Like many countries in Europe, Germany and Austria are looking to adopt digital KYC in order to streamline the customer onboarding process.

A digital onboarding process allows banks and financial institutions to offer a good first impression to customers. This favours a good customer-bank relationship from the start and also appeals to digitally native customers such as the Gen Z, who will have most of the buying power in a few years time. In addition to enhanced customer experience, a digital KYC system drastically reduces costs and makes it easier to meet regulations.

Germany and Austria are considered to be some of the most developed nations in the EU, yet their customer onboarding systems are mostly manual. Communication with customers takes place through the post or phone calls, leading to time-consuming errors and corrections from both parties.

Many financial institutions are afraid of moving forward with any new technologies due to the risk of breaching regulations and receiving large fines. However, with regulators enacting digital-friendly laws and Fintechs offering tech-specific services, financial services players in Austria and Germany now have the opportunity to adopt eKYC and take their customer onboarding system to the next level.

Regulation in Austria and Germany

After the 2008 financial crisis, regulations in Europe became much more stringent and expensive to meet.

Since the implementation of PSD2, GDPR and MiFID II, firms in Europe have spent over $750 million every year just to keep up with compliance. And according to BBVA research, financial institutions in Europe are currently spending 10-15% of their workforce on compliance and risk management – anything to avoid the huge fines that regulators are imposing. Thousands of regulations are being updated and published every year, and firms are having to hire entire compliance teams just to stay on top of them.

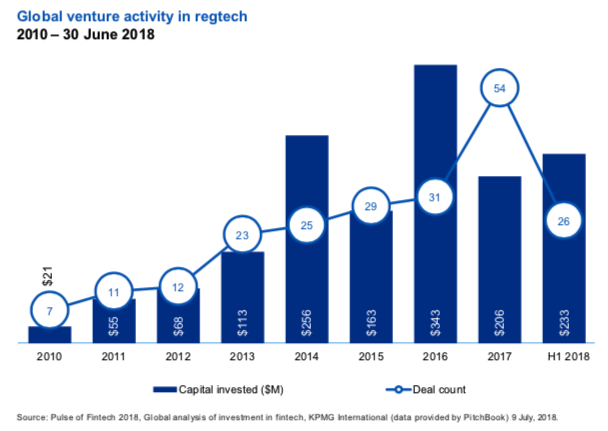

Global venture activity in RegTech according to the KPMG Pulse of Fintech report

In 2014, the German Federal Financial Supervisory Authority took the first step towards digitization by encouraging financial institutions to leverage video calls in order to onboard customers. The regulator has also encouraged institutions to partner with Fintechs that offer secure, AML compliant solutions to banks looking to onboard customers seamlessly.

However, regulations in Germany have “digitised” rather than “transformed” the onboarding process: they’ve simply replaced the manual process with a two-way video. This does not streamline the process and continues to be very manual, which means it’s still very expensive and time-consuming for financial institutions.

Austria, in comparison, offers some of the most advanced regulatory technology, where the central bank (OeNB) and other banks are implementing new reporting models. This has encouraged Austrian banks to join forces and found a joint venture called the Austrian Reporting Services (AuRep) – Europe’s largest regulatory reporting utility processing 1.4 billion records per report. This innovative approach to reporting means that firms and institutions in Austria have managed to lower regulatory costs as well as security risk. However, this is just one step in the direction of digital transformation; many onboarding processes still remain manual.

Using eKYC in Austria and Germany

As regulations increase in complexity across the board, financial institutions are turning to eKYC to help onboard customers in a more cost-efficient way. By introducing digital KYC, firms in Austria and Germany can move away from a traditional, time-consuming and expensive manual process to a digital and seamless process. Both countries have adopted video-streaming technology or new reporting models in an attempt to automate and streamline the process, but the next step for a secure and rapid onboarding process requires a new kind of technology: artificial intelligence.

Austria is increasingly aware of the need to adopt a much more automated KYC process and is one of the first countries in Europe to allow identification using AI, starting with the telecommunication industry. In January 2019, the IVO regulation (Identification Ordinance) was put in place obliging individuals to complete identification in order to buy a prepaid SIM card. Telecommunication providers are allowed to use an automated digital system relying solely on artificial intelligence: the person’s information is captured and a computer verifies every security feature necessary. Biometrics are also in force, allowing a user to verify their identity with a selfie. The forward thinking reporting system together with the IVO regulation means that Austrian firms are some of the most qualified in Europe to adopt efficient eKYC technologies.

Germany has also taken a step towards digital verification but is still working on the laws and incentives to encourage firms to introduce AI into customer verification. Both Germany and Austria are looking to remedy the issue of expensive onboarding by partnering up with Fintechs that specialise in compliance, digital onboarding and customer experience. This not only solves the issues of cost and time-consumption, but it means firms can allocate resources to what they do best, instead of spending large amounts of resources on compliance.

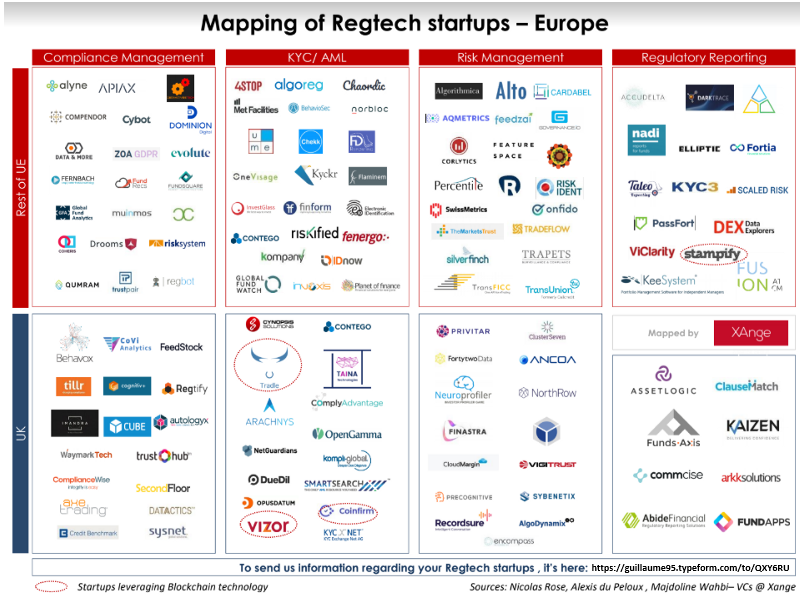

Germany also has Berlin, one of the largest Fintech hubs in Europe. The constant stream of innovative Fintech startups means financial services players in Germany have a large pool of potential partners to help with digital onboarding and other technical processes. Although Germany may not have the laws and reporting systems that Austria has, one could argue it has more opportunities to partner with specialised Fintechs that can offer higher quality services. Having said that, Austria isn’t falling far behind, with the country regularly offering million-dollar programs to help startups grow. An innovative culture and tech-friendly regulations are both key ingredients to adopting efficient eKYC systems.

Although Austria and Germany have taken larger steps than their European counterparts, both countries still struggle with expensive and time-consuming identity verification processes. eKYC provides an opportunity for entities in both countries to meet increasingly complex regulations, offer a seamless customer onboarding experience and drastically reduce implementation costs.