Data Preparation: Wealthport Seeks to Solve Wealth Managers’ Core Problems

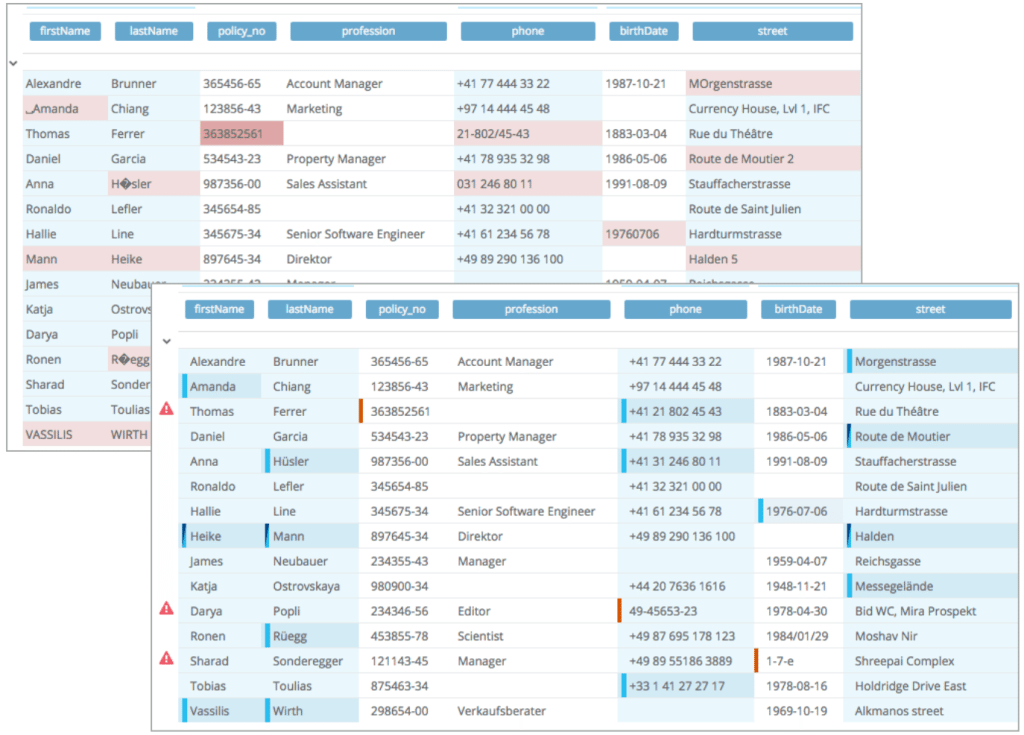

by Fintechnews Switzerland October 19, 2015Aiming at helping organizations generate value from their data, Wealthport is a data preparation as a service company that uses advanced machine learning algorithms and Big Data technologies to accelerate the preparation of data, improve their quality and enrich them with resources that are publicly available.

Based in Schlieren/Switzerland, the startup uses state-of-the-art algorithm that clean, normalize and unify data sources the way a human expert would do. The startup has been experiencing growth in Europe and Asia, founders Tobias Wildmer and Bernhard Bicher said in an interview.

“We basically save asset managers from drowning in information by turning tedious manner researches into continuously delivered insights,” Widmer, co-founder and CTO of Wealthport told the audience during a presentation at Capital On Stage London.

Wealthport’s technology turns collected Web data into high-quality information, cleans them and enriches them with third-party data sources. The platform can identity correlations and patterns. Its machine deep learning tech, models human behavior and can learn from feedbacks to become stronger and more accurate.

Essentially, Wealthport seeks to solve core problems in wealth management, Widmer and co-founder and CEO Bernhard Bicher said.

“Wealth managers are under heavy cost pressure and need to increase the internal process efficiency,” the two founders said.

And unlike banks, startups such as Wealthport are agile and can respond more quickly and accurately to the needs of wealth managers and their end customers.

They continued:

“New generations, [digital natives], want [new forms of] communication that are more digital, and [these generations] are more informed than ever. […] Our platform increases efficiency and […] we are the first software company to offer an integrated mobile solution for the front processes in wealth management.”

By leveraging technology, Wealthport wants to deliver reliable and accurate information so professionals and organizations can get the right insights and make smart decisions “within seconds, not months.”

Ultimately, Wealthport has a use for anyone that has to deal with a large amount of information on a daily basis and isn’t restricted to wealth managers.

In fact, the startup offers three different packages that suit any size and type of users. The Standard one, typically for individuals, supports 1 GB of monthly data. The Professional package can support up to five team members with unlimited data and REST API integrations. And finally, the Enterprise package includes all the Professional plan, plus custom system integrations.

Machine learning is a hot technology in analytics applications and underpins new data preparation tools that let users integrate data for analysis.

Interest in machine learning technology often relies on its capacity to automate and improve analytical predictions. Startups such as Alation, Alterux and Paxata all provide with self-service data preparation services. These startup have so far received great traction and have raised significant amount of funding.

But interest in the field isn’t restricted to a dynamic startup scene as big tech firms including IBM, Informatica and Saleforce are also starting to tap into the space.

Image credit: Cloud, Wealthport Linkedin.

No Comments so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.