Mastercard Study: Share of Financially Excluded Consumers in LatAm Cut in Half Since COVID-19

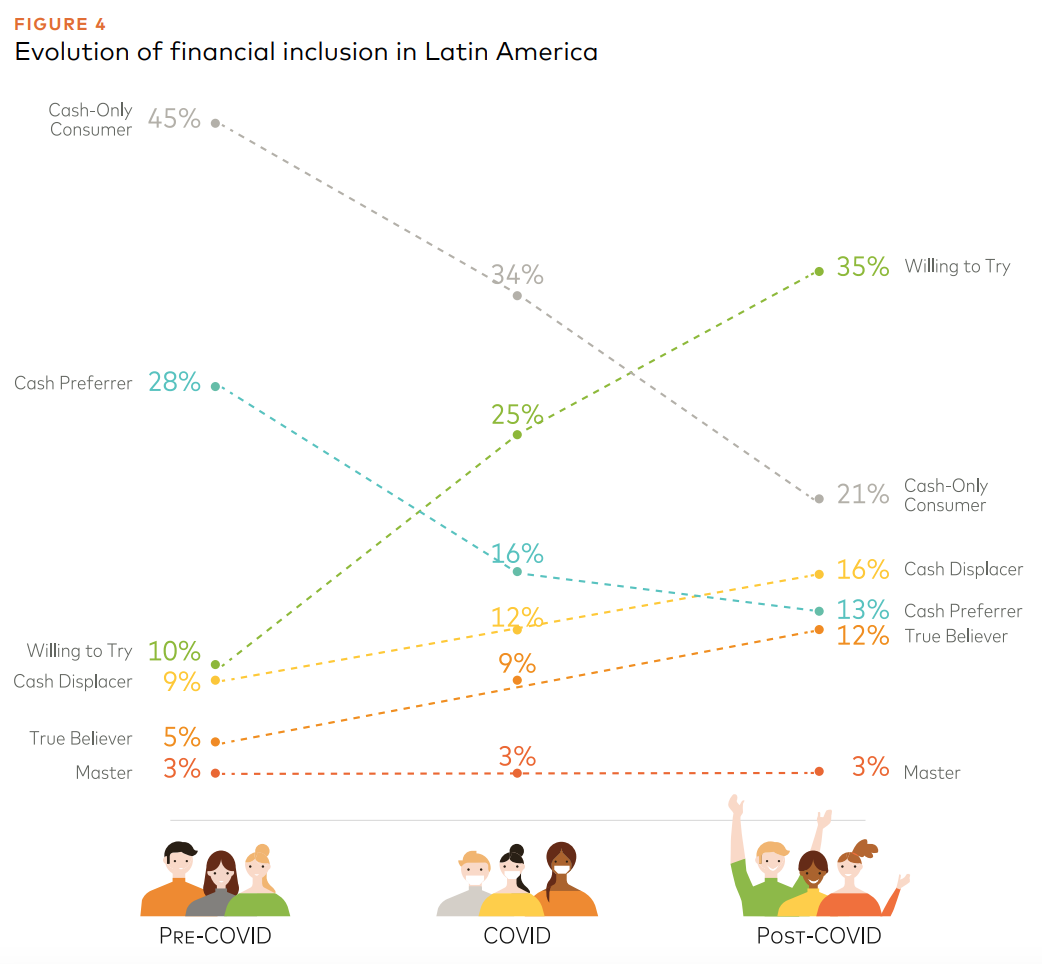

by Fintechnews Switzerland September 4, 2023The number of cash-only consumers, or those without a financial account, has decreased substantially in Latin America (LatAm) over the past couple of years, plummeting from 45% in 2020 to only 21% in 2023, a new study by Mastercard and research firm Americas Market Intelligence (AMI) found.

The research, which is based on in-depth interviews with 25 financial service providers operating in LatAm and online surveys of 2,815 individuals within seven major markets in the region, found that most LatAm consumers gained access to basic financial products between 2020 and 2023.

