Tag "robo-advisory"

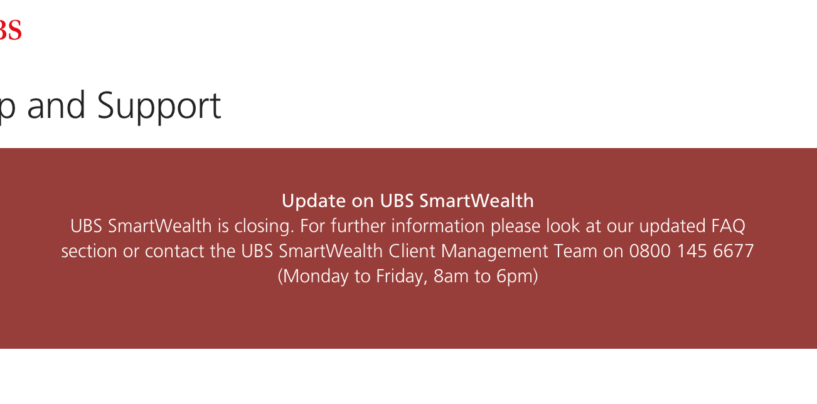

UBS Terminates UK Robo-Advisor Offering, Sells IP to Wealthtech Startup SigFig

UBS has decided to shut its robo-advisory offering in the UK, SmartWealth, and sell the intellectual property (IP) rights to San Francisco-based wealthtech company SigFig. As part of the transaction, a number of staff at SmartWealth will join SigFig. Behind

Read More3 Trends Driving Switzerland’s Wealthtech Industry

Fintech companies are penetrating nearly every financial services segment, driving both innovation and disruption. Subsegment focus areas of fintech include digital payments (paytech), fully-digital insurance (insurtech), banking (banktech), wealth management services (wealthtech), and the creation of marketplaces for selling financial

Read MoreWealthtech Flourishes in Switzerland

A new generation of fintech companies is building digital solutions to transform the investment and asset management industry. Often referred to as “wealthtech” companies, these use artificial intelligence (AI) and big data to offer advice, and provide low-cost alternatives with

Read MoreTop 9 Wealthtech Companies in Europe

Over the past ten years, numerous startups with digital business models have emerged within the wealth management industry. These businesses leverage digital platforms and technology to help investors connect with their peers and the right advisors, in addition to provide

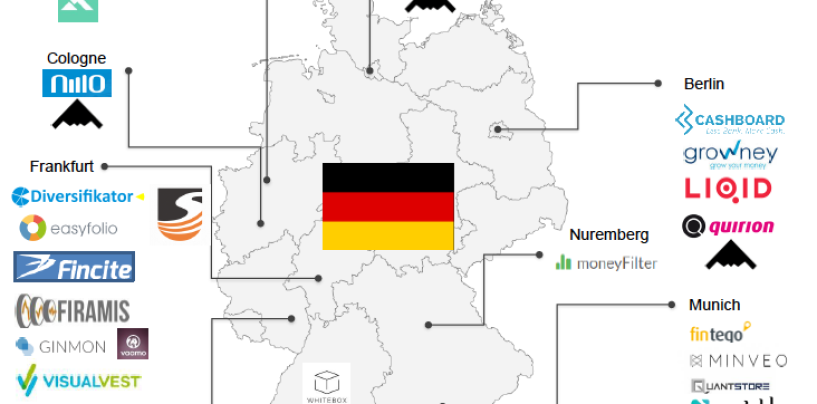

Read MoreGermany’s Robo-Advisory Sector Is Getting Crowded

With 23 robo-advisors, Germany is Europe’s most crowded market when it comes to automated, algorithm-based portfolio management advice services. According to reports from Techfluence, there are currently some 64 robo-advisors in Europe, with the two predominant markets being Germany and

Read MoreNew Report: Robo-Advisory Model At a Tipping Point

The robo-advisory model is at a tipping point with all current players needing further development if the robo concept is to prove long-lasting. Without further refinement on the part of the individual robo-advisors themselves, a substantial portion of current providers

Read MoreWealth Managers ‘Dangerously Behind’ in Digital Tech Adoption

The rise of technology has altered how we live and do business, impacting all parts of the economy, including finance and wealth management. But as digital disruption advances, wealth managers are found to be “dangerously behind” the curve in adoption,

Read More