Apple Introduces Apple Family Card, Allowing Spouses to Merge Their Credit Lines

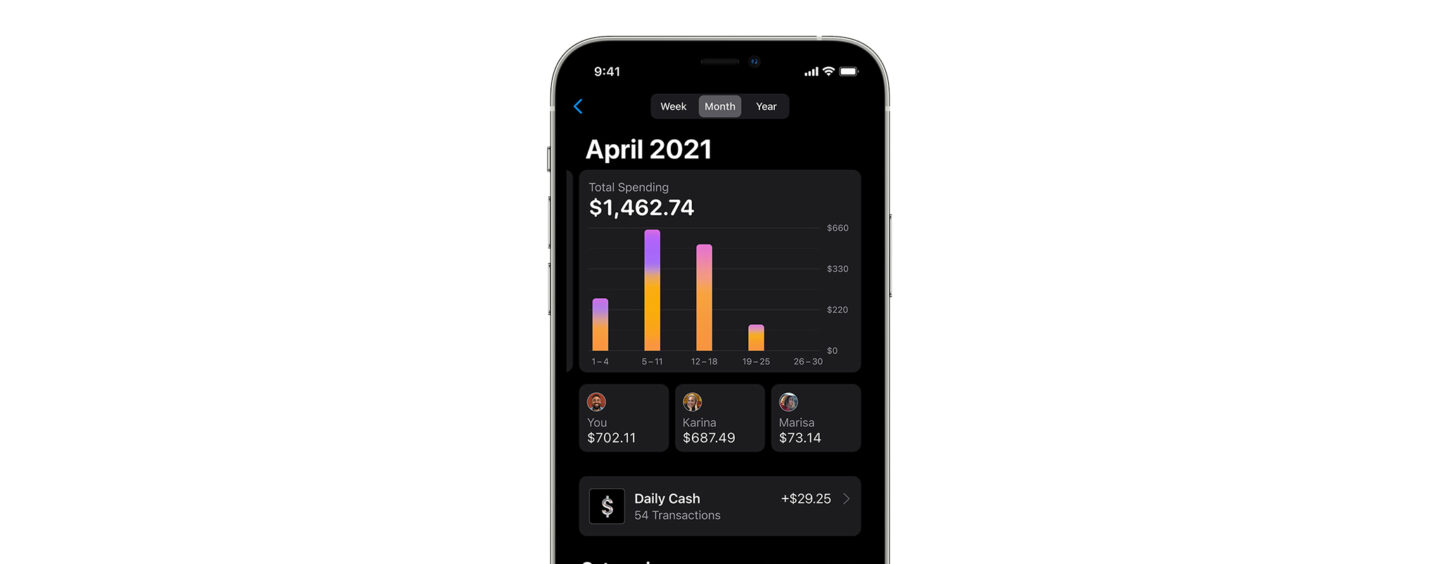

by Fintechnews Switzerland April 22, 2021Apple announced the launch of Apple Card Family, which allows users to share their Apple Card in order to track purchases, manage spending, and build credit together with their Family Sharing group.

Available in the US in May, Apple Card Family allows two people to co-own an Apple Card, and share and merge their credit lines while building credit together equally.

Apple Card Family also enables parents to share Apple Card with their children, while offering optional spending limits and controls to help teach smart and safe financial habits.

The new offering is designed to help the Family Sharing group achieve a healthier financial life by making it easy to track spending, all on iPhone and with a single monthly bill.

Apple Card is the first credit card designed for an iPhone and to help people lead a healthier financial life.

Built into the Apple Wallet app on iPhone, Apple Card has simplified the application process, eliminating all fees, encouraging users to pay less interest, and providing a new level of privacy and security.

Without credit card number, CVV security code, expiration date, or signature on the card, the titanium Apple Card is more secure than any other physical credit card.

Jennifer Bailey

“We designed Apple Card Family because we saw an opportunity to reinvent how spouses, partners, and the people you trust most share credit cards and build credit together.

There’s been a lack of transparency and consumer understanding in the way credit scores are calculated when there are two users of the same credit card, since the primary account holder receives the benefit of building a strong credit history while the other does not,”

said Jennifer Bailey, Vice President at Apple Pay.