Investors should keep an eye on Artificial Intelligence and Machine Learning Made in Switzerland

by Fintechnews Switzerland October 20, 2017Artificial intelligence (AI) is set to substantially disrupt the financial services industry, transforming how we bank, invest, and get insured.

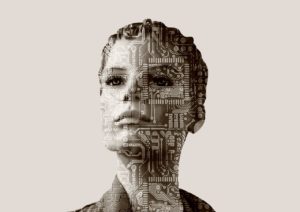

AI refers to machines that are capable of performing specific tasks that normally require human intelligence such as visual perception, speech recognition, decision-making, and language translation. AI and related technologies are made possible by the colossal volumes of data we are able to collect and process.

AI has been all the buzz these past few years, and according to CB Insights, AI startups raised over US$2 billion in 2016 alone.

In the area of financial services, AI is expected to bring major shifts in financial institutions’ workforces. The World Economic Forum highlighted in a report released in August this year three particular changes and their effects:

- Front-end AI: The public face through which customers interact with financial organizations will be AI, similar to the AI now dominating interactions between customers and tech firms.

- Coworking with AI: Humans and computers working together will have a “force multiplying effect” compared to humans or AI alone.

- Suite of capabilities: Ultimately, leadership will shift its focus from managing teams of people to managing suites of capabilities.

Image credit: Artificial intelligence, via Pixabay

In a magazine interview, Swiss bank UBS said it could shed almost 30,000 workers in the years ahead due to technological advances in the banking industry.

“If you look at UBS, we employ a meaningful amount of people— almost 95,000, including contractors,” UBS’s chief executive Sergio Ermotti told Bloomberg Markets. “You can have 30% less, but the jobs are going to be much more interesting jobs, where the human content is crucial to the delivery of the service.”

Despite the likely job losses, AI has a lot to offer, notably when it comes to enhanced consumer experience as well as modern and personalized access to services.

“It’s not the Big Bang; it’s going to be very gradual,” Ermotti said. “But you’re going to be faster — much more efficient, proficient. Instead of serving 50 clients, you’ll be able to serve 100 and in a more sophisticated way.”

One location in particular that could likely become the epicenter of AI is Zurich.

Zurich is often on the short list of places that companies consider when planning a new research facility in fields such as computer science, material science, biotechnology and pharmaceuticals. Google, Disney, IBM, Hoffmann La Roche and Biogen have all invested in research centers there.

Switzerland could be an AI Country

According to Felix Moesner, CEO of Swissnex, a tech consulate located in the US, the choice of Zurich was purely strategic.

“Zurich, widely recognized as a world banking center, is also a powerhouse for university and industrial research,” Moesner told NetworkWorld. “Google is pursuing a global pool of specialized talent in Zurich to enlarge its research center. AI and machine learning are very academic pursuits, with most research still taking place in university labs.”

“The academic bias of AI and machine learning research makes locating near a leading technical university essential for recruiting the best talent and to foster ongoing research with university labs.”

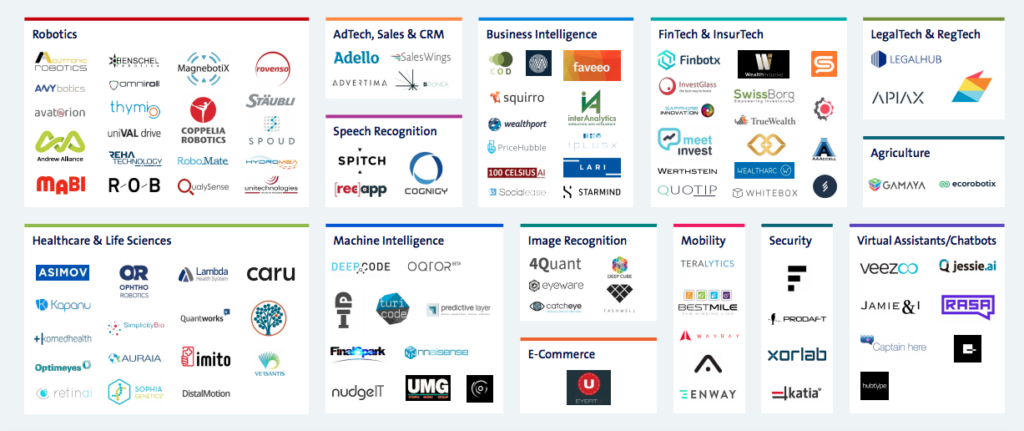

In addition to the international corporations, local startups too have been leveraging Switzerland’s large pool of talent to develop homemade AI solutions.

According to Swisscom, there are over 20 startups that use AI for fintech and insurtech solutions.

A Swiss Robo-Accounting Startup for SME

One of these new players is Accounto Technology, a startup that has developed an innovative online accounting platform. Accounto’s technology uses machine learning, self-recognition and advanced accounting processes to enable a high level automation. The platform processes paper-based and PDF documents which are then handled by the Machine Learning application.

According to Alain Veuve, CEO and founder of Accounto, Swiss small and medium-sized enterprises (SMEs) spend twelve billion CHF annually on bookkeeping. Veuve believes that these costs can be reduced by at least 80%.

Accounto’s long term mission is to bring machine learning technology into the business software sector. We chose accounting and administration for small companies as the first field because it seems to us that many parameters are just right to implement at the time,” Veuve wrote in a blog post. In 2018, Accounto will be looking to build API products to enable individual integrations for enterprise customers and ERP manufacturers.

The global business accounting software market is projected to grow to US$4.1 billion by 2021 at a CAGR of more than 6% between 2017 and 2021.

An interesting Swiss Regtech AI startup is Apiax, which just secured 1.5Mio USD funding from Swiss investors.

Other interesting Swiss Fintech AI Startups includes Finbotx, which provides portfolio management solutions, InvestGlass, a robo-advisor for bankers and advisors, Tilbago, a Robo-Bill-collection platfom or Quotip, a management tool for structured investments.

Featured image: Artificial intelligence, via Pixabay.