With COVID-19 accelerating digital transformation, wealth managers are expected to increase tech spending to reach approximately US$24 billion annually by 2023, according to a new research by Celent, the tech advisory arm of Oliver Wyman.

By the end of 2020, the wealth management industry is projected to spend US$21.4 billion on tech, and the figure is set to grow at a compound annual growth rate (CAGR) of 5% year-over-year (YoY) until 2023.

But before wealth management firms ramp up tech spending, they will need to recover from decreased revenues induced by COVID-19, meaning that accelerated tech spending won’t kick in before mid-2021, the report says.

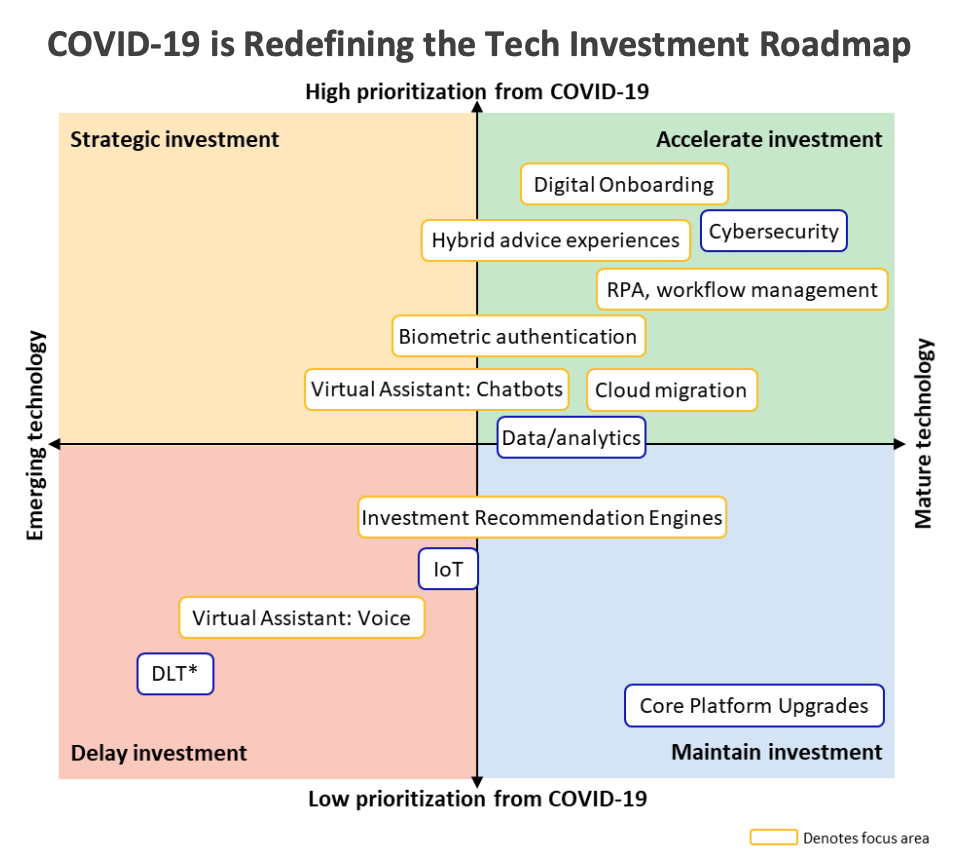

Among the top priorities areas of investment, the report names hybrid advice experiences, digital onboarding, cybersecurity, robotic process automation (RPA) and workflow management, biometric authentication, chatbots, and cloud migration.

COVID-19 is Redefining the Tech Investment Roadmap, Source: Wealth Management Technology Forecast 2020-2023, Celent, August 2020

Wirehouses, full-service broker-dealers ranging from small regional brokerages to large institutions, will continue to be the biggest spenders when it comes to tech spending, accounting for 37% of overall IT spending by 2023. After wirehouses, independents will account for 17%, a 5.5% increase compared with 2020, the report says. Out of the total IT budgets by 2023, 58% will go towards external software and services.

Impact on COVID-19 on wealth management

COVID-19 and social distancing measures are substantially transforming how investors and financial advisors collaborate.

According to a recent survey by fintech firm Broadridge Financial Solutions, over half (57%) of investors said communications with their advisor had changed in some way in light of new stay-at-home mandates. 62% of those who reported a change in mode of communication said they would entirely or partially maintain their new methods after the pandemic ends, implying that the consumer behavior changes instigated by COVID-19 are here to stay.

