Switzerland’s Insurtech Industry Ranks 4th Within Europe: IFZ Study

by Fintechnews Switzerland December 15, 2021With 50 insurtech companies, Switzerland is one of Europe’s largest hubs for insurance innovation. The figure puts the country at the fourth position amongst 31 European nations in absolute number, surpassing Spain, Italy, the Netherland and Sweden, a new industry report by the Institute of Financial Services Zug IFZ in cooperation with the House of Insurtech Switzerland (HITS) shows.

The inaugural IFZ Insurtech Report, released on December 03, 2021, draws on desk research and data compiled by the two organizations to provide a comprehensive overview and analysis of active insurtechs in Switzerland but also the broader European region.

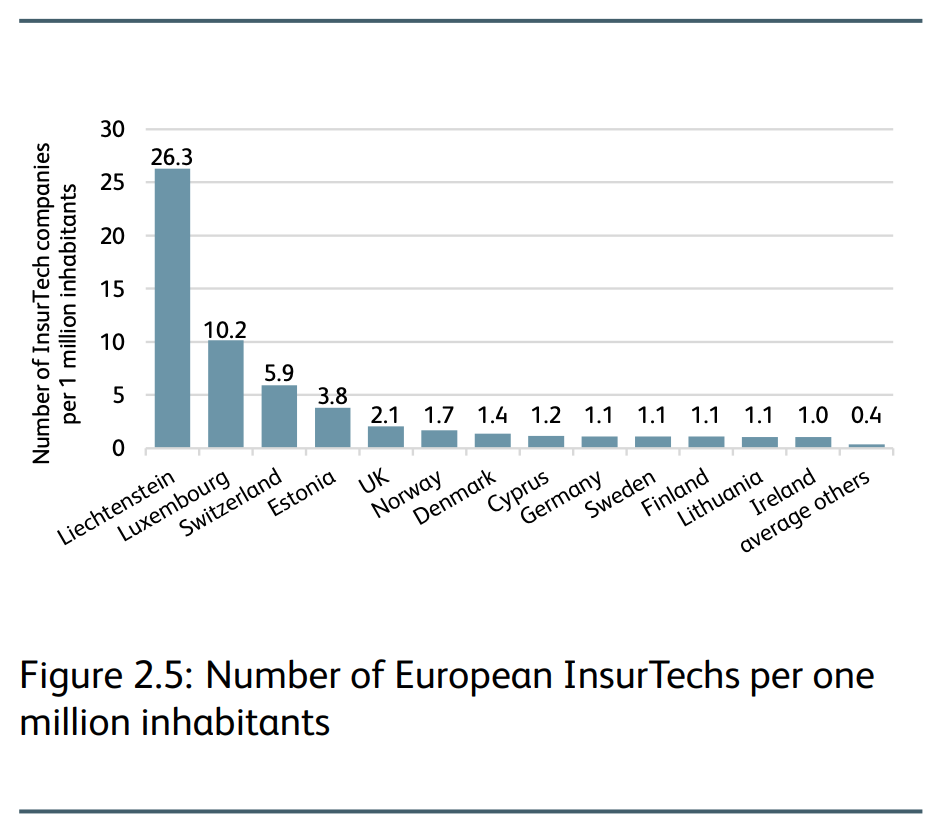

The organizations identified 50 insurtech companies in Switzerland, giving the country a 10% market share within the European continent. Looking at the number of companies in relation to the number of inhabitants, Switzerland ranks even higher, standing at the third position in terms of insurtechs per capita.

Number of European insurtechs per one million inhabitants, Source: IFZ Insurtech Report

