Finch Capital released a detailed analytical report titled ‘FinTech: The Future Post CV-19’ which discusses the challenges and opportunities that the sector will face both during, and more significantly after, the crisis.

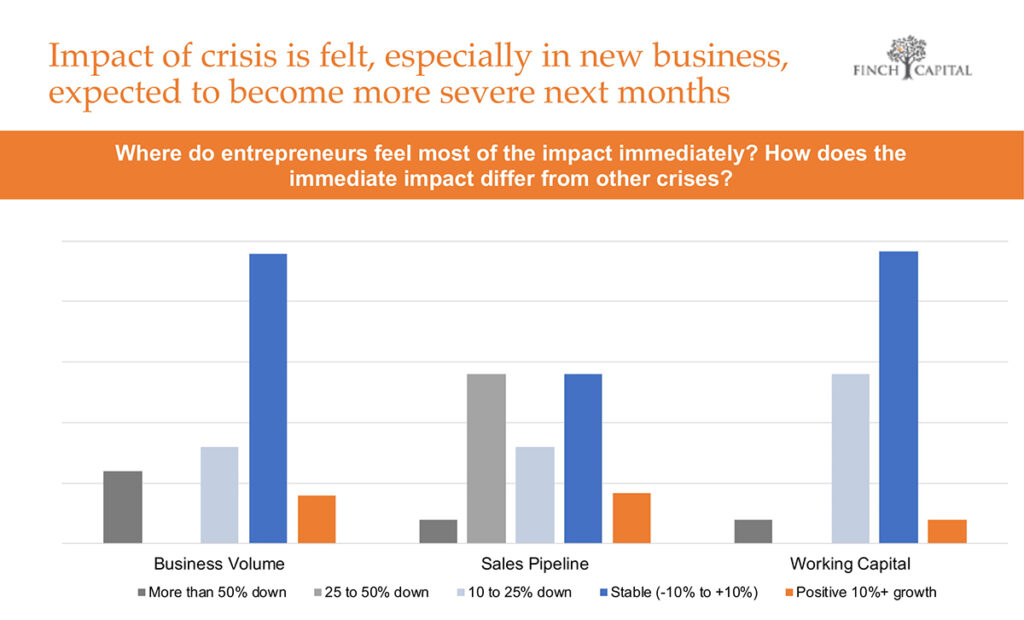

COVID-19 has had an enormous impact on our lives and is reframing the way we work, consume and interact. Startups in the earlier stages of their life cycles are particularly vulnerable if growth stagnates or even drops for a period of 3 – 6 months. T

he uncertainty of the current situation puts pressure on fundraising, cash management, marketing and staff management. In the short-term we see many hurdles that startups need to grapple with in order to survive, and limited opportunities; however, post-crisis (Q4 2020 +) we believe the lasting impact on society creates conditions which favor increased momentum, growth, and the unleashing of a virtuous cycle for FinTech companies.

The Finch Capital report covers for the FinTech industry, the (i) short-term impact of the crisis (ii) structural implications post-crisis, translating into an ever-swifter adoption of digitalisation and (iii) landscape in terms of growth, unit, economics, consolidation, funding dynamics and exits.

Radboud Vlaar

” 2020 will be challenging for FinTechs to navigate, but there are better times ahead. Post-crisis, disruptive winners will “take all”, as we expect surging demand from financial services for technology to master digital-only interaction, enabled by AI and big-data analytics”,

says Radboud Vlaar, Managing Partner at Finch Capital.

