Banking Clients Slow to Fully Interact with Their Feature-Rich Mobile Bank Apps. GamificatBanking Clients Slow to Fully Interact with Their Feature-Rich Mobile Bank Apps. Gamification might elpion might Help

by Company Announcement August 19, 2017Banking clients around the world have started to conduct many banking transactions over their mobile phones: to check balances, make payments or shop online. However, even if banks have been introducing their mobile apps, they are not being used to their full potential.

One of the main challenges for a banking app is in its mobile functions – usually, clients only do balance checks or quick payments, but ignore the rest of them. Additionally, the mobile app usage intensity could also be much higher if users were fully aware of the benefits. One mobile-enabled client uses their banking app only 4.8 times a month, while an average mobile app is launched 12.8 times per month.

So why are users hesitant to take full advantage of their bank’s mobile apps?

According to Ilja Polivanovas, CEO of Challenger platform by Enga Systems and an expert in gamification for banks, there are a few reasons.

“Most mobile app users don’t have the habit to open an app when they are looking for the closest ATM, nor do they usually consider an instant money transfer to a friend who picked up their lunch tab,” said Ilja Polivanovas. “Banking apps have their own special functionalities, but they often share one problem: people don’t know about them. For example, not many users know they can log into their banking app through quick authorization (such as PIN), so often they don’t even bother checking their bank balance, assuming it would be too difficult.”

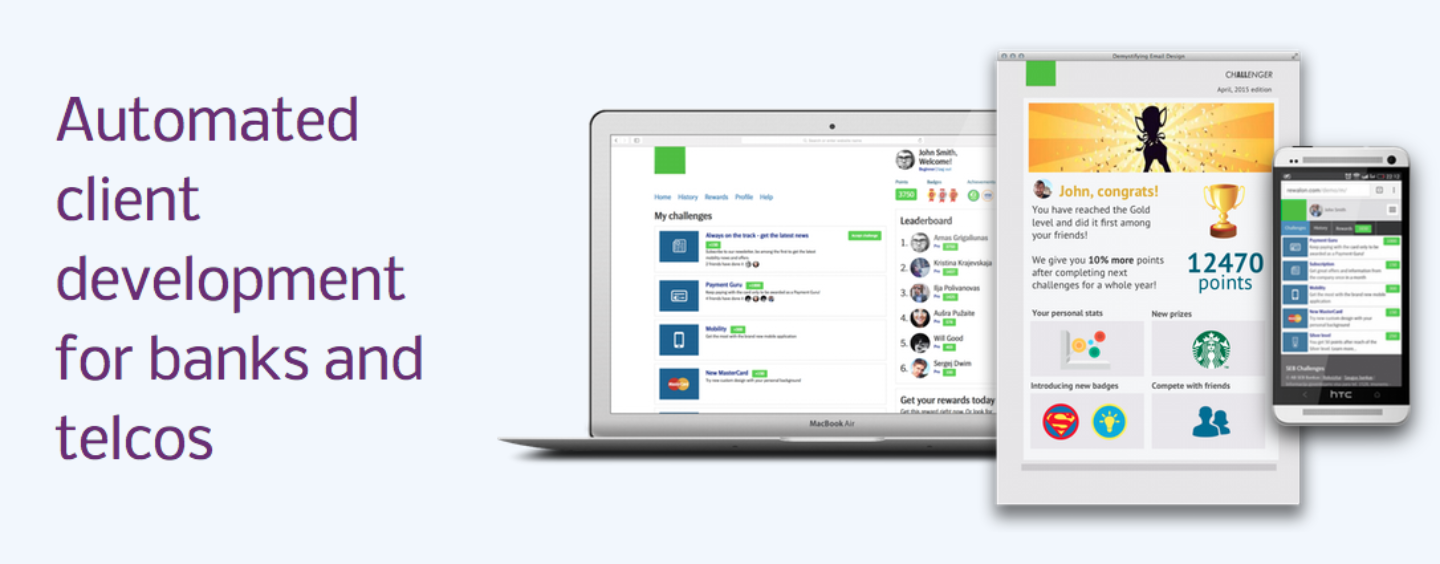

Challenger Platform has been created to motivate bank clients to take full advantage of their mobile apps, as well as other banking features, through learning process. The platform directly teaches the user about different functionalities of an app, and uses gamification to achieve results.

“Banks need to look at mobile banking from a different perspective,” said Ilja Polivanovas. “People do need a simple, but engaging motivation to understand and onboard with the features of a banking app. To engage clients, we use gamification, rewards and direct communication as one organic solution.”

Challenger Platform was recently able to bring 16% more mobile banking clients to OTP Banka Hrvatska in just five months, blowing all the records of mobile customer engagement.

“People are not motivated to try new banking products – research shows they’d rather go to a dentist,” said Mr. Polivanovas. “We have researched behavioral patterns and determined that people need fresh, simple, new ways to notice products that will actually be useful for them – and for their wallet.”

Challenger Platform also has dramatically affected other areas of its client’s (OTP Banka Hrvatska) performance: number of clients using prepaid Mastercard increased by 12.8%, while the number of Visa Web Prepaid cards increased by 9.5%.