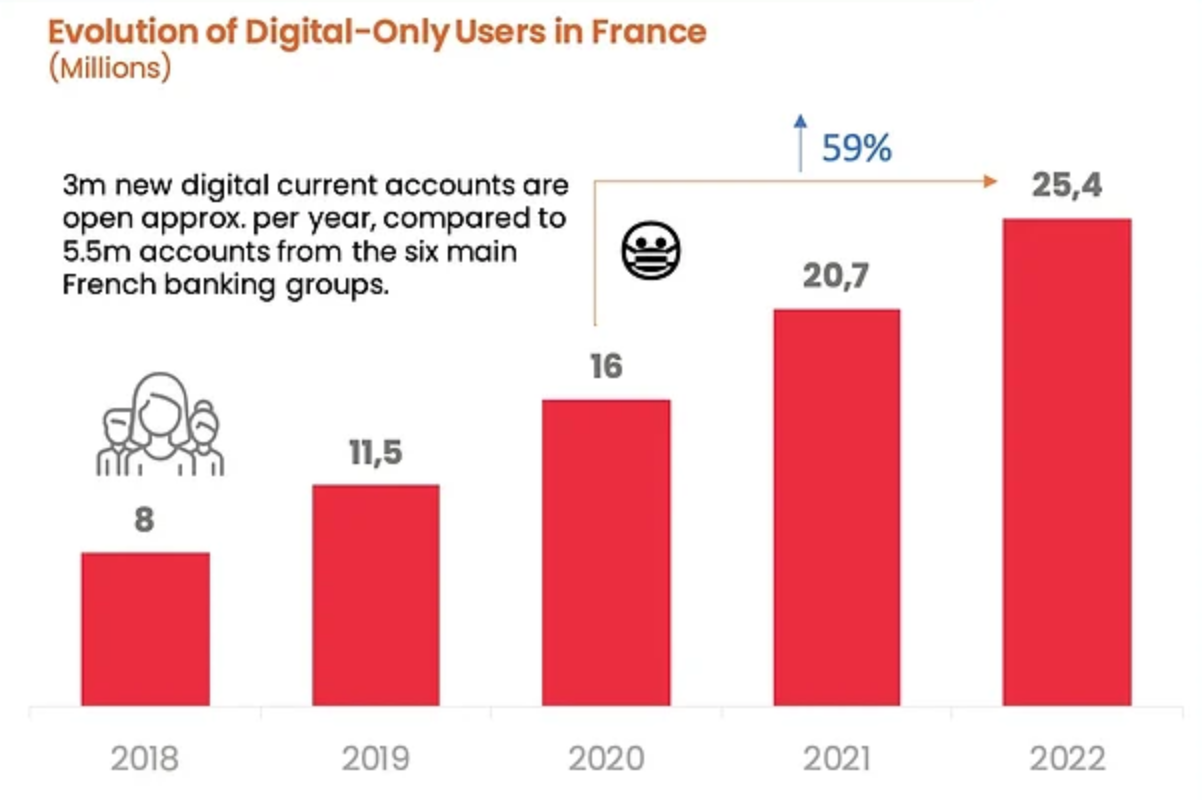

Digital banking is booming in France, reaching a total of 25 million users in 2022, data from C-Innovation show. The figure represents an increase of more than threefold over a four year period and marks an impressive rise from the eight million customers the digital banking sector reported in 2018.

In a new report released on September 29, the French fintech-focused research firm looks at the state of digital banking in France, delving into the profound shift the banking industry is witnessing and the brands leading the market.

According to the report, France is undergoing a remarkable transformation in its financial landscape, marked by the blending of traditional banking and fintech innovation. This shift is being driven by changing consumer preferences, demand for convenient digital experiences and a move away from traditional brick-and-mortar banking experience.

The transformation is evidenced by the traction digital banking has seen over the past years, the report shows. Between 2018 and 2022, France added more than 3 million new digital current accounts each year. The rise started accelerating in 2019, adding 5 million new customers annually.

