Fintech Market Rebounds as Public Markets Recover, Private Investments Increase

by Fintechnews Switzerland May 9, 2023Global fintech investment declined significantly throughout 2022, with funding dropping by 46% from 2021’s record levels, deals falling 8% year-over-year (YoY) and unicorn births sinking to a low of five new unicorns in Q4 2022, representing an 87% drop compared with Q4 2021, data from CB Insights’ State of Fintech 2022 show.

Supply chain disruptions, rising geopolitical tensions and a looming recession are among the main reasons behind the decline, prompting investors to slow their investment pace and halting the startup funding frenzy.

Following the steady decline of investment activity in 2022, global fintech funding and deal activity rebounded significantly in Q1 2023, driven by late-stage rounds and a public market recovery.

A new report by London-based corporate finance advisory Royal Park Partners looks at the state of the fintech market in Q1 2023, delving into public markets performances, private investment activity, and fintech exit trends observed during the past quarter.

Public markets recover

After a turbulent Q4 2022, public markets recouped some of their losses in Q1 2023, helping fintech segments regain strength, data from the report show.

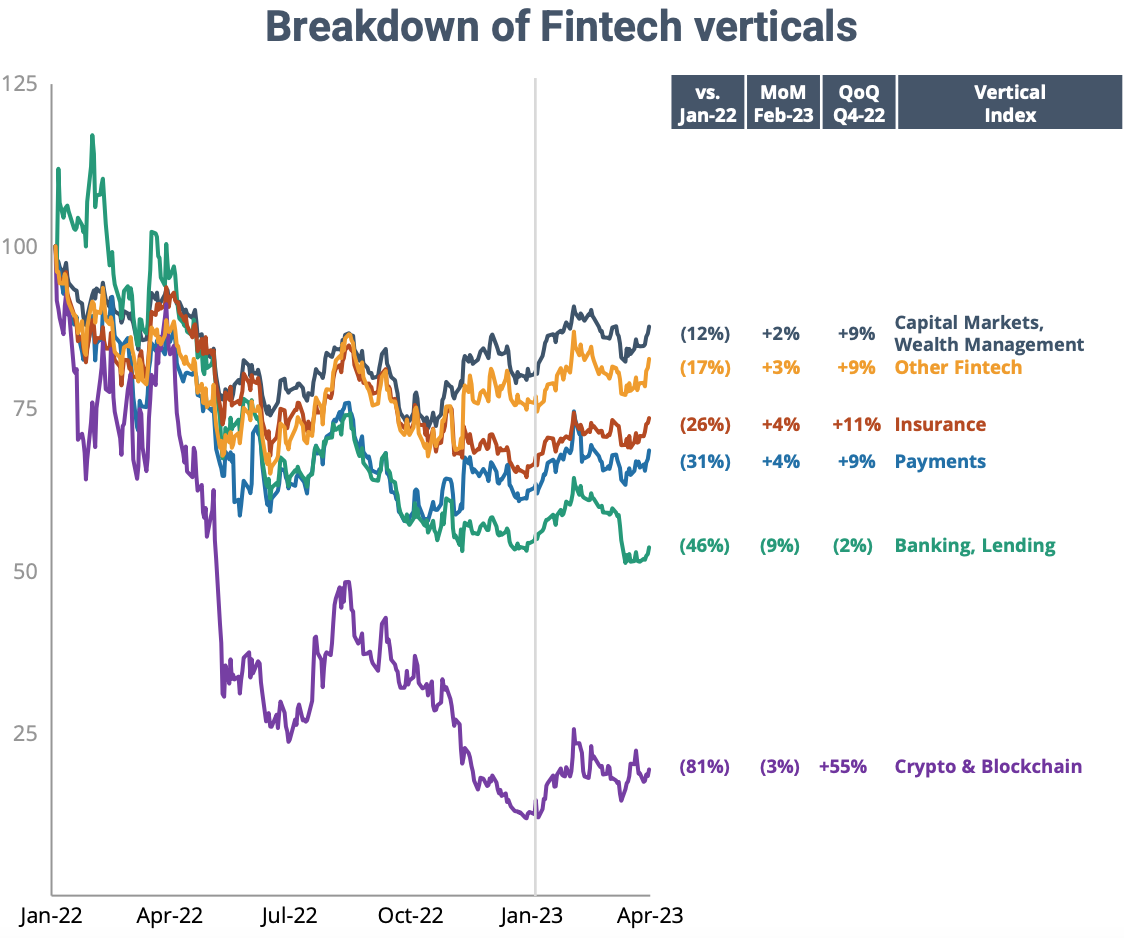

The cryptocurrency and blockchain vertical recorded the strongest increase as it continued to recover from the decline caused by the FTX bankruptcy and other scandals. A cohort comprising 10 publicly listed companies in the sector, including Bakkt, Coinbase and Galaxy, witnessed an increase of 55% in share prices quarter-on-quarter (QoQ), the biggest growth observed across all the fintech verticals studied.

