In Guatemala, Incumbents Tap Fintech Specialists to Ramp up Tech Capabilities

by Fintechnews Switzerland December 2, 2021In Guatemala, incumbent banks are teaming up with fintech startups to benefit from their technological advancements, enable a seamless digital customer experience and access new market segments.

Banco de los Trabajadores (Bantrab) is among the prominent financial group in the country that’s eyeing partnership opportunities with startups. It’s currently exploring a tie-up with home delivery app Hugo that would focus on offering financial services to small and medium-sized enterprises (SMEs).

“We, as banks, have a market to serve and certain capacities,” Michel Caputi, corporate general director of Bantrab, told Forbes Centroamerica in an interview. “Fintech companies give us greater scalability without generating a high cost.”

Spanish digital identity verification company Mobbeel is one of the tech-focused ventures that are growing steadily in the Guatemalan market, riding on rising demand from the finance sector.

Mobbeel is the developer of MobbScan, a platform for online identity verification. The technology scans identity documents (IDs), both from mobile devices and through a web channel, verifies their authenticity, and then uses biometric facial recognition to compare that ID to a live photo of the individual.

Last year, the company signed two new customers: Banco G&T Continental, a leading bank in the country, and Pronet, a payment service provider.

These partnerships focus on enabling digital onboarding on Dig&tal, the digital banking offering of Banco G&T Continental, and Pronet’s Akisi app, an e-wallet that allows users to pay bills and purchase goods at merchants.

Digital wallet platform Fri is another player that’s managed to ink partnerships with no less than six banks in the country. The fintech startup provides a multi-bank digital wallet that allows users to send, request and receive money, as well as pay by QR code by simply linking their bank accounts. Currently, the service is available to customers of Banco G&T Continental, Banco Industrial, Banrural, Promerica, Interbanco and MiCoope.