Evolution of digital-only users in France (millions), Source: Digital Drives the Evolution and Expansion of France’s Banking Industry, C-Innovation, Sep 2023

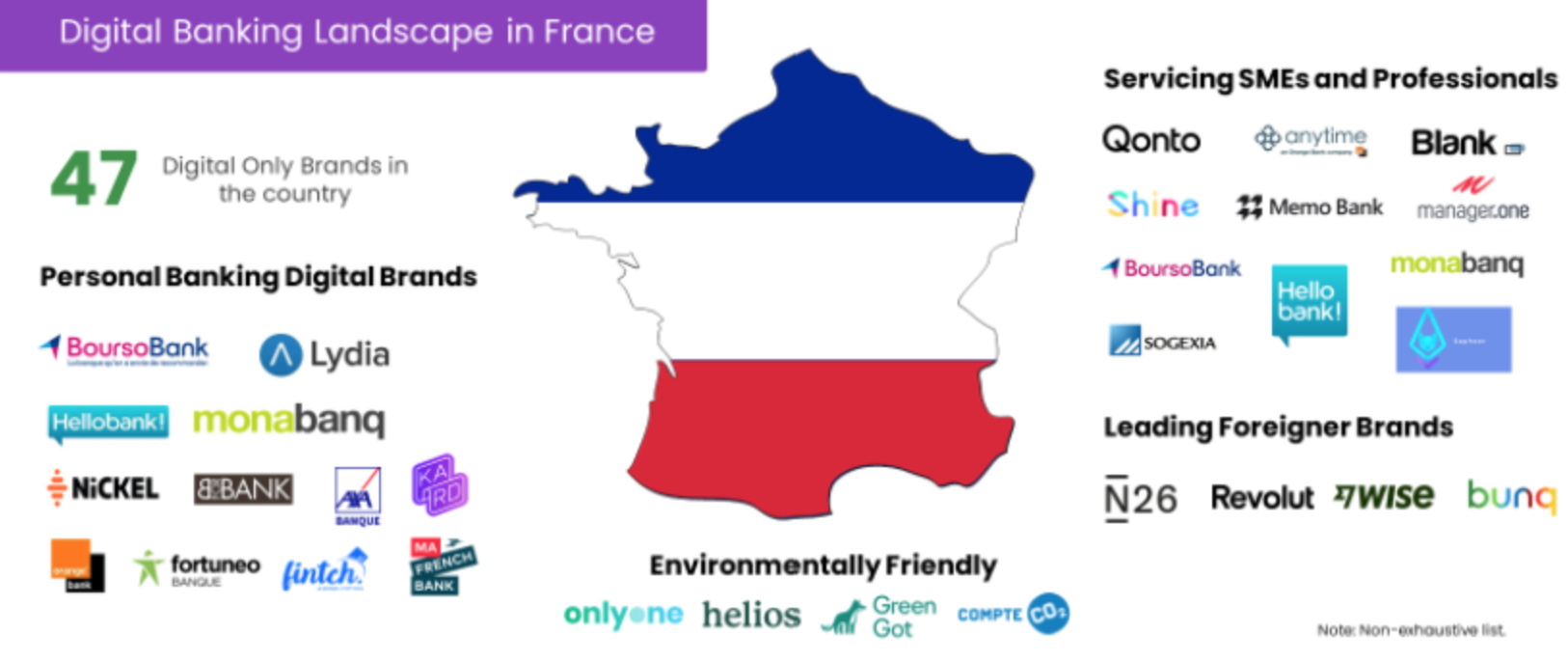

France’s digital banking landscape

France is currently home to 47 digital-only brands, with 12 brands providing personal banking services and 10 servicing small and medium-sized enterprises, and professionals.

Digital banking landscape in France, Source: Digital Drives the Evolution and Expansion of France’s Banking Industry, C-Innovation, Sep 2023

Homegrown digital banks are currently leading the domestic market. Lydia is the country’s biggest digital bank in France, holding a 21% market share. Lydia started back in 2013 as a simple money transfer app. The service has since evolved into a full-fledged digital bank, offering payment cards, savings, investments, trading and more. Lydia has raised about US$250 million in funding so far and is one of France’s eight fintech unicorns, data from Dealroom and CB Insights show.

Following Lydia is BoursoBank with a 19% market share. BoursoBank was founded in 1995 as an online broker and has expanded its portfolio of products throughout the years to provide a comprehensive range of financial products encompassing daily banking services, lending, savings, insurance coverage, stock trading, and more. BoursoBank became a subsidiary of Societe Generale in 2014 after the French multinational financial services firm acquired the company.

