Digitalisation in the Banking Sector – Switzerland 1, Europe 0 ?

by Fintechnews Switzerland January 15, 2019Ten years after the global banking crisis, the Swiss financial industry faces its next crucial challenge.

Once again, it must fundamentally renew itself, and perhaps even selectively reinvent itself. The driving force behind this new evolution is the growing digitalisation of the banking sector.

The stakes are high for the established players in the field, who ultimately fight for their own survival. Small agile fintech companies, as well as large innovative tech giants, are lurking ominously, ready to jump at the opportunity to serve the digital needs of a new generation of consumers with forward-looking digital solutions.

The issue of digitalisation is of crucial significance to Switzerland, and its implications for one of the country’s most important – if not the most important – economic sector are not to be underestimated.

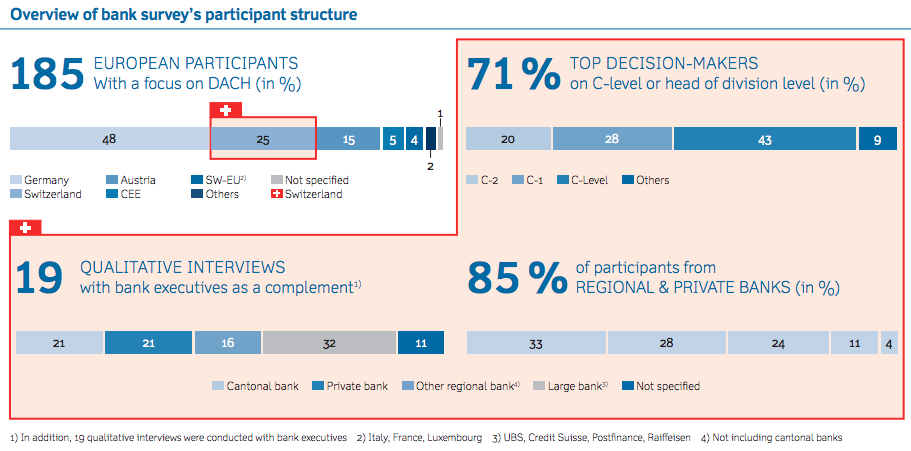

In light of this, the Swiss Finance Institute has partnered with zeb to examine, through a representative study, the current status of digitalisation within the Swiss banking sector. The main objective of the study is to determine the level of digital maturity of Swiss banks compared with the rest of Europe.

Overview of bank survey’s participant structure

Swiss banks are well-positioned, however it is too early to claim victory

The study findings show that the financial sector has recognized that it risks being relegated to second place by new market players if it does not combat them with effective countermeasures and does not consider digitalisation as an opportunity to be seized upon.

The digitalisation of the financial sector is turning out to be a truly Herculean task for individual bank institutions. Although all market players grapple with the topic of digital banking, they are following different solution approaches and tackling individual challenges.

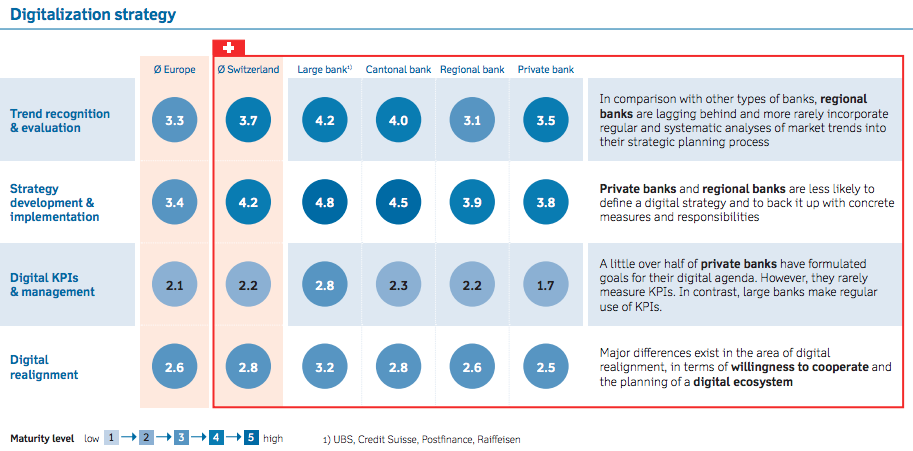

Digitalisation strategy

This much can be said: in comparison with the rest of Europe, Swiss banks are well-positioned in terms of knowledge, however they still lag behind in terms of implementing those insights into concrete measures.

The specific characteristics of the Swiss banking landscape, including the importance of private banking as well as the relatively small size of the Swiss market on the European scale, explain the fact that the digitalisation of the banking business is tackled at a slower, more collected pace.

