Startupticker has released the second edition of its Swiss Startup Radar report which examines Swiss startup exits.

The research, conducted in collaboration with HEC Lausanne, University of Lausanne, found that in terms of exits, the trend in Switzerland is positive with the total number of exits continuing to increase over the years.

Positive long-term trend, Swiss Startup Radar 2019:2020- Focus on Exits, Startupticker

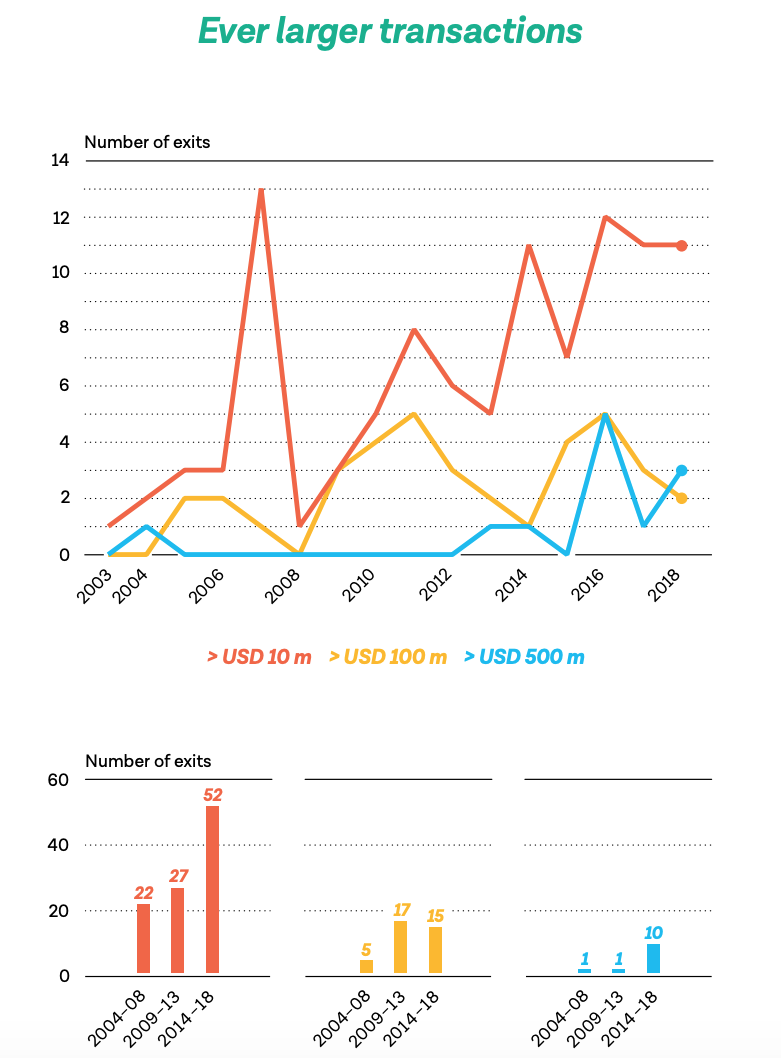

Along with the quantity, the quality has also improved with exits of more than CHF 500 million appearing five years ago and continuing to increase in number over the years. According to the research, the increasing number of exits and financing rounds indicate the emergence of a startup culture in Switzerland.

Even larger transactions, Swiss Startup Radar 2019:2020- Focus on Exits, Startupticker

The study also found that it takes about 10 years for a startup to achieve an exit, and that most CEOs (50%) who have sold a startup remain on the startup scene. 30% are working in another startup, 14% are active as investors and 9% are startup advisors or mentors.

Interestingly, a good third of startup CEOs remain with the acquiring company after the sale, implying that oftentimes these firms remain relatively independent and continue to build in the spirit of the team, the report says.

The career afterward, Swiss Startup Radar 2019:2020- Focus on Exits, Startupticker

