Covid Netherland Market-Report and Holland’s Top 20 Growth Fintech

by Fintechnews Switzerland August 17, 2020In the Netherlands, the COVID-19 pandemic is spurring the need for more sophisticated and digitized financial products, according to a research conducted by industry trade group Holland Fintech, in collaboration with Fintech Aera.

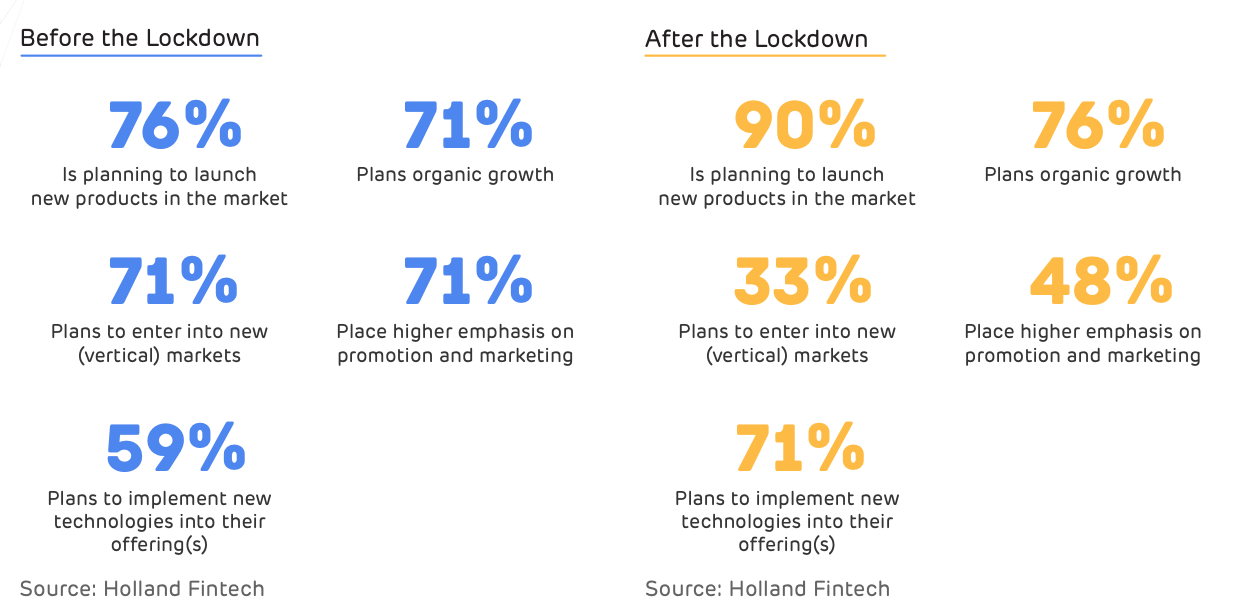

In a new report titled The State of the Dutch Fintech Market 2020, the organizations share findings from a survey conducted earlier this year of companies in the European and Dutch fintech sector. The research found that 90% of respondents are planning to introduce new products in the market, a significant increase compared with the 76% figure pre-lockdown.

COVID-19 is also forcing fintech firms and banks to accelerate adoption of cutting-edge technology, with 71% planning to implement new techs into their offerings, compared with 59% pre-lockdown.

In these uncertain times, fintech vendors are focusing on maintaining their current market positions rather than expanding. Only 33% of respondents are planning to enter into new vertical markets, a considerable decrease compared with the pre-lockdown sentiment where 71% were planning to do so.

Respondents also indicated that higher emphasis on promotional and marketing will take a deep dive as well.

Fintech vendors survey, Source: The State of the Dutch Fintech Market 2020, Holland Fintech and Fintech Aera, June 2020