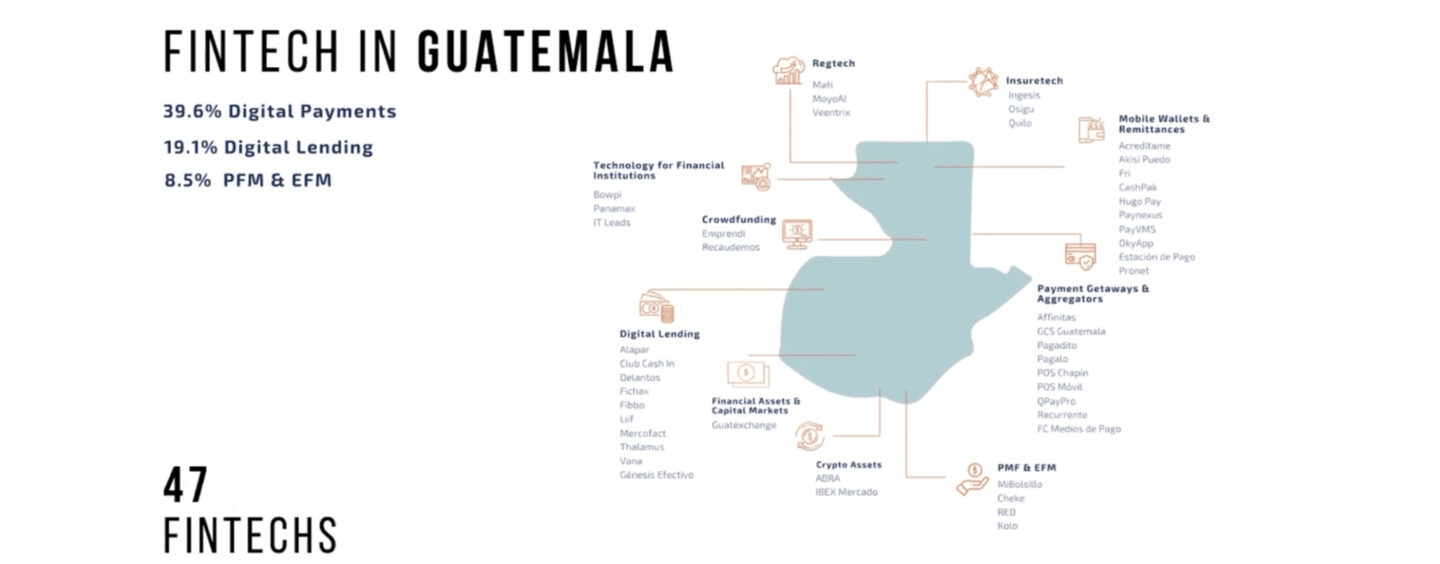

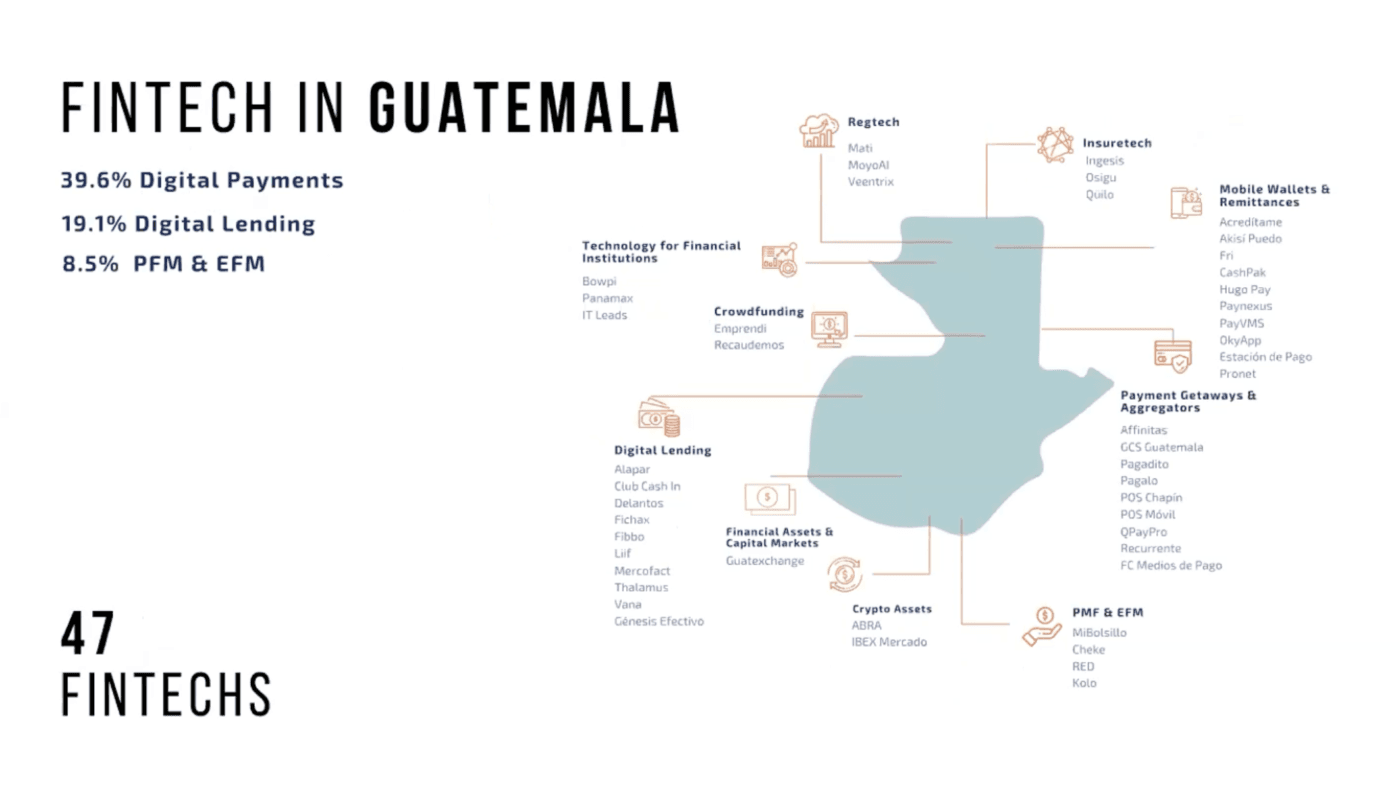

Guatemala’s fintech landscape

Fintech is still a very nascent industry in Guatemala with only a handful of pure players. Data from industry trade group Fintech Guatemala suggest that there are just 47 fintech companies in the country.

39.6% of these companies operate in the digital payment space, followed by online lending (19.1%) and personal financial management (8.5%).