Key findings:

- Expect crisis mode until Q3 2020, followed by a 12 – 18-month recovery

- Digital-only becomes the new industry norm in financial services, greatly accelerating a trend which started in the last decade

- Shift to digital-only triggers a “Big Pocket” battle between incumbents and challengers to win the (newly) online customer

- Financial Institutions turn to Tech companies rather than in-house solutions to accelerate digital transformation

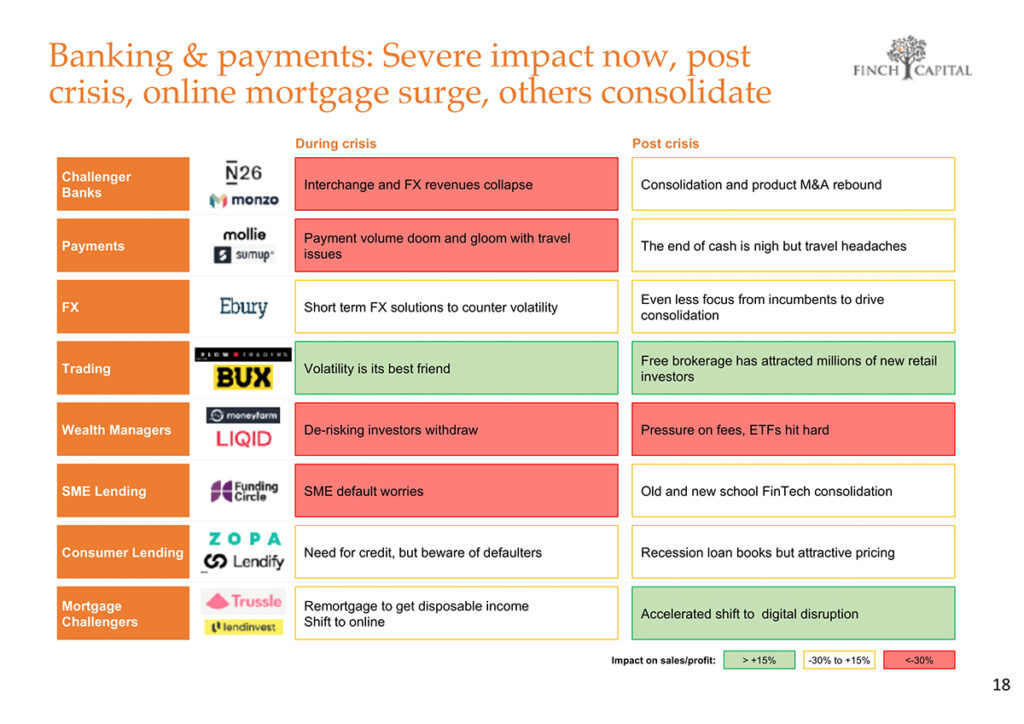

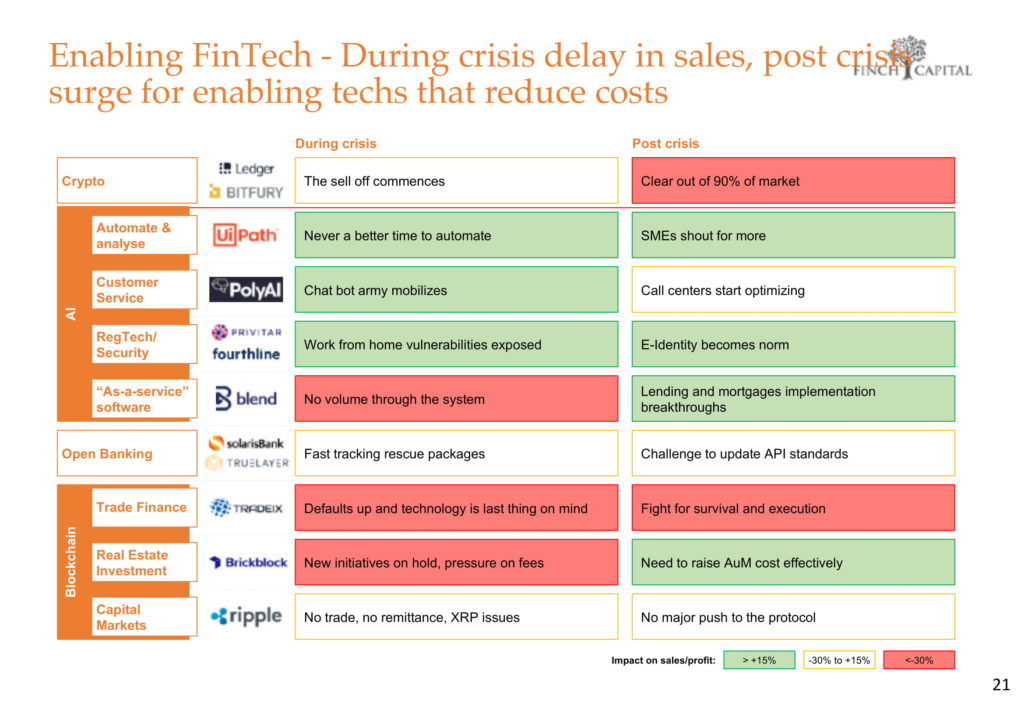

FinTech sector winners:

- Consumer and SME lending platforms: best-adapting mechanism to swiftly and efficiently deliver capital to key segments of the economy

- Mortgage and life insurance digitalization: leaping forward with technology to disrupt the role of intermediaries, whose role was often face-to-face