The Dutch fintech industry in 2019

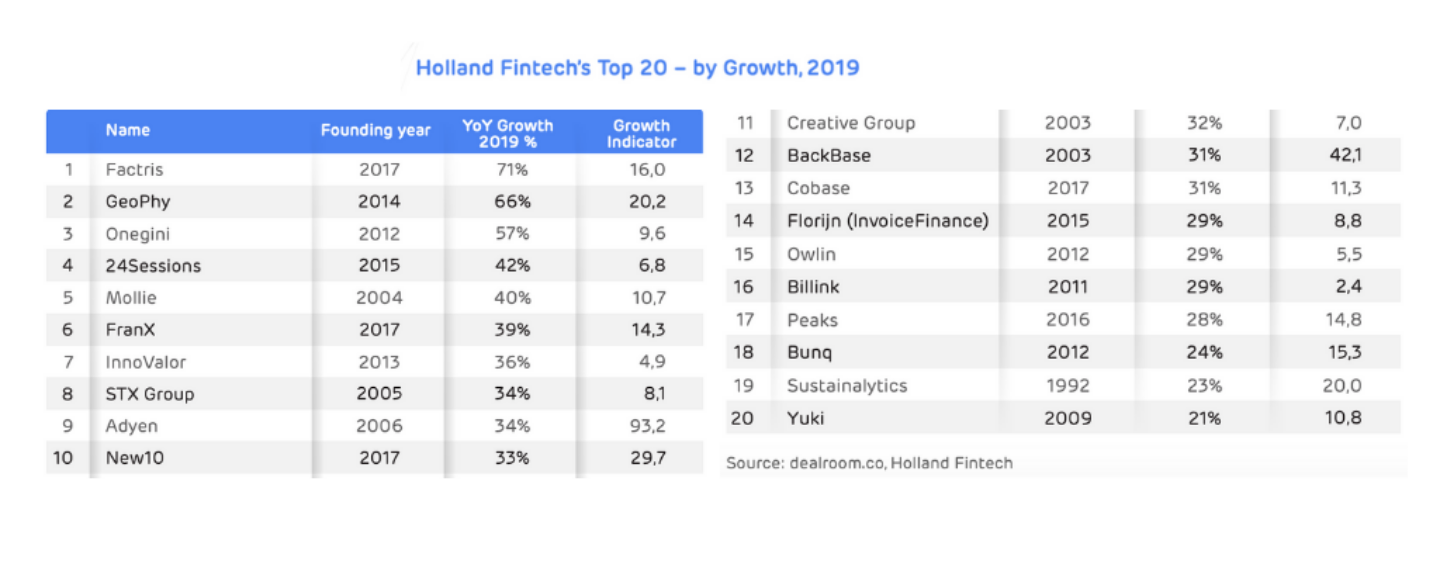

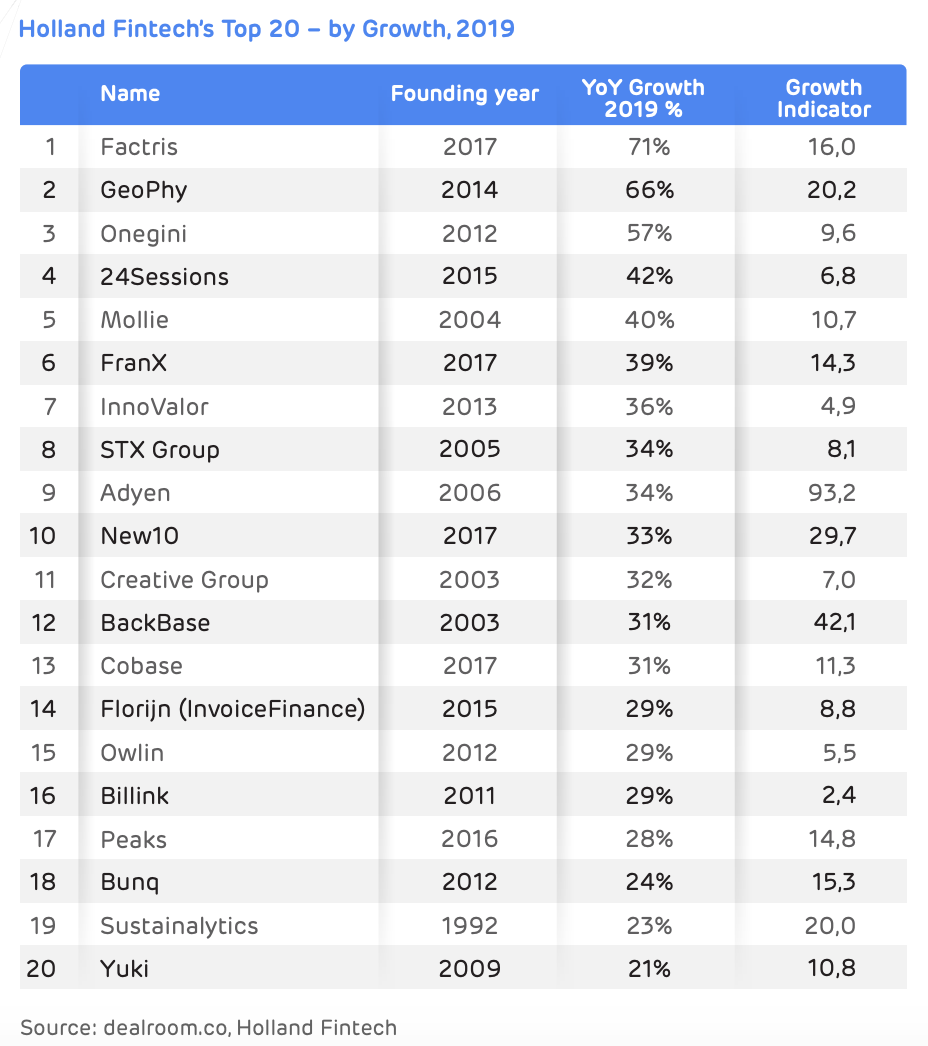

Looking at the Dutch fintech sector’s growth over the past year, the research found that companies with a strong tech component outperformed in the market, with Factris, GeoPhy and Onegini ranking as the top three performers in terms of year-on-year (YoY) growth at 71%, 66% and 57% respectively.

Factris is an online invoice factoring platform targeted European small and medium-sized enterprises (SMEs). GeoPhy is proptech startup that leverages artificial intelligence (AI). And Onegini designs and develops security software.

Holland Fintech’s Top 20 – by Growth, 2019, Source: The State of the Dutch Fintech Market 2020, Holland Fintech and Fintech Aera, June 2020

