Nascent Metaverse Finance Industry Provides Investors with Exciting Opportunities

by Fintechnews Switzerland June 20, 2022In 2021, interest in the metaverse spiked following a surge in sales of non-fungible tokens (NFTs) and announcements from bigtechs sharing their interest and investment in the space.

This year, the momentum is continuing, with corporations, venture capitalists (VCs) and private equity (PE) firms having invested more than US$120 billion in the metaverse in the first five months of 2022 alone, a figure that’s more than double the US$57 billion committed to the space in all of 2021, data from McKinsey show.

As the concept of an immersive virtual environment continues to gather steam, the so-called metaverse finance (MetaFi) landscape is starting to take shape, providing plenty of opportunities for entrepreneurs and investors alike to tap into.

This is one of the conclusions shared in a new report co-authored by Switzerland’s Institute of Financial Services Zug IFZ and Synpulse8, the fintech division of global management consulting company Synpule.

The document, titled Metaverse Report: An overview of the current status and developments for the financial industry, aims to provide the financial sector with an introduction to the metaverse and its developments, and discuss the drivers of the trend and its potentials.

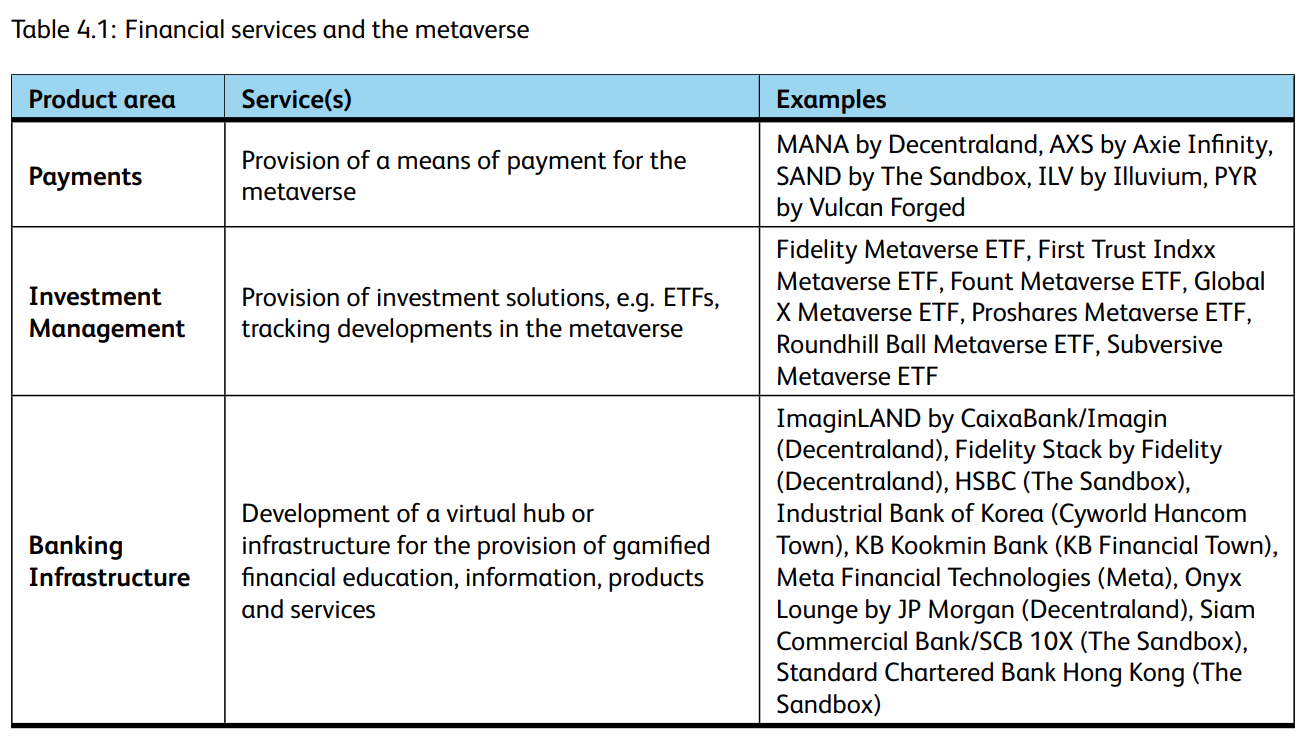

At this stage of game, financial services are still scarce in the metaverse, the report says, and only three main product areas can be observed:

- The payments category, which mainly includes payment tokens associated with distributed ledger technology (DLT)-based metaverses that are used for the purchase and trade of virtual land or other products and services (e.g. MANA by Decentraland and SAND by The Sandbox);

- Investment management, which involves the provision of investment solutions such as metaverse-related thematic ETFs (e.g. Fidelity Metaverse ETF and Proshares Metaverse ETF); and

- The banking infrastructure category, which includes all the companies and organizations involved in the development of virtual hubs or infrastructure for the provision of financial services (e.g. Fidelity Stack by Fidelity (Decentraland); HSBC (The Sandbox)).

In the area of deposit and lending, the report notes no concrete financial solutions offered yet, and advises traditional financial service providers to look into possible solutions in the medium to long term.