Evolution of financial inclusion in Latin America, Source: The state of financial inclusion post COVID-19 in Latin America and the Caribbean: New opportunities for the payments ecosystem, Mastercard and Americas Market Intelligence, May 2023

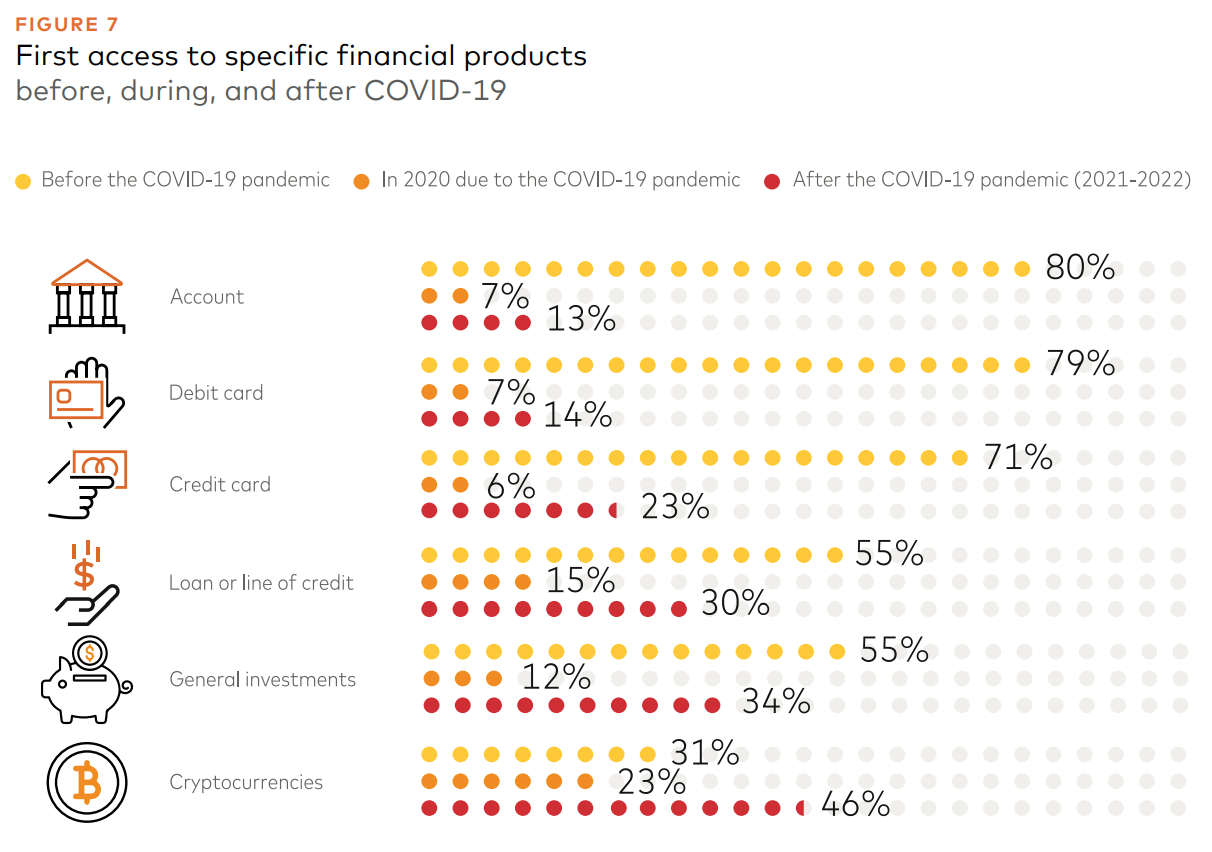

Delving deeper into the types of products used, results show that at least 20% of LatAm respondents opened their first savings product during the pandemic, while more than four out of ten accessed products such as credit (45%) and investments (46%) for the first time because of COVID-19, a share that soars to 69% for cryptocurrencies.

These findings suggest that the digitalization rush triggered by the COVID-19 pandemic has boosted the adoption of financial services and subsequently accelerated financial inclusion.

First access to specific financial products (before, during, and after COVID-19), Source: The state of financial inclusion post COVID-19 in Latin America and the Caribbean: New opportunities for the payments ecosystem, Mastercard and Americas Market Intelligence, May 2023

Results also show that COVID-19-related social benefits programs helped bank more than 40 million people in Brazil, Colombia, and Argentina alone.

In 2023, 15% of respondents accessed their first savings/deposit account product and 9% accessed their first digital wallet thanks to government assistance during COVID-19. Brazil and El Salvador are the leaders in this respect, with 15% and 22% of respondents in these respective countries stating that they accessed virtual wallets for the first time as a result of a government subsidy or financial assistance during the pandemic.

Government-provided first access to financial services, Source: The state of financial inclusion post COVID-19 in Latin America and the Caribbean: New opportunities for the payments ecosystem, Mastercard and Americas Market Intelligence, May 2023

Despite clear improvement in financial access, results show that there is still a gap among Latin American individuals to achieve more advanced forms of financial inclusion. Only three out of ten LatAm consumers have access to loans, insurance or investment products, and 21% still do not have access to a financial account.

