Fintech Funding Drops 46%; Banking Startups Among Worst Hit

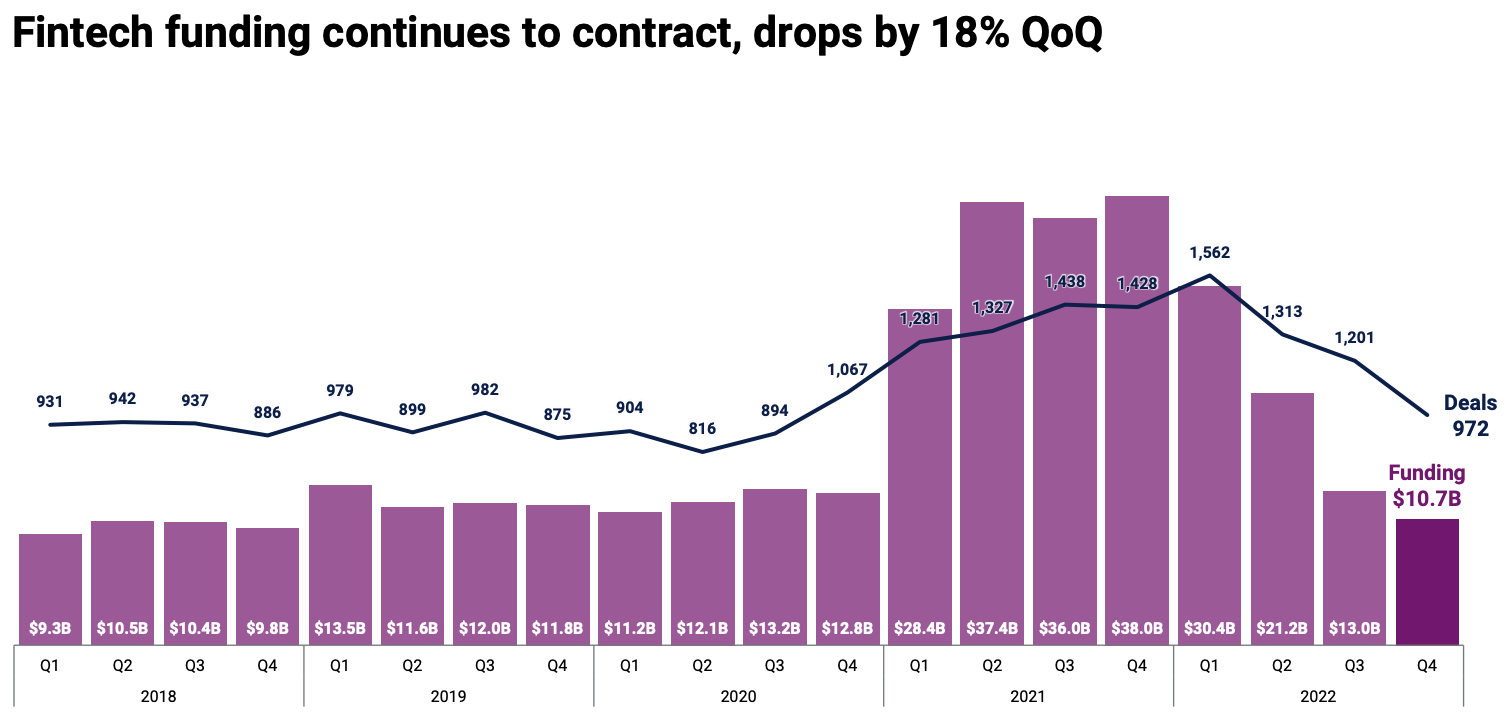

by Fintechnews Switzerland February 1, 2023In 2022, fintech companies secured a total of US$75.2 billion in funding, a sum that represents a 46% decline from 2021. Deal counts also decreased, falling 8% year-on-year (YoY) from 5,474 deals in 2021 to 5,048 deals last year, data from CB Insights’ State of Fintech 2022 show.