Biotech stands out

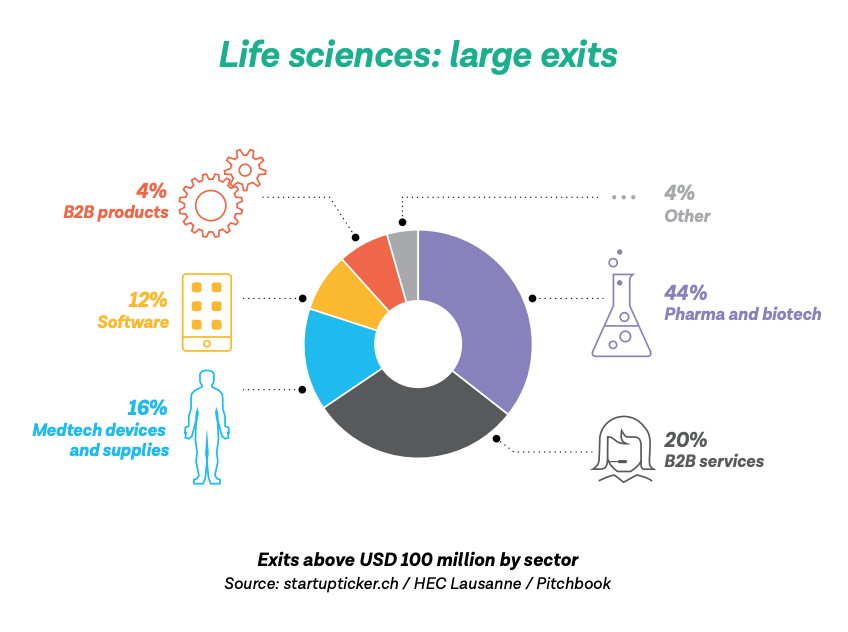

When taking a deeper look into the Swiss startup ecosystem, the biotech industry stands out, accounting for almost half (44%) of exits in which companies were valued at more than CHF 100 million, while medtech companies account for 16%. The figures showcase that the life science sector is clearly ahead in the major transactions, the report says.

Life sciences: large exits, Swiss Startup Radar 2019:2020- Focus on Exits, Startupticker

The Swiss Startup Radar 2019/2020 report echoes the 2020 Swiss Venture Capital Report, released by Startupticker earlier this year, which looks at the state of venture capital investment in Switzerland.

According to the research, biotech companies in Switzerland raised CHF 624.7 million in funding in 2019, or 27.2% of total money raised by Swiss startups last year. Biotech ranked second after information and communications technology (ICT), which raised the most funding last year at CHF 840.2 million.

Meanwhile, fintechs raised CHF 360.3 million in 2019, a 91.8% increase in investment amount compared with the previous year.

Fintech exits

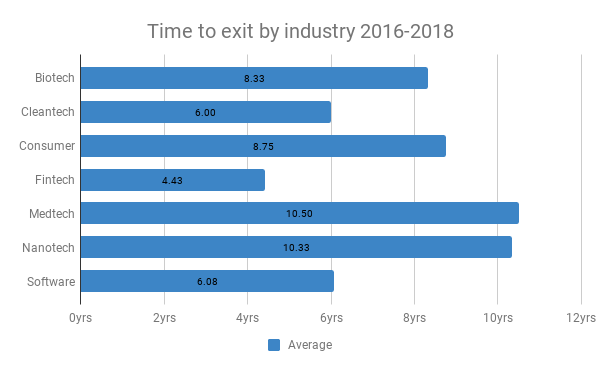

A separate research by early-stage venture investor Tatjana de Kerros released last year claims that Swiss fintech startups have an average exit age of 4.4 years, a short lifecycle compared with over industries.

Time to exit by industry 2016-2018, Boudkov.com

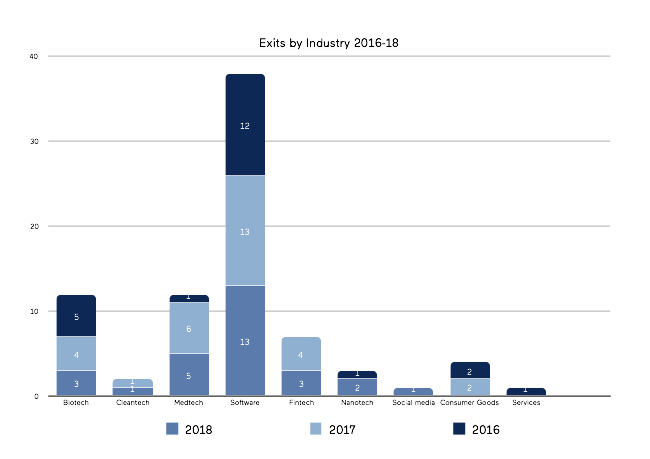

Strongly linked to the short exit lifecycle, Swiss fintech startups each raised on average CHF 13.85 million, with a total disclosed funding of CHF 27.7 million. In 2017, there were four fintech exits, and three exits in 2018, the study says.

Exits by industry, Boudkov.com

Notable fintech exits include regtech startup Qumram, which was acquired in 2017 by US company Dynatrace, and Orbium, a Swiss management consultancy and technology services provider to the financial services industry which was acquired in January 2019 by Accenture.

In December 2019, Swiss regtech startup id4 was acquired by Apeiron Holdings, Thalassa Holdings’ wholly owned Swiss subsidiary, for about CHF 7 million. Id4 specializes in the provision of software in client lifecycle management supporting financial institutions compliance.

And just last month, Zurich-based fintech company AAAccell announced the exit to the LPA Group, an European market leader in capital market technologies. AAAccell was founded in 2014 as a spin-off of the University of Zurich. The company develops risk and asset management solutions that leverage artificial intelligence (AI) and machine learning (ML).

Featured image credit: Unsplash