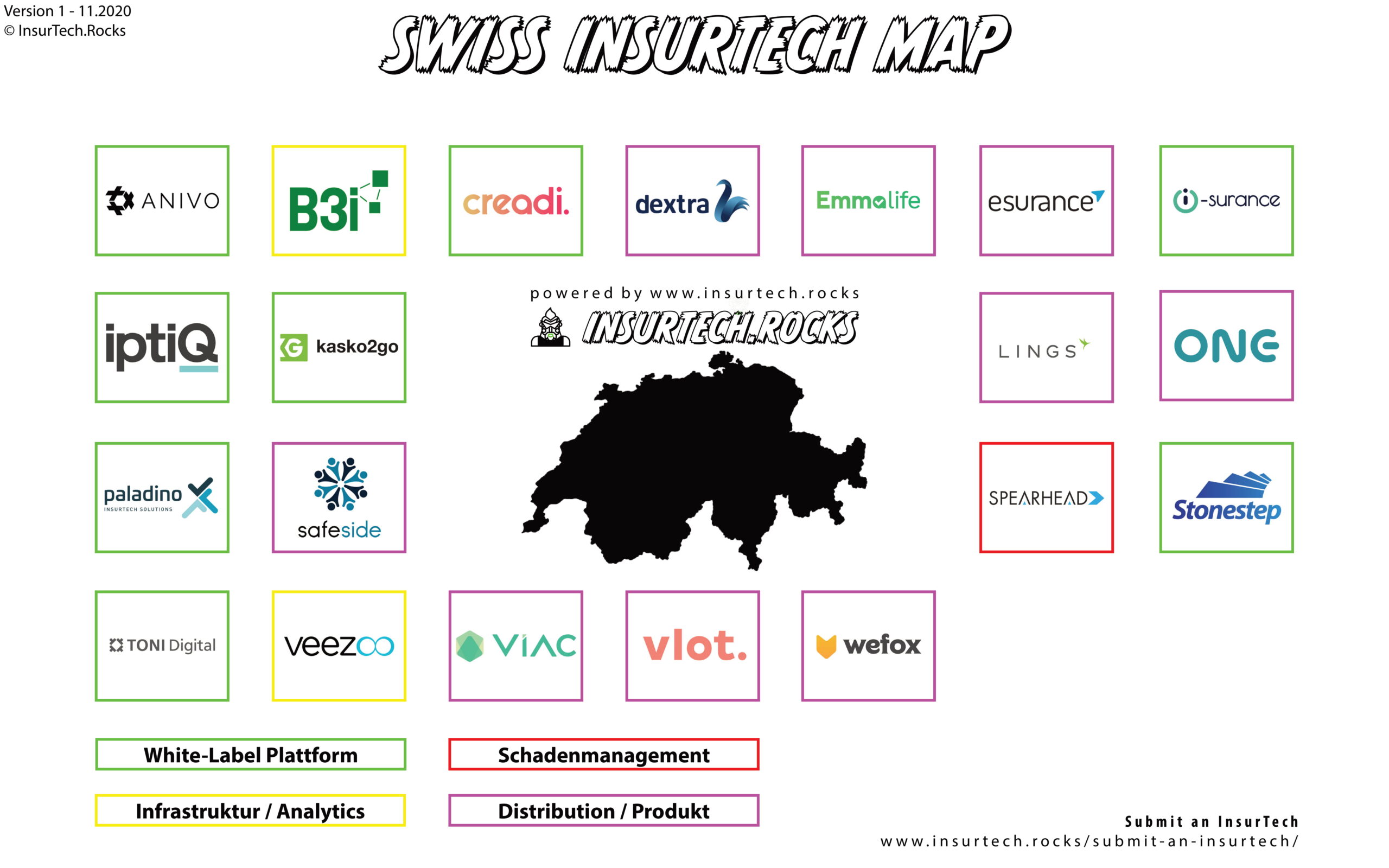

Insurtech.Rocks, a management and digital consulting dedicated to the Swiss insurance ecosystem, has released their Swiss Insurtech Map for the year 2020 where 20 up-and-coming startups in the ecosystem are highlighted.

The following are the 20 insurtech startups in the Swiss ecosystem to watch out for:

ANIVO

Insurtech Anivo provides insurance companies, banks, telecommunications providers and ecosystems with a technology platform for rapid market introduction and highly efficient distribution of innovative insurance products.