The report says that the top three is reflective of current fintech trends in the Netherlands, including increasing focus on alternative finance, continued growth in sub-segments such as regtech, legaltech, proptech and insurtech, as well as rising focus on identity solutions.

According to the research, the Dutch fintech market is characterized by a limited number of large, established companies, followed by a large number of smaller companies. Interesting, the Netherlands’ current fastest growing fintech providers are relatively young ventures, with 65% of the top 20 being founded after 2010.

Dutch fintech investments and M&A activity

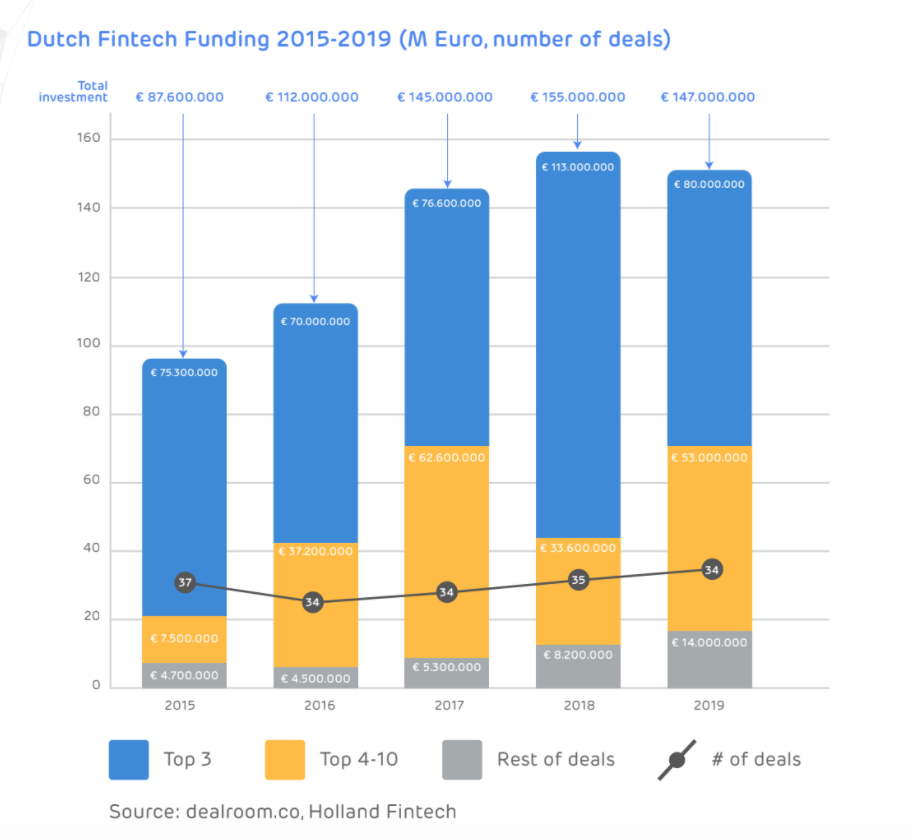

In 2019, Dutch fintech investment saw a minor decline to EUR 147 million, compared with 2018’s all-time high of EUR 155 million.

