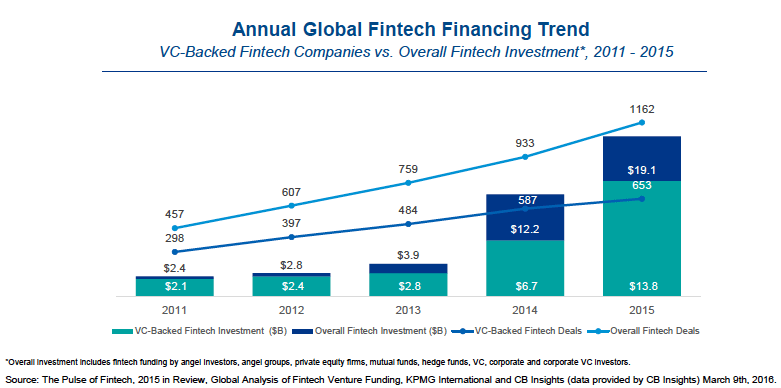

Global Investment in Fintech Companies Totaled US$19.1 Billion in 2015

by Fintechnews Switzerland March 14, 2016In 2015, VC-backed fintech companies raised US$13.8 billion – an increase of more than 100% compared with last year – across 653 deals. VC-backed fintech companies took 73% of the overall fintech funding in 2015, which reached a record of US$19.1 billion across 1162 deals, according to a new report by KPMG and CB Insights.

Annual Global Fintech Financing Trend, The Pulse of Fintech, 2015 in Review, CB Insights & KPMG

The report, entitled “The Pulse of Fintech, 2015 in Review,” is a global analysis of fintech venture funding.

“2015 was a tremendous year for fintech investment around the globe,” Warren Mead, Global Co-Leader, KPMG Fintech practice, KPMG International, and Head of Challenger Banks, KPMG in the UK, said in a statement. “The evolving needs of digitally savvy consumers and the drive for efficiency, not least to meet regulatory and compliance costs, is propelling innovation in financial services like never before – and investors are taking notice.”

Fintech is becoming impossible to ignore, and although it is hard to imagine how the industry will evolve, investors across the world are drawn to the potential of enabling big banks to kick-start their own innovation.

Fintech is becoming impossible to ignore, and although it is hard to imagine how the industry will evolve, investors across the world are drawn to the potential of enabling big banks to kick-start their own innovation.

According to Brian Hughes, National Co-Lead Partner, KPMG LLP’s Venture Capital Practice, “the millennial generation is at the forefront of many of the changes that are occurring.”

“They have grown up with the Internet, are more tech-savvy than previous generations and like to do everything on-demand from their smartphones,” Hughes said in a statement. “These characteristics are driving a lot of disruptions across all industries, especially fintech.”

“Over the past year, there has been a shift as banks have moved from seeing fintech companies as disruptors to cocreators. Banks are increasingly collaborating with fintechs to embed new services and technologies that improve customer experience and drive efficiency.”

Fiona Grandi, National Leader for Fintech, KPMG LLP, said the banking industry is experiencing a permanent shift, adding that every major banks has a digital strategy to take their products and services mobile.

Key global trends and highlights

The 85-page report suggests the following trends:

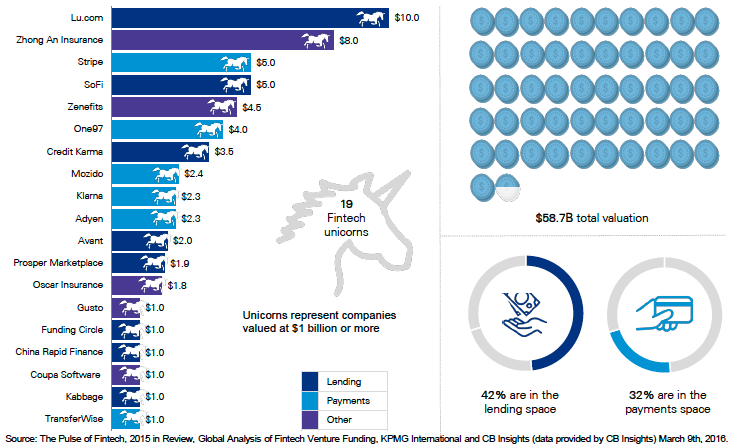

Payments and lending lead the fintech space

Payments and lending have been the key sub-sectors driving fintech historically. Of the 19 fintech unicorns globally, the vast majority are focused on either payments processing or on lending technologies.

