European Fintech Report Forecasts Decline in Fintech Funding Over the Next Year

by Fintechnews Switzerland September 22, 2020Finch Capital, an early stage venture capital firm focusing on the fintech sector in Europe and South East Asia, issued its annual State of European FinTech report for 2020.

The report covers a range of topics impacting the fintech industry which includes where we are today (European fintech landscape), the impact of CV-19, the M&A conundrum and trends the Finch Capital team anticipates will shape the European fintech landscape in 2021.

Key findings from the report

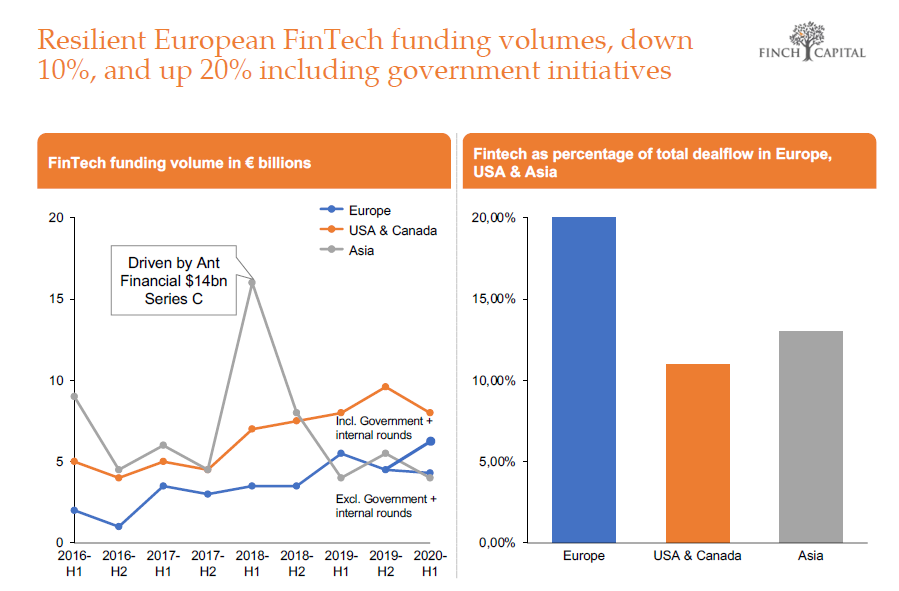

Overall, fintech is a resilient European tech growth engine for now. European fintech funding by VCs and PE firms in H1 2020 is reported to be down by around 10%, but when corrected for government funding it is up 20%.

This is because the funding databases only record publicly announced equity rounds, while most government funding went in as a convertible debt note and so was not disclosed.