Insurtech Anivo provides insurance companies, banks, telecommunications providers and ecosystems with a technology platform for rapid market introduction and highly efficient distribution of innovative insurance products.

B3i

B3i is creating a better insurance industry by developing standards, protocols and network infrastructure to remove friction in risk transfer. B3i’s shareholders and participants believe that new technologies can give end consumers of insurance better and faster access to insurance.

B3i is creating a better insurance industry by developing standards, protocols and network infrastructure to remove friction in risk transfer. B3i’s shareholders and participants believe that new technologies can give end consumers of insurance better and faster access to insurance.

CREADI

Creadi ist ein unabhängiges Start-up und hundert prozentige Tochter der Pax Holding AG.

Creadi ist ein unabhängiges Start-up und hundert prozentige Tochter der Pax Holding AG.

DEXTRA

Die Dextra ist ein reiner Online-Versicherer. Nach einem erfolgreichen Start der Dextra Rechtsschutzversicherung, wurde im 2017 die Dextra Versicherungen AG gegründet, welche aktuell die Autoversicherung vertreibt.

Die Dextra ist ein reiner Online-Versicherer. Nach einem erfolgreichen Start der Dextra Rechtsschutzversicherung, wurde im 2017 die Dextra Versicherungen AG gegründet, welche aktuell die Autoversicherung vertreibt.

EMMALIFE

EmmaLife ist eine Marke der Creadi AG. Als unabhängiges InsurTech-Start-up der Pax Holding in Basel und getreu unserem Motto «Rethink Insurance» sind wir Teil der digitalen Zukunft von Versicherungen. In einem kleinen Team arbeitet Emma life mit Hochdruck und viel Elan daran, das Thema Vorsorge für alle zugänglich und verständlich zu gestalten.

EmmaLife ist eine Marke der Creadi AG. Als unabhängiges InsurTech-Start-up der Pax Holding in Basel und getreu unserem Motto «Rethink Insurance» sind wir Teil der digitalen Zukunft von Versicherungen. In einem kleinen Team arbeitet Emma life mit Hochdruck und viel Elan daran, das Thema Vorsorge für alle zugänglich und verständlich zu gestalten.

ESURANCE

esurance betreibt eine digitale Versicherungsplattform mit spezifischen Branchenlösungen für KMU, Selbständige und Startups. Als Broker macht esurance Versicherungen einfach, transparent und digital.

esurance betreibt eine digitale Versicherungsplattform mit spezifischen Branchenlösungen für KMU, Selbständige und Startups. Als Broker macht esurance Versicherungen einfach, transparent und digital.

ISURANCE

i-surance ist eine white-labeling Plattform und bietet innovativen Versicherungsschutz, unabhängig davon, in welchem Segment. Ziel ist es, das Kerngeschäft und das Kundenerlebnis des Partners zu stärken und zu dessen stetig wachsenden Umsatz beizutragen.

i-surance ist eine white-labeling Plattform und bietet innovativen Versicherungsschutz, unabhängig davon, in welchem Segment. Ziel ist es, das Kerngeschäft und das Kundenerlebnis des Partners zu stärken und zu dessen stetig wachsenden Umsatz beizutragen.

IPTIQ

iptiQ is transforming the way consumers buy insurance with a unique digital insurance engine which incorporates the latest technology with world-class underwriting capabilities.

iptiQ is transforming the way consumers buy insurance with a unique digital insurance engine which incorporates the latest technology with world-class underwriting capabilities.

KASKO2GO

kasko2go AG is an innovative provider of insurance solutions that aims to promote a safe driving culture in society. Thanks to specially developed AI and telematic big data assessments with Pay-As-You-Drive and Pay- How-You-Drive models, kasko2go AG reduces insurance premiums by up to 50%.

kasko2go AG is an innovative provider of insurance solutions that aims to promote a safe driving culture in society. Thanks to specially developed AI and telematic big data assessments with Pay-As-You-Drive and Pay- How-You-Drive models, kasko2go AG reduces insurance premiums by up to 50%.

LINGS

Lings provides “on-demand” insurance policies. Items such as camera equipment, bicycles, laptops, smartphones, or drones. Items can be easily insured with a single click. If necessary, for just one day.