Fintech funding steady declined throughout the year, dropping from US$30.4 billion in Q1 to US$21.2 billion in Q2, US$13 billion in Q3 and US$10.7 billion in Q4 – the latter being the lowest level since 2018.

Global fintech funding quarterly, Source: State of Fintech 2022, CB Insights, Jan 2023

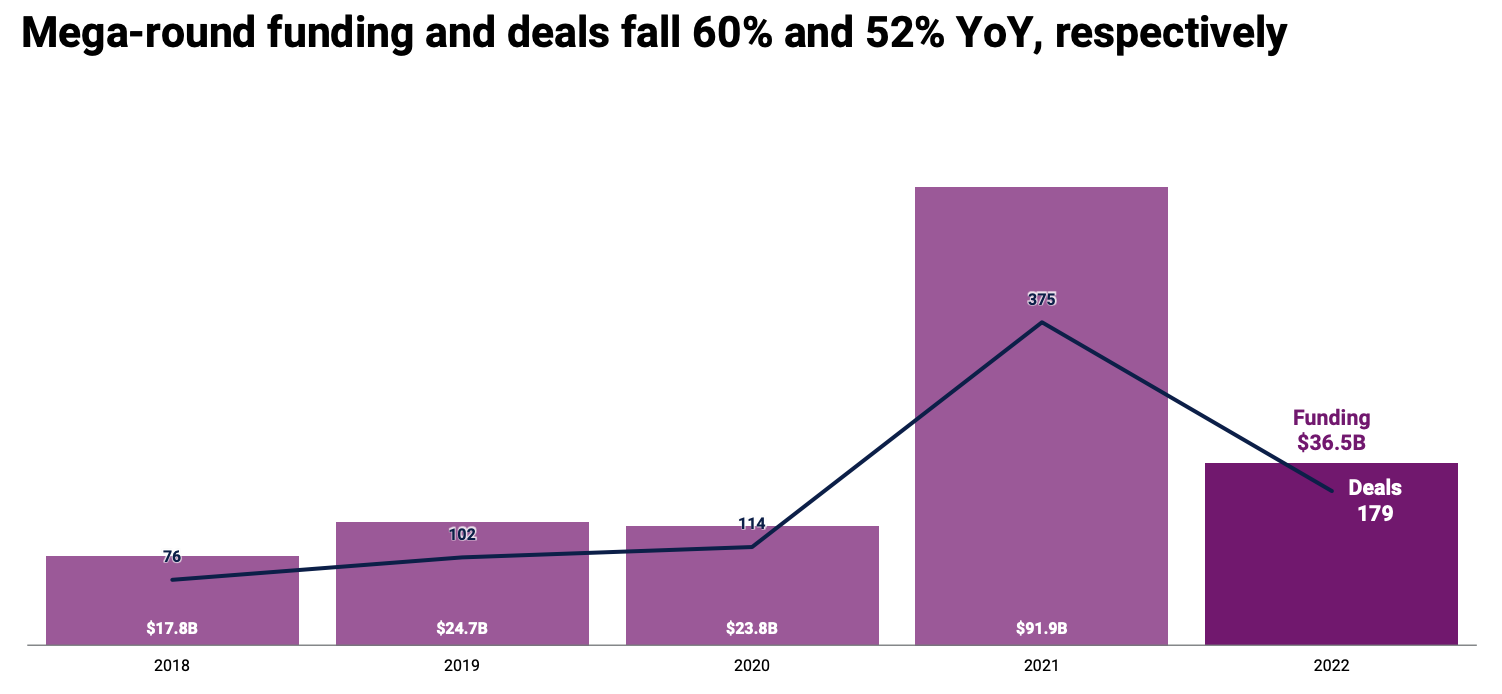

Investors scaled back their investment pace in 2022 amid slumping public markets, a trend that’s evidenced by the decrease in mega-rounds of US$100 million.