In light of these and other specificities of the Swiss banking sector, the study results can be summarized around three essential findings

3 Essential Findings from the Study

In the process of digitalization, Swiss banks follow an intelligent “fast follower” approach.

As mentioned above, Swiss banks in general are strategically well-positioned to successfully master the upcoming digitalisation of their business.

The study clearly shows that. The greatest threat lies in the infamous “Kodak effect.” Ultimately, companies need to pick the right time to launch a digital offering whose scope and outcome are defined by their own customers’ needs.

Like the former American leader in conventional photography, Swiss banks have also recognized early on the disruptive potential of the digitalisation of their business activities.

Until now, however, due to a lack of strategic necessity and to relatively weak competition, Swiss banks have failed to uncompromisingly implement and launch their digital concepts.

Hopefully, the Swiss banking sector, unlike Kodak, will not miss the right moment to implement its existing strategies and concepts and to catch up with its leading international competitors as well as with new contenders.

Banks need to actively embark their employees on the journey towards digitalisation

The digitalisation of the financial sector begins in people’s minds, as does the corresponding fundamental change of the whole industry.

Only when banks succeed in preparing and motivating their employees can digitalisation be successful for all involved. The anxieties of many bank employees concerning the digital future remain a huge obstacle.

Concerns about job security are tangible and stand in the way of constructive debate on the topic. The ball is not in the court of the employees as much as in the court of management. A digital business model certainly requires employees to gain new skills and competencies. Job requirements will of course change.

However, it would be wrong to assume that the human factor will become less important in a digital world. On the contrary, the capacity to innovate and be creative cannot be outsourced to machines.

The same is true of individual, customized client advice in the segment of private banking. It is apparent, however, that many banks suffer from a lack of digital leadership.

Banks need prominent, assertive leaders, who will be entrusted with the task of implementing digitalisation and will be widely supported in the day-to-day business.

Individual figureheads are still considered as “eccentrics”, although it is precisely these creative minds who have the power to move things ahead and to spark enthusiasm within their company’s own ranks.

A strict separation of IT and business expertise is not conducive to achieving objectives

Traditionally, banks are hierarchical structures and follow well-established rules that leave employees very little room for maneuver within the narrow scope of their areas of responsibility.

Consequently, interdepartmental projects often fail due to disputes over respective areas of responsibility or particular interests. This issue could be tackled by implementing an agile organizational model, made of small flexible teams who could, independently of conventional structures, think and act cross-functionally.

IT and business experts, however, still often work separately on the topic of digitalisation, although a dynamic network encompassing and combining the expertise of all areas involved could deploy much more creative power.

While many bank managers express their enthusiasm at the innovative capacity that is the hallmark of tech companies, for the time being no Swiss bank has made the decision to move away from the traditional top-down organizational model to a more modern network organization.

In summary, it should be noted that the focus of the Swiss banking sector should not be as much on digitalising the banking business, as on developing a digital Swiss banking, which will bring the unique features of the Swiss banking system in line with the unavoidable digital evolution.

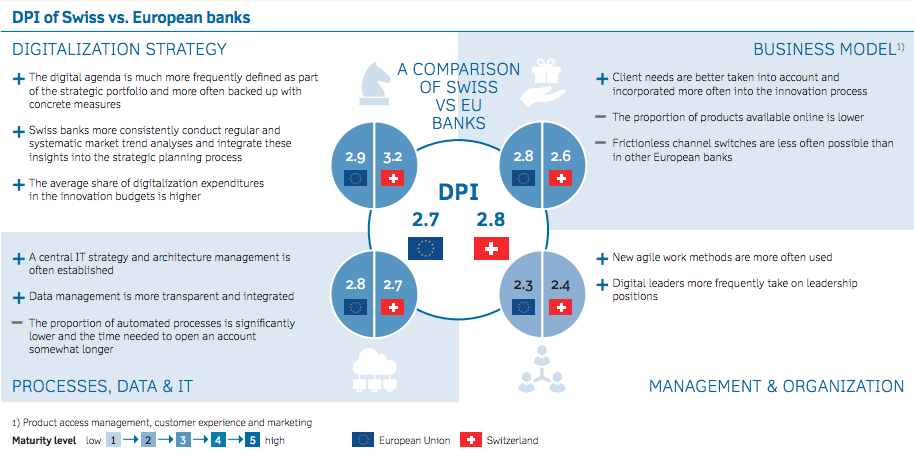

DPI of Swiss vs. European banks

DPI of Swiss vs. European banksThe “Digital Pulse Check 3.0 – Switzerland vs. Europe” report is available online: www.sfi.ch/DigitalPulseCheckEN

Featured image credit: Edited from Freepik here, here and here