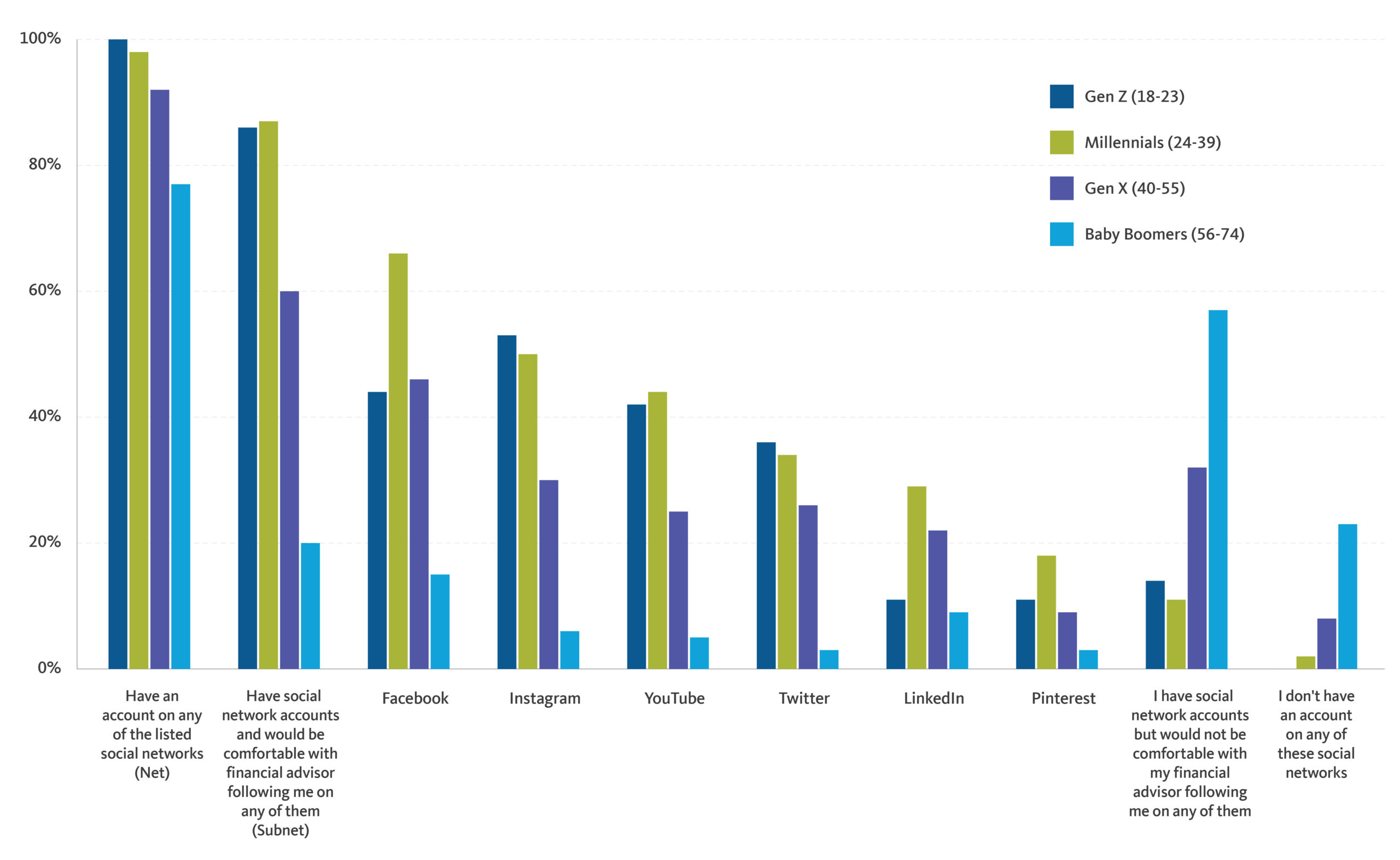

A key finding from the study was that social media has become key to connecting with younger generations. 86% of Gen Z and 87% and Millennials said they were comfortable having advisor follow them on social media to offer a more customized experience.

Facebook was found to be the most popular social media platform for Millennials (66%), Gen X (46%) and Baby Boomers (15%) to interact with their financial advisors through social media. Meanwhile, Gen Z said they preferred Instagram (53%).

Interacting with wealth customers through social media, Source: Broadridge Financial Solutions survey, July 2020

Many experts and industry observers believe that COVID-19 will bring hybrid robo-advisory services to the mainstream. Though wealthtech startups like Betterment and Wealthfront have gained notable traction over the past years, the market volatility and uncertainty brought in by COVID-19 have shown that investors still want relationships with human advisors.

A new survey by fintech management company Diaman Partners found that since the beginning of COVID-19, investors have lost trust in using robo-advisors. The study, which surveyed more than 1,000 investors in the UK, found that the preferred solution was actually a hybrid advice model (40%).