Disparities between various segments of the population are also a reality with only 59% of low-income respondents in the sample studied and 40% of those living outside of major cities owning a financial account, compared to the regional average of 79%.

Usage of cash on the decline

The survey’s results also reveal that usage of cash across LatAm is declining at a steady pace in favor of digital payments methods. Before COVID-19, 56% of respondents reported using cash for half or more of their expenses, a proportion that now stands at 43%.

Argentina, Brazil and Mexico, specifically, reported the most significant reduction in cash usage, which declined by 20%, 17% and 17%, respectively.

Cash usage before and after COVID-19, Source: The state of financial inclusion post COVID-19 in Latin America and the Caribbean: New opportunities for the payments ecosystem, Mastercard and Americas Market Intelligence, May 2023

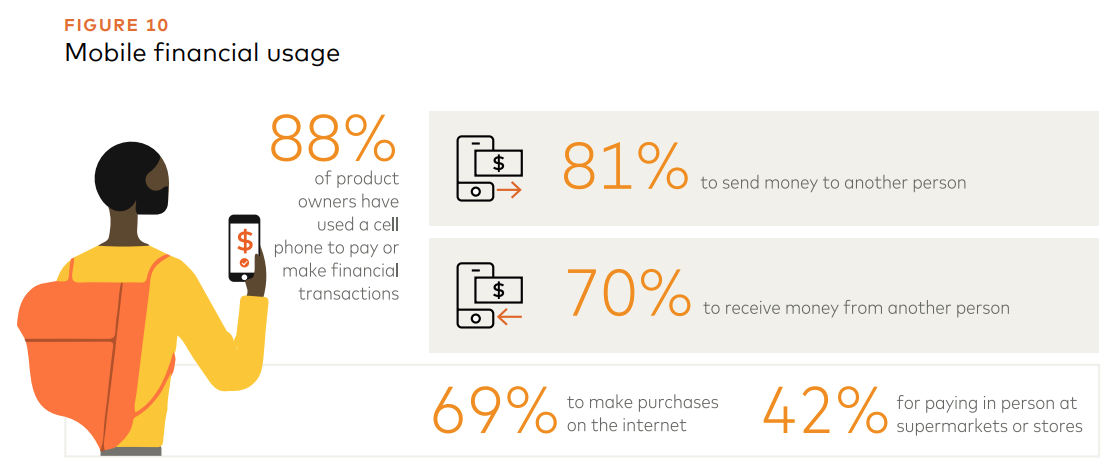

With smartphone penetration reaching 80% across the region, mobile phones have become the new standard for conducting financial transactions, with 88% of respondents indicating using a cellphone to pay or make transactions.

Results from the survey show that peer-to-peer (P2P) payments are the main use of mobile phones in financial terms (81% to send and 70% to receive), followed by online shopping (69%) and payment for services (68%).

Mobile financial usage

Despite an uptake in mobile P2P transfers, some payment modalities still have room for growth. QR code payments, in particular, were found to be the least-used payment method at a regional level, with half of the population stating that they do not use them. Markets including Argentina and Brazil recorded the highest penetration rates, at 71% and 65%, respectively, owing to these two countries having enabled QR code interoperability, the report notes.

Results from the Mastercard/AMI study are consistent with other research studies and reports which argue that the proliferation technology and new fintech companies in LatAm have helped improve financial inclusion.

A 2023 paper by the International Monetary Fund states that fintech innovation is revolutionizing the traditional financial sector by simplifying access to financial services, noting that about three-quarters of LatAm digital banks’ customers are unbanked and underbanked consumers and small and medium-sized enterprises (SMEs) and that two-thirds of neobanks’ loans go to these demographics.

Among the report’s highlights, it notes that LatAm’s fintech industry is currently led by digital payments providers and neobanks, which serve 300 million and 30 million users, respectively.

In 2021, a quarter of fintech startups in the region focused on digital payments and remittances, making it the largest fintech segment in the region. Digital banks, which made up for just 5% of all LatAm fintech startups in 2021, witnessed nevertheless the fastest growth among fintech startups between 2017 and 2021 at 57%.

About 1,000 fintech companies were active in LatAm in April 2023, with 65% of these being based in either Brazil or Mexico, according to Flagship Advisory Partners, a fintech and payments consultancy firm.

Fintech startups in Latin America, Source: The Rise and Impact of Fintech in Latin America, International Monetary Fund, March 2023

This article first appeared on fintechnews.am

Featured image credit: edited from Freepik