Besides crypto and blockchain, the capital markets and wealth management, payments and insurance cohorts each witnessed an increase of approximately 10% QoQ. The banking and lending cohort fell behind the rest of the group, retrieving 2% QoQ.

Breakdown of fintech verticals by share price evolution, Source: Q1 2023 Quarterly Fintech Market Update, Royal Park Partners

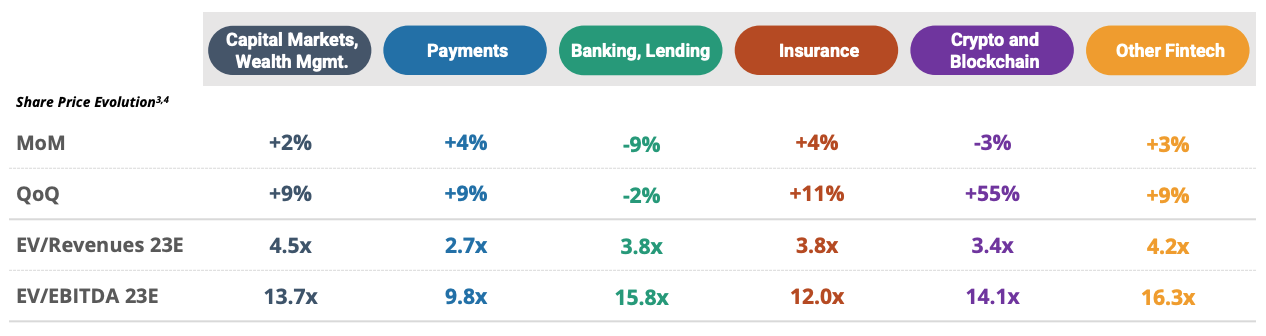

Looking at key stock valuation measurement metrics, data show that payments recorded the lowest enterprise value-to-revenue (EV/R) and enterprise value to earnings before interest, taxes, depreciation, and amortization (EV/EBITDA) multiples, standing at 2.7x and 9.8x, respectively. This makes payments the fairest priced and healthiest cohort of the verticals studied for Q1 2023.

EV/R and EV/EBITDA are two popular valuation tools that help determine if a stock is adequately priced. EV/R only considers the top line, focusing on a company’s revenue-generating ability. EV/EBITDA, on the other hand, takes into account operating expenses and taxes, helping thus determine a company’s ability to generate operating cash flows.

Fintech public markets performances Q1 2023, Source: Q1 2023 Quarterly Fintech Market Update, Royal Park Partners

Private fundraising rebounds

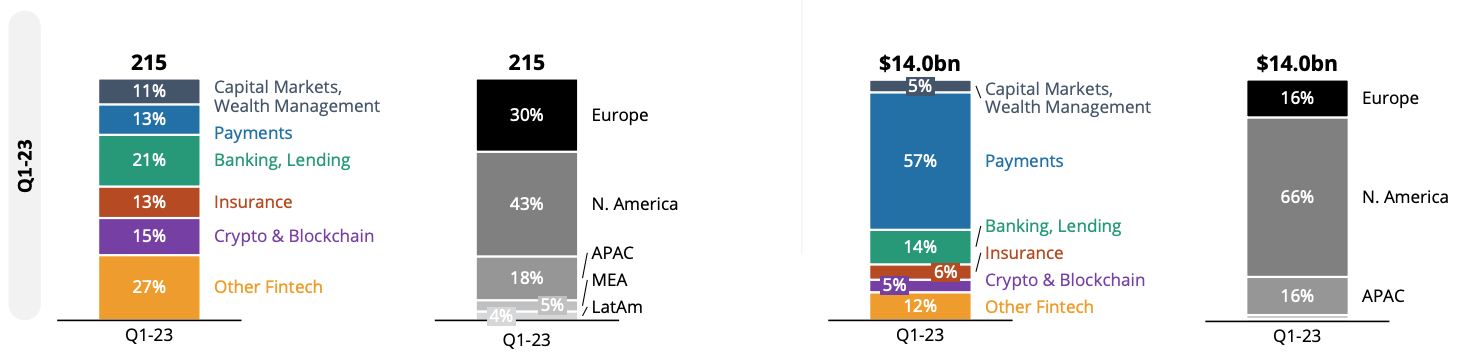

Private funding activity increased remarkably in Q1 2023, growing more than twofold QoQ to US$14 billion, data from the report show. The number of deals also increased, rising from 176 in Q4 2022 to 215 in Q1 2023.

