Technology-enabled innovation is reshaping financial products, market players, market structure and even money itself, removing key frictions in the provision of financial services, enabling new business models and allowing market participants to reach previously underserved segments at lower costs.

But while the ongoing digitalization of the financial system is creating unprecedented opportunities for the industry to offer more inclusive and efficient services, it also calls for new approaches to regulation and supervision, and requires heightened collaboration between public authorities across data protection, privacy, and competition.

These are the recommendations formulated in a new report by the World Bank Group. The paper, titled Fintech and Future of Finance paper, explores the rise of fintech and the digital transformation of financial services, delving into the various policy implications of these emerging trends.

According to the report, to harness the full potential of fintech, regulators should implement policies that enable and encourage safe financial innovation and adoption. Given the rapid spread of innovation, they should adopt an approach that’s proactive, pragmatic, clear, and collaborative with public and private stakeholders. This is particularly critical considering that new fintech innovations are emerging at an accelerated pace and because fintech issues oftentimes cut across financial prudential supervisors, market conduct and competition authorities, and consumer protection agencies.

But while, fintech innovation creates promising opportunities, including improved financial inclusion and efficiency gains, it also introduces an array of risks which must be mitigated.

This calls for proper safeguards to, among others, maintain fair competition, financial stability, ensure data and consumer protection, and prevent the abuse of market power, the report says.

Data collection principles and proactive monitoring of market conduct, frameworks for open banking and data ownership, initiatives to foster development of financial infrastructure and fair and transparent access to them, and revisiting any restriction on product tying and linkages between banking and commerce, are among the critical issues regulators should consider.

A well-balanced fintech regulatory landscape is ever so important today as trends like open finance and embedded finance are rapidly gaining ground and blurring the boundaries of the financial sector.

These trends are leading to a more complex constellation of traditional regulated institutions, technology and product providers, forcing regulators to broaden the monitoring horizons and re-assess regulatory perimeters.

Booming fintech industry

These past few years have seen fintech and digital transformation increase in importance, a trend that accelerated with COVID-19.

As part of the research, the World Bank Group conducted a global survey, polling 330 market participants from 109 countries to capture market perceptions of the impact of fintech and digital technology.