The slight decline is in line with the global trend, where pure fintech investments seem to have reached their peak, the report says. Nevertheless, fintech remains a major tech segment, representing 20% of all VC money invested in Europe.

Dutch Fintech Funding 2015-2019 (M Euro, number of deals), Source: The State of the Dutch Fintech Market 2020, Holland Fintech, June 2020

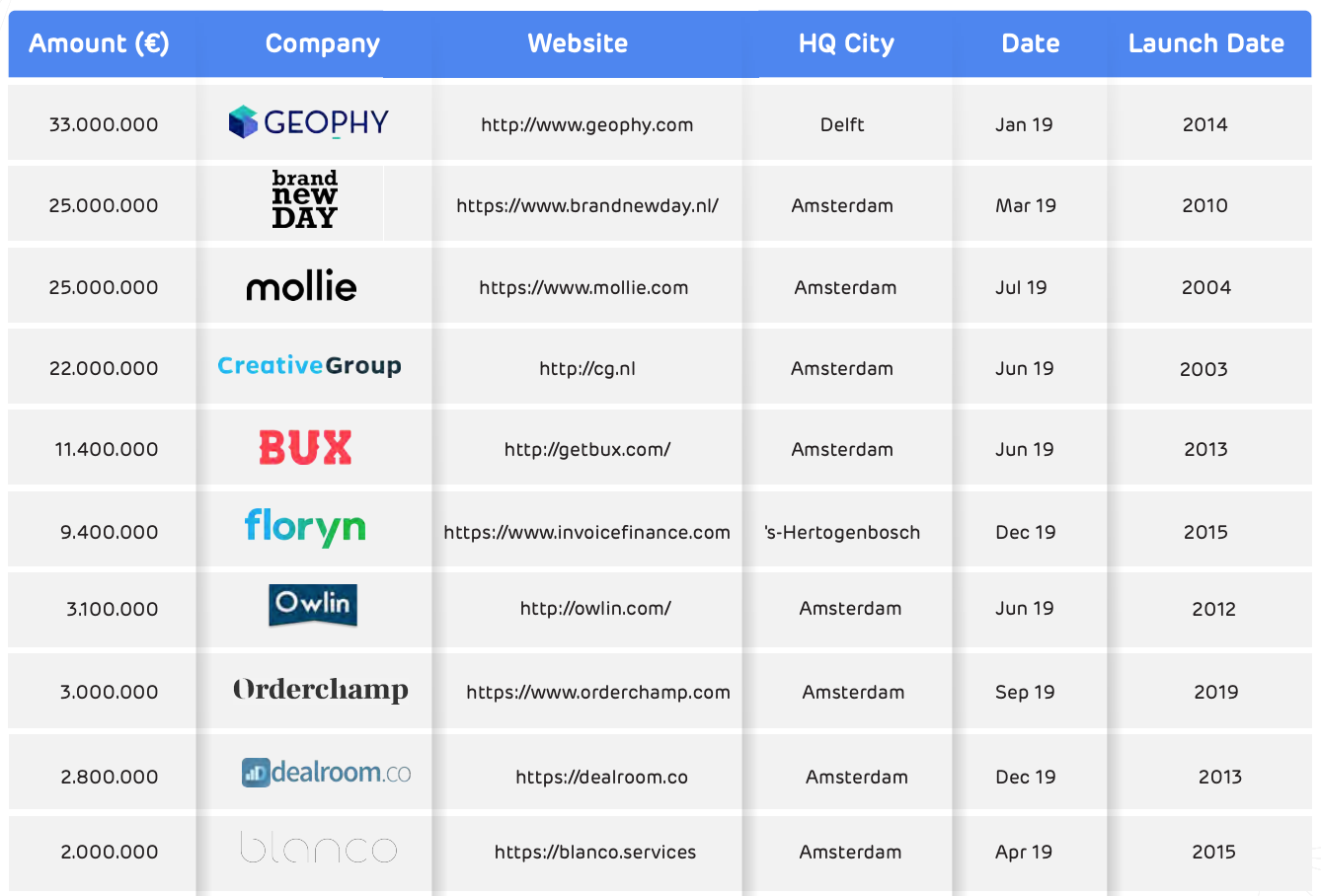

In 2019, 40 Dutch fintech companies received funding, with the three largest deals representing 54% of the total amount invested that year. In 2019, the ten largest deals made up 90% of all funding.