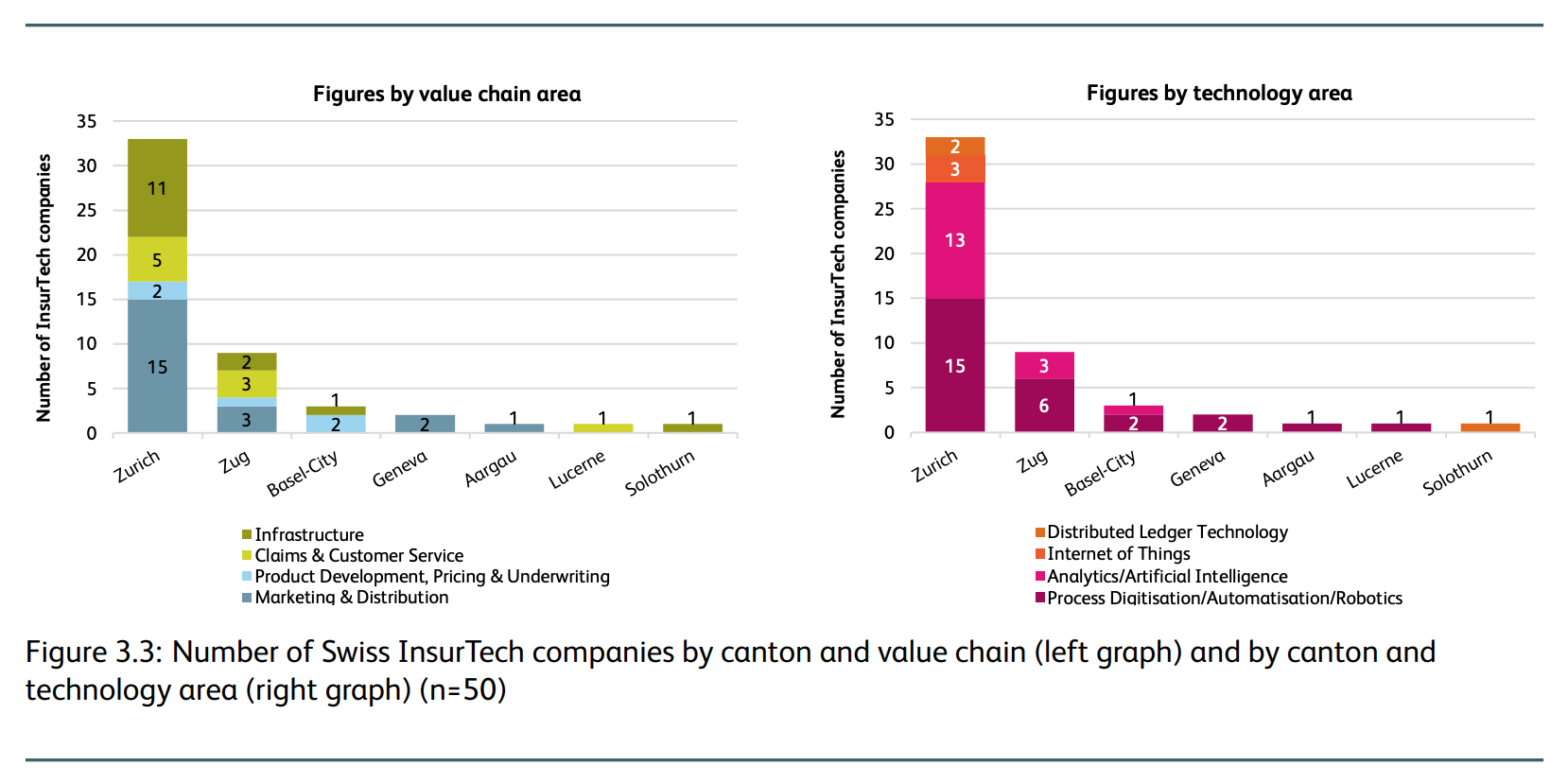

In Switzerland, Zurich is emerging as the largest insurtech hub, hosting 33 companies (66%), followed by Zug (18%) with nine companies. The rest of the Swiss insurtech companies are located in Basel-City (three companies), Geneva (two companies), Aargau, Lucerne, and Solothurn (one company each).

Zurich and Zug’s leadership in insurtech can be explained by the two cantons’ well developed financial ecosystem and fintech industry. This year’s IFZ Fintech Study ranks Zurich the largest fintech hubs in Switzerland with 149 fintech companies, followed by Zug with 117.

Number of Swiss insurtech companies by canton and value chain (left graph) and by canton and technology area (right graph) (n=50), Source: IFZ Insurtech Report

Delving more deeply into the Swiss insurtech industry, the research found some particularities in Switzerland compared to the broader European region.

For one, Swiss companies are more focused on international customers than the rest of European insurtech companies. Out of the 50 Swiss insurtechs, 62% address customers in a cross-border context. In comparison, 53% of European insurtechs distribute their products and services internationally.

Another particularity of the Swiss insurtech industry is its concentration around the Marketing and Distribution category, which comprises 42% of all Swiss insurtech companies, or 21 ventures. The second largest segment is Infrastructure (30%) with 15 companies. The remaining 14 companies are split between the categories Claims and Customer Service (nine companies) and Product Development, Pricing and Underwriting (five companies).

Comparing these metrics to the European insurtech landscape, companies in the Infrastructure category are underrepresented in Switzerland while those in the Marketing and Distribution category are overrepresented.

Swiss insurtech companies were also found to be using more cutting-edge technologies than the rest of Europe. 6% of Swiss insurtech companies indicated using Internet-of-Things (IoT). The same figure applies for Distributed Ledger Technology (DLT). In comparison, 4% of European insurtech companies specialize in the IoT and 3% in DLT.