QoQ growth was driven by a rise in fundraising activity in the verticals of capital market and wealth management, insurance and the “other fintech” cohort, which comprises companies in categories such as payroll, governance, risk and compliance, price comparison and credit data.

Payments, meanwhile, saw a decline in the number funding rounds but deal value soared drastically, growing more than sevenfold QoQ to US$8 billion, thanks to Stripe’s US$6.5 billion Series I.

Looking at geographical distribution, data show that North America attracted the lion’s share, securing over 66% of all fintech funding in Q1 2023. Asia-Pacific (APAC) and Europe came second, neck and neck with a 16% market share each. Most investment rounds in Q1 2023 (60% of all fintech deals) were made at the late-stage level as investors focused on supporting more mature and established fintech companies instead of placing new bets.

Notable private funding rounds recorded in Q1 2023 include mobile payments application PhonePe’s US$643 million late stage round, consumer lending platform Abound’s US$602 million debt and equity finance, and workforce management platform Rippling’s US$500 million Series E.

Q1 2023 fintech deal number and deal value, Source: Q1 2023 Quarterly Fintech Market Update, Royal Park Partners

M&A activity remains strong

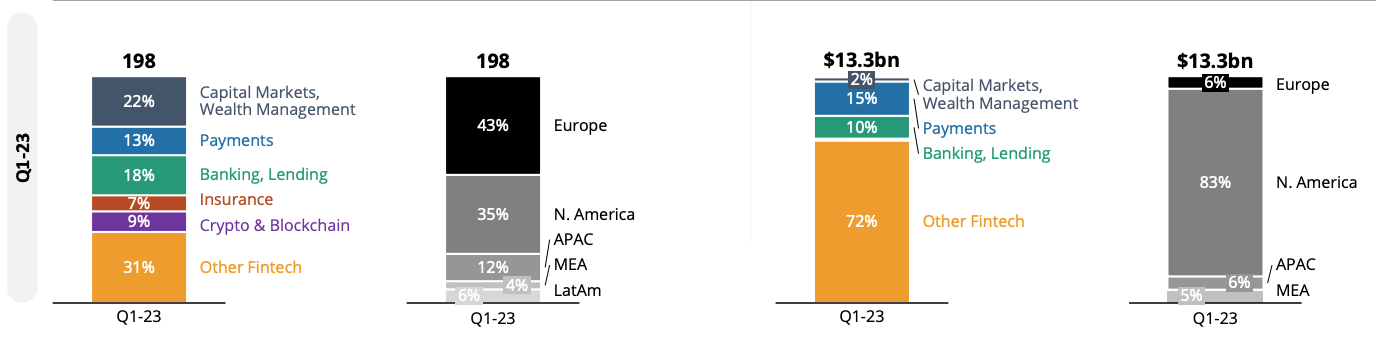

In Q1 2023, mergers and acquisitions (M&A) activity remained dynamic, totaling US$13.3 billion through 198 deals. North America secured the largest share in total deal value (83%) but Europe closed the most rounds (43%).

Notable deals included the US$8 billion buy-out of spend management company Coupa by Thoma Bravo – a deal that accounted for 63% of the total M&A value of the quarter –; the acquisition of Duck Creek Technologies by Vista Equity Partners for US$2.6 billion; and MAX’s acquisition by CLAL Insurance & Finance for US$687 million.

Q1 2023 fintech mergers and acquisitions deal number and deal value, Source: Q1 2023 Quarterly Fintech Market Update, Royal Park Partners

Looking at other startup exit types, the report notes that six fintech companies went public by merging with a special purpose acquisition company (SPAC). These companies included REAL Messenger, a proptech social networking platform from the US, Roadzen, an insurtech company from India, Cheche Technology, a Chinese auto insurtech, and DigiAsia Bios, an Indonesian business-to-business (B2B) fintech-as-a-service (FaaS) company.

Three other companies chose the route of an initial public offering (IPO): New POS Technology, a Chinese payment company; Worldpay, a UK-based payment processing company; and Adenasoft, a South Korean software developer service financial services companies.

Featured image credit: Edited from Freepik