Dutch fintech VC deals by size in 2019, Source: The State of the Dutch Fintech Market 2020, Holland Fintech and Fintech Aera, June 2020

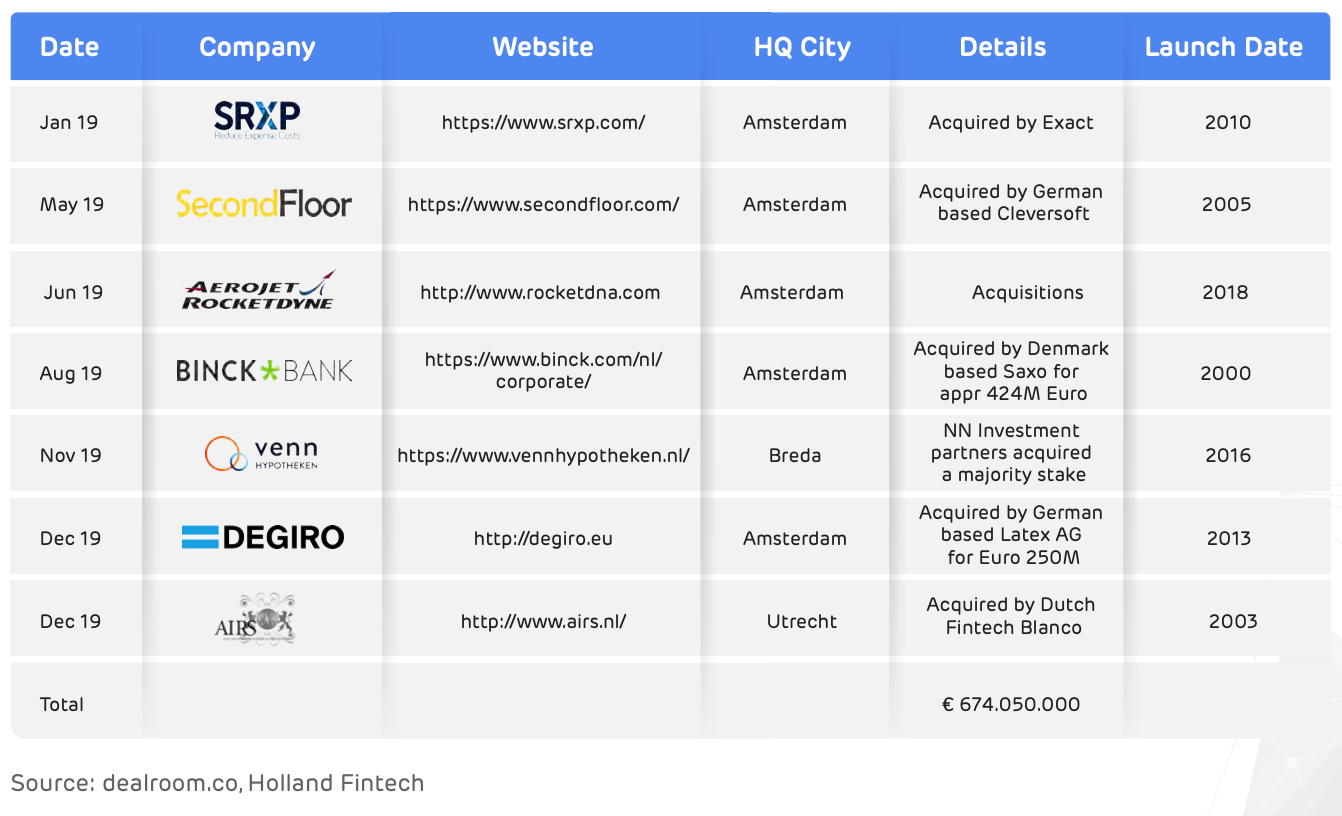

2019 saw six acquisition deals in the fintech space, combining a total of EUR 674 million. Major acquisitions in 2019 include SRXP, Secondfloor, BinckBank, Venn Hypotheken, DEGIRO, AIRS, and Binckbank.

Fintech acquisitions in 2019 by size, Source: The State of the Dutch Fintech Market 2020, Holland Fintech and Fintech Aera, June 2020

According to the report, the current economic conditions will spur merger and acquisition (M&A) activity where players with cash reserves will aim to consolidate the market.

The survey’s results echo that, with respondents stating that while 2019 saw a limited number of acquisition deals, activity is expected to grow in 2020.

“The impact of COVID-19 on the fintech scene will spur acquisitions as smaller fintech will be challenged by changing business conditions,” the report says. “The larger ones will go on an acquisition quest to acquire smaller firms in distress, and to consolidate and grow their market share.”