Source: Dealroom

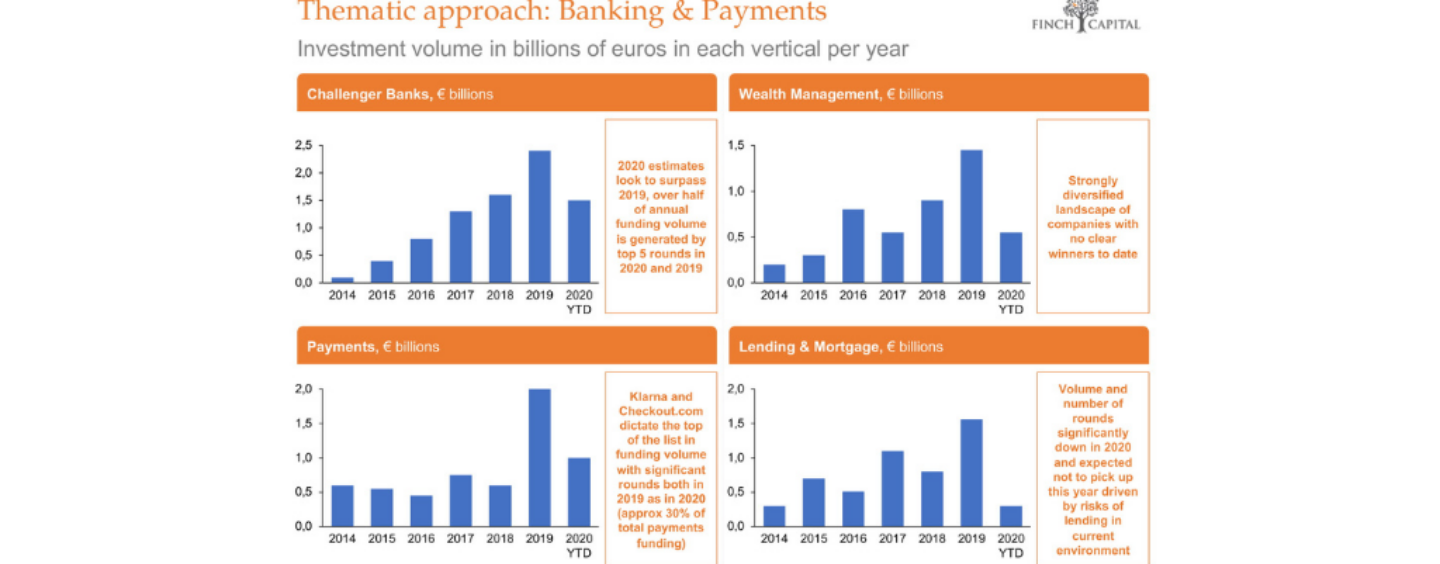

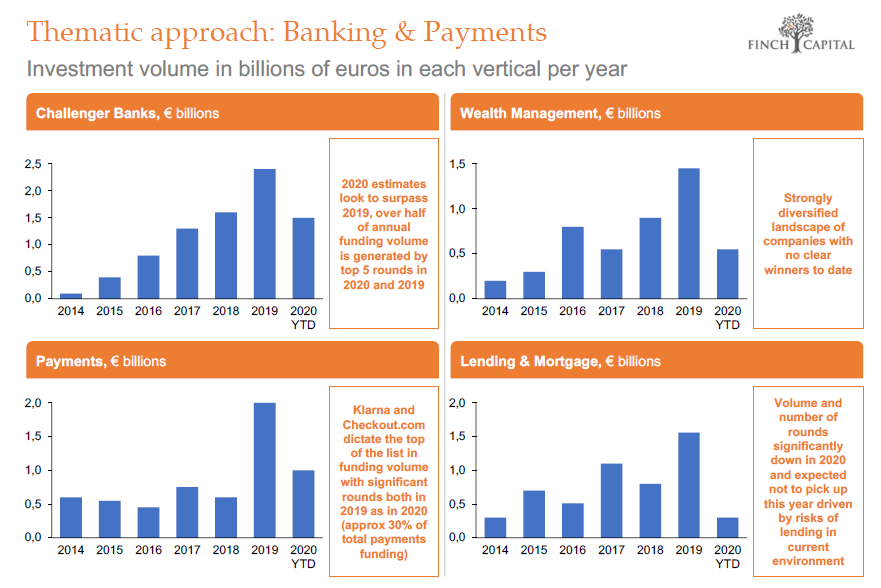

Impact of the lockdown on the fintech sectors was in line with our predictions, except for payments and mortgages that both went up, contrary to what we predicted. For payments, travel rebounded faster than expected and e-commerce skyrocketed 210% as brick and mortar shops closed and people were stuck at home.

Source: Dealroom

Analysis of the top 50 European fintech hiring and firing, showed startups took this chance to reevaluate cost inefficiencies. Coupled with government support programs, they reduced headcount on sales teams given limited in person sales meetings and increased customer support and lived to fight another day.

We expect the next 12 months to be dynamic as fundraising becomes more selective and drops in Q4 and 2021 which will be a harsh reality for the many shake out and down round candidates whose runway got extended into 2021.

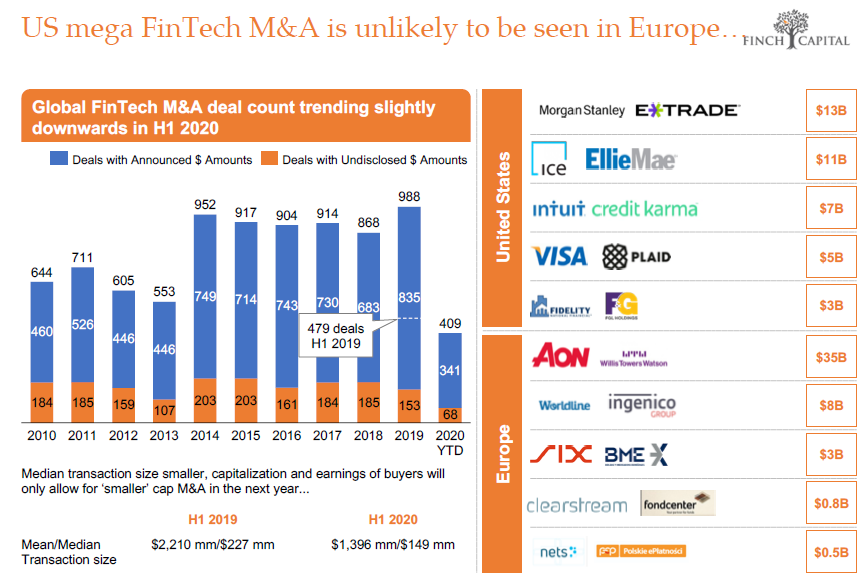

European fintech M&A momentum hindered by lack of big bold buyers and fragmentation. Despite the M&A boom in the US, Europe lacks big ticket M&A buyers for fintechs, and challenger banks in particular.

Source: FT Partners, 2020

Some of the big trends that will shape 2021 – cracking the exit path of the challenger banks to the rise of global privacy and consolidation of fragmented players there will be a lot of opportunity in the sector with a new focus on profitability.