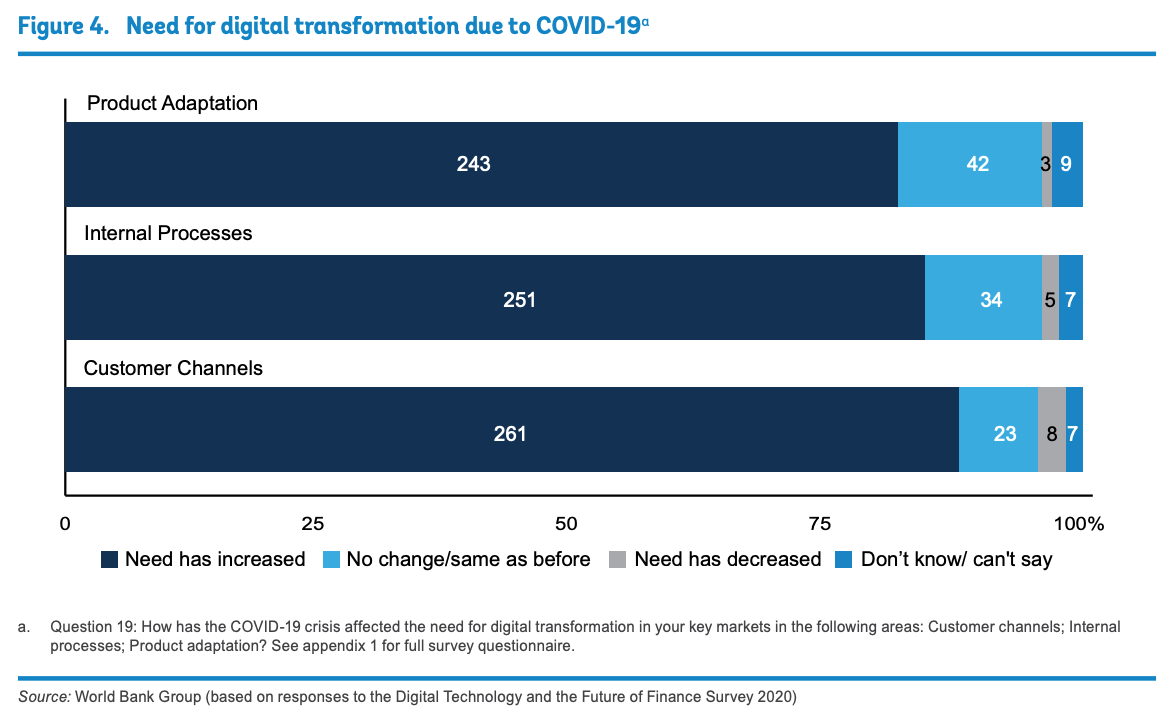

The study found that, of the 330 respondents surveyed, more than 80% felt that the COVID-19 pandemic increased the need for fintech and digital transformation and made digitization in customer channels, product adaptation, and internal processes a strategic priority.

Need for digital transformation due to COVID-19, Source: World Bank Group (based on responses to the Digital Technology and the Future of Finance Survey 2020)

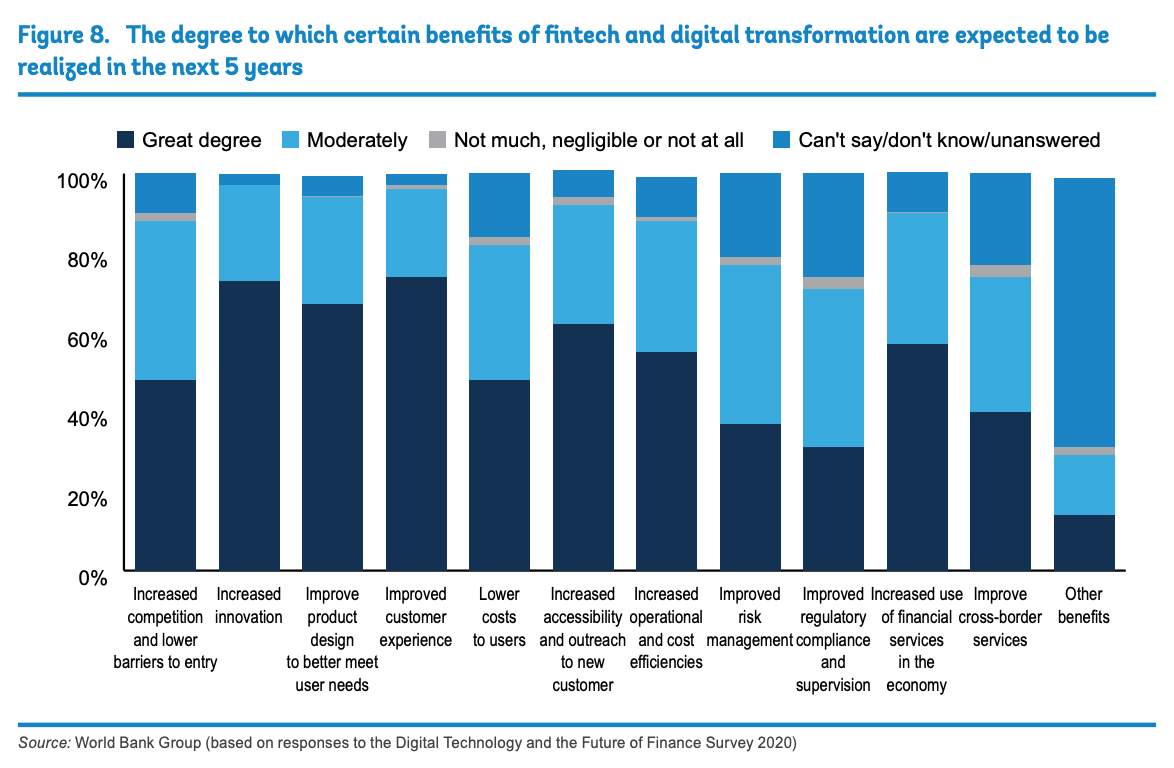

Industry participants indicated expecting fintech and digital transformation to result in a range of benefits to customers, providers and the economy. Over the next five years, key benefits that respondents believed will be realized to a “great degree” include improved customer experience (74%), increased innovation (73%), improved product design to meet user needs (67%) and increased accessibility and outreach to new customers (62%).

