Latin America (LatAm), one of the fastest-growing e-commerce markets globally, has become a preferred destination for European companies looking to expand globally, an appeal that’s owed to the region’s booming smartphone penetration, rapidly digitizing population and improving payment infrastructure, a new report by Canadian payment processor Nuvei says.

The paper, titled Insights and Opportunities for Regional Expansion Success: Interconnecting Europe and Latin America, provides insights into the connections between European and LatAm markets and explores e-commerce payment trends, growth drivers and opportunities.

According to the paper, LatAm has emerged into a compelling market for European brands and is oftentimes the first overseas region European merchants contemplate expanding into. These brands are attracted to LatAm’s increasing Internet penetration, growing smartphone adoption and rapid e-commerce growth, and are seeking to tap into the two regions’ deeply rooted commercial relationships, cultural synergies, and the general affinity Latin Americans have for European brands.

Another reason European merchants are finding success in LatAm relates their experience in catering to local payment preferences, the report notes. Just like they adapt to the diverse payment landscape in Europe, European brands understand the need to enable multiple payment methods in LatAm.

This approach is required due to the heterogeneity of the region where customer preferences and banking penetration can vary greatly from one country to another. Digital account penetration, for example, is quite uneven across LatAm, ranging from 65% in Peru to 72% in Mexico, 75% in Colombia, 81% in Brazil, and 90% in Chile, the report notes.

This heterogeneity requires merchants to enable a wide range of alternative payment methods, it says, including local bank transfers, digital wallets, buy now, pay later (BNPL) arrangements, and local card schemes.