In 2022, mega-rounds accounted for just US$36.5 billion, marking a 60% drop from 2021’s record activity. The number of mega-round also fell by 52% YoY to 179.

The year’s top five equity deals were Checkout.com’s US$1 billion Series D, Flexport’s US$935 million Series E, Klarna’s US$800 million round, Viva Wallet’s US$869 million round, and Coda Payments’ US$690 million Series C.

Checkout.com is a company based in the UK that offers a cloud based end-to-end payment platform; Flexport is a technology company from the US that focuses on supply chain management and logistics, including order management, trade financing, insurance, freight forwarding and customs brokerage; Klarna is a leading buy now, pay later (BNPL) startup from Sweden; Viva Wallet is a Greek neobanking startup aimed at small and medium-sized enterprises (SMEs); and Coda Payments is a Singaporean provider of cross-border monetization solutions for digital products and services.

Fintech mega-round funding and deals in 2022, Source: State of Fintech 2022, CB Insights, Jan 2023

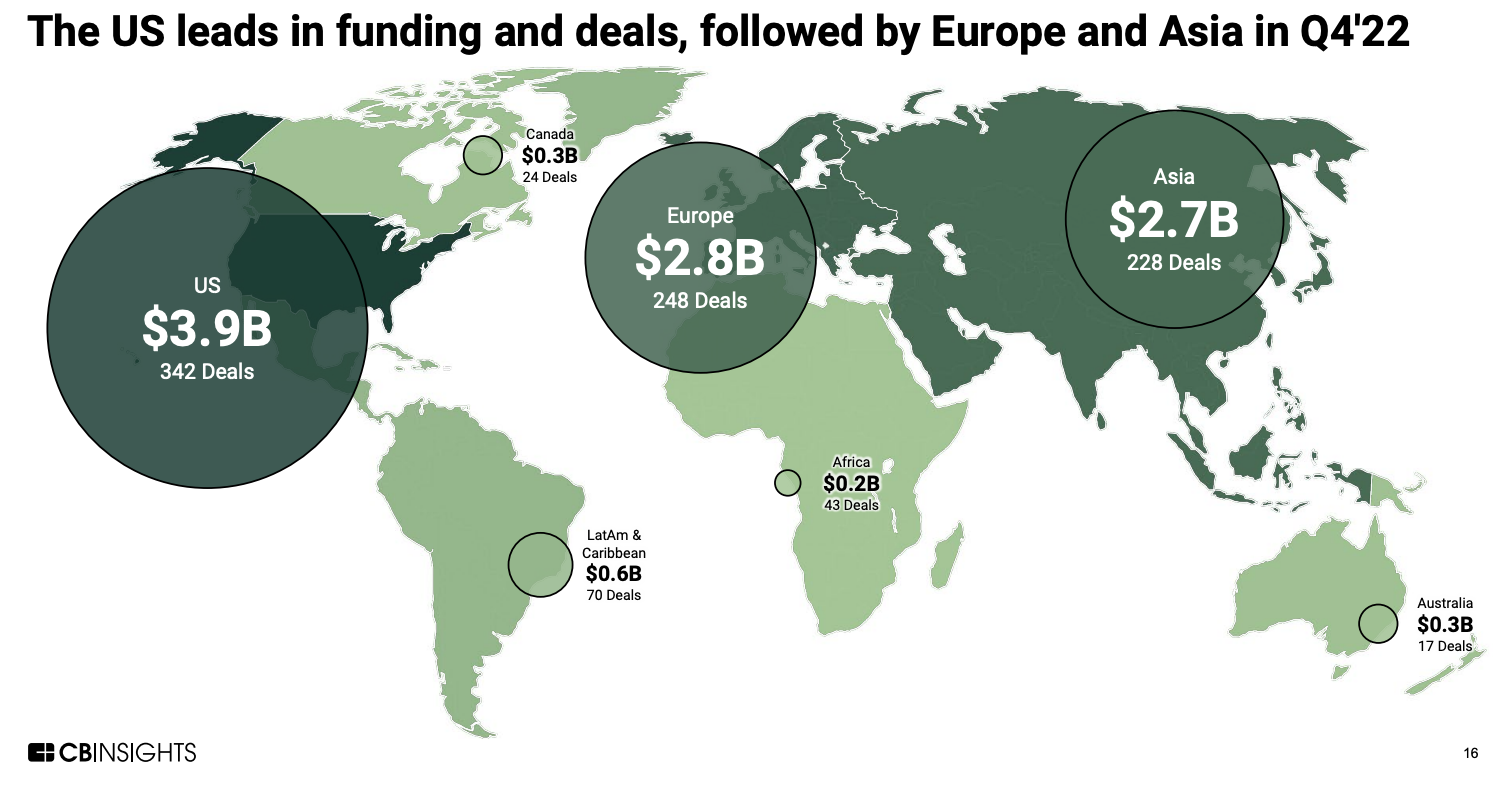

Looking at Q4 2022 metrics, data show that the US continued to led the world in fintech funding and deals, securing a total of US$3.9 billion across 342 deals. Europe came second, with US$2.8 billion raised through 248 deals, followed by Asia with US$2.7 billion and 228 deals.

The figures give the US a market share of 35% in Q4 global fintech funding, while Europe and Asia recorded market shares of 26% and 23%, respectively, a ranking that’s consistent with previous quarters.

Across all the regions studied, Latin America and the Caribbeans recorded the sharpest drop, slumping 71% YoY from US$13.9 billion in 2021 to just US$4 billion in 2022.

Fintech funding by region in Q4 2022, Source: State of Fintech 2022, CB Insights, Jan 2023

While the US, Europe, Asia and Latin America all witnessed a drop in both fintech funding and deal counts, Africa was the only region to see a YoY increase in fintech deals, recording 227 rounds in 2022. The number represents a 25% YoY increase.

Notable deals secured in 2022 include MoneyFellows’ US$31 million Series B, Moove’s US$30 million funding round, as well as Tanda and Telda, which secured US$20 million each in respective seed rounds. The four rounds were the region’s largest fintech deals in 2022.

MoneyFellows is a collaborative group lending and savings platform from Egypt; Moove is a mobility fintech that provides revenue-based vehicle financing and financial services to mobility entrepreneurs across ride-hailing, logistics, mass transit, and instant delivery platforms; Tanda is a Kenyan paytech startup; and Telda is an Egyptian consumer money app.