FinTech ‘enablers’ around AI, IoT and software solutions are in high demand:

- AI: bots for call-centers; account-opening procedures; loan automation,

- KYC: increased need for safe digital ID given volume of digital business transacted and robust solutions required for protection of client assets

Areas under pressure:

- Challenger banks: high valuations, and lower expected activity post-crisis

- Wealth management: client de-risking and lower AUMs impacting bottom line

- Payments/FX: decreased transaction activity affecting commission businesses

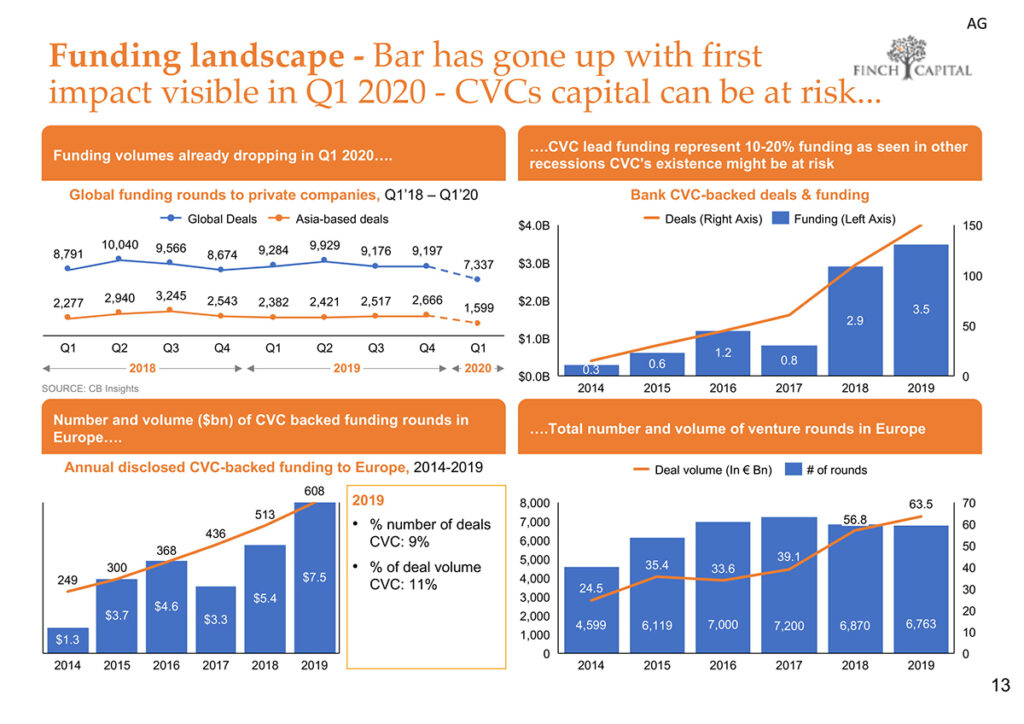

Pull-back of corporate VC-led investments in combination with higher hurdles for companies’ access to funding put pressure on valuations in later-stage rounds

Increased M&A and trade-sales in under-$250m category of fintech companies, as fewer IPOs expected