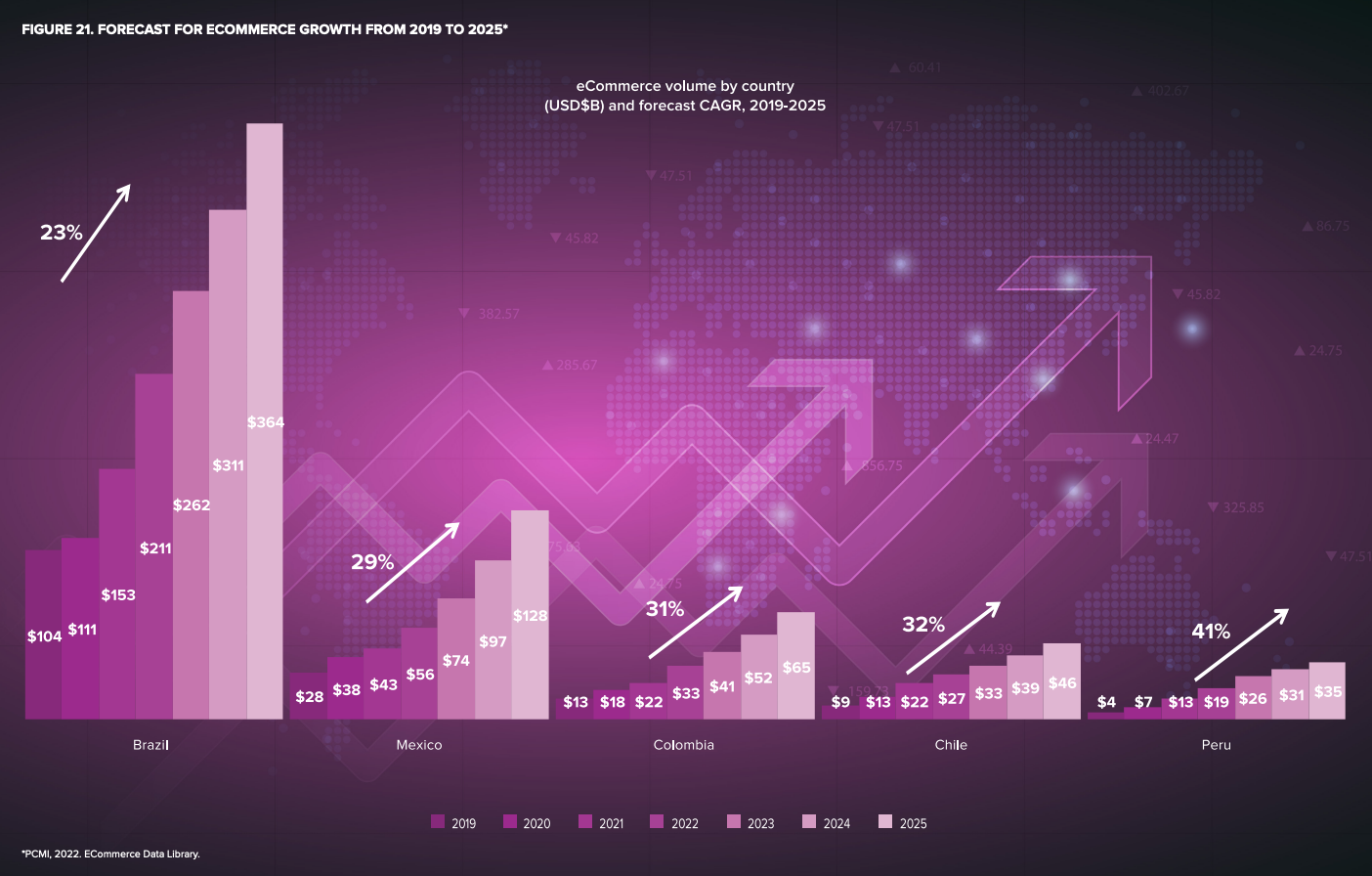

LatAm is one of the fastest-growing e-commerce markets in the world with Brazil and Mexico both growing more than 20% per year, and even faster moving opportunities in Colombia, Chile, and Peru, the report says.

Forecast for e-commerce growth from 2019 to 2025, Source: Insights and Opportunities for Regional Expansion Success: Interconnecting Europe and Latin America, Nuvei, 2023

With consumer e-commerce demand outpacing local supply, cross-border e-commerce is growing by 29% annually as Latin Americans eagerly look to international brands.

Payments and Commerce Market Intelligence (PCMI) estimates that the current cross-border share of European merchants stands at 2% of all of LatAm’s cross-border e-commerce in 2023, but this is currently growing more than 20% per year. Latin Americans are expected to spend US$1 billion at European e-commerce merchants this year. Of this amount, 72% will be Brazilian, and 20%, Mexican, cross-border spending with European merchants.

Across LatAm, the total cross-border e-commerce opportunity represents around US$53 billion, growing 42% in 2022, compared to 35% for the domestic market, PCMI says.

According to Nuvei, the rise of cross-border e-commerce in LatAm will accelerate in the medium term, driven by payment modernization efforts from governments across the region.

Recognizing the importance of efficient and secure payment systems for economic growth and financial inclusion, several countries in the region have implemented reforms and introduced innovative solutions to enhance their payment ecosystems.

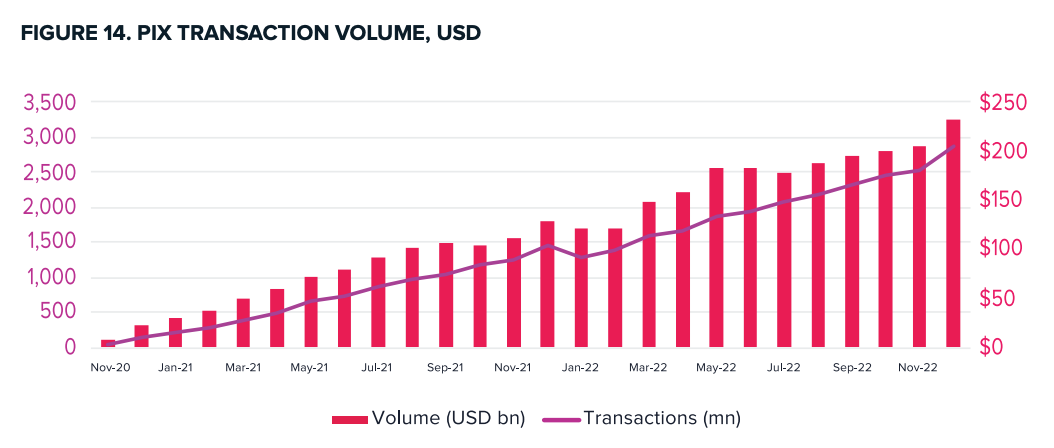

Brazil launched in 2020 an instant payment system called PIX. PIX allows individuals and businesses to make real-time payments and transfers, 24/7, including weekends and holidays. The system has gained immense popularity due to its convenience, speed, and low cost, reaching in March 2023 monthly transaction volume and value of three billion and US$250 billion, respectively.

PIX transaction volume, USD, Source- Insights and Opportunities for Regional Expansion Success- Interconnecting Europe and Latin America, Nuvei, 2023

Another notable example is Mexico where the government launched in 2019 CoDi, a real-time electronic payment method designed to reduce the use of cash, promote competition and improve financial inclusion.

These ongoing modernization efforts will make financial services even more accessible in LatAm and create new commerce opportunities for merchants locally and abroad, the report says.

This article first appeared on Fintech News America.

Featured image credit: Edited from freepik