Keen Innovation Launches Mortgage Calculator for English Speakers in Switzerland

by Fintechnews Switzerland July 1, 2020Homeownership and the housing market in Switzerland are complex fields to navigate on the best of days, but as an English-speaking foreigner, it becomes even trickier.

Keen Innovation AG, the external innovation lab of Basler Kantonalbank Bank (BKB) and Bank Cler, tuned into this particular challenge and set out to find an optimal solution. The result: Hyppo.ch, the country’s first and only personalized mortgage calculator for English speakers in Switzerland.

Available as a web app that works on every device, Hyppo.ch is free to use and intuitively walks the user through a mortgage calculation while explaining every detail of the cost breakdown.

Ilya Shumilin

“Hyppo answers the most important questions that people ask themselves when it comes to buying property – what can they actually afford, and does it make sense to buy. We’ve taken it one step further by tailoring this innovation to foreign nationals and expats who have to jump extra hurdles in the homeownership process in Switzerland. The fact that this solution meets the needs of this specific target audience makes it both extremely unique and wonderfully helpful,”

says Ilya Shumilin, Open Innovation Manager at Keen Innovation AG.

Unlocking the door to home ownership

To develop this one-of-a-kind mortgage calculator solution, the team at Keen Innovation started with user research which involved speaking to foreign nationals living and working in Switzerland. After assessing their needs, concerns and pain points, the team built a prototype that was tested by users from the target group and beyond. Doing this ensured that Hyppo.ch functions in a way that makes sense for the user and answers the most common questions that come up during the process – as well as questions users didn’t even know they should ask.

Developed over the course of only two months, Hyppo.ch is the ideal starting point for English speakers considering buying a property in Switzerland.

Mortgage calculations made easy

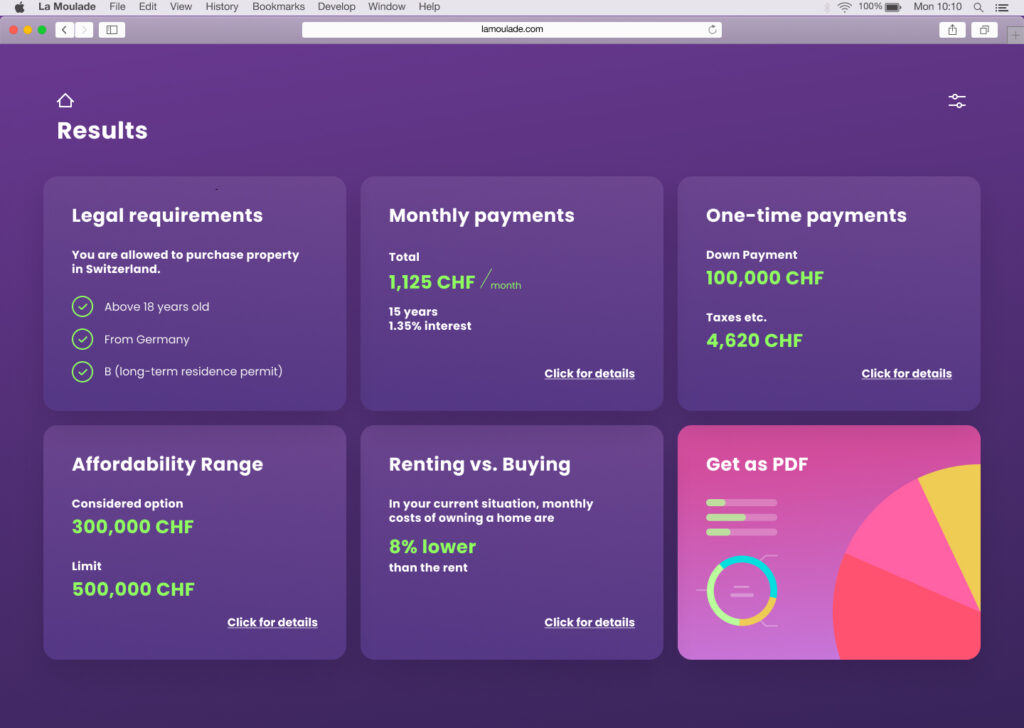

In a matter of minutes, the user can find out what they can actually afford and also uncover hidden costs. They will also find out if it is smarter to continue renting or to buy. With just a few taps and clicks, they boost their financial savvy and can feel confident in taking the next steps. The overview generated after the necessary information added is completely personalized.

No matter where they are, users can use Hyppo.ch to see if they meet the legal requirements for homeownership in Switzerland. Whether they have a particular property in mind or not, they can see what they can afford based on their current income. Alternatively, it can also be used by real estate agents or property owners who are guiding potential buyers or who want specific insight into the profile of their ideal buyer.