Tag "robo-advisors"

Switzerland Lags Behind in Adopting Robo-Advisors, Investment Tech

Swiss investors are lagging behind their European counterparts in embracing investment technology services. A new survey by Swiss banking technology provider Avaloq, which polled 1,430 investors across 10 countries in Europe and Asia, found that only 8% of Swiss respondents

Read MoreWealthtech Spending to Reach US$24B Annually by 2023

With COVID-19 accelerating digital transformation, wealth managers are expected to increase tech spending to reach approximately US$24 billion annually by 2023, according to a new research by Celent, the tech advisory arm of Oliver Wyman. By the end of 2020,

Read MoreBank CIC Launches “Next-Gen Robo-Advisor” Clevercircles

A new robo-advisor called Clevercircles has been launched by Bank CIC in Switzerland that promises more possibilities for investors and which brings a social aspect into online wealth management. Developed in partnership with Swiss IT services provider ti&m, Clevercircles joins

Read MoreRobo-Advisory Market In Germany

Robo-advisors are set to become more and more important in Germany, and by 2022, it is estimated that these will manage as much as US$14 billion in assets under management (AUM) at a annual growth rate of 42.2%, according to

Read MoreAll Robo Advisors You Have To Know In Switzerland

Robo advisors, a class of financial advisor that provide financial advice or investment management online with moderate to minimal human intervention, are growing in popularity. These provide digital financial advice based on mathematical rules or algorithms to automatically allocate, manage

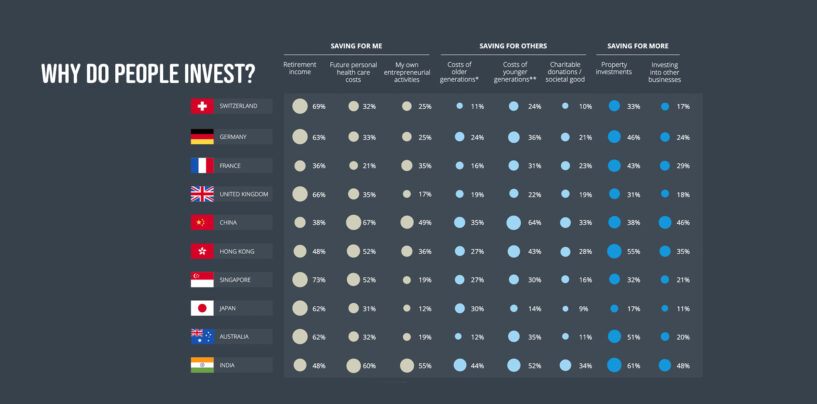

Read MoreThe Rise of Wealthtech: Infographic

Evolving consumer expectations, the rapid adoption of technology and new competitors entering the markets are placing new demands on today’s wealth management firms. These trends are re-shaping the look and feel of the industry, and the change is happening across

Read More7 Interesting Wealthtech Solutions from Switzerland

Tighter regulation, fast-paced customer demands, market shifts and disruptive technologies are amongst the many forces that have been changing the wealth management industry, creating a new playing field for professionals. Notably, the emergence of digital technologies for delivering services is

Read MoreRobo-Advisory: Wealth Managers Need to Adapt to New Environment

Robo-advisors are causing an uproar and the wealth management industry needs to adapt to this new environment, says Morgan Stanley, one of the largest wealth managers on Wall Street. According to Michael Cyprys, an equity analyst at the firm: “The

Read MoreNew Report: Robo-Advisory Model At a Tipping Point

The robo-advisory model is at a tipping point with all current players needing further development if the robo concept is to prove long-lasting. Without further refinement on the part of the individual robo-advisors themselves, a substantial portion of current providers

Read More