Banking startup funding takes a hit

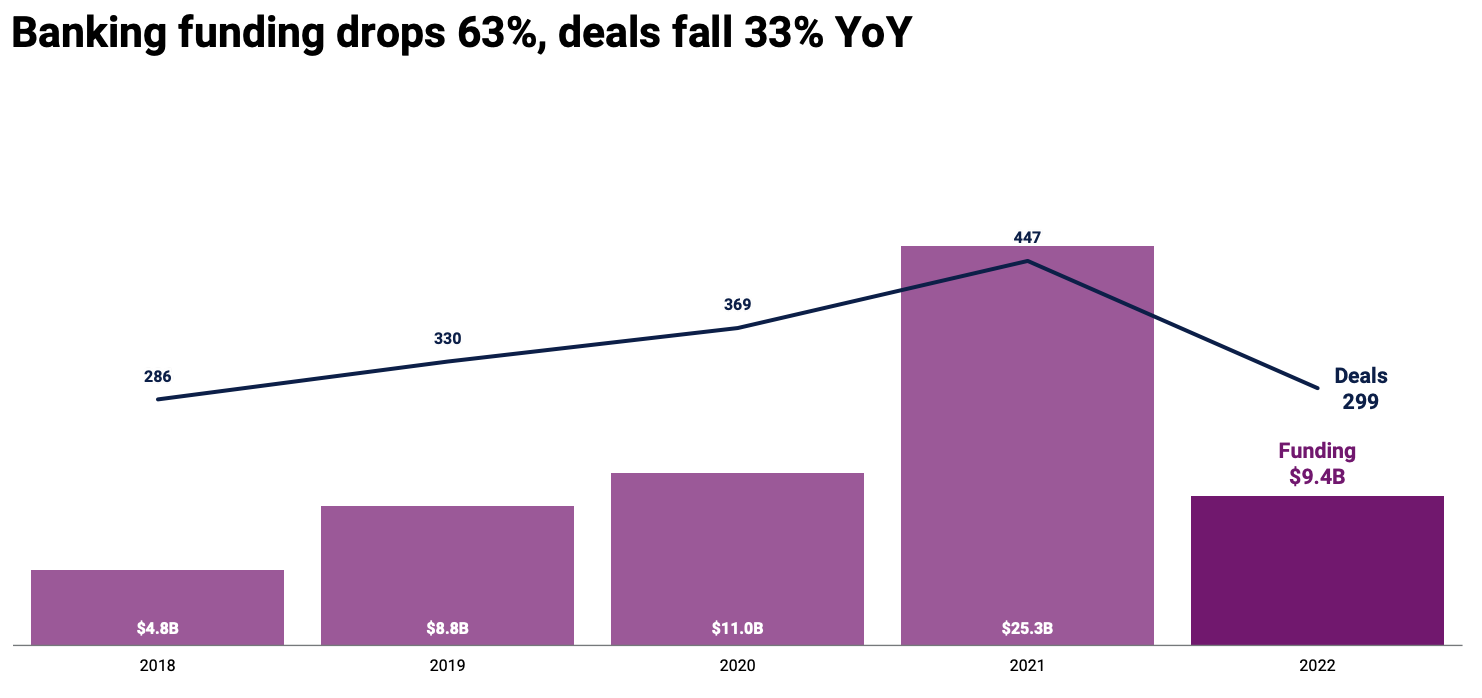

Though all the major fintech categories witnessed a drop in funding last year, data show that banking startups took the biggest hit, with funding plummeting 63% and deals falling 33% YoY. Globally, banking startups secured a mere US$9.4 billion through 299 deals – the lowest level since 2018.

Notable deals closed in Q4 2022 include Tryllian’s US$358 million round, Lulo Bank’s US$200 million round and Avant’s US$150 million round.

Tryllian is a digital bank from the US that aims to provide customers with banking and payment accounts, investments and insurance services all in one app; Lulo Bank is a Colombian mobile banking app that provides money transfers, payment services and lending products; and Avant is an American fintech company that provides digital banking products, including personal loans, credit cards and auto refinance.

Global banking funding, Source: State of Fintech 2022, CB Insights, Jan 2023

At the other end of the spectrum, capital markets tech companies recorded the lowest percentage drop in funding, with total funding declining 39% YoY from US$3.8 billion in 2021 to US$2.3 billion in 2022. Deal count, meanwhile, fell to a five-year low of just 119 in 2022.

Top equity deals in the space secured in Q4 2022 include Vesttoo’s US$80 million Series C, Viridios Capital’s US$36 million Series B, and BMLL Technologies’ US$26 million Series B.

Insurtech, meanwhile, was the only fintech sector to see a YoY increase in merger and acquisition (M&A) transactions, recording a total of 81 deals in 2022, up 40% from 2021’s 58. The figure represents a new high for the sector.