The degree to which certain benefits of fintech and digital transformation are expected to be realized in the next 5 years, Source: World Bank Group (based on responses to the Digital Technology and the Future of Finance Survey 2020)

The survey also sought to understand market participants’ predictions for the years to come. While products, processes and channels will undeniably continue digitizing, respondents were in agreement that a combination of physical and digital will prevail.

Half of banks and remittance operators, and 60% of microfinance institutions, non-bank financial institutions (NBFIs), and payments operators, expect business to be conducted largely through physical locations. Banks, meanwhile, expect to continue serving customers through branches and proprietary digital channels.

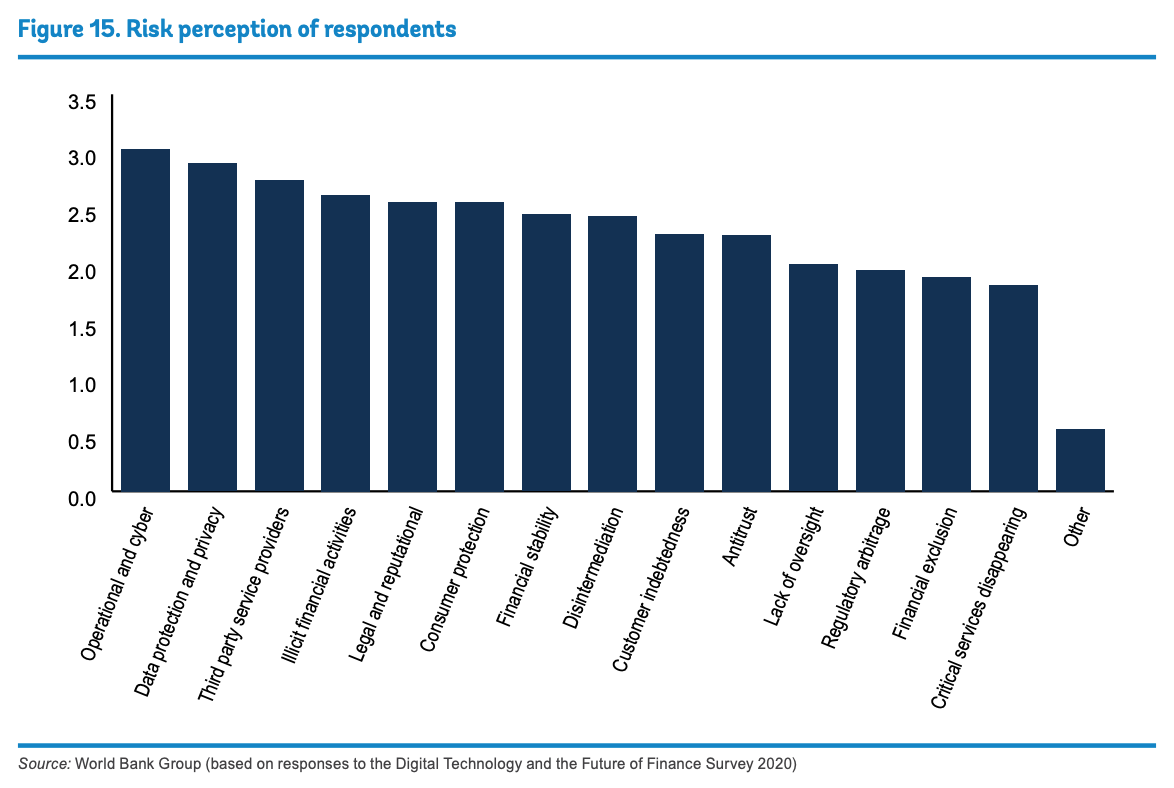

Respondents were also asked about their biggest concerns relating to the rapid adoption of technology and digital tools. Unsurprisingly, respondents ranked operational and cybersecurity risk at the top of the list, followed by data protection and privacy, and third-party service providers.

Risk perception of respondents, Source: World Bank Group (based on responses to the Digital Technology and the Future of Finance Survey 2020)

Featured image credit: Edited from Unsplash