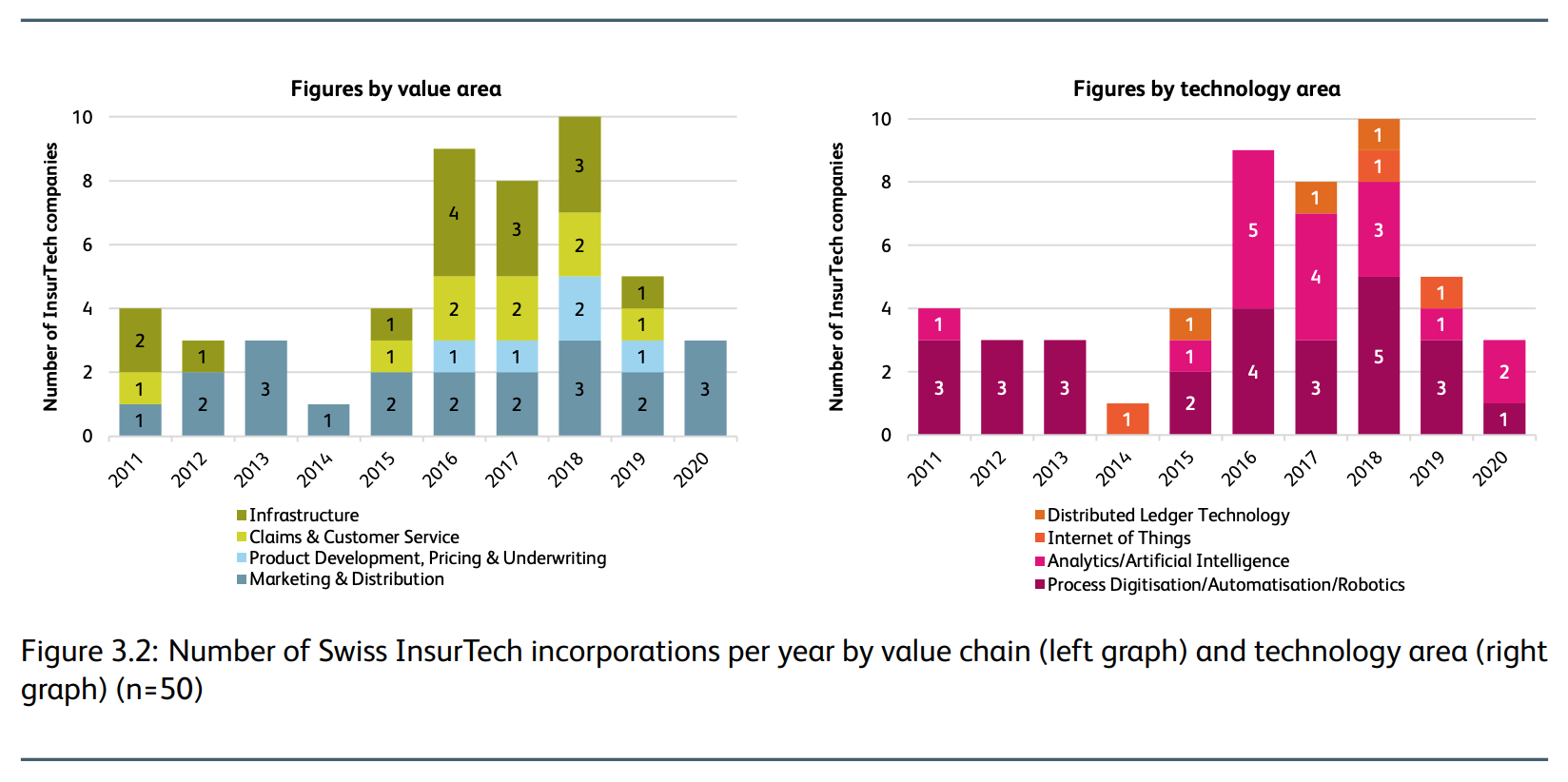

Number of Swiss insurtech incorporations per year by value chain (left graph) and technology area (right graph) (n=50), Source: IFZ Insurtech Report

The European insurtech landscape

The research identified a total of 497 insurtechs in Europe with the UK emerging as the largest insurtech hub with 136 companies. The UK is followed by Germany (91 companies) and France (61 companies).

Number of European insurtechs by country of headquarters and value chain (left graph) and by country of headquarters and technology area (right graph) (n=497), Source: IFZ Insurtech Report

An analysis of the value chain shows that 42% of the European insurtech companies operate in the Infrastructure category. Marketing and Distribution is the second most crowded segment with 30%, followed by Claims and Customer Service (15%) and Product Development, Pricing and Underwriting (13%). Within the Asset Management category, only one company in Europe was identified.

Most insurtech companies in the region use mature technologies including Process Digitization/Automatization/Robotics (63%) and Analytics/Artificial Intelligence (30%).