2022 was a trying year for the fintech industry which faced uncertainties related to geopolitical conflicts, supply chain challenges, as well as rising inflation and interest rates. Macroeconomic headwinds weighed on consumer-facing businesses, forcing many to undergo mass-layoffs and scale back on their expansion plans.

These market conditions have prompted investors to turn their focus on business-to-business (B2B) fintech companies, which many argue are more shielded from market volatility and are poised for strong growth amid digitalization efforts.

Rising interest in B2B fintech is evidenced by the relative dynamism the sector is witnessing as well as strong venture capital (VC) funding activity.

Citing data from Dealroom, Panagiotis Kriaris, a fintech executive currently serving as the head of business development at German paytech company Unzer, noted in a recent blog post that the global VC funding pullback has had a limited impact on B2B fintech, compared to B2C fintech.

In 2022, B2C fintech VC funding declined 47%, plummeting from US$57 billion to just US$30 billion. In comparison, B2B fintech VC funding fell down by only 32%, declining from US$93 billion in 2021 to US$63 billion in 2022.

What’s also noteworthy is the considerably larger amount of funding the B2B fintech sector is managing to secure globally compared to B2C fintech, a sum that’s more than double what B2C fintech companies raised last year.

Untapped opportunities

Compared to B2B, B2C business models are much more vulnerable to rising inflation, interest rates and macroeconomic turbulence, investors told Sifted in recent interviews. Additionally, B2C fintech is a rather saturated space, compared to B2B fintech, implying fiercer competition to score customers and the constraint of focusing on growth at all costs to gain the critical mass needed for their business model to function.

“A lot of the B2B fintechs actually need fewer clients. Each one is much larger and brings them much more revenue,” Khalil Hefaf, an investment manager at Target Global, told Sifted.

“While on the B2C side you have to waste loads of money on marketing, on the B2B side, there’s often a network effect where each client you onboard has a network of partner companies you can tap into.”

Another reason why investors are flocking to B2B fintech is the sheer size of the addressable market. The B2B buy now, pay later (BNPL) market, for example, is expected to grow to US$200 billion in Europe and the US over the next couple of years, Berlin-based B2B BNPL startup Mondu told Sifted in May 2022.

London-based B2B BNPL startup Hokodo has an even brighter outlook for the market as it pegs the current Western European B2B BNPL market at US$12 trillion.

Rising adoption of digital technologies

For Magda Posluszny, a fintech investor at Lakestar, another major growth driver of the B2B fintech sector is the accelerated adoption of digital technologies as well as opportunities relating to helping incumbents upgrade their slow and clunky legacy technology.

“There’s always a lag while the infrastructure gets built, but when so many new fintech applications and business models emerged, what became really apparent was that interacting with banks is really difficult: they’re not designed for these higher volumes,” Posluszny told Sifted. “Payments will always be sexy: there’s still a massive problem to solve everywhere in Europe around B2B payments, so we’ll always looking for the next solution there.”

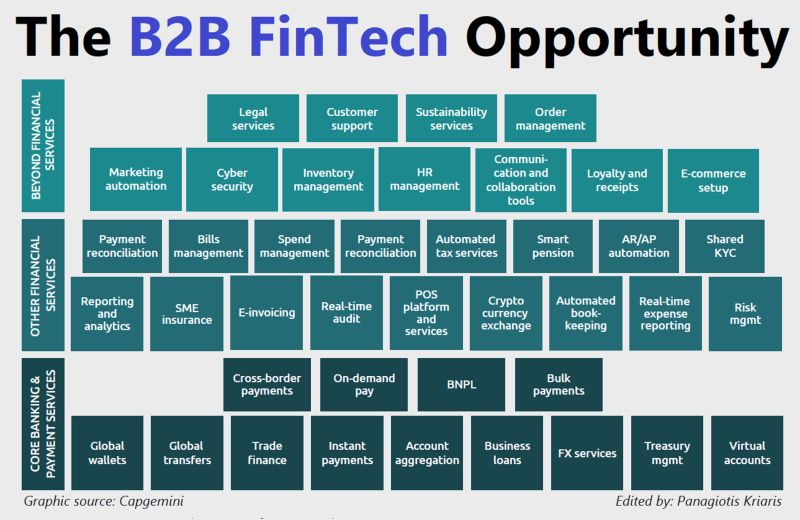

Echoing Posluszny’s statements, Unzer’s Kriaris said that “adding tangible value to all kinds of organizations across an ever-wider spectrum of segments remains a long untapped opportunity.”

He noted that the COVID-19 pandemic and the ensuing enforced digitization have drastically changed the way businesses perceive their B2B needs, and the way they buy technologies and services, prompting increased demand for B2B digital solutions.

B2C fintech companies enter the B2B space

The rise of B2B fintech is further evidenced by the flurry of B2C fintech companies building out a B2B software side to their business and launching relevant products.

In the UK, neobank Starling Bank said last year that it would sell its software to other banks to fulfil its global ambitions rather than expand via its core consumer digital banking offering. The digital bank has 3 million clients, about 500,000 of which are businesses.

BNPL leader Klarna is another fintech firm exploring B2B opportunities, launching in May 2022, its Klarna Kosma open banking sub-brand and business unit. The open banking platform focuses on connecting financial services businesses to tens of thousands of banks across Europe and the US.

Finally, payments heavyweight American Express introduced in August 2022 American Express Global Pay, a new digital solution that enables US businesses to make domestic and international B2B payments.

American Express has been strengthening its B2B propositions over the past few years, partnering in September 2021 with Extend, a New York City-based fintech specializing in virtual cards, and collaborating in Billtrust, a B2B accounts receivable automation and integrated payments leader, in April 2022.

The B2B Fintech Opportunity infographic, Source: Panagiotis Kriaris, LinkedIn, Jan 2023

Featured image credit: freepik