At the third and fourth positions are Hello Bank and Nickel with a 12% and 11% market share, respectively. Both Hello Bank and Nickel are digital banking services owned by traditional lender BNP Paribas. Hello Bank started operations in 2013 and is available in several European countries including Belgium, Germany and Italy. Nickel, which became a subsidiary of BNP Paribas in 2017 after its acquisition, operates in countries including Spain, Belgium and Portugal.

German N26 and UK-based Revolut follow suit, with a share of 9% each. They are the top two foreign digital banks in the French market.

N26 is licensed digital bank headquartered in Berlin that provides a free basic current account and a debit card, with overdraft and investment products, as well as premium accounts available for a monthly fee.

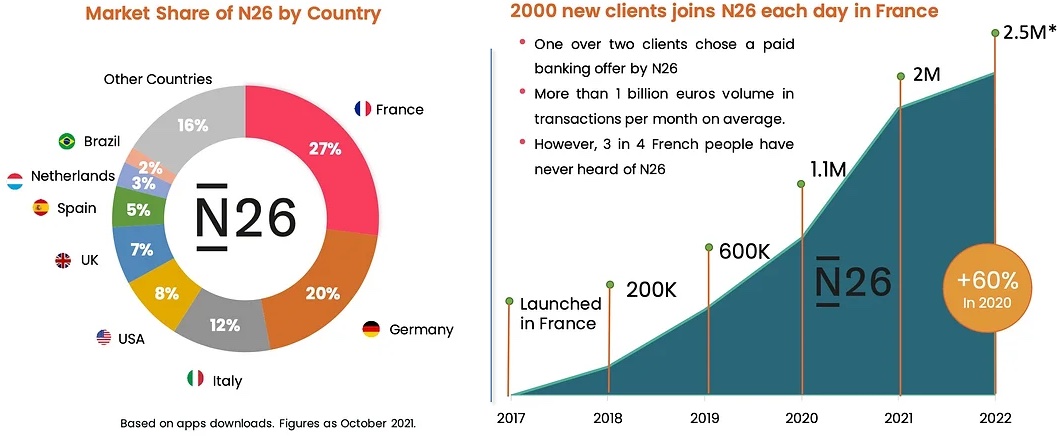

France is N26’s largest market (27%), ahead of its home country of Germany (20%), the report says. As of 2022, 2.5 million consumers in France had opened an account with N26. 2,000 new clients join the digital bank each day in the country, it claims.

N26, a prominent foreign neobank in France, Source: Digital Drives the Evolution and Expansion of France’s Banking Industry, C-Innovation, Sep 2023

Revolut, meanwhile, is one of the world’s top digital banks, clocking 35 million retail customers globally. The startup offers accounts featuring currency exchange, debit cards, virtual cards, Apple Pay, interest-bearing “vaults”, stock trading, cryptocurrencies, commodities, and other services, and operates in more than 30 countries.

Digital-only banks market share in France, Source: Digital Drives the Evolution and Expansion of France’s Banking Industry, C-Innovation, Sep 2023

Traditional banks lead the market

One particular trait of the French digital banking landscape is the leadership position the traditional banking sector holds in the space.

In France, established financial institutions have not only recognized the need to adapt; they’ve also embraced change and injected fintech innovations into their array of services, the report notes. The outcome has been the emergence of hybrid banking services that combine the traditional banking’s bedrock qualities of trust and stability, with the agility and convenience ushered in by fintech innovation.

This trend is revealed by the prominence of bank-backed neobanking brands among France’s top digital banking players and underscores the adaptability and strategic foresight of France’s established financial institutions, the report says.

Banks have adopted various strategies in this regard, with some like Societe Generale pursuing acquisitions of digital banking businesses, while others such as BNP Paribas developed digital banking solutions in-house, it notes.

Number of customers by European digital banks associated with a traditional brand, Source: Digital Drives the Evolution and Expansion of France’s Banking Industry, C-Innovation, Sep 2023

Despite having witnessed a strong uptake in digital banking solutions these past years, France has one of the world’s lowest adoption of fintech solutions. A 2019 consumer survey conducted by EY found that fintech adoption in France stood at just a mere 35% then, far behind European leaders including the Netherlands (73%), Ireland (71%) and the UK (71%), and below the global average of 64%.

Consumer fintech adoption across 27 markets, Source: Global Fintech Adoption Index, EY, 2019

Featured image credit: edited from freepik