Financial services and the metaverse, Source: Metaverse Report: An overview of the current status and developments for the financial industry, Institute of Financial Services Zug IFZ and Synpulse8, June 2022

Investment opportunities

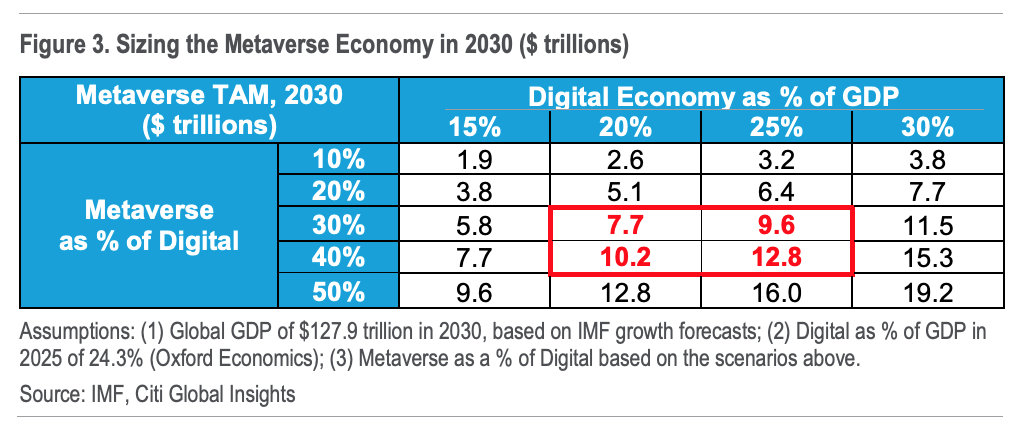

Although the metaverse and its boundaries as a concept is still very much a moving target, several estimates suggest that it could become a massive market.

Citi forecasts that by 2030, total metaverse users could be anywhere between one billion to five billion users. The bank estimates a target addressable market for the metaverse economy in the range of US$8 trillion to US$13 trillion.

Sizing the Metaverse Economy in 2030 ($ trillions), Source: IMF, Citi Global Insights, 2022

These prospects make the metaverse an interesting investment opportunity for investors, the Institute of Financial Services Zug IFZ/Synpulse8 report says.

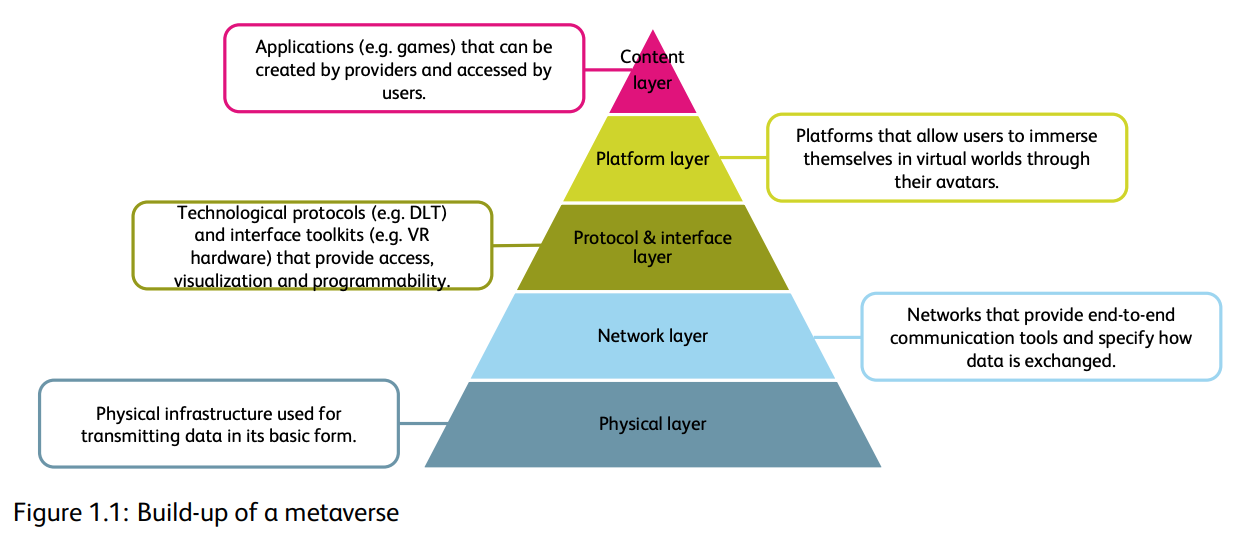

It advises investors looking to capitalize on the trend to look for technology-oriented industries that are developing the metaverse. This includes those developing the physical layer, including chip producers like Qualcomm and Nvidia and cloud infrastructure providers like Amazon Web Services (AWS) and Microsoft Azure, as well as companies developing the network layer, including those involved in 5G and low latency networks like Swisscom and AT&T.

Investors should also consider the organizations creating the technological protocols and interface toolkits that provide access, visualization and programmability. This includes DLT protocols like Ethereum and Cardano, virtual reality (VR) headsets providers, holographic solution providers and 3D specialists.

The third area, the platform layer, comprises the platforms that allow users to immerse themselves in virtual worlds. These platforms can be centralized worlds like Roblox and Minecraft, and decentralized worlds such as Decentraland and The Sandox.

Finally, the fourth and last layer, the content layer, encompasses the applications created by providers and accessed by users. This include payment solutions (e.g. Visa and PayPal), cryptocurrency exchanges (e.g. Binance and Kraken), crypto wallets (e.g. Metamask and Bitski) and NFT marketplaces (e.g. OpenSea and Dapper).

Since direct financial exposure to the metaverse is not possible, indirect investments in providers of the required technologies are an proper option for investors looking to participate in the development of the metaverse, the report says.

Build-up of a metaverse, Source: Metaverse Report: An overview of the current status and developments for the financial industry, Institute of Financial Services Zug IFZ and Synpulse8, June 2022

Featured image credit: Freepik