Zurich Financial Services Australia has announced the launch of a new Robo Advisor tool entitled the Wealth Index.

The Wealth Index allows advisors to create their own custom, client-facing surveys on a wide range of specialized areas including insurance, estate planning, superannuation and investments.

Inputs are used to calculate a score or “index,” which may identify an area of expertise a client needs an advice.

When using the Wealth Index tool, advisors have the ability to choose the design of the survey and how they want to share it with their clients.

The surveys can be completed on any mobile device within a few minutes and were especially designed to allow individuals “to ‘self-assess’ their preparedness and literacy across different aspects of their finances,” the company said.

According to Zurich’s Head of Sales Strategy and Research, Andy Marshall, the new tool is a way to enhance client engagement experience, notably for advisors who wish to reach out to new clients by utilizing automated technologies and new working styles.

“For advisers, having an automated or ‘robo’ tool like the Wealth Index to equip them with information such as the type of cover, level of debt, and knowledge – or lack thereof – of their clients’ sum insured prior to the first meeting could be a game-changer,” Marshall said.

He continued:

“The new tool not only increases client engagement from the very beginning of the advice journey, it also maximizes efficiency for both the adviser and client by setting the adviser up with a clear point of discussion and practical ways to work with the client and demonstrate value long before they’ve even walked in the door.”

Adopting new technologies is more important than ever in the digital era we live in, Marshall argued, notably for advisors.

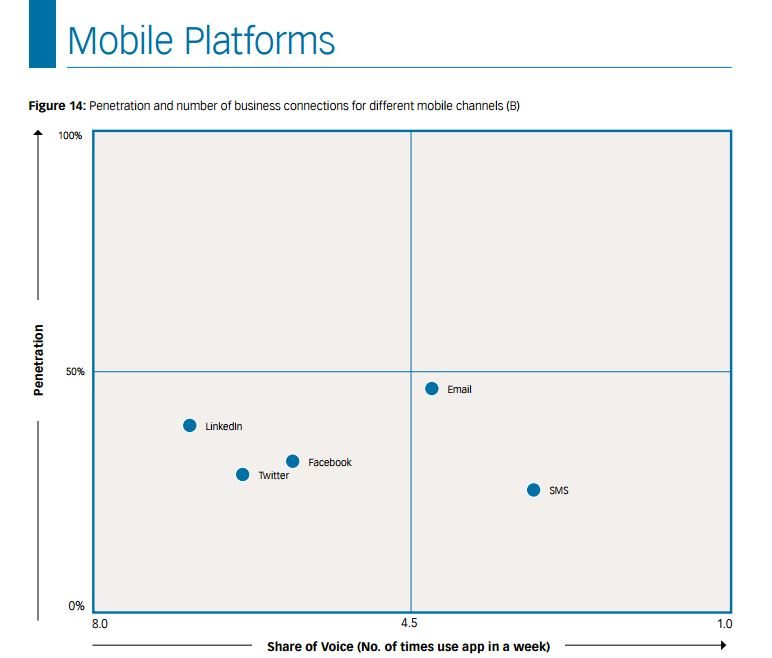

“The way clients are now consuming their information and interacting with businesses is definitely changing,” he said. “For advisers looking to maintain success into the future, they need to be re-thinking who their ‘typical’ client is, how they behave, and how best to communicate with them.”

The new robo-advice tool sits within Zurich’s Adviser Flipchart app, the firm’s tablet and mobile app released in late February that allows advisors’ clients to project insurance outcomes based on simple criteria.

The mobile app is available free of charge and can be customized to one’s own brand and colors. The firm hopes it will become a standardized tool across the advice space as it can be branded at the practice level.

To learn more about Zurich’s Wealth Index and Advisers Flipchart app Zurich advises to visit: adviserflipchart.com.

However, when visiting this Landingpage there are no information there. But when contacting them they provide a very useful presentation about the tool.

Of course this service is not ground-breaking, however independent “old school” insurance advisors might like this service as they can tailor made the page with own Logo, pictures etc,- So they don’t have to programm by themself.

Furthermore Zurich Insurance mentions in the press release also a very interesting White Paper. This shows that Zurich Insurance Australia fully understand the importance of mobile.

“Connected Convenience The new digital engagement paradigm for financial advice clients”