Lings provides “on-demand” insurance policies. Items such as camera equipment, bicycles, laptops, smartphones, or drones. Items can be easily insured with a single click. If necessary, for just one day.

KNIP

Die Knip App – Dein digitaler Versicherungsmakler wurde am 9. Juli 2020 eingestellt.

Die Knip App – Dein digitaler Versicherungsmakler wurde am 9. Juli 2020 eingestellt.

ONE

ONE is the most digital insurer outside China. It’s straight-through processing ratio is about 90%. Almost all processes are fully digital. ONE uses state-of-the art technologies like AI, OCR, picture recognition, NLP and others. 60% of all claims are settled in real-time.

ONE is the most digital insurer outside China. It’s straight-through processing ratio is about 90%. Almost all processes are fully digital. ONE uses state-of-the art technologies like AI, OCR, picture recognition, NLP and others. 60% of all claims are settled in real-time.

PALADINO

Paladino Insurtech is an end-to-end insurance service provider enabling insurers and new players to manage all insurance processes centrally, automatically and digitally.

Paladino Insurtech is an end-to-end insurance service provider enabling insurers and new players to manage all insurance processes centrally, automatically and digitally.

SAFESIDE

SafeSide Life AG, a Swiss-based digital life insurance platform provider, aims to simplify the process of purchasing life insurance without compromising user experience.

SafeSide Life AG, a Swiss-based digital life insurance platform provider, aims to simplify the process of purchasing life insurance without compromising user experience.

SPEARHEAD

Spearheads Telematics solutions allow Automotive Insurances as well as Fleet, Leasing and Car Rental Companies to leave behind the limitations of today’s analog and inefficient First Notification of Loss and claims handling processes, and enable them to progress to a digital, automated and smart Claims and Vehicle Life-Cycle Management 4.0.

Spearheads Telematics solutions allow Automotive Insurances as well as Fleet, Leasing and Car Rental Companies to leave behind the limitations of today’s analog and inefficient First Notification of Loss and claims handling processes, and enable them to progress to a digital, automated and smart Claims and Vehicle Life-Cycle Management 4.0.

STONESTEP

Steonetep is a Swiss-based insurtech that is changing how insurance is delivered in emerging markets.

Steonetep is a Swiss-based insurtech that is changing how insurance is delivered in emerging markets.

TONI DIGITAL

TONI Digital is breaking up the traditional insurance value chain and work together with proven partners in producing a value network. They focus on lean, simple and automated processes for everyone – end customer, partner and internal systems. Their dis-integrated value chain and automation efforts are resulting in scale effects and unpreceded cost advantages.

TONI Digital is breaking up the traditional insurance value chain and work together with proven partners in producing a value network. They focus on lean, simple and automated processes for everyone – end customer, partner and internal systems. Their dis-integrated value chain and automation efforts are resulting in scale effects and unpreceded cost advantages.

VEEZOO

Veezoo is a Spin-Off from ETH Zurich founded in 2016 with the mission to empower every employee with data-driven decisions Insurance + Artificial Intelligence = Veezoo

Veezoo is a Spin-Off from ETH Zurich founded in 2016 with the mission to empower every employee with data-driven decisions Insurance + Artificial Intelligence = Veezoo

VIAC

VIAC has the vision of a 3a solution that you can recommend to your best friends with a clear conscience. They are convinced that with this solution, which has been optimized down to the smallest detail, we are showing a way in which our generation can protect itself against the impending problems of old-age provision.

VIAC has the vision of a 3a solution that you can recommend to your best friends with a clear conscience. They are convinced that with this solution, which has been optimized down to the smallest detail, we are showing a way in which our generation can protect itself against the impending problems of old-age provision.

VLOT

vlot helps families and individuals rapidly and intuitively understand the financial impact of death, disability and the lack of adequate retirement funds.

vlot helps families and individuals rapidly and intuitively understand the financial impact of death, disability and the lack of adequate retirement funds.

WEFOX

The wefox platform connects insurance companies to brokers that manage and consult their customers completely digital. wefox currently features more than 300 insurance companies on the marketplace and serves more than 450.000 consumers (predominantly across German speaking countries).

The wefox platform connects insurance companies to brokers that manage and consult their customers completely digital. wefox currently features more than 300 insurance companies on the marketplace and serves more than 450.000 consumers (predominantly across German speaking countries).