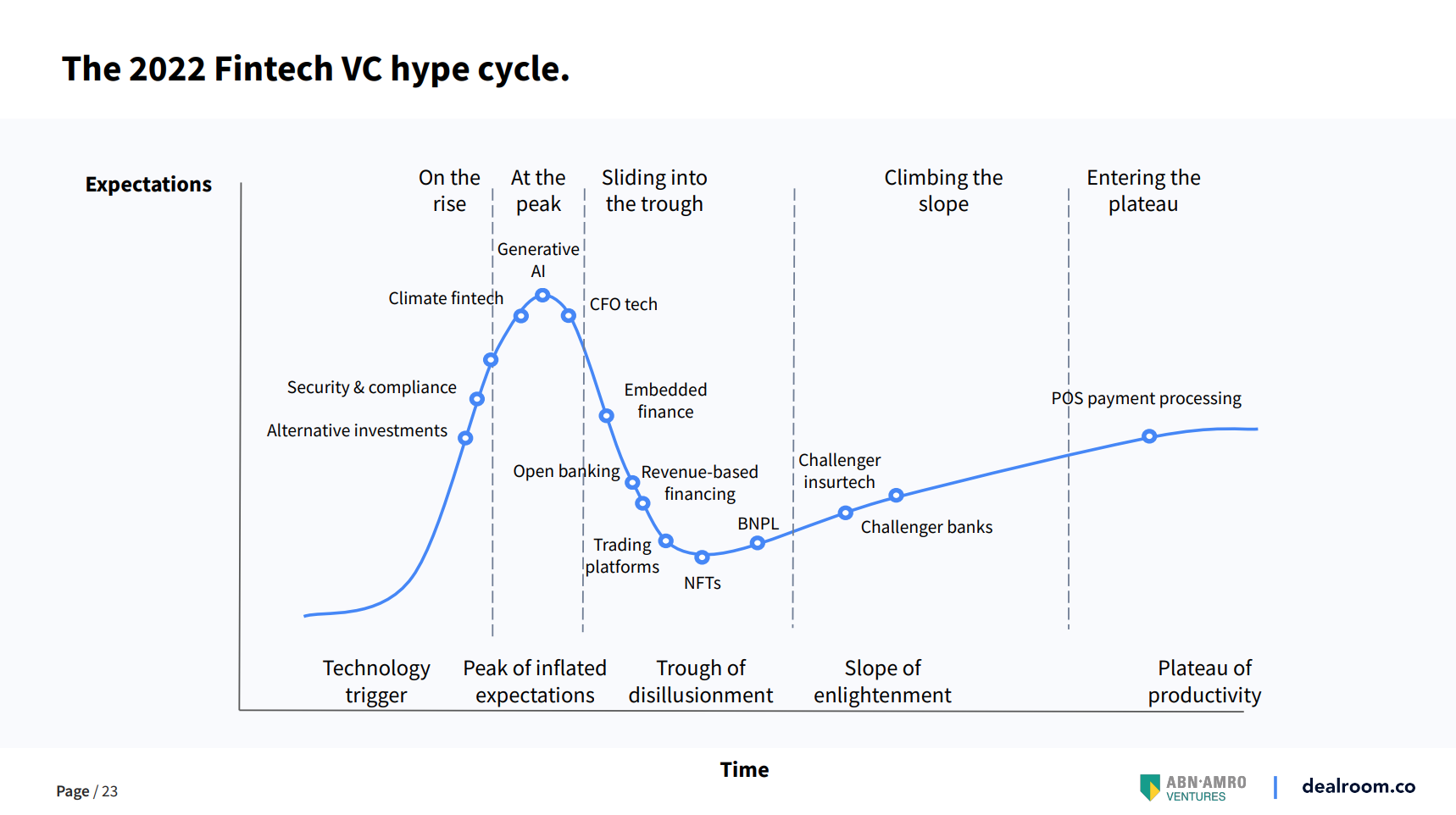

2022 was an eventful year for the fintech industry, which was marked with much hype around trends including non-fungible tokens (NFTs), open banking, embedded finance and buy now, pay later (BNPL).

While much of these propositions and business models are still trying to find their feet and define a path to profitability, categories including challenger insurtech, challenger banks and point-of-sale (POS) payment processing are starting to be better understood and are finding market applicability and relevance, according to a Dealroom and ABN-AMRO Ventures report.

The 2022 fintech VC hype cycle, Source: Fintech Report 2022, Dealroom/ABN-AMRO Ventures, Jan 2023

Featured image credit: edited from Unsplash