Fintech Unicorns, The Pulse of Fintech, 2015 in Review, CB Insights & KPMG

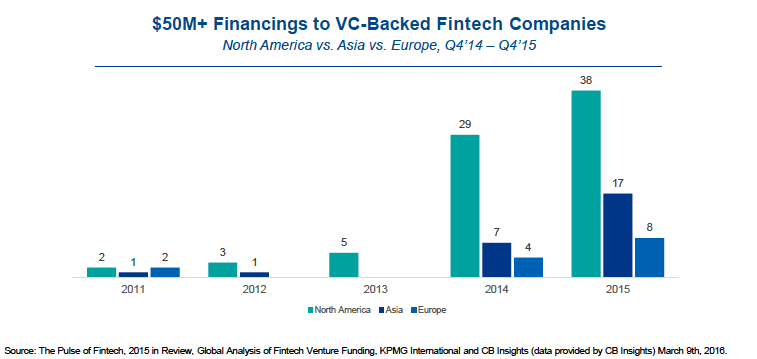

Deal size growing

The rise of US$50m+ mega-rounds across the world reflects increasing interest in established entrepreneurs and business models that could be quick-to-market. North American and Asia saw significant rise in fintech mega-rounds in 2015, 38 deals and 17 deals respectively.

A few examples include marketplace lender Social Finance, Inc.’s (SoFi) US$1 billion Series E funding round, but also Kabbage’s US$135 million Series E round, and DianRong’s US$207 million Series C.

Fintech Mega-Rounds, The Pulse of Fintech, 2015 in Review, CB Insights & KPMG

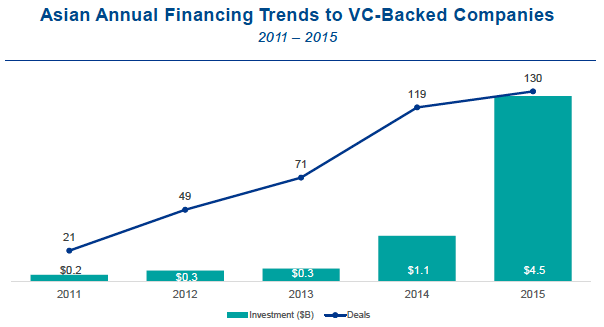

Asia fintech funding explodes

Asian fintech startups had a record year for investment activity in 2015, raising a total of US$4.5 billion on 130 deals. In particular, China drove more than half of all funding. India also saw a major leap in fintech investment, as total funding jumped past US$1 billion for the first time.

Asian Annual Financing Trends to VC-Backed Companies, The Pulse of Fintech, 2015 in Review, CB Insights & KPMG

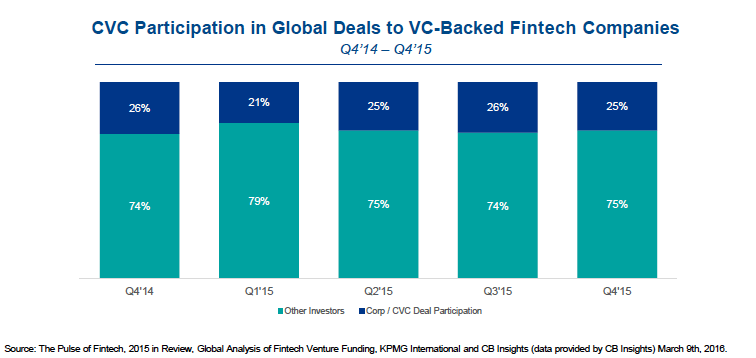

Corporates play a big role in fintech funding, especially in Asia

Corporate participation in global deals to VC-backed fintech companies accounted for 25% of investment. However, the number varies dramatically from 40% in Asia to just 10% in Europe.

Corporate Participation, The Pulse of Fintech, 2015 in Review, CB Insights & KPMG

KPMG Enterprise, KPMG Fintech and CB Insights will be hosting a live webinar on March 21, 2016 at 11:00am EST to discuss “The Pulse of Fintech,” investment trends and key players in fintech.

Get the full “The Purse of Fintech, 2015 in Review” report: https://home.kpmg.com/xx/en/home/insights/2016/03/the-pulse-of-fintech-q1-2016.html

6 Comments so far

Jump into a conversationIn my opinion investment in Fintech companies is increasing. It brings a huge benefit to businesses.