Splendit: Switzerland’s First Peer-to-Peer Student Loans Platform

by Fintechnews Switzerland September 10, 2015Splendit is a Swiss online platform that allows students to raise funding for their educational expenses and scholarships through crowdfunding campaigns.

Launched in November 2014, the platform connects students with private investors and allows the former to raise a significant amount of money in a crowdfunding manner, while enabling the latter to make sustainable investments with a fair and competitive return.

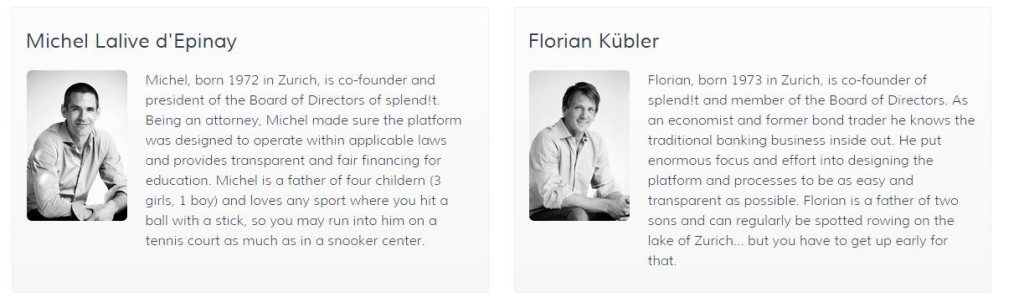

The company was founded in 2011 by two bankers, Florian Kübler who is the head of Structured Products Sales at ZKB and Michel Lalive d’Epinay who is Head Cross Products Compliance at UBS.

“We wanted to build something good and sustainable,”

Kübler told Nzz.ch.

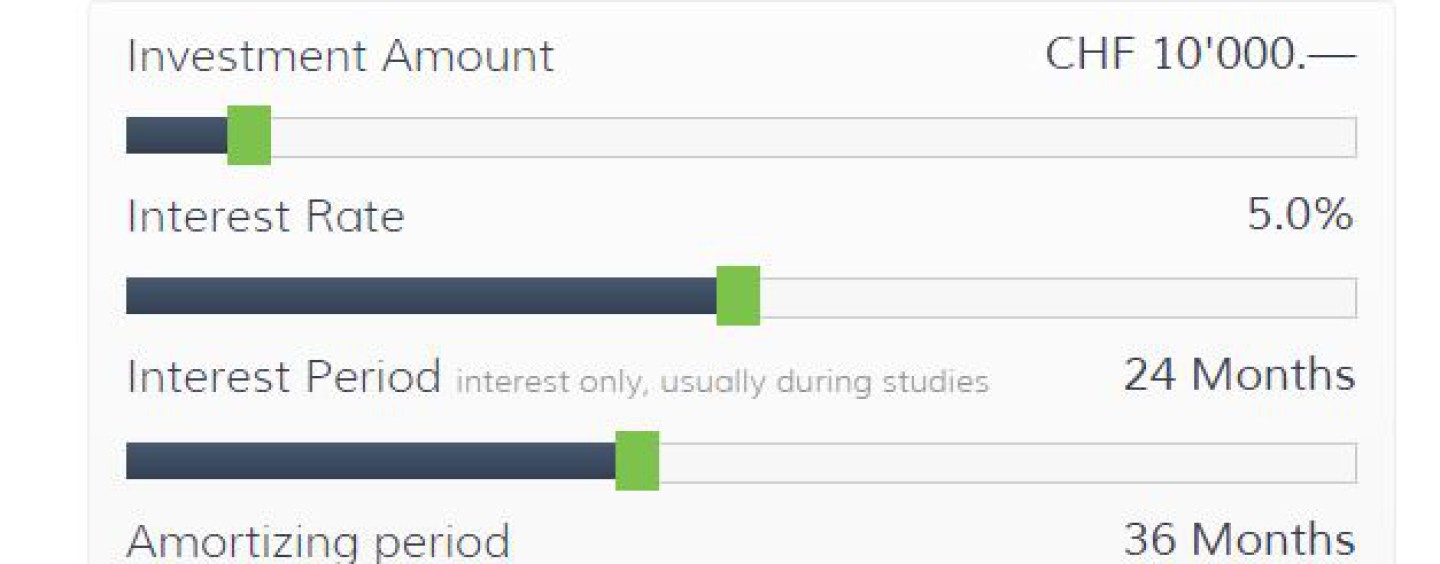

On Splendit, students can decide the terms that are the most

convenient for them such as the amount, duration, interest rate and repayment duration. Investors consider anonymous testimonies of students and then decide at what interest rate they wish to lend, with a maximum rate of 8%.

“The better the student has written his or her education loan application, the lower the interest rate he or she will get,” Kübler explained.

Interest rates are negotiated in the auction: the more convincing the dossier is, the more likely an investor will invest in the loan at a lesser interest rate.

Students pay interests from the beginning, but repayments happen only after the end of their studies. Investors pay a 2% fee off the amount invested, while students pay CHF 10 per month as their loan runs.

The campaign is conducted with transparency and both parties need to respect certain terms and conditions.Splendit checks students’ enrollments, controls cash flows and helps solve issues between parties. But despite strict controls, there are still risks in investing in human capital and education, Kübler said.

To mitigate the risk of default, students write debt recognitions to their investors. Investors are also advised to diversify and invest in multiple student loans.

“Our ideal investor is an alumnus who believes in the future of education, who can assess well the kind of situations students are in, and who want to help,” Kübler said. “Our ideal student is clever and full of initiatives, but needs money.”

With the rise of peer-to-peer lending, it was only a matter of time before startups and organizations realize they could offer the same services as Lending Club or Funding Circle but for the student loan market.

Alongside Splendit, Swiss non-profit organization studienaktie.org, aims to “enable education for all people,” according to its website. Similarly to Splendit, studienaktie.org provides students and investors with a platform for raising educational funding, but unlike Splendit who operates mainly for profit and charges, studienaktie.org mainly focuses on connecting both parties.

Apart from enabling financing, studienaktie.org also assists students in developing a life plans, and provides coaching, mentoring and networking sessions, to support students in their education projects.

5 Comments so far

Jump into a conversationMy niece is going to move to Switzerland. I think that this article will definitely help her . Thanks for sharing this very informative article. I will share this to her .

Great! My cousin is going to college already. I think that splendit will definitely help him to finance his education. This is a very helpful article. Thanks for sharing this site.