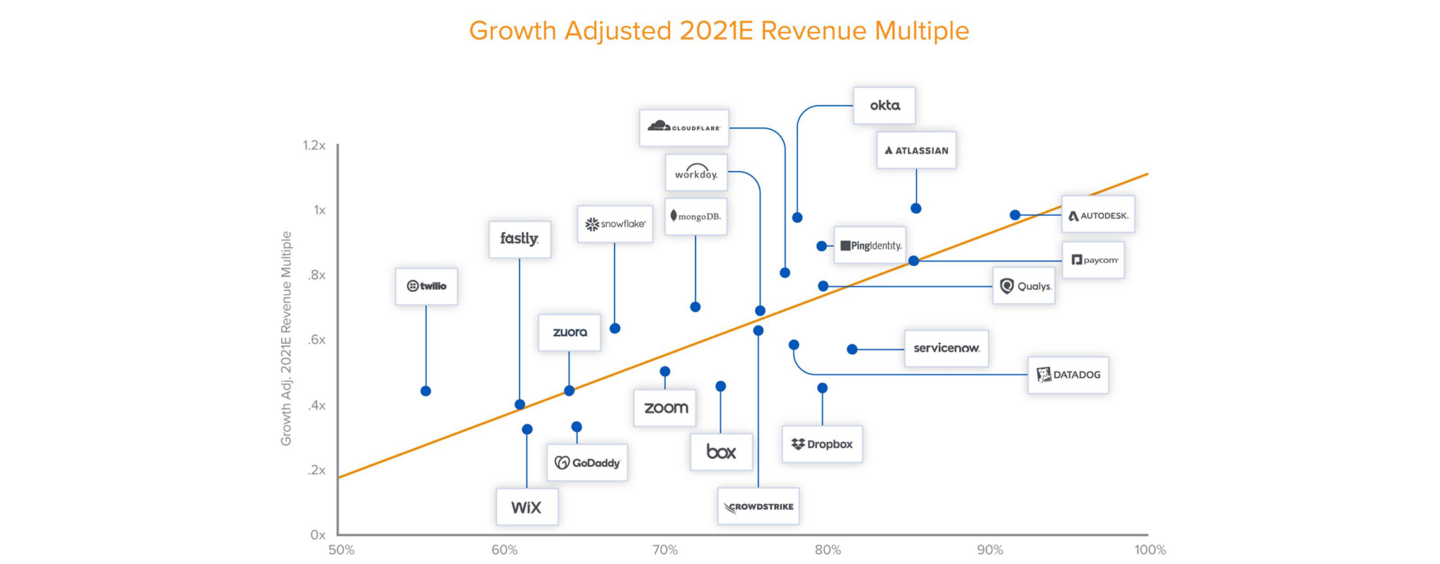

Featured image source: CapIQ as of May 2021; note: charts herein are for informational purposes only and should not be relied upon when making any investment decision