Fintech startups in Guatemala, Source: Fintech Guatemala

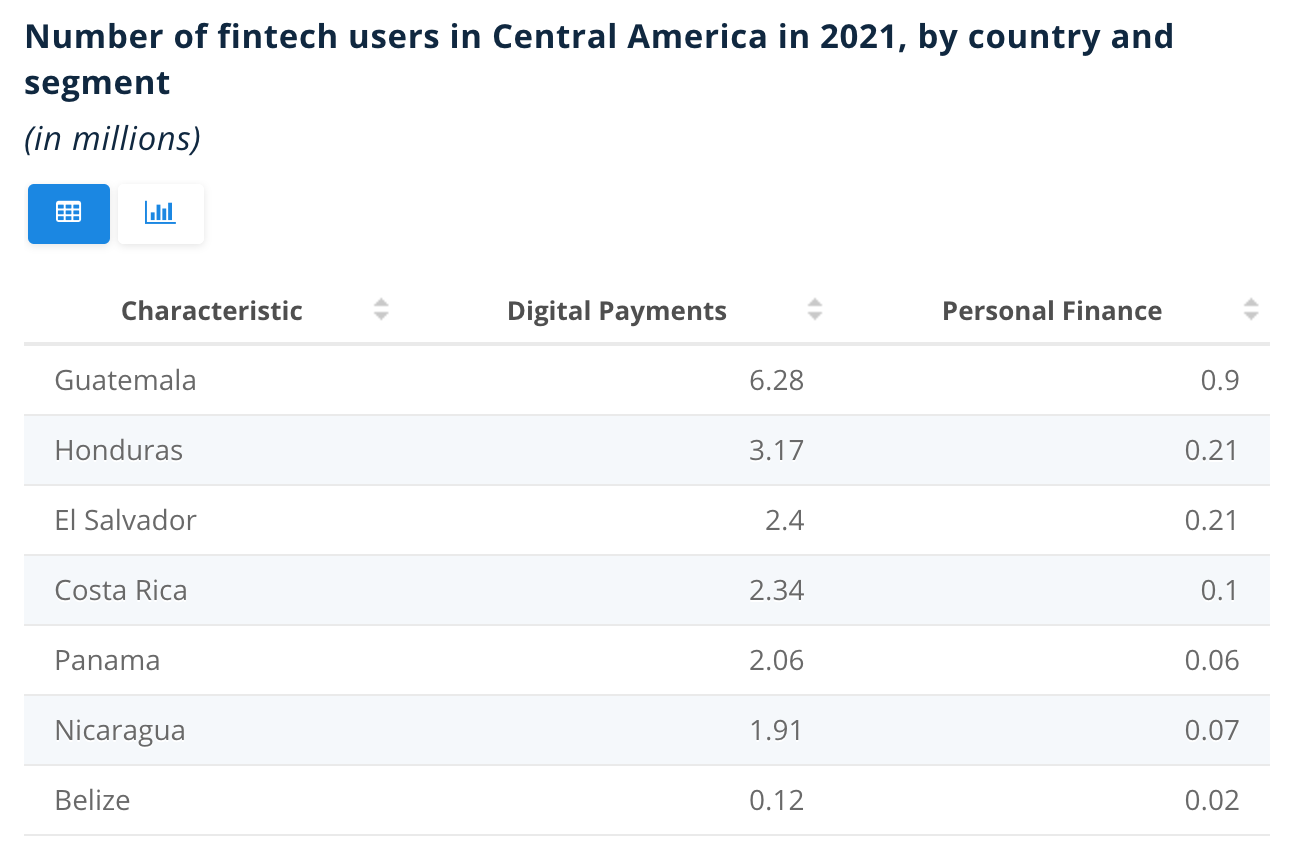

Data from Statista ranks Guatemala as the largest market of fintech users in Central America with around 6.3 million digital payments users, and 1 million customers of personal financial services. Honduras ranks second with around 3.2 million users in the segment of digital payments and another 210,000 in personal financial management services.

Number of fintech users in Central America in 2021, by country and segment (in millions), Source: Statista

These metrics pale in comparison with South America’s fintech landscape. In Brazil, for example, 33% of Internet users had conducted financial consultations, payments or other transactions online in 2020, and total transaction value in the digital payment segment is projected to amount to US$53.6 million in 2021, against just US$13.2 million for Guatemala.

According to Enrique Galdamez, the executive director of Fintech Guatemala, despite a relatively small fintech industry, Guatemala is a hot market for digital financial services because of its large population of unbanked and high smartphone penetration rate of 69%.

“In Guatemala, 56% of the population is currently unbanked; that’s more than one in two,” Galdamez said during a recent webinar. “Also, 88% of the population does not have access to credit.”

Currently, there is no specific regulation for fintech companies in Guatemala, forcing fintech companies in the country to navigate a complex and burdensome financial regulatory landscape to carry out their business, says law firm Consortium Legal.

So far, efforts to stimulate the sector have been timid, with banking regulator the Superintendent of Banks (SIB) creating for example a so-called an innovation hub in 2019 to act as a meeting point between